Post content & earn content mining yield

placeholder

【$ARC Signal】Short | Weak consolidation after volume breakout

$ARC After a sharp drop of -18.55% with increased volume, the price is consolidating weakly at a low level. High open interest suggests selling pressure has not been fully released. The current pattern is a continuation of the downtrend.

🎯 Direction: Short (Short)

🎯 Entry: 0.0670 - 0.0685

🛑 Stop Loss: 0.0710 (Rigid Stop Loss)

🚀 Target 1: 0.0620

🚀 Target 2: 0.0580

$ARC Price drops sharply with massive volume; market logic indicates that judgment should be based on open interest. Currently, high open interest combined with a b

$ARC After a sharp drop of -18.55% with increased volume, the price is consolidating weakly at a low level. High open interest suggests selling pressure has not been fully released. The current pattern is a continuation of the downtrend.

🎯 Direction: Short (Short)

🎯 Entry: 0.0670 - 0.0685

🛑 Stop Loss: 0.0710 (Rigid Stop Loss)

🚀 Target 1: 0.0620

🚀 Target 2: 0.0580

$ARC Price drops sharply with massive volume; market logic indicates that judgment should be based on open interest. Currently, high open interest combined with a b

ARC-13.92%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

wcnm

那就是干!

Created By@醋冲

Listing Progress

0.00%

MC:

$3.42K

Create My Token

can’t believe this was two years ago \n\nis time flying for everyone or just me lol

- Reward

- like

- Comment

- Repost

- Share

The one chart I’m actively watching is $ROSE. If we reclaim this range, this thing will go insane.\n\nVolume at the lows is as high as it was at ATH, you think that’s normal? fuh nah.\n\nOBV is also showing crazy strength, it went from $3B to $10B.

- Reward

- like

- Comment

- Repost

- Share

- Technical Outlook on Altcoins: Ethereum and XRP Look for Short-Term Rebound:

Ethereum's price remains within a range of $2900 to $3000, despite the overall trend leaning downward. The Relative Strength Index (RSI) at 39 on the daily chart is hindering its recovery, indicating that sellers continue to dominate the trend. Any move toward the midline could signal a shift in momentum from bearish to bullish.

The MACD indicator on the daily chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. The red histogram bars below zero continue

View OriginalEthereum's price remains within a range of $2900 to $3000, despite the overall trend leaning downward. The Relative Strength Index (RSI) at 39 on the daily chart is hindering its recovery, indicating that sellers continue to dominate the trend. Any move toward the midline could signal a shift in momentum from bearish to bullish.

The MACD indicator on the daily chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. The red histogram bars below zero continue

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Altcoins, including Ethereum (ETH) and Ripple (XRP), are testing key support levels, confirming the fragility of the current market structure. Ethereum's price remains above the $2900 support level but below the pivotal support level of $3000. Meanwhile, XRP has maintained stability above the $1.90 level, indicating short-term stability as bulls attempt to regain the $2.00 level.

【$GUN Signal】Long + Volume and Price Breakout

$GUN Strong breakout after a 30% increase in volume, combined with a surge in open interest, is a typical signal of institutional entry rather than a short squeeze.

🎯 Direction: Long

🎯 Entry: 0.0328 - 0.0335

🛑 Stop Loss: 0.0315 ( Rigid Stop Loss )

🚀 Target 1: 0.0360

🚀 Target 2: 0.0385

The price broke out under massive volume, with open interest rising simultaneously, confirming the authenticity of the new buying. The market shows strong absorption of buy orders, with limited pullback, indicating market psychology has shifted from hesitation

$GUN Strong breakout after a 30% increase in volume, combined with a surge in open interest, is a typical signal of institutional entry rather than a short squeeze.

🎯 Direction: Long

🎯 Entry: 0.0328 - 0.0335

🛑 Stop Loss: 0.0315 ( Rigid Stop Loss )

🚀 Target 1: 0.0360

🚀 Target 2: 0.0385

The price broke out under massive volume, with open interest rising simultaneously, confirming the authenticity of the new buying. The market shows strong absorption of buy orders, with limited pullback, indicating market psychology has shifted from hesitation

GUN32.15%

- Reward

- like

- Comment

- Repost

- Share

‘liquidate all the bulls. \n\ngood. now do it again. \n\nexcellent. \n\none more time. \n\nvery nice. \n\nok, liquidate the bulls now. \n\nnicely done. \n\nmake them think it’s over. \n\nwonderful. \n\nnow nuke the bears again. \n\ngreat, now make them think they’re back. \n\nliquidate them again.’

