Публікуйте контент і заробляйте на видобутку контенту

placeholder

KatyPaty

Ласкаво просимо на канал трансляцій KatyPaty.

Переглянути оригінал

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

$SOL Що трапилось з цією монетою, вона вже не стабільна? Чому так часто здається, що вона повернеться, а потім знову зливається🤣 ой Після удару за ударом, кожен удар смертельний, хочеш зібрати трохи зерна, так важко... купуєш багато — вона знижується, і назад не повернеться, купуєш в коротку — гора ще вища, азартні ігри теж мають залишити трохи солодкого, друзі, ідіть додому, дружина ще там, якщо не повернетеся зараз, важко сказати, чи будете ви тут чи ні.

SOL-5,14%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

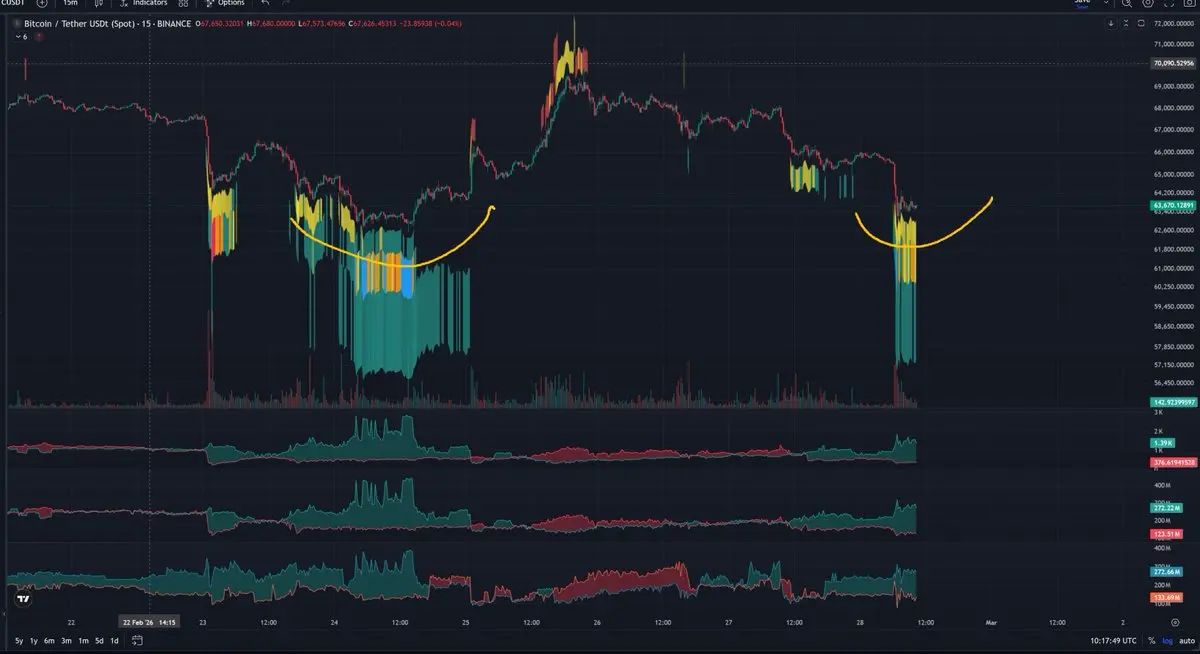

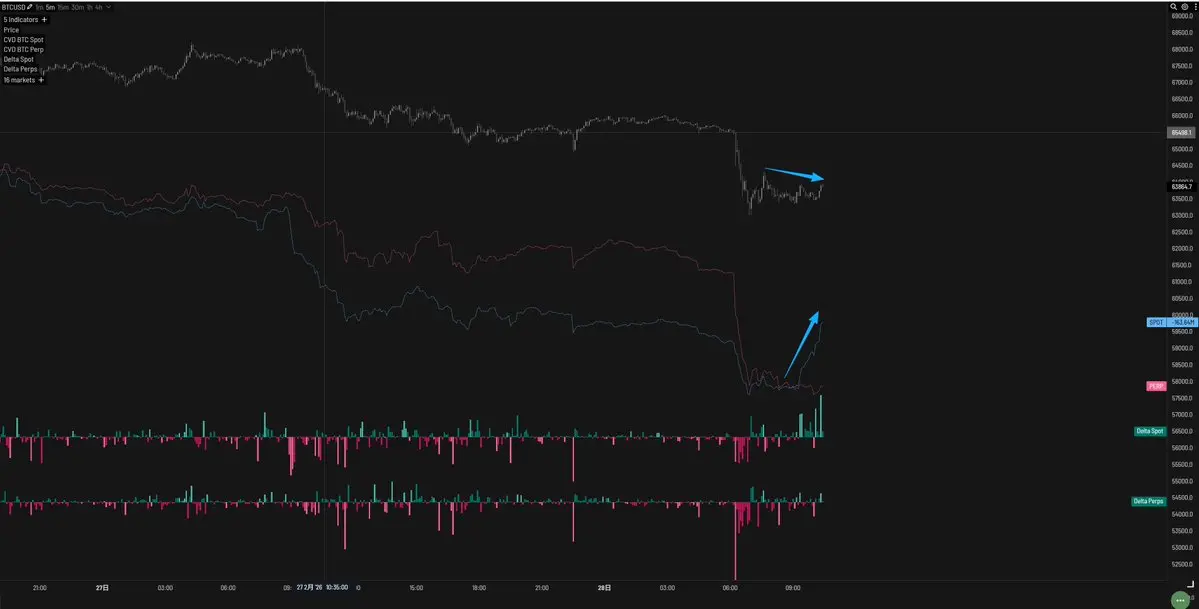

Сьогоднішній ринок..

Сьогоднішня ситуація, під впливом новин, технічний аналіз може не мати багато значення.. Існує ймовірність втрати дії, далі багато що залежить від того, чи розшириться ситуація...

