Post content & earn content mining yield

placeholder

OldASaid.

The idea is to first suppress and then promote. Good morning, brothers. Yesterday, Lao A mentioned that breaking through resistance is not that easy, and escaping the range is even more difficult. The intraday Hangqin basically moved up as expected and then retraced, pulling back from the top smoothly.

The daily chart closed with a long upper shadow shooting star. If this candle closes at the top, it is a very clear bearish signal. However, in the context of the overall range, it can only be seen as a slightly bearish signal again. The market is returning to consolidation. As always, do not ex

View OriginalThe daily chart closed with a long upper shadow shooting star. If this candle closes at the top, it is a very clear bearish signal. However, in the context of the overall range, it can only be seen as a slightly bearish signal again. The market is returning to consolidation. As always, do not ex

- Reward

- like

- Comment

- Repost

- Share

One of the most interesting things I've noticed in $TON lately is how the line between crypto and traditional markets is gradually blurring. With the advent of xStocks on STONfi, this is particularly evident. Within the network, it is now possible to work with tokenized versions of real stocks, such as Nvidia, as easily as with any other token.

Importantly, this is not an attempt to complicate the process or hide it behind a new interface. Everything looks familiar: wallet, exchange, on-chain asset. And thanks to Backed Finance, the value of xStocks follows the price of the underlying asset,

Importantly, this is not an attempt to complicate the process or hide it behind a new interface. Everything looks familiar: wallet, exchange, on-chain asset. And thanks to Backed Finance, the value of xStocks follows the price of the underlying asset,

TON3.22%

- Reward

- like

- Comment

- Repost

- Share

#DoubleRewardsWithGUSD Earning Yield with $GUSD & Launchpool: A Forward-Looking DeFi Allocation Strategy

As DeFi matures, yield generation is shifting from short-term APR chasing to deliberate capital allocation. Staking today is no longer about finding the highest number on a dashboard — it’s about understanding where yield comes from, how sustainable it is, and how it fits into a broader portfolio strategy. Within this context, $GUSD paired with Launchpool participation represents a layered approach to yield that balances stability with optional upside.

$GUSD as a Core Yield Instrument

Stabl

As DeFi matures, yield generation is shifting from short-term APR chasing to deliberate capital allocation. Staking today is no longer about finding the highest number on a dashboard — it’s about understanding where yield comes from, how sustainable it is, and how it fits into a broader portfolio strategy. Within this context, $GUSD paired with Launchpool participation represents a layered approach to yield that balances stability with optional upside.

$GUSD as a Core Yield Instrument

Stabl

GUSD0.04%

- Reward

- 13

- 4

- Repost

- Share

CryptoVortex :

:

Merry Christmas ⛄View More

- Reward

- 4

- 7

- Repost

- Share

AylaShinex :

:

Watching Closely 🔍️View More

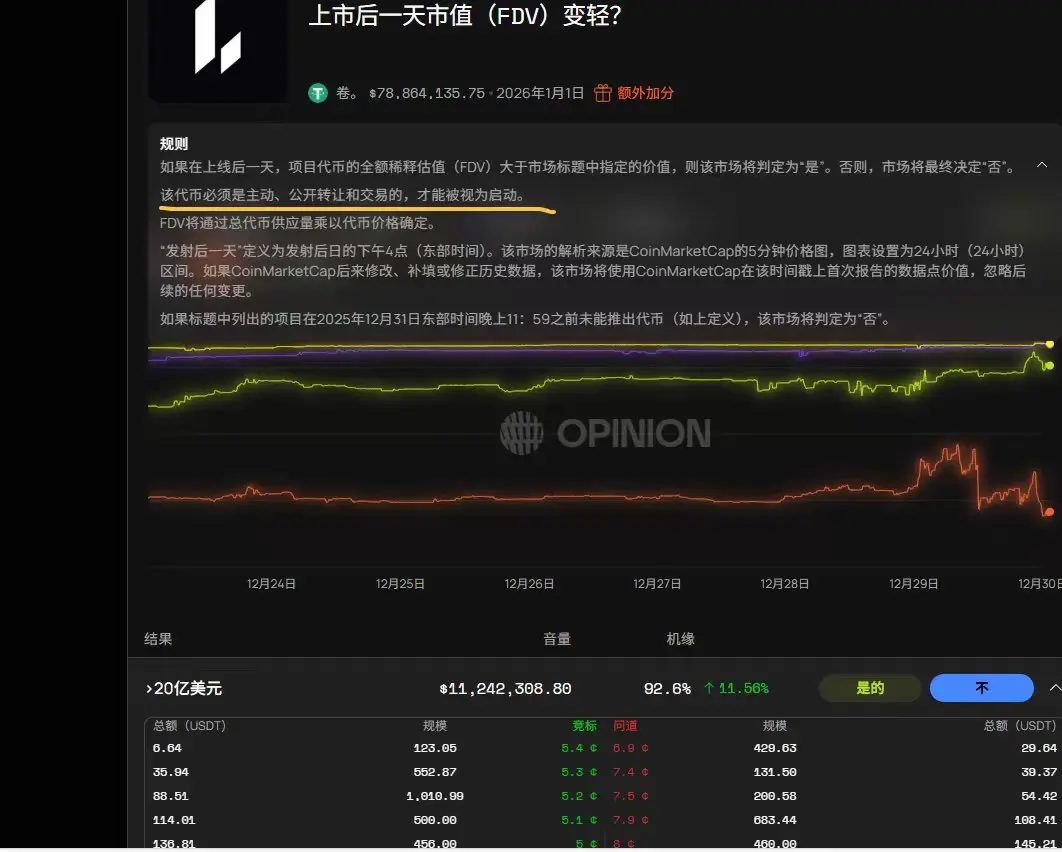

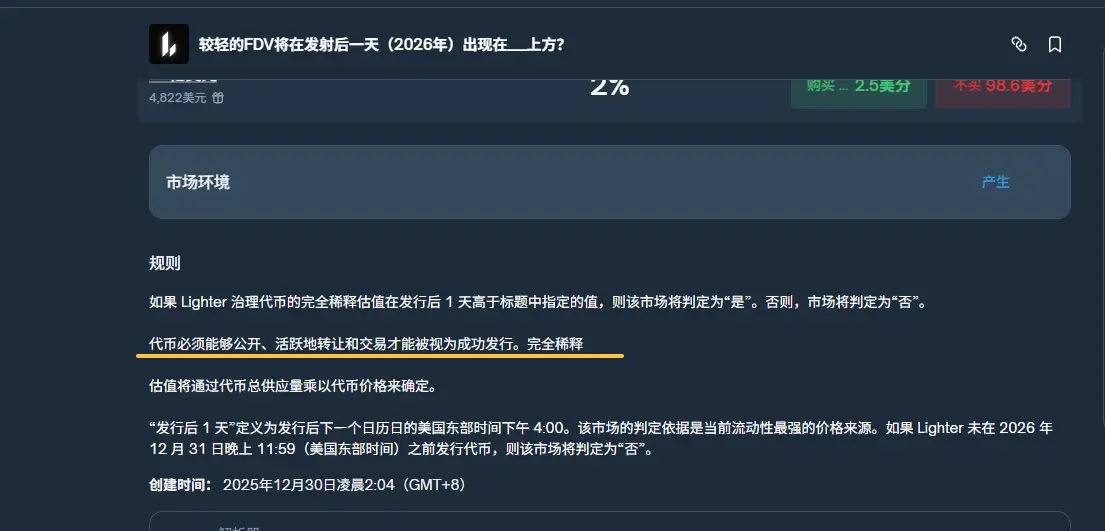

ligter predicts there will be a betting opportunity in the market tomorrow.

If other platforms do not list lit spot, it will be judged as no.

2B no has a big betting opportunity tomorrow.

If other platforms do not hit 1 or 0.5 tomorrow, you can consider betting.

@zhudi32 Is my understanding correct?

If other platforms do not list lit spot, it will be judged as no.

2B no has a big betting opportunity tomorrow.

If other platforms do not hit 1 or 0.5 tomorrow, you can consider betting.

@zhudi32 Is my understanding correct?

LIT-43.64%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- 3

- 1

- Share

Kurnitoxt99 :

:

Pay close attentionView More

$ZBT

#ZEROBASE is a decentralized infrastructure network that provides real-time zero-knowledge proofs (ZKP) for various applications, such as private identities, passwordless login, private transactions, and cross-domain verification.

The ZBT token is the native utility token within the network — with a total supply of 1 billion ZBT.

ZBT also adopts multichain standards like LayerZero OFT (Omnichain Fungible Token) to enable cross-chain operations.

#Gare #ZBT

#ZEROBASE is a decentralized infrastructure network that provides real-time zero-knowledge proofs (ZKP) for various applications, such as private identities, passwordless login, private transactions, and cross-domain verification.

The ZBT token is the native utility token within the network — with a total supply of 1 billion ZBT.

ZBT also adopts multichain standards like LayerZero OFT (Omnichain Fungible Token) to enable cross-chain operations.

#Gare #ZBT

ZBT-3.04%

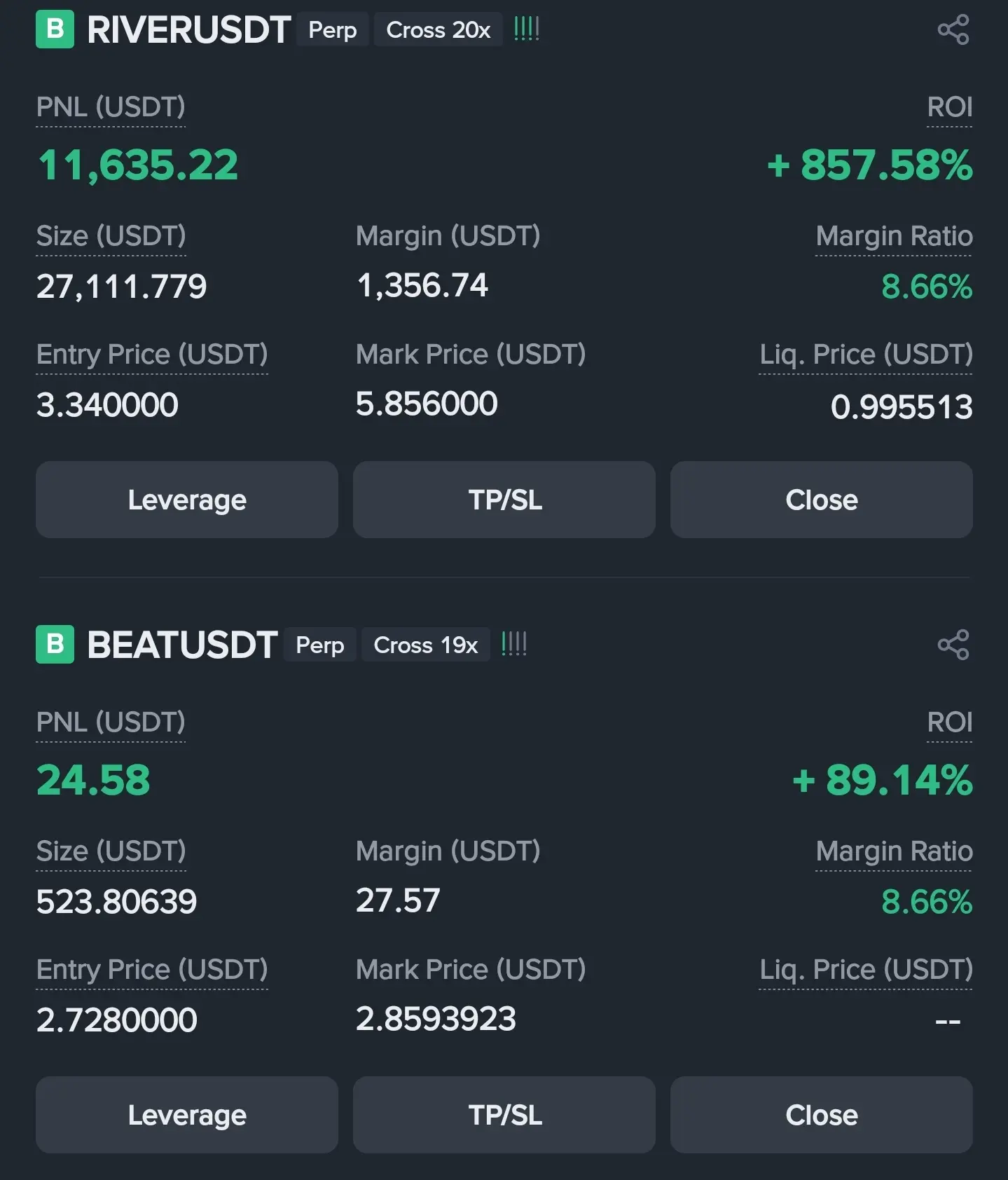

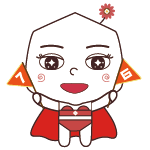

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 1

- Repost

- Share

munii :

:

way to buy iphone 17 pro max today😆When will I have such a title on Sesame, Artist🤔

On Sesame, I go by Pants Can't Lift🧐

View OriginalOn Sesame, I go by Pants Can't Lift🧐

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 4

- Repost

- Share

RijinDoujin958 :

:

XP is making a move🥳View More

Relive a year in crypto—riding the market highs and taking bold leaps. Every moment counts. Check your #2025GateYearEndSummary now, recap your 2025 crypto adventure with Gate, and get 20 USDT through sharing. https://www.gate.com/competition/your-year-in-review-2025?ref=VQAVXF9DAW&ref_type=126&shareUid=U1VDVlpWCAQO0O0O

- Reward

- 4

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

Join the Gate Holiday Season Carnival and the Snowball Challenge to unlock a $100,000 USDT prize pool! Trade, invite, and share to earn snowball rewards. New users can also claim a 50 USDT Holiday Gift. https://www.gate.com/competition/holiday-season?ref_type=165&utm_cmp=7uuf2O1N&ref=UFRFAQ0M

- Reward

- 19

- 15

- Repost

- Share

Bab谋_Ali :

:

Merry Christmas ⛄View More

GateAI releases beautiful women😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

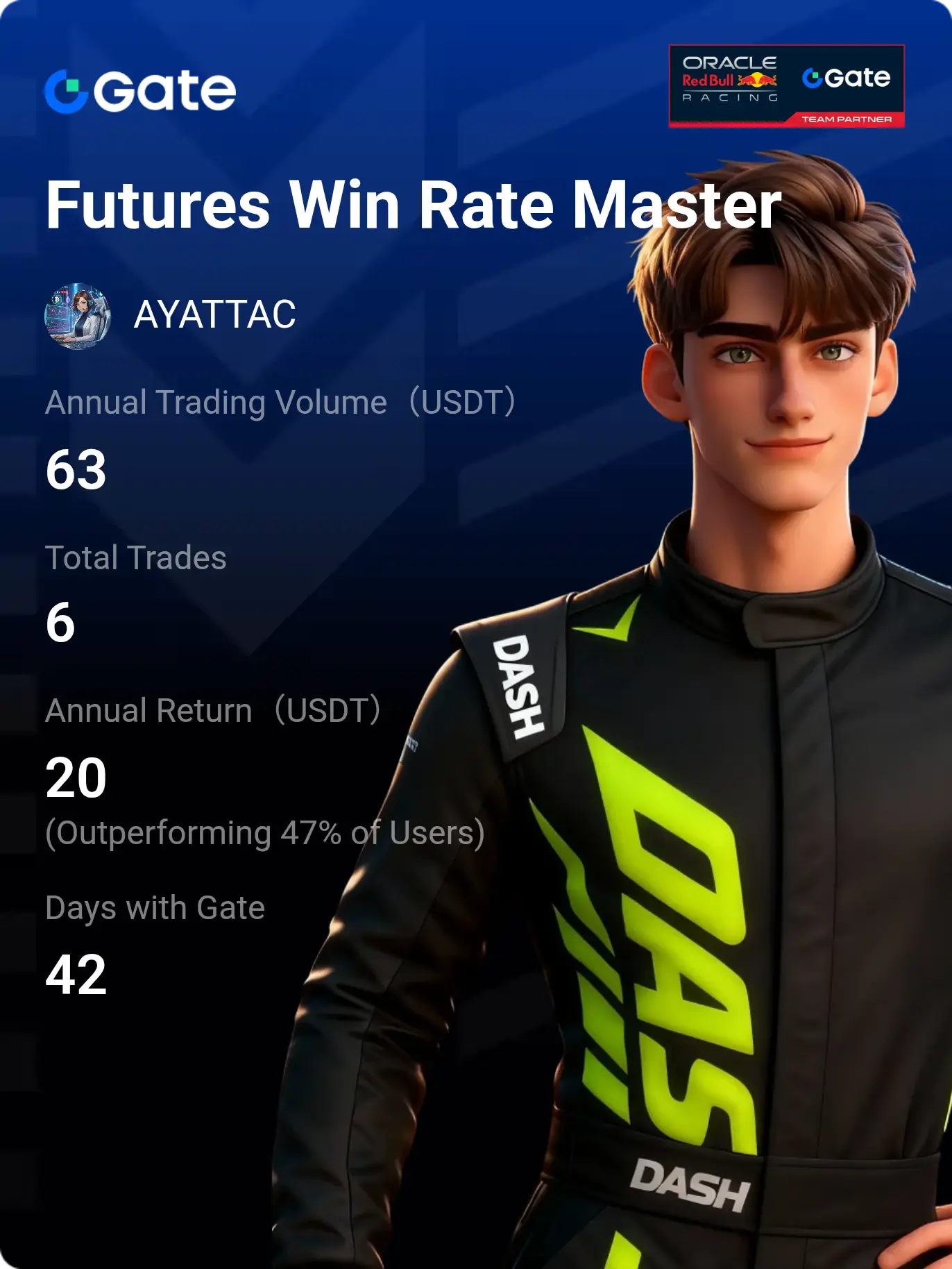

"During a Lifetime"

Brothers, hello everyone. I am trader Zhu Yidan. Recently, I saw a quote that said: "If during your lifetime you can't see yourself in your prime, then you've truly lived a wasted life."

I used to think that being in your prime meant wearing luxury watches, driving expensive cars, and wearing designer brands. Now I understand that these are just external displays. The true essence of being in your prime focuses on the words "yourself"—a strong physique, extraordinary courage, both physically and mentally.

This is a process from the outside in. When you lack those external p

View OriginalBrothers, hello everyone. I am trader Zhu Yidan. Recently, I saw a quote that said: "If during your lifetime you can't see yourself in your prime, then you've truly lived a wasted life."

I used to think that being in your prime meant wearing luxury watches, driving expensive cars, and wearing designer brands. Now I understand that these are just external displays. The true essence of being in your prime focuses on the words "yourself"—a strong physique, extraordinary courage, both physically and mentally.

This is a process from the outside in. When you lack those external p

- Reward

- 1

- Comment

- Repost

- Share

Brothers, how many likes is this picture worth?

View Original

- Reward

- like

- Comment

- Repost

- Share

Relive a year in crypto—riding the market highs and taking bold leaps. Every moment counts. Check your #2025GateYearEndSummary now, recap your 2025 crypto adventure with Gate, and get 20 USDT through sharing. https://www.gate.com/competition/your-year-in-review-2025?ref=VLBEBGGJBQ&ref_type=126&shareUid=VlZMUl5YBAoO0O0O

- Reward

- 1

- 1

- Repost

- Share

Ybaser :

:

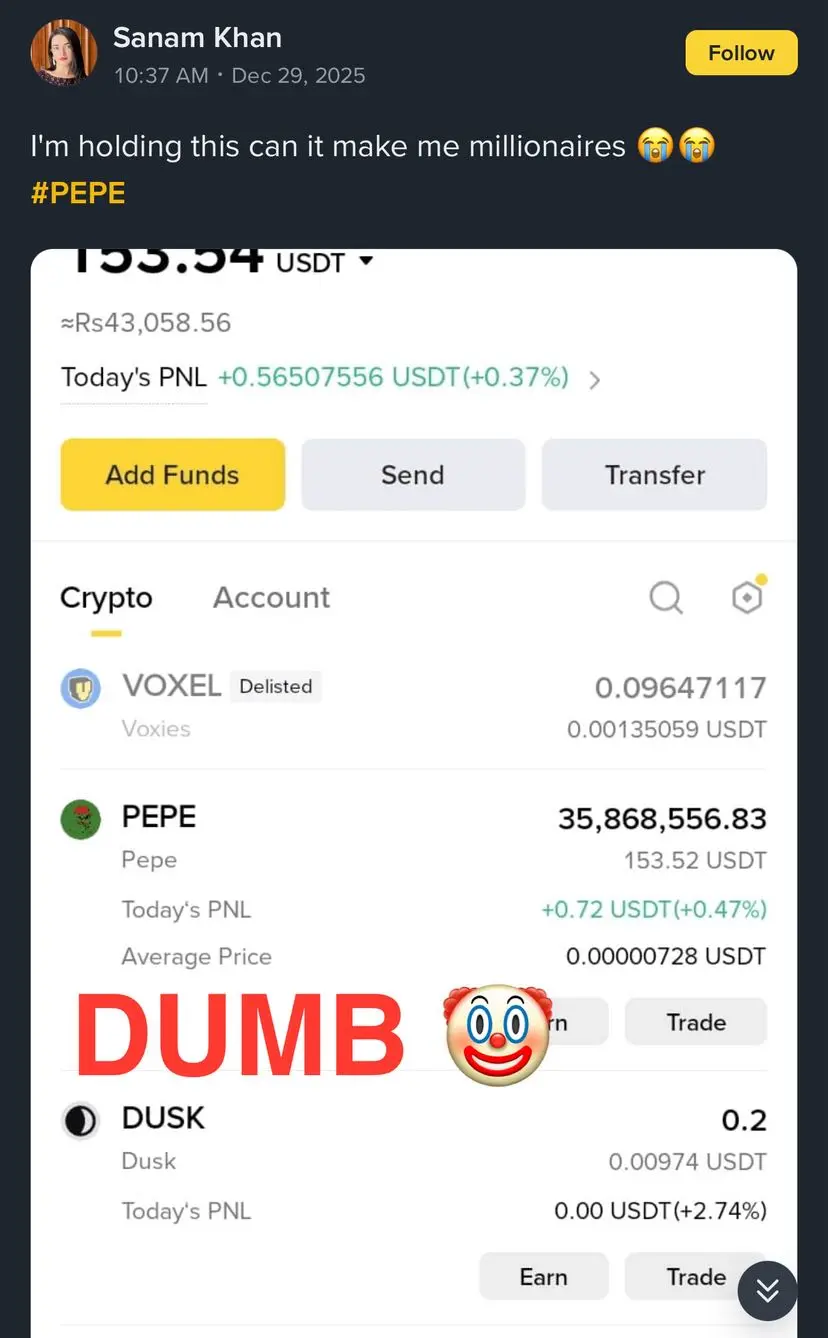

Merry Christmas ⛄People are soo dumb nowdays 🤡🤣

She want to become millionaire with 100$ 😂

She want to become millionaire with 100$ 😂

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#GoldPrintsNewATH Gold Enters a New Price Discovery Phase

Gold has officially surpassed its previous all-time highs and moved into a fresh price discovery cycle, with spot prices trading near $4,506 per ounce. This breakout represents one of the strongest structural rallies in modern gold market history and reflects deeper shifts in global capital allocation.

Key Drivers Behind Gold’s Historic Move

1. Monetary Policy Outlook

Market expectations for U.S. Federal Reserve rate cuts in 2026 have strengthened gold’s appeal. Lower interest rates reduce the opportunity cost of holding non-yielding as

Gold has officially surpassed its previous all-time highs and moved into a fresh price discovery cycle, with spot prices trading near $4,506 per ounce. This breakout represents one of the strongest structural rallies in modern gold market history and reflects deeper shifts in global capital allocation.

Key Drivers Behind Gold’s Historic Move

1. Monetary Policy Outlook

Market expectations for U.S. Federal Reserve rate cuts in 2026 have strengthened gold’s appeal. Lower interest rates reduce the opportunity cost of holding non-yielding as

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

Merry Christmas ⛄Do not forget to help others; do not forget the burden you bear.

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitwise Foresees End of Bitcoin’s Four-Year Cycle, Anticipates New Highs in 2026 - - #cryptocurrency #bitcoin #altcoins

BTC1.54%

- Reward

- like

- Comment

- Repost

- Share

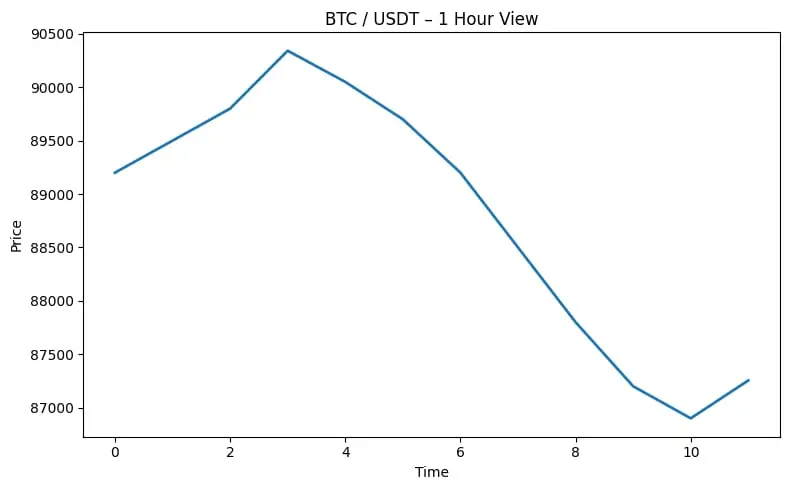

$BTC 📊 BTC Market View | 1 Hour Timeframe

Token: BTC

Pair: BTC/USDT

Timeframe: 1H

BTC faced strong selling pressure after rejecting the 90,300 zone. Price dropped fast and is now trading near 87,200, where buyers are starting to react.

On the 1-hour chart, momentum is still weak, but selling pressure looks slower compared to the earlier dump. Volume increased during the drop, which often means panic selling may be close to cooling off.

🔍 1H Technical View

Strong rejection from 90K resistance

Price testing key support around 86,700 – 87,000

Moving averages turning down → short-term trend is

Token: BTC

Pair: BTC/USDT

Timeframe: 1H

BTC faced strong selling pressure after rejecting the 90,300 zone. Price dropped fast and is now trading near 87,200, where buyers are starting to react.

On the 1-hour chart, momentum is still weak, but selling pressure looks slower compared to the earlier dump. Volume increased during the drop, which often means panic selling may be close to cooling off.

🔍 1H Technical View

Strong rejection from 90K resistance

Price testing key support around 86,700 – 87,000

Moving averages turning down → short-term trend is

BTC1.54%

- Reward

- 5

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.59K Popularity

160.09K Popularity

30.61K Popularity

89.07K Popularity

2.53K Popularity

Hot Gate Fun

View More- MC:$3.62KHolders:20.09%

- MC:$3.57KHolders:10.00%

- MC:$3.55KHolders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$3.61KHolders:20.04%

News

View MoreUS court opposes DEF's submission of amicus brief as it considers rehearing the MEV case

3 m

Federal Reserve Meeting Minutes: Participants generally expect the economic growth rate to accelerate by 2026

4 m

Federal Reserve meeting minutes reveal dissent over rate