- Reward

- like

- Comment

- Repost

- Share

institutional bullish signals? BlackRock + Delaware Life investing in Bitcoin

- Reward

- like

- Comment

- Repost

- Share

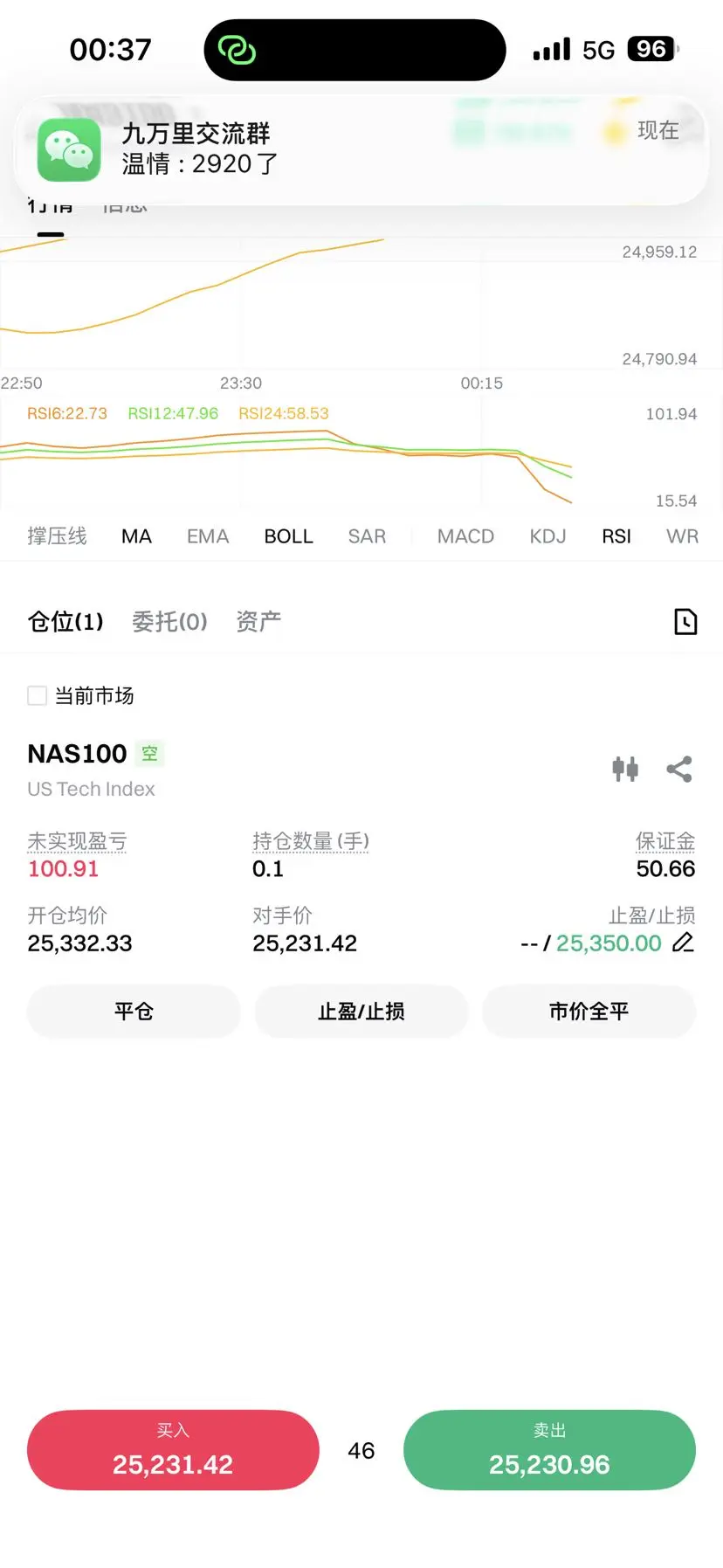

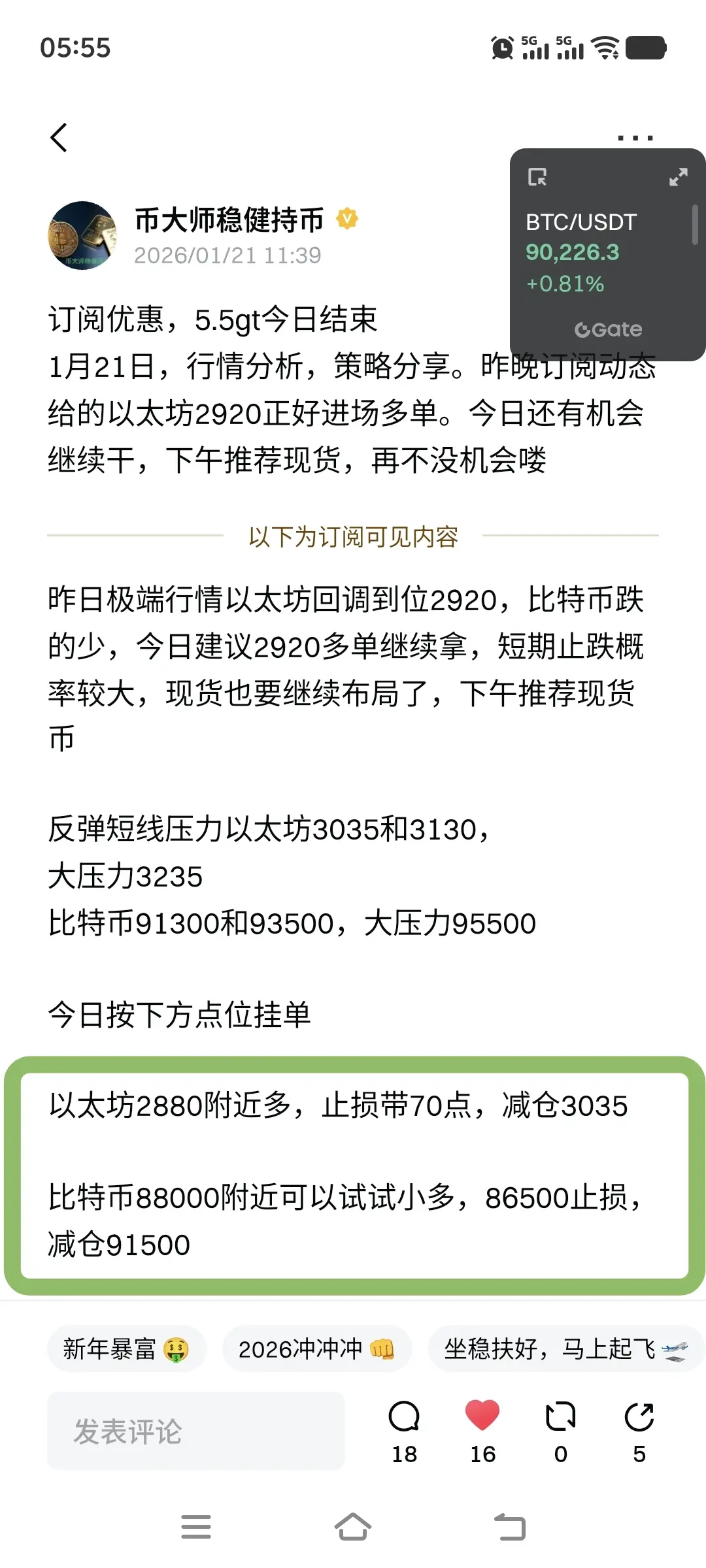

By following the subscription dynamic points to place orders steadily, everything is settled. The day before yesterday, Ethereum at 2920 was bought long based on the dynamic points. Yesterday, the dynamic Ethereum at over 2880 and Bitcoin at 88000 were both perfectly executed for profit. Just follow the subscription dynamic points to place orders, and profit is that simple.

We professionally provide subscription dynamic contract entry points, aiming for long-term stable profits, not for short-term frequent trading excitement.

Yesterday's recommended spot currencies have already rebounded, seiz

We professionally provide subscription dynamic contract entry points, aiming for long-term stable profits, not for short-term frequent trading excitement.