Але поки що подивимось на ситуацію..

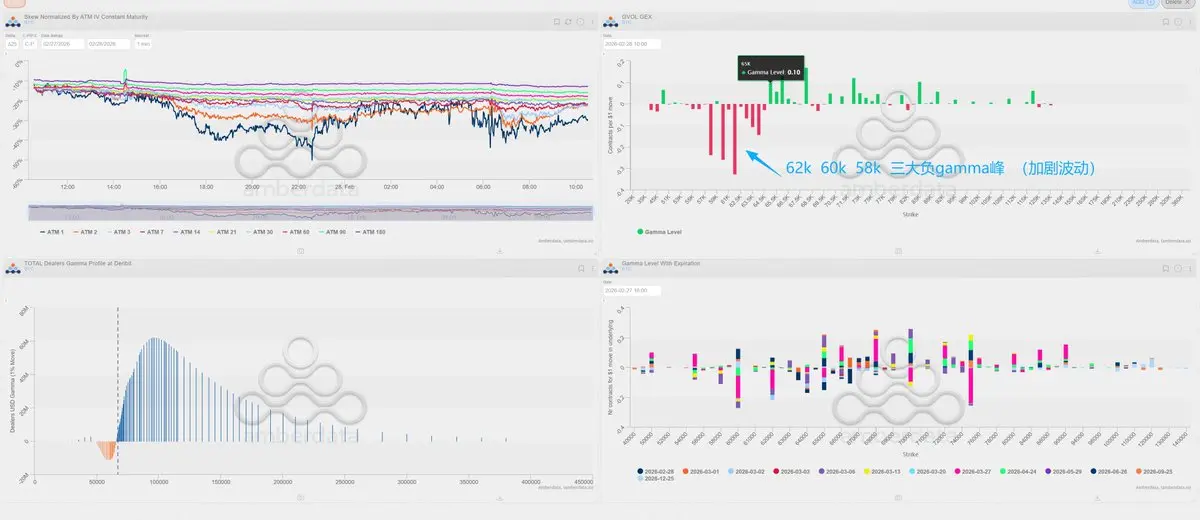

Малюнок 1 За товщиною книги ордерів тут все ще залишається попитний район, який був раніше. Якщо не враховувати великі новини, то з технічної точки зору це традиційний середньостроковий район входу для бичачих позицій у моїй системі..

Малюнок 2 Наразі попит нижче за 63k здебільшого складається з ордерів у сітці по 500 пунктів. Реальніші великі обсяги попит

Переглянути оригіналСьогоднішня ситуація, під впливом новин, технічний аналіз може не мати багато значення.. Існує ймовірність втрати дії, далі багато що залежить від того, чи розшириться ситуація...

Але поки що подивимось на ситуацію..

Малюнок 1 За товщиною книги ордерів тут все ще залишається попитний район, який був раніше. Якщо не враховувати великі новини, то з технічної точки зору це традиційний середньостроковий район входу для бичачих позицій у моїй системі..

