MasterOfChaosTheory

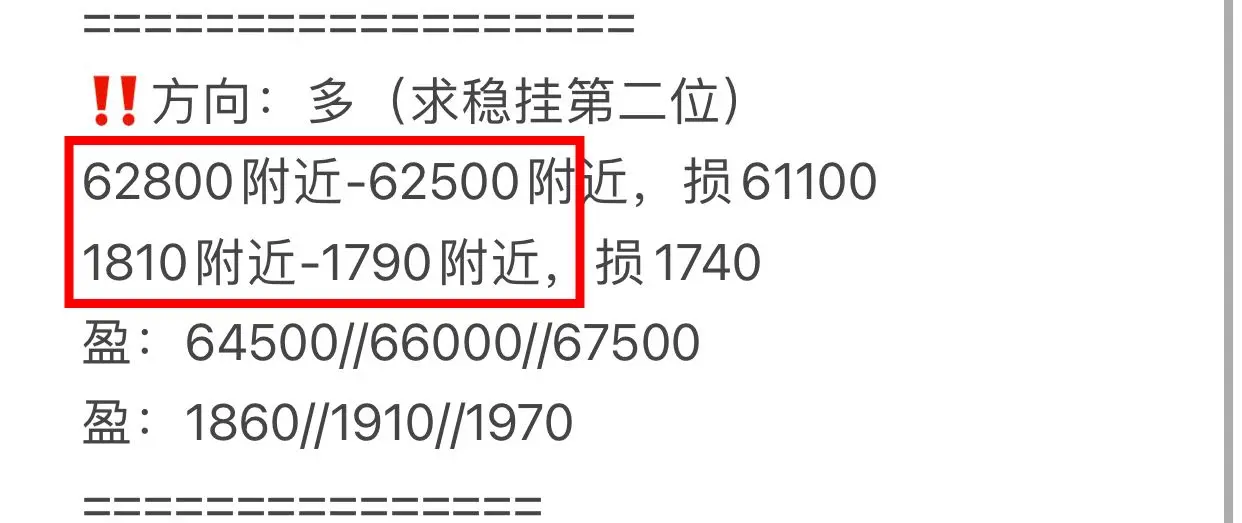

‼️ Гуань Пінхе та Лун Лао Тієн дають вам‼️ Контракт на 25 число/ринковий ордер вже оновлено👇 Криптовалютний світ слідує лише за правильними людьми, дякуємо всім за підтримку, підписки зі знижкою на честь весняних свят вже понад 370 осіб💰 Натисніть тут👇

https://www.gate.com/zh/profile/纏論大師

🔥 Останнім часом понад 3,6 мільйони юанів з'їдено‼️ Минулого тижня 2100/70900 коротких позицій 1795/62450, з'їдено 55 тисяч📉 Вчора ввечері 1800/62800 понад 1925/66250, рівень опору — знову великий прибуток #比特币反弹

https://www.gate.com/zh/profile/纏論大師

🔥 Останнім часом понад 3,6 мільйони юанів з'їдено‼️ Минулого тижня 2100/70900 коротких позицій 1795/62450, з'їдено 55 тисяч📉 Вчора ввечері 1800/62800 понад 1925/66250, рівень опору — знову великий прибуток #比特币反弹

BTC2,88%

- Нагородити

- 10

- 13

- Репост

- Поділіться

BigBigBigBigBigBubbleGum :

:

Пік 2026 року 👊Дізнатися більше

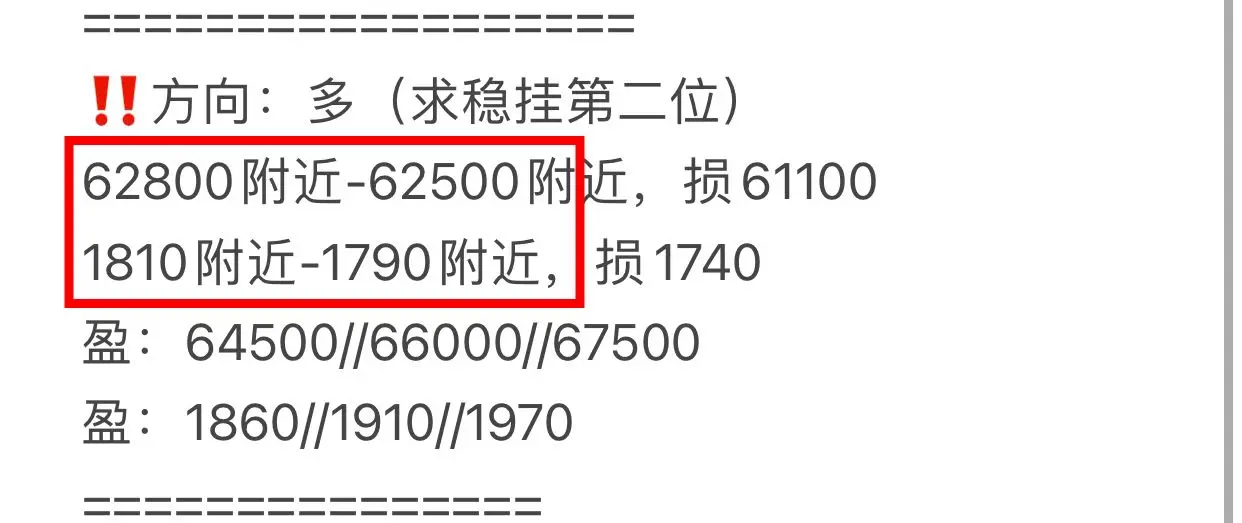

‼️ Гуань Пінхе та Лун Лао Тієн передають вам‼️ Контракт на 25 число/ринковий ордер вже оновлено👇 У криптосвіті лише з правильними людьми, дякуємо всім за підтримку, підписки зі знижкою на святковий сезон вже понад 370 осіб💰 Натисніть тут👇

https://www.gate.com/zh/profile/比特國王歸來

🔥 Останнім часом з’їдено понад 3,6 мільйона юанів‼️ Минулого тижня 2100/70900 коротких позицій, 1795/62450 — купівля на зростанні, 55 тисяч юанів на м’ясо📉 Вчора ввечері 1800/62800, зараз понад 1925/66250 — рівень опору, знову купуємо великі обсяги #比特币反弹

https://www.gate.com/zh/profile/比特國王歸來

🔥 Останнім часом з’їдено понад 3,6 мільйона юанів‼️ Минулого тижня 2100/70900 коротких позицій, 1795/62450 — купівля на зростанні, 55 тисяч юанів на м’ясо📉 Вчора ввечері 1800/62800, зараз понад 1925/66250 — рівень опору, знову купуємо великі обсяги #比特币反弹

BTC2,88%

- Нагородити

- 10

- 10

- Репост

- Поділіться

BigBigBigBigBigBubbleGum :

:

З Новим роком 🧨Дізнатися більше

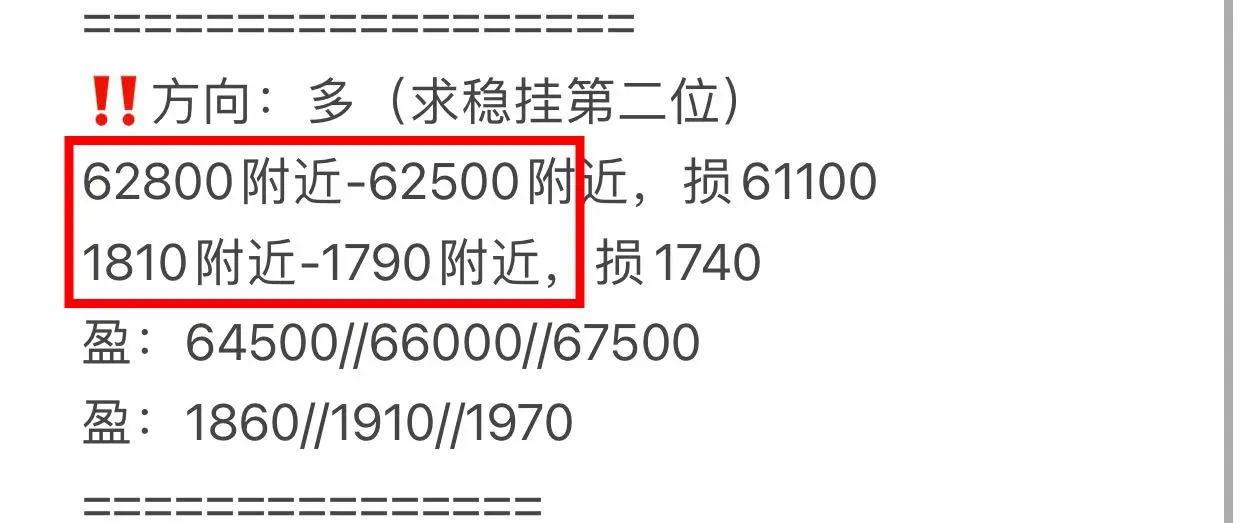

‼️ Guanhe і старі друзі, підтримайте нас‼️ Контракт на 25 число/ринковий товар вже оновлено👇 У криптосвіті лише з правильними людьми, дякуємо всім за підтримку, понад 370 людей вже підписалися на півціновий підпис до свят 💰 Натисніть тут👇

https://www.gate.com/zh/profile/小鬼每日合約

🔥 Останнім часом з'їли понад 3,6 мільйони доларів‼️ Минулого тижня 2100/70900 коротких позицій, 1795/62450 — їжа на м'ясо 55 тисяч 📉 Вчора ввечері 1800/62800, зараз понад 1925/66250 — рівень тиску, знову їмо великі шматки #比特币反弹

https://www.gate.com/zh/profile/小鬼每日合約

🔥 Останнім часом з'їли понад 3,6 мільйони доларів‼️ Минулого тижня 2100/70900 коротких позицій, 1795/62450 — їжа на м'ясо 55 тисяч 📉 Вчора ввечері 1800/62800, зараз понад 1925/66250 — рівень тиску, знову їмо великі шматки #比特币反弹

BTC2,88%

- Нагородити

- 10

- 10

- Репост

- Поділіться

BigBigBigBigBigBubbleGum :

:

З Новим роком 🧨Дізнатися більше

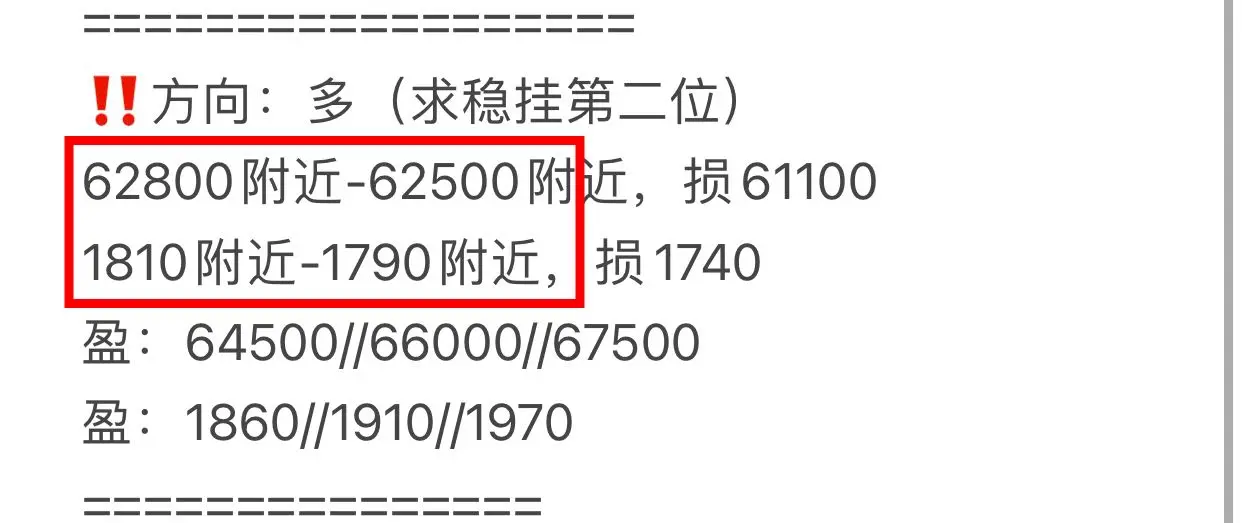

‼️ Гуань Пінхе, Лун Лао Тієнь, передаю вам‼️ Контракти на 25 число/спотові ордери вже оновлено👇 У криптосвіті лише з тими, хто правильний, дякуємо всім за підтримку, святкові підписки за півціни вже понад 370 людей💰 Натисніть тут👇

