# YiLihuaExitsPositions

4.2K

Peacefulheart

#YiLihuaExitsPositions In markets, sometimes the loudest moments are the quietest moves.

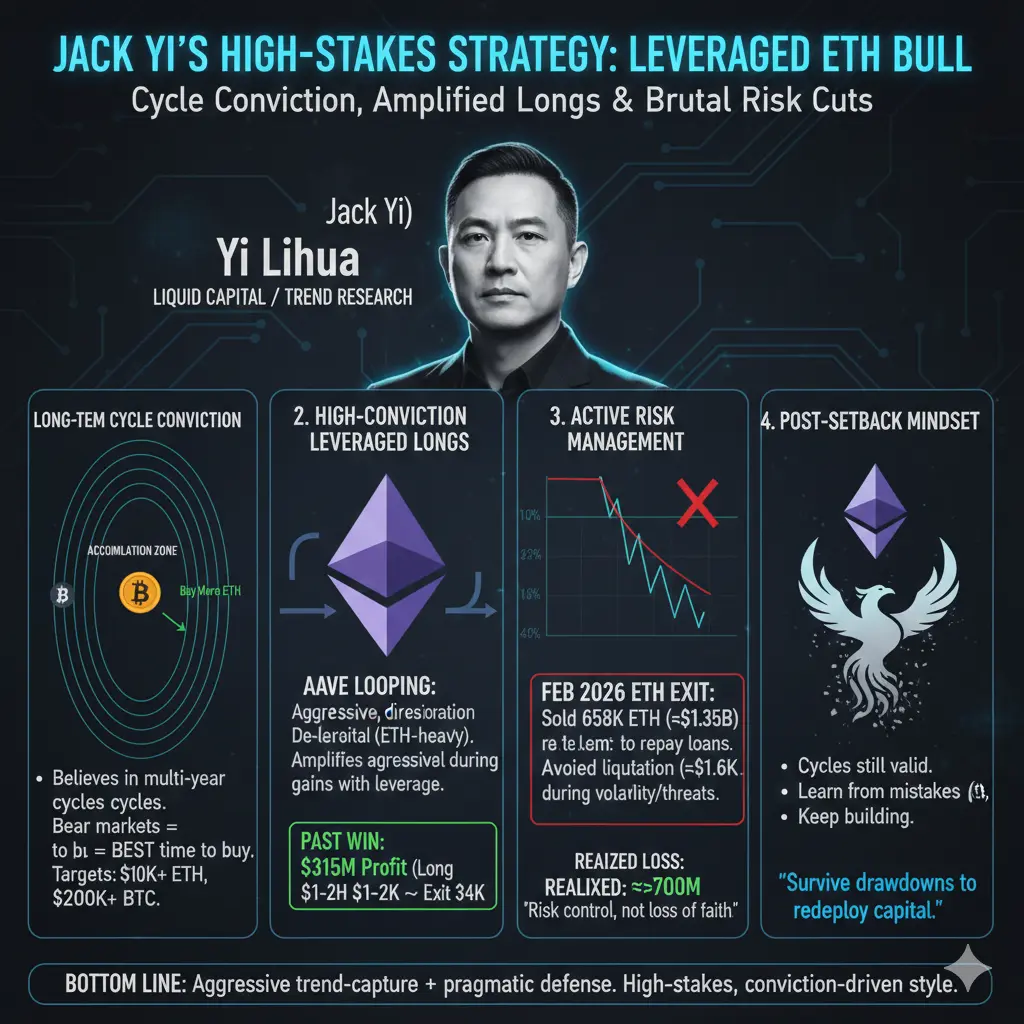

Yi Lihua, founder of Liquid Capital, has gradually reduced billion-dollar leveraged positions on Ethereum and transferred ETH to exchanges. While the market may perceive this as an “exit,” a closer look shows it’s a strategic self-rescue maneuver—focused on financial sustainability, not panic.

💹 Market Cycles & Risk Management:

Despite ~$750M unrealized loss, Yi Lihua is lowering leverage ratios and pushing liquidation levels down.

Large-scale investors see short-term volatility as a long-term learning an

Yi Lihua, founder of Liquid Capital, has gradually reduced billion-dollar leveraged positions on Ethereum and transferred ETH to exchanges. While the market may perceive this as an “exit,” a closer look shows it’s a strategic self-rescue maneuver—focused on financial sustainability, not panic.