Малюнок 2 Наразі попит нижче за 63k здебільшого складається з ордерів у сітці по 500 пунктів. Реальніші великі обсяги попит

- Нагородити

- 1

- 1

- Репост

- Поділіться

GateUser-497d3e8f :

:

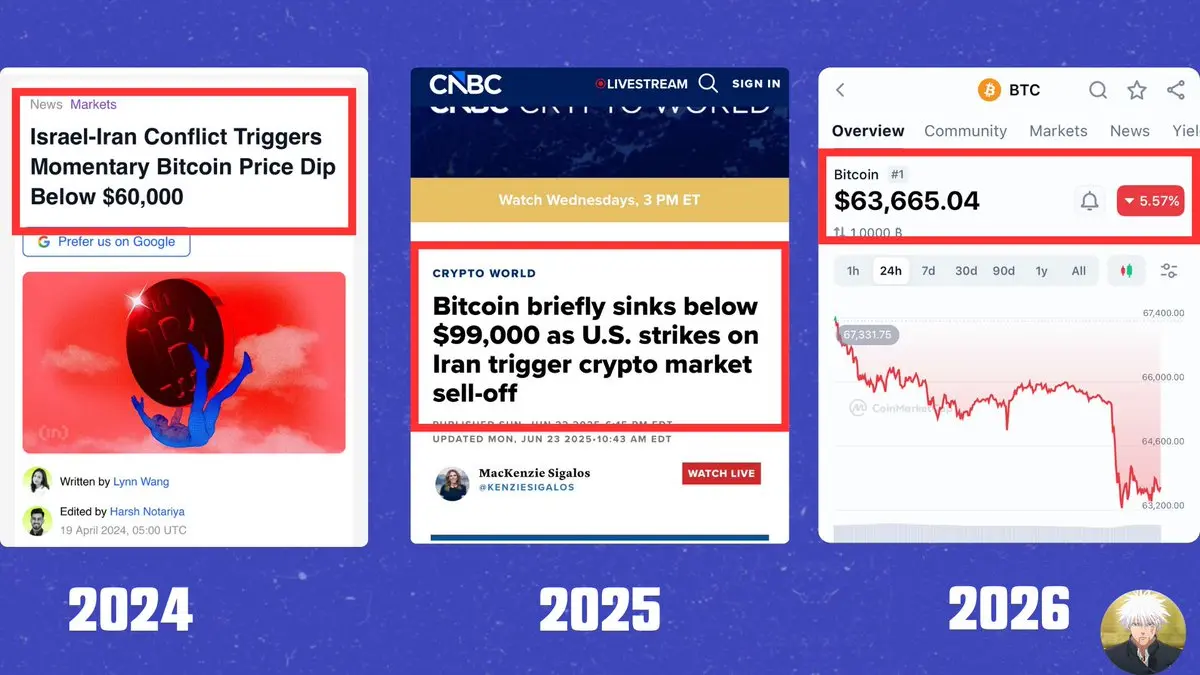

Пік 2026 року 👊星星之火

星星之火

Створено@gatefunuser_936d

Перебіг лістингу

100.00%

Рин. кап.:

$2.16K

Більше токенів

$ESP ESP знизився на 35%, але це не зупиниться на цьому — він може продовжити падіння. Відкрити коротку позицію $ESP

Остаточна цільова ціна: $0.1

#Gate广场发帖领五万美金红包 $ESP

Остаточна цільова ціна: $0.1

#Gate广场发帖领五万美金红包 $ESP

ESP-12,67%

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

- Нагородити

- 2

- 1

- Репост

- Поділіться

Crypto_Exper :

:

Слідуй за мною, брате, я повернуся, ми повинні підтримувати один одного 🥰✅- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

🧧 Gate Square $50,000 Грошовий дощ у червоних конвертах Безумовна роздача, публікуйте, щоб виграти 100%!

Захід повністю покращено, нагороди без обмежень!

🚀 Кожен отримує свою частку: нові та старі користувачі можуть публікувати, щоб отримати нагороди, максимум 28U за пост!

📈 Більше постів — більше нагород: участь без обмежень, чим більше публікуєте, тим більше червоних конвертів зможете зловити!

Приєднуйтесь зараз:

1️⃣ Оновіть додаток: оновіть до версії v8.8.0.