https://www.gate.com/zh/profile/缠浪解盘

🔥 Останнім часом з'їдено понад 3,6 мільйони юанів‼️ Минулого тижня 2100/70900 коротких позицій 1795/62450, з'їдено 550 000 юанів📉 Вчора ввечері 1800/62800, зараз понад 1925/66250, рівень опору — знову великий прибуток #比特币反弹

https://www.gate.com/zh/profile/缠浪解盘

🔥 Останнім часом з'їдено понад 3,6 мільйони юанів‼️ Минулого тижня 2100/70900 коротких позицій 1795/62450, з'їдено 550 000 юанів📉 Вчора ввечері 1800/62800, зараз понад 1925/66250, рівень опору — знову великий прибуток #比特币反弹

BTC2,88%

- Нагородити

- 10

- 11

- Репост

- Поділіться

BigBigBigBigBigBubbleGum :

:

З Новим роком 🧨Дізнатися більше

🌹Гуан Хуей, член нашої команди, дає вам‼️ Неусвідомлено підписка вже четвертий рік, кількість підписників перевищила 330 людей🀄️ Весняна акція 5GT закінчиться завтра, і знову буде 10GT. Друзі, які підписалися, не дурні, якщо не заробляєте — не вирішуйте😄 Можна натиснути👇 або скопіювати для підписки через веб-версію:

https://www.gate.com/zh/profile/何时了秋雨

🌹Минулого тижня 1890/65700, понад 2105/70900 — знову їмо велику м’ясну страву

🌹Зворотнім ходом 70600/2085, порожньо 62450/1795 — знову їмо велику м’ясну страву

🌹Минулої ночі 62800/1800, зараз понад 66250/1925 — тиск знову змушує їсти м’я

https://www.gate.com/zh/profile/何时了秋雨

🌹Минулого тижня 1890/65700, понад 2105/70900 — знову їмо велику м’ясну страву

🌹Зворотнім ходом 70600/2085, порожньо 62450/1795 — знову їмо велику м’ясну страву

🌹Минулої ночі 62800/1800, зараз понад 66250/1925 — тиск знову змушує їсти м’я

BTC2,88%

- Нагородити

- 10

- 10

- Репост

- Поділіться

KeepUpWithTheRhythmOfTheTimes :

:

Пік 2026 року 👊Дізнатися більше

🔥 Guan і Пеєнь, старі друзі, даю вам‼️ Неусвідомлено підписка вже третій рік, святкова знижка на підписку вже понад 400 людей, дякую за підтримку‼️ Друзі, які підписуються, не дурні, якщо не заробляєте — ви самі винні 😄 Натискайте нижче або копіюйте посилання для підписки на веб-сторінці:

https://www.gate.com/zh/profile/波段王k神

🔥 Минулого тижня 1890/65700, понад 2105/70900 — знову великий прибуток

🔥 Зворотній хід 70600/2085, коротка позиція 62450/1795 — знову великий прибуток

🔥 Вчора ввечері 62800/1800, зараз 66250/1925 — тиск, знову прибуток

🔥 Глянути скрізь — тільки зробить вас все більш

https://www.gate.com/zh/profile/波段王k神

🔥 Минулого тижня 1890/65700, понад 2105/70900 — знову великий прибуток

🔥 Зворотній хід 70600/2085, коротка позиція 62450/1795 — знову великий прибуток

🔥 Вчора ввечері 62800/1800, зараз 66250/1925 — тиск, знову прибуток

🔥 Глянути скрізь — тільки зробить вас все більш

BTC2,88%

- Нагородити

- 10

- 10

- Репост

- Поділіться

KeepUpWithTheRhythmOfTheTimes :