💹 Market Cycles & Risk Management:

Despite ~$750M unrealized loss, Yi Lihua is lowering leverage ratios and pushing liquidation levels down.

Large-scale investors see short-term volatility as a long-term learning an

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#YiLihuaExitsPositions

#YiLihuaExitsPositions 🚨

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

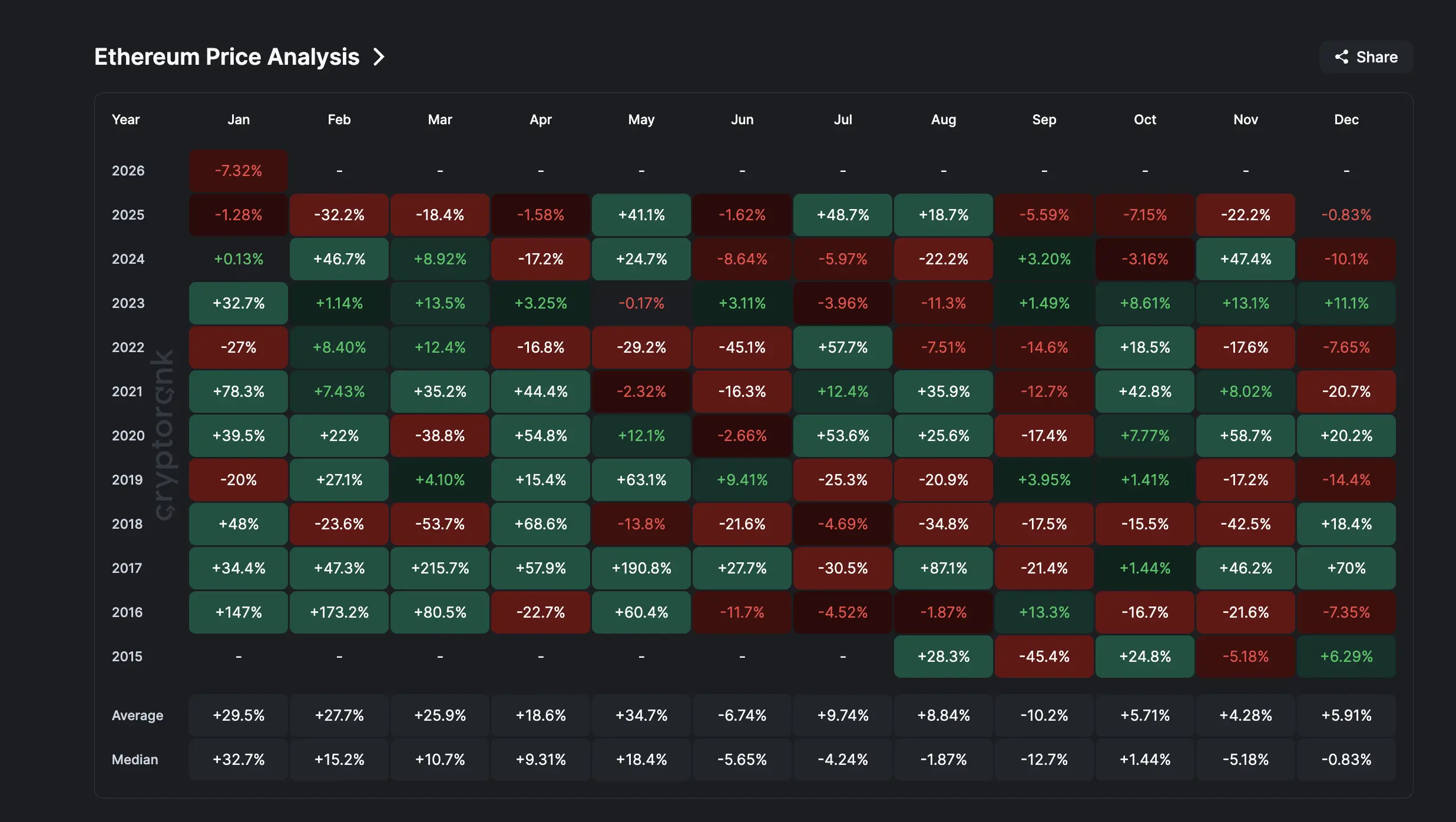

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

#YiLihuaExitsPositions 🚨

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

- Reward

- 11

- 15

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#YiLihuaExitsPositions

The surge of discussion around #YiLihuaExitsPositions reflects a notable shift in market sentiment driven by the actions of one of the most closely watched figures in crypto trading. Yi Lihua, known for bold positioning and a strong conviction in Ethereum, has recently reduced a significant portion of his leveraged exposure. This move has drawn widespread attention because it signals a transition from aggressive risk-taking to a more defensive and calculated stance amid heightened market volatility.