2️⃣ Відкрийте червоні конверти: натисніть, щоб опублікувати, нагороди будуть автоматично зараховані!

Публікуйте зараз, щоб отримати

Переглянути оригіналЗахід повністю покращено, нагороди без обмежень!

🚀 Кожен отримує свою частку: нові та старі користувачі можуть публікувати, щоб отримати нагороди, максимум 28U за пост!

📈 Більше постів — більше нагород: участь без обмежень, чим більше публікуєте, тим більше червоних конвертів зможете зловити!

Приєднуйтесь зараз:

1️⃣ Оновіть додаток: оновіть до версії v8.8.0.

2️⃣ Відкрийте червоні конверти: натисніть, щоб опублікувати, нагороди будуть автоматично зараховані!

Публікуйте зараз, щоб отримати

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

Ізраїль розпочав напад на Іран 🚨

$BTC втратив $2,500 менш ніж за годину, коли з'явилися заголовки про удари Ізраїлю по Ірану

За 60 хвилин були знищені позиції з leveraged longs $209M

Приблизно $72B зникло з загальної ринкової капіталізації криптовалют

Ситуація стає напруженою

Будьте обережні.

$BTC втратив $2,500 менш ніж за годину, коли з'явилися заголовки про удари Ізраїлю по Ірану

За 60 хвилин були знищені позиції з leveraged longs $209M

Приблизно $72B зникло з загальної ринкової капіталізації криптовалют

Ситуація стає напруженою

Будьте обережні.

BTC-2,93%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Іран завдав потужних ударів по військових базах США в Катарі, Бахрейні та ОАЕ, ситуація повністю перейшла у стан війни, це відповідь на атаки Ізраїлю на столицю Ірану 🇮🇷.#Gate广场发帖领五万美金红包 $BTC

BTC-2,93%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Вплив несподіваних подій, короткострокові пут-опціони різко зростають у ціні, у 2-5 разів, швидко зростає прихована волатильність, швидко коливається гра на продаж пут-опціонів, не займаючи кошти, опціони для великих виграшів за невеликі вкладення

Переглянути оригінал

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Доброго ранку,

це хороший день, щоб мати хороший день…

🐸

Переглянути оригіналце хороший день, щоб мати хороший день…

🐸

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

TMZ

Tamizhan

Створено@NLSTrading

Перебіг лістингу

0.00%

Рин. кап.:

$0.1

Більше токенів

#美以袭击伊朗

Дійсно, вихідні почалися з бою

Гра йде на вихідних!!!

З четверга почали планувати срібло ще до переговорів

Чому саме срібло, а не золото?

Тому що коливання срібла більші, ніж у золота

Коли в криптомірі з’являться опціони на золото та срібло?

Чекаємо на значне відкриття в понеділок

Брати, чи зможе цей лот піднятися у ціні в 20 разів після відкриття?

…………

#黄金 #白银 #美国以色列突袭伊朗BTC短线跳水

$XAU $XAG

Дійсно, вихідні почалися з бою

Гра йде на вихідних!!!

З четверга почали планувати срібло ще до переговорів

Чому саме срібло, а не золото?

Тому що коливання срібла більші, ніж у золота

Коли в криптомірі з’являться опціони на золото та срібло?

Чекаємо на значне відкриття в понеділок

Брати, чи зможе цей лот піднятися у ціні в 20 разів після відкриття?

…………

#黄金 #白银 #美国以色列突袭伊朗BTC短线跳水

$XAU $XAG

Переглянути оригінал

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Ось детальний, професійний аналіз торгівлі та торговий план на основі ARC/USDT.

Огляд ситуації на ринку

Конфлікт між двома таймфреймами:

· Вищий таймфрейм - HTF: Щоденний графік або 3м/1Д показує катастрофічне падіння.

Ціна обвалилися з максимуму 0.15871 до 0.02694. Полігонові смуги Боллінджера демонструють екстремальну волатильність, і ціна наразі знаходиться біля нижньої смуги, що свідчить про потенційний відскок у зоні перепроданості, але загальний тренд є агресивно медвежим.

· Нижчий таймфрейм - LTF: Графік на 1-годину/15-хвилинний показує іншу картину. Тут ціна стискається у вузьком

Огляд ситуації на ринку

Конфлікт між двома таймфреймами:

· Вищий таймфрейм - HTF: Щоденний графік або 3м/1Д показує катастрофічне падіння.

Ціна обвалилися з максимуму 0.15871 до 0.02694. Полігонові смуги Боллінджера демонструють екстремальну волатильність, і ціна наразі знаходиться біля нижньої смуги, що свідчить про потенційний відскок у зоні перепроданості, але загальний тренд є агресивно медвежим.

· Нижчий таймфрейм - LTF: Графік на 1-годину/15-хвилинний показує іншу картину. Тут ціна стискається у вузьком

ARC-11,49%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

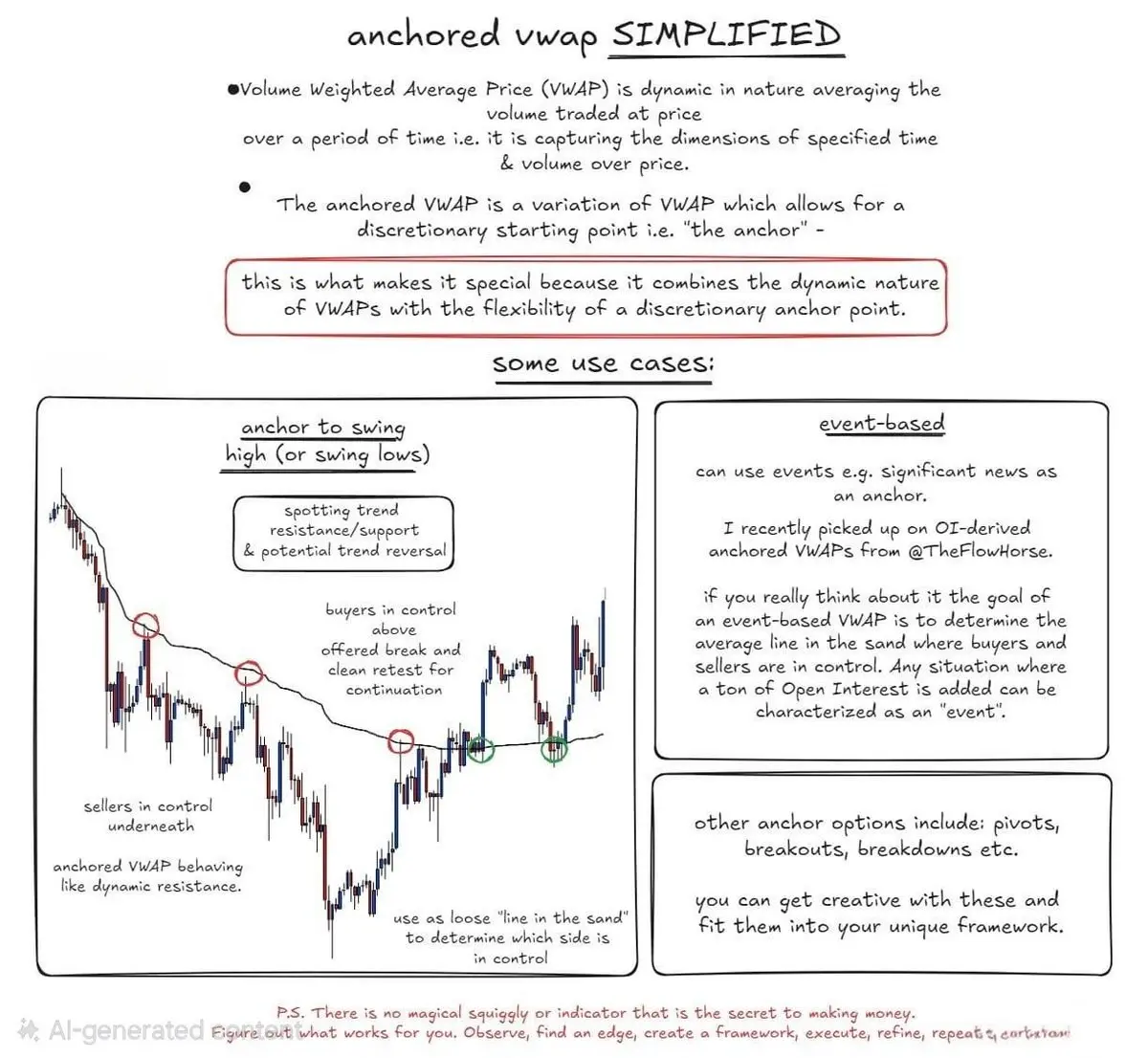

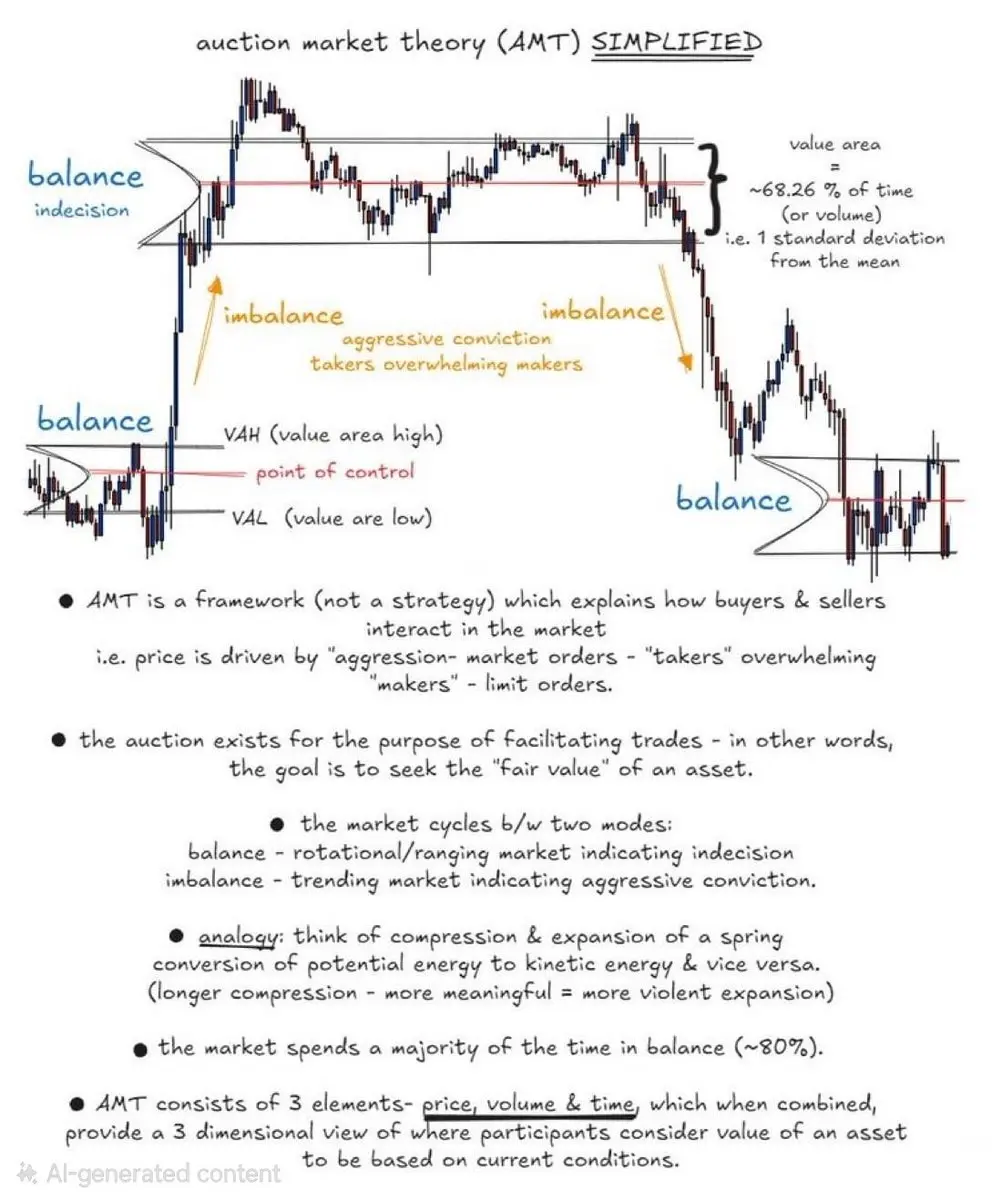

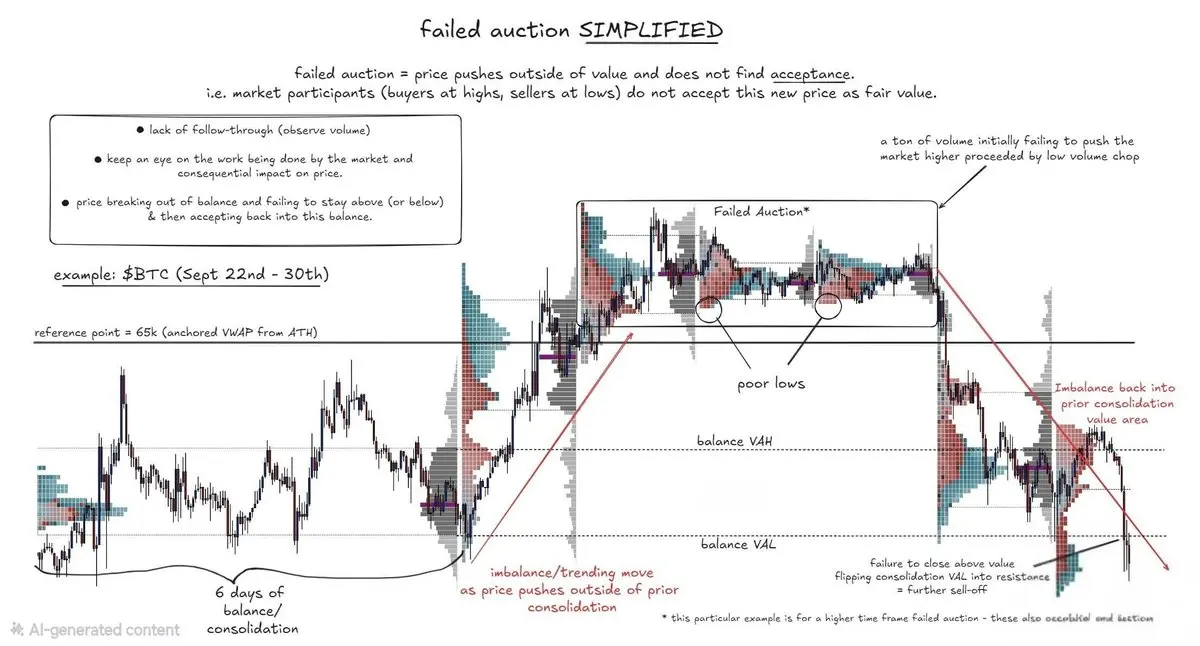

Теорія аукціонного ринку + ВЗВП з прив'язкою + Неуспішний аукціон — Повна структура

Більшість трейдерів слідують за індикаторами. Професіонали читають аукціон.

1️⃣ Теорія аукціонного ринку (AMT)

Ринки обертаються між балансом (прийняттям, справедливою вартістю, обертанням) та дисбалансом (агресивним розширенням).