Yesterday's recommended spot currencies have already rebounded, seiz

ETH2.54%

- Reward

- 11

- 8

- Repost

- Share

SisterYuanBao :

:

New Year Wealth Explosion 🤑View More

The less you say, the more you earn. Click on the avatar to view subscriptions and get firsthand information resources.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 3

- Repost

- Share

TxRobotAutomatically :

:

Big brother is awesomeView More

狂暴大牛

狂暴大牛

Created By@ProfessionalBrotherOnlyEmpty

Listing Progress

0.00%

MC:

$3.43K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

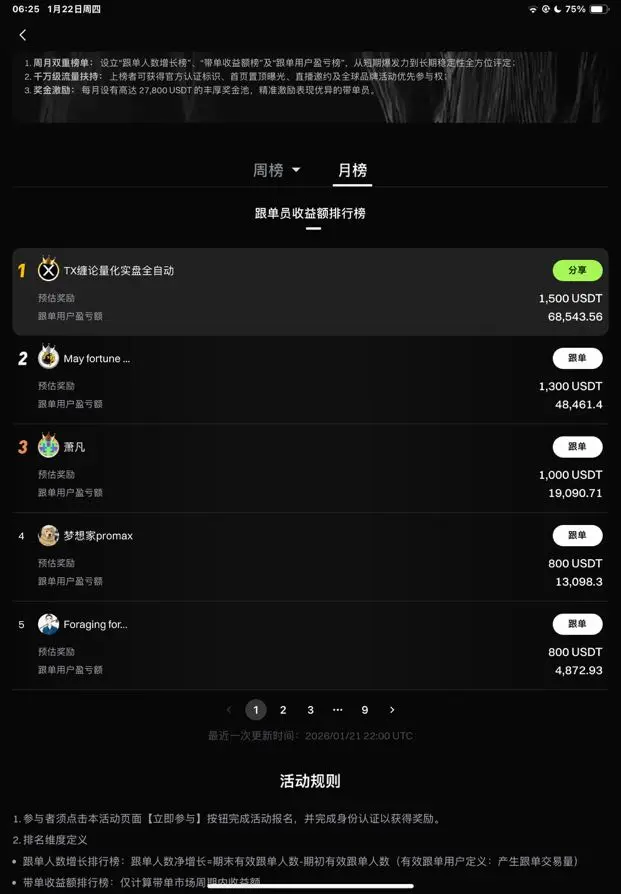

#GateSquareCreatorNewYearIncentives A New Era of Crypto Content, Community & Reward Potential in 2026

As the crypto landscape evolves, community engagement and high‑quality information have become cornerstones of smarter investing and broader adoption. Gate.io, one of the world’s leading crypto trading and ecosystem platforms, is doubling down on this truth with its most ambitious initiative yet — the #GateSquareCreatorNewYearIncentives program. What began as a seasonal engagement initiative has quickly transformed into a cornerstone strategy that rewards creators, empowers investors, and stre

As the crypto landscape evolves, community engagement and high‑quality information have become cornerstones of smarter investing and broader adoption. Gate.io, one of the world’s leading crypto trading and ecosystem platforms, is doubling down on this truth with its most ambitious initiative yet — the #GateSquareCreatorNewYearIncentives program. What began as a seasonal engagement initiative has quickly transformed into a cornerstone strategy that rewards creators, empowers investors, and stre