:

Щасливого та благополучного 🧧Дізнатися більше

🔥 guan和平 轮老铁们給U‼️不知不覺訂閱已第3個年頭,春節半價訂閱優惠已破400人,感謝支持‼️訂閱的朋友誰也不傻,不賺誰定你😄蘋果可點擊👇也可複製到網頁端訂閱:

https://www.gate.com/zh/profile/清泉石下流

————————————————

🔥 上週1890/65700多2105/70900再吃大肉

🔥反手70600/2085空62450/1795吃大肉

🔥昨晚62800/1800多現66250/1925壓力再吃肉

————————————————

🔥4月7號布局現貨全部完美進場吃肉📈

1、20gt最低19.9拉漲24.2漲幅21%

2、1.9xrp最低1.61拉漲2.3漲幅21%

3、110sol最低95拉漲155漲幅41%

4、0.13doge最低0.129拉漲0.185漲幅43%

5、4.7uni最低4.55拉漲6.1漲幅30%

6、12.5附近etc最低12.6拉漲17.5漲幅39%

7、1250people最低975拉漲1740漲幅40%

8、14附近avax最低14.6拉漲23漲幅57.5%

9、510ada最低510拉漲725漲幅42%

10、2sui最低1.7拉漲3.82漲幅91%

11、120aave最低114拉漲190漲幅58.3%

12、1450ygg最低1350拉漲2050漲幅42%

13、580pepe

Переглянути оригіналhttps://www.gate.com/zh/profile/清泉石下流

————————————————

🔥 上週1890/65700多2105/70900再吃大肉

🔥反手70600/2085空62450/1795吃大肉

🔥昨晚62800/1800多現66250/1925壓力再吃肉

————————————————

🔥4月7號布局現貨全部完美進場吃肉📈

1、20gt最低19.9拉漲24.2漲幅21%

2、1.9xrp最低1.61拉漲2.3漲幅21%

3、110sol最低95拉漲155漲幅41%

4、0.13doge最低0.129拉漲0.185漲幅43%

5、4.7uni最低4.55拉漲6.1漲幅30%

6、12.5附近etc最低12.6拉漲17.5漲幅39%

7、1250people最低975拉漲1740漲幅40%

8、14附近avax最低14.6拉漲23漲幅57.5%

9、510ada最低510拉漲725漲幅42%

10、2sui最低1.7拉漲3.82漲幅91%

11、120aave最低114拉漲190漲幅58.3%

12、1450ygg最低1350拉漲2050漲幅42%

13、580pepe

- Нагородити

- 10

- 10

- Репост

- Поділіться

KeepUpWithTheRhythmOfTheTimes :

:

Щасливого та благополучного 🧧Дізнатися більше

🌹guan мир, родина Луня, дарує вам‼️ Неусвідомлено підписка вже четвертий рік, святкові знижки на підписку вже перевищили 400 осіб, дякуємо за підтримку‼️ Друзі, які підписуються, не дурні, якщо не заробляєш, то ти — точно не ти 😄 Натискайте на Apple👇 або копіюйте посилання для підписки через веб:

https://www.gate.com/zh/profile/秋雨何时了

————————————————

🌹 Минулого тижня 1890/65700 понад 2105/70900 знову їмо великі шматки

🌹 У відповідь 70600/2085 порожньо 62450/1795 — знову їмо великі шматки

🌹 Вчора ввечері 62800/1800 понад 66250/1925 — тиск, знову їмо

————————————————

🌹 7 квітня всі позиці

Переглянути оригіналhttps://www.gate.com/zh/profile/秋雨何时了

————————————————

🌹 Минулого тижня 1890/65700 понад 2105/70900 знову їмо великі шматки

🌹 У відповідь 70600/2085 порожньо 62450/1795 — знову їмо великі шматки

🌹 Вчора ввечері 62800/1800 понад 66250/1925 — тиск, знову їмо

————————————————

🌹 7 квітня всі позиці

- Нагородити

- 10

- 10

- Репост

- Поділіться

KeepUpWithTheRhythmOfTheTimes :

:

Щасливого та благополучного 🧧Дізнатися більше

- Нагородити

- подобається

- 7

- Репост

- Поділіться

111111111111111111111 :

:

😂😂😂Дізнатися більше

Я намагаюся використовувати просту мову для технічного аналізу, щоб навіть новачки могли зрозуміти.

Вчора ввечері після досягнення 62500 4-годинний графік закрився вище за 63000, а потім знову коливаннями піднімався і опускався до ранку, швидко піднявшись до 66300 і потім продовжуючи падіння. Тут хочу сказати, що я поставив ордер на сон з рівнем 66666, саме через цю зону, яка є рівнем опору. Не очікував, що кожного разу "собачий" великий гравець буде діяти не за шаблоном: коли наближається до рівня опору, він одразу знижується. Не хочу багато скаржитися, але кожного разу щось не вистачає, щоб

Вчора ввечері після досягнення 62500 4-годинний графік закрився вище за 63000, а потім знову коливаннями піднімався і опускався до ранку, швидко піднявшись до 66300 і потім продовжуючи падіння. Тут хочу сказати, що я поставив ордер на сон з рівнем 66666, саме через цю зону, яка є рівнем опору. Не очікував, що кожного разу "собачий" великий гравець буде діяти не за шаблоном: коли наближається до рівня опору, він одразу знижується. Не хочу багато скаржитися, але кожного разу щось не вистачає, щоб

BTC2,88%

- Нагородити

- 3

- 7

- Репост

- Поділіться

TheMidnightBellTolls,Reaching :

:

Слідуй за Figure Brother і їж м'ясо[得意]Дізнатися більше

Я прочитав анекдот, дуже смішно, сподіваюся, що в очах у вас Гоу-ге не такий вчитель😀😀😀, побачивши таке, краще одразу заблокувати, якщо вважаєте, що Гоу-ге теж, краще швидко заблокувати.

非菜:Вчителю, що сьогодні робимо?

Вчитель:Якщо нижче не пробиває 1800, а вище не пробиває 1900 — продаємо

非菜:Зараз 1805, можна більше?

Вчитель:Падіння досить сильне, дивимося, чи проб’ється 1800, якщо не проб’ється — можна більше

非菜:Зараз 1820, це вважається, що не пробито, можна більше, так?

Вчитель:Так, можна більше, вже було більше при 1805, ти не додав?

菲菜:Добре, я зараз додам, при падінні дод

Переглянути оригінал非菜:Вчителю, що сьогодні робимо?

Вчитель:Якщо нижче не пробиває 1800, а вище не пробиває 1900 — продаємо

非菜:Зараз 1805, можна більше?

Вчитель:Падіння досить сильне, дивимося, чи проб’ється 1800, якщо не проб’ється — можна більше

非菜:Зараз 1820, це вважається, що не пробито, можна більше, так?

Вчитель:Так, можна більше, вже було більше при 1805, ти не додав?

菲菜:Добре, я зараз додам, при падінні дод

- Нагородити

- подобається

- 6

- Репост

- Поділіться

多赚uuuu :

:

Основна причина — це постійне обходження собакомагазинів.Дізнатися більше

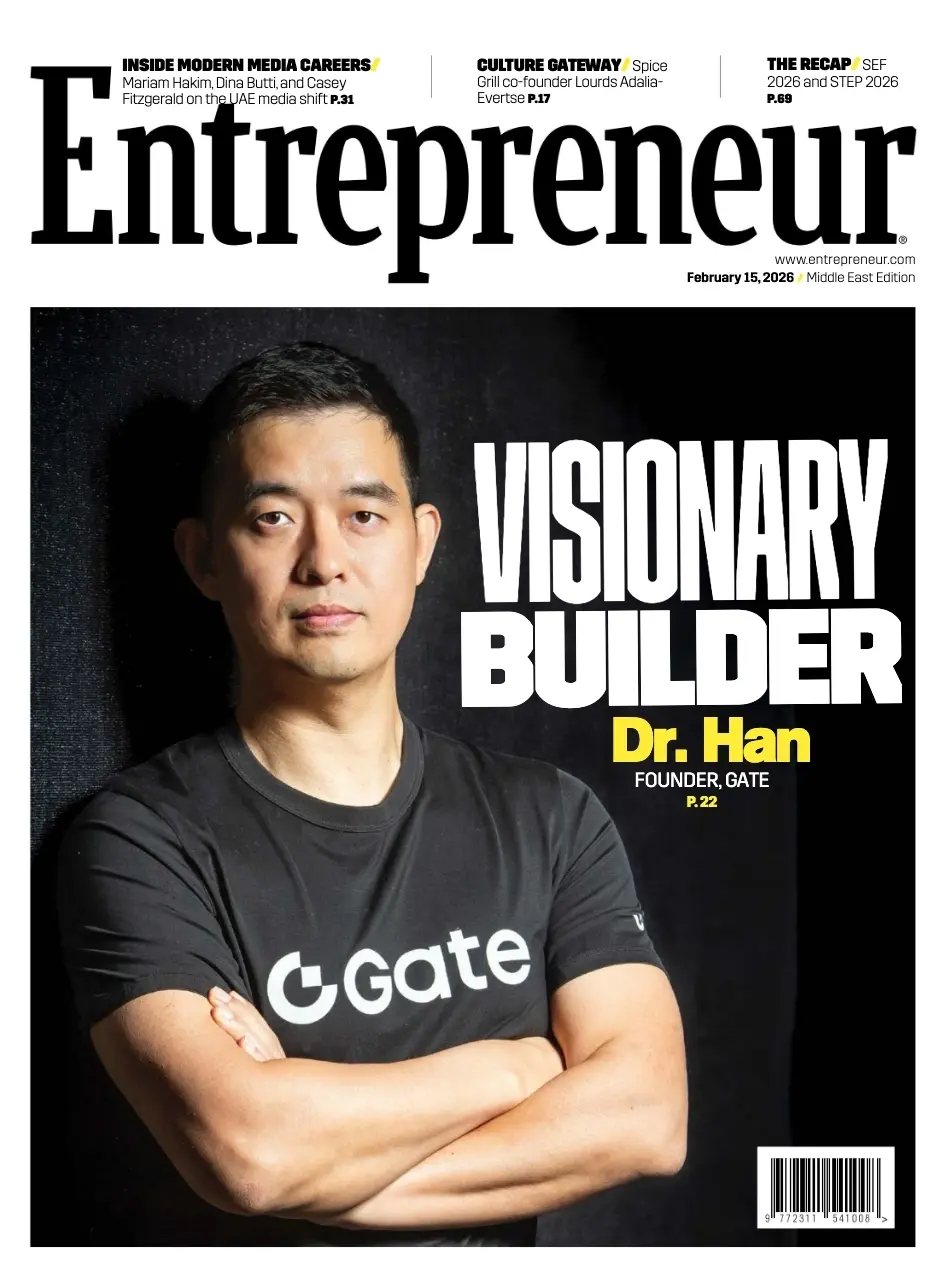

Від Піонера до Титана криптовалют! 🚀

Величезні вітання доктору Хану за те, що він з'явився на обкладинці Entrepreneur Middle East!

13 років наполегливої праці, все ще на передовій.

Він прокладає шлях; ми фіксуємо прибутки.

👇 Залиште коментар "Gate to the Moon", щоб приєднатися до хайпу!

Переглянути оригіналВеличезні вітання доктору Хану за те, що він з'явився на обкладинці Entrepreneur Middle East!

13 років наполегливої праці, все ще на передовій.

Він прокладає шлях; ми фіксуємо прибутки.

👇 Залиште коментар "Gate to the Moon", щоб приєднатися до хайпу!

- Нагородити

- 3

- 8

- Репост

- Поділіться

CryptoSocietyOfRhinoBrotherIn :

:

GT є GTДізнатися більше

- Нагородити

- подобається

- 4

- Репост

- Поділіться

GateUser-e47fc9af :

:

Гірше за тебе, вже вирізав один, а вчора знову вліз у цей більше одногоДізнатися більше

Ранкова трансляція о 19:30, 19:14 двічі оголошували короткі позиції і заробили на цьому, ха-ха😃, ексклюзивний фінансовий код для членів, нова стратегія торгівлі вже тут, підписуйтеся на Даньо Го, стабільний прибуток без ліквідації#特朗普宣布新关税政策 $BTC $GT $ETH

Переглянути оригіналТільки для підписників

Підпишіться зараз, щоб переглядати ексклюзивний контент- Нагородити

- 5

- 10

- Репост

- Поділіться

CowPower :

:

Щасливого та благополучного 🧧Дізнатися більше

Короткостроковий контракт у реальному часі

$ETH

Продаж за базовою ціною 1930

Додатковий продаж за ціною 1952

Завершення з прибутком при 1882

Обмеження збитків при 2020

#AI担忧导致IBM暴跌11%

$ETH

Продаж за базовою ціною 1930

Додатковий продаж за ціною 1952

Завершення з прибутком при 1882

Обмеження збитків при 2020

#AI担忧导致IBM暴跌11%

ETH3,66%

- Нагородити

- 1

- 3

- Репост

- Поділіться

Caution :

:

1954 можна продовжувати довгу позицію по базовому активу 🥰Дізнатися більше

- Нагородити

- 1

- 3

- Репост

- Поділіться

TheShyWindOutsideThe :

:

Порожнеча — і все, цей товар можна лише повністю зняти.Дізнатися більше

- Нагородити

- 3

- 2

- Репост

- Поділіться

GateUser-a8e7a6e8 :

:

Твердо HODL💎Дізнатися більше

Я торгую цифровими валютами на старій біржі Gate з 2012 року, приєднуйся до мене і бери участь у найгарячішій події сьогодні! https://www.gate.com/campaigns/4117?ref=VgUSAFpX&ref_type=132&utm_cmp=ZGIvqZzb

Переглянути оригінал

- Нагородити

- 2

- 3

- Репост

- Поділіться

CryptoBGs :

:

До Місяця 🌕Дізнатися більше

- Нагородити

- подобається

- 2

- Репост

- Поділіться

GodOfTheUniverse :

:

Немає необхідності!Дізнатися більше

#VitalikSellsETH

П circulateуються повідомлення, що Віталік Бутерін продав частину своїх активів Ethereum — заголовок, який природно привертає увагу ринку.

Але контекст важливий.

🔍 Що повинні розуміти інвестори

1️⃣ Транзакції засновників не завжди є медвежими

Великі перекази токенів засновниками часто пов’язані з:

• Фінансування екосистеми

• Благодійні внески

• Операційна ліквідність

• Диверсифікація портфеля

Не кожна продаж — це втрата переконань.

2️⃣ Реакція ринку проти фундаментальних показників

Короткострокова волатильність цін може виникати через настрої — але довгострокові фундаменталь

П circulateуються повідомлення, що Віталік Бутерін продав частину своїх активів Ethereum — заголовок, який природно привертає увагу ринку.

Але контекст важливий.

🔍 Що повинні розуміти інвестори

1️⃣ Транзакції засновників не завжди є медвежими

Великі перекази токенів засновниками часто пов’язані з:

• Фінансування екосистеми

• Благодійні внески

• Операційна ліквідність

• Диверсифікація портфеля

Не кожна продаж — це втрата переконань.

2️⃣ Реакція ринку проти фундаментальних показників

Короткострокова волатильність цін може виникати через настрої — але довгострокові фундаменталь

ETH3,66%

- Нагородити

- 1

- 2

- Репост

- Поділіться

GateUser-b6ad9613 :

:

Обезьяна в 🚀Дізнатися більше

Завантажити більше

Популярні теми

Дізнатися більше71.38K Популярність

164.74K Популярність

41.77K Популярність

7.73K Популярність

418.47K Популярність

Популярні активності Gate Fun

Дізнатися більше- 1

KX

空虚

Рин. кап.:$2.37KХолдери:20.00% - Рин. кап.:$0.1Холдери:00.00%

- 3

🦅

宝宝

Рин. кап.:$0.1Холдери:10.00% - Рин. кап.:$2.37KХолдери:20.00%

- Рин. кап.:$2.39KХолдери:20.00%

Закріпити