Recent on-chain and position data indicate that Yi Lihua substantially

The surge of discussion around #YiLihuaExitsPositions reflects a notable shift in market sentiment driven by the actions of one of the most closely watched figures in crypto trading. Yi Lihua, known for bold positioning and a strong conviction in Ethereum, has recently reduced a significant portion of his leveraged exposure. This move has drawn widespread attention because it signals a transition from aggressive risk-taking to a more defensive and calculated stance amid heightened market volatility.

Recent on-chain and position data indicate that Yi Lihua substantially

ETH-4,56%

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- like

- Comment

- Repost

- Share

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- 1

- Comment

- Repost

- Share

#YiLihuaExitsPositions

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

BTC-2,73%

- Reward

- 6

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

New Year Wealth Explosion 🤑View More

#YiLihuaExitsPositions

In markets, sometimes the loudest moments are when the most strategic moves are hidden.

The gradual reduction of billion-dollar leveraged positions—particularly on Ethereum—and the ETH transfers to exchanges by Liquid Capital founder Yi Lihua might be perceived by the market as an "exit." However, a deeper look reveals this is a professional "self-rescue" maneuver and a calculated move for financial sustainability.

Market Cycles and Risk Management

Maintaining liquidation levels in crypto markets is not just a game of mathematics; it is a test of patience. Despite a

In markets, sometimes the loudest moments are when the most strategic moves are hidden.

The gradual reduction of billion-dollar leveraged positions—particularly on Ethereum—and the ETH transfers to exchanges by Liquid Capital founder Yi Lihua might be perceived by the market as an "exit." However, a deeper look reveals this is a professional "self-rescue" maneuver and a calculated move for financial sustainability.

Market Cycles and Risk Management

Maintaining liquidation levels in crypto markets is not just a game of mathematics; it is a test of patience. Despite a

- Reward

- 7

- 8

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

⚠️ #YiLihuaExitsPositions

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

BTC-2,73%

- Reward

- 6

- 11

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#YiLihuaExitsPositions

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

- Reward

- 3

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

🔥 #YiLihuaExitsPositions 🔥

Market buzz: Yi Lihua, one of the prominent investors, is reportedly exiting some of their positions. This move could signal caution or portfolio rebalancing. 📉💡

💡 Key Points:

Investor Action: Partial or full exit from certain holdings.

Market Sentiment: Traders may react to anticipate further moves.

Next Steps: Keep an eye on price reactions and related market indicators.

⚠️ Bottom Line: Major exits like this can create short-term volatility. Stay alert and watch the charts! 📊

Market buzz: Yi Lihua, one of the prominent investors, is reportedly exiting some of their positions. This move could signal caution or portfolio rebalancing. 📉💡

💡 Key Points:

Investor Action: Partial or full exit from certain holdings.

Market Sentiment: Traders may react to anticipate further moves.

Next Steps: Keep an eye on price reactions and related market indicators.

⚠️ Bottom Line: Major exits like this can create short-term volatility. Stay alert and watch the charts! 📊

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

181.84K Popularity

41.68K Popularity

3.06K Popularity

4.2K Popularity

3.72K Popularity

2.22K Popularity

2.29K Popularity

269 Popularity

13.39K Popularity

2.12K Popularity

1.62K Popularity

1.13K Popularity

18.43K Popularity

17.67K Popularity

37.08K Popularity

News

View MoreOverview of Mainstream Perp DEXs: Hyperliquid's open interest continues to decline and has now fallen below $5 billion

3 m

Gate Launches 2026 Spring Festival Celebration, Million Red Envelope Rain to Celebrate the New Year, Horse Racing Betting Sharing 100,000 USDT

12 m

Cango completed the sale of 4,451 Bitcoins last week, with a net profit of approximately $305 million.

13 m

BitMart "BM Discover" Section Launches AntiHunter (ANTIHUNTER)

18 m

Bitwise has launched five crypto ETPs, including Bitcoin and Ethereum, on the Italian Stock Exchange.

21 m

Pin