70–80% часу ціна знаходиться у балансі.

Чим довше стиснення → тим більш різким є розширення.

2️⃣ ВЗВП з прив'язкою

Прив'язка до ключової події (зміщення максимум/мінімум, пробій, важливі новини).

Відстежує справжню середню ціну з того моменту.

Вище = покупці контролюють ситуацію.

Нижч

Переглянути оригіналБільшість трейдерів слідують за індикаторами. Професіонали читають аукціон.

1️⃣ Теорія аукціонного ринку (AMT)

Ринки обертаються між балансом (прийняттям, справедливою вартістю, обертанням) та дисбалансом (агресивним розширенням).

70–80% часу ціна знаходиться у балансі.

Чим довше стиснення → тим більш різким є розширення.

2️⃣ ВЗВП з прив'язкою

Прив'язка до ключової події (зміщення максимум/мінімум, пробій, важливі новини).

Відстежує справжню середню ціну з того моменту.

Вище = покупці контролюють ситуацію.

Нижч

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Звіти стверджують, що Ілон Маск витратив $20,000 на індивідуальну зачіску в Шанхаї — і інтернет розділився. 💇♂️

Деякі називають це сміливим і знаковим, інші ставлять під сумнів цінник.

Любите це чи ні, коли Ілон робить крок, світ говорить. 🚀

Переглянути оригіналДеякі називають це сміливим і знаковим, інші ставлять під сумнів цінник.

Любите це чи ні, коли Ілон робить крок, світ говорить. 🚀

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

【$GWEI сигнал】Довгий - підтвердження прориву та відскоку на 1H, очевидний намір основних гравців підтримувати ціну

$GWEI Рівень 1H після значного зростання наразі знаходиться на кінці здорової флагової корекції, ціна стабільно торгується навколо 0.0445, відмовляючись від глибокого відкату. Рівень 4H вже закріпився вище EMA20 (0.0379), тренд змінився з падіння на зростання. Поточний RSI на 1H (58.42) у здоровій зоні, що готує до нових спроб підйому.

🎯Напрямок: Довга (Long)

⚡Вхід/ордер: 0.0445 - 0.0448 (безпосередньо біля поточної ціни)

🛑Стоп-лосс: 0.0426 (нижче 1H EMA20)

🚀Ціль 1: 0.0480

🚀Ці

Переглянути оригінал$GWEI Рівень 1H після значного зростання наразі знаходиться на кінці здорової флагової корекції, ціна стабільно торгується навколо 0.0445, відмовляючись від глибокого відкату. Рівень 4H вже закріпився вище EMA20 (0.0379), тренд змінився з падіння на зростання. Поточний RSI на 1H (58.42) у здоровій зоні, що готує до нових спроб підйому.

🎯Напрямок: Довга (Long)

⚡Вхід/ордер: 0.0445 - 0.0448 (безпосередньо біля поточної ціни)

🛑Стоп-лосс: 0.0426 (нижче 1H EMA20)

🚀Ціль 1: 0.0480

🚀Ці

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$CGPT Верхня тінь різко відкидає, супроводжуючись сильними продажами свічок....

Здається, це збір ліквідності перед подальшим зниженням.

Вхід: 0.0190 – 0.0194

TP1: 0.0182

TP2: 0.0174

TP3: 0.0166

Стоп-лосс: 0.0206

#Gate广场发帖领五万美金红包 $CGPT

Здається, це збір ліквідності перед подальшим зниженням.

Вхід: 0.0190 – 0.0194

TP1: 0.0182

TP2: 0.0174

TP3: 0.0166

Стоп-лосс: 0.0206

#Gate广场发帖领五万美金红包 $CGPT

CGPT-10,44%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

🇺🇸🇮🇷 ОНОВЛЕННЯ СИТУАЦІЇ США – ІРАН 🚨

🔹 Президент Трамп заявив, що він хоче уникнути використання американських військ для атаки на Іран, але також визнав, що іноді доводиться діяти. Він підкреслив, що наразі не прийнято остаточних рішень, але висловив незадоволення тим, як Іран веде переговори, і запевнив, що Ірану не дозволено мати ядерну зброю.

🔹 Дипломатичні зусилля все ще тривають. Міністр закордонних справ Оману працює з американськими посадовцями, включаючи віцепрезидента JD Vance, щоб знизити напруженість. Міністерство закордонних справ США повідомило, що міністр закордонних спра

Переглянути оригінал🔹 Президент Трамп заявив, що він хоче уникнути використання американських військ для атаки на Іран, але також визнав, що іноді доводиться діяти. Він підкреслив, що наразі не прийнято остаточних рішень, але висловив незадоволення тим, як Іран веде переговори, і запевнив, що Ірану не дозволено мати ядерну зброю.

🔹 Дипломатичні зусилля все ще тривають. Міністр закордонних справ Оману працює з американськими посадовцями, включаючи віцепрезидента JD Vance, щоб знизити напруженість. Міністерство закордонних справ США повідомило, що міністр закордонних спра

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Завантажити більше

Приєднуйтеся до нашої зростаючої спільноти разом із 40M користувачами

⚡️ Приєднуйтеся до обговорення криптоманії разом із 40M користувачами

💬 Спілкуйтеся з улюбленими топовими авторами

👍 Дивіться те, що вас цікавить

Популярні теми

Дізнатися більше42.46M Популярність

150.32K Популярність

95.05K Популярність

1.66M Популярність

492.39K Популярність

Популярні активності Gate Fun

Дізнатися більше- Рин. кап.:$2.34KХолдери:20.00%

- Рин. кап.:$2.29KХолдери:10.00%

- Рин. кап.:$0.1Холдери:10.00%

- Рин. кап.:$2.34KХолдери:20.14%

- Рин. кап.:$2.33KХолдери:20.07%

Новини

Дізнатися більшеUSDD 2.0 постачання майнінгу, етап XV, офіційно розпочато

15 м

CertiK: У лютому збитки криптоіндустрії через експлуатацію вразливостей склали приблизно 35,7 мільйонів доларів

29 м

Міністр закордонних справ Ірану: Іран обмежить удари по військових базах США у Близькому Сході лише військовими об'єктами

49 м

Другий етап роздачі Bitlayer вже відкритий для отримання

1 г

Аналіз: Фінансова ставка по Біткоїну знизилася до -6%, що може спричинити потенційний висхідний тиск на короткі позиції

1 г

Закріпити