TOKEN1%

- Reward

- 4

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

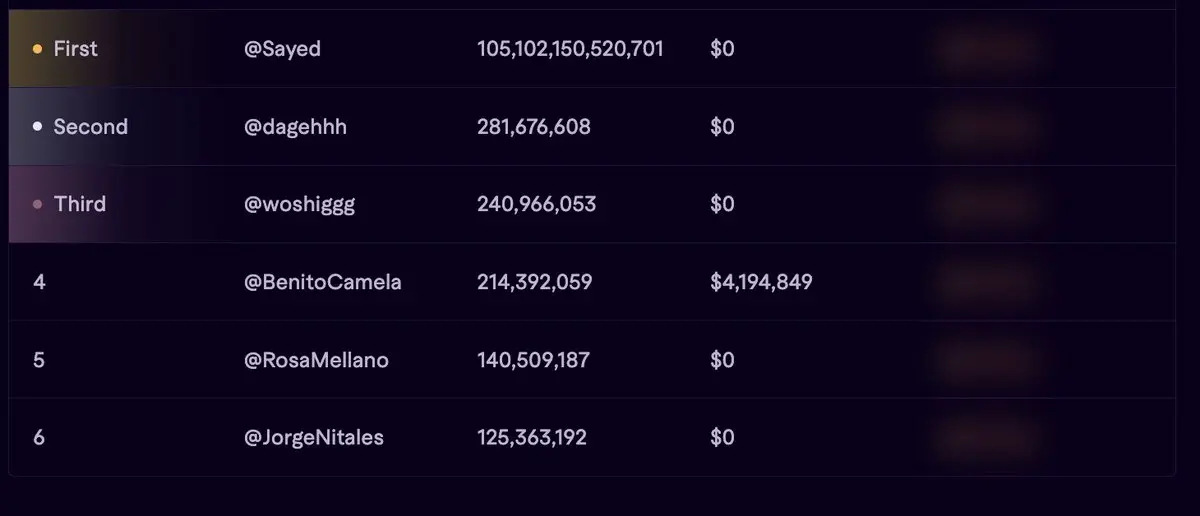

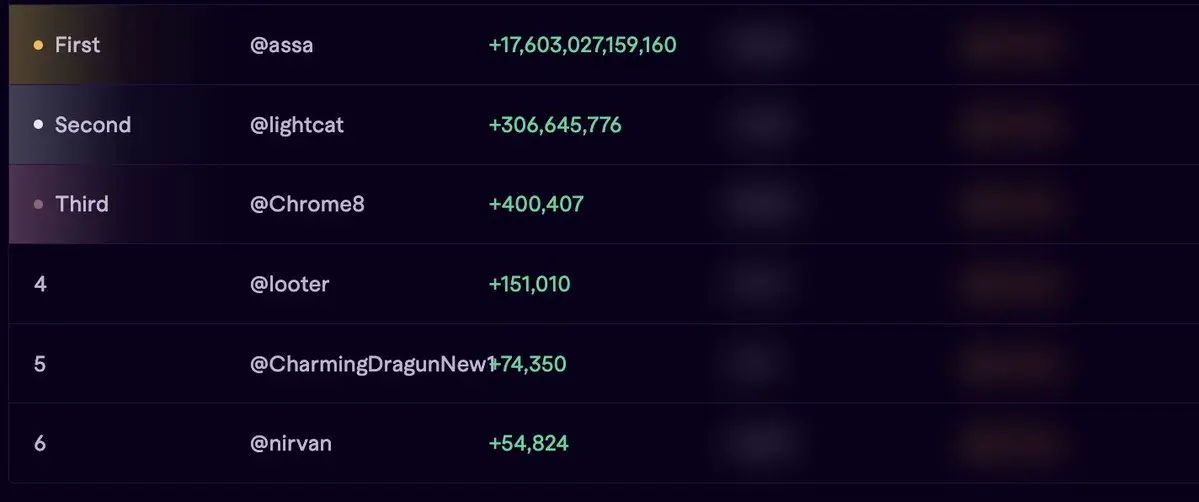

Something feels off with the Week 1 leaderboard 🧐🧐\n\nTop 1 spot volume shows over $105T\nTop 1 profit shows +$17B.\nThis is far beyond normal user behavior.\n\nEither there is a hidden mechanic, or someone found a loophole to inflate volume and PnL without real risk.\n\nIf the goal is fair distribution for real traders, this needs clarification.\nTransparency matters, especially when GP and airdrop allocation depend on these numbers.\n\n@GeniusTerminal team should explain how this is possible.

- Reward

- 1

- Comment

- Repost

- Share

I do see a very similar structure of Oct. 2024.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More39.05K Popularity

21.27K Popularity

8.77K Popularity

58.53K Popularity

343.71K Popularity

Hot Gate Fun

View More- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.43KHolders:10.00%

News

View MoreThe Federal Reserve has a 95% probability of maintaining interest rates in January, with only a 5% chance of a rate cut.

1 h

Data: 1,705 BTC transferred from anonymous addresses, worth approximately $136 million

1 h

US stocks close with the three major indices up over 1%, Trump’s post boosts the market

2 h

Trump: Hopes Hasset remains in office; the Federal Reserve Chair candidates have been narrowed down to two or three.

2 h

Data: In the past 24 hours, the total liquidation across the network was $1.005 billion, with long positions liquidated at $670 million and short positions at $335 million.

3 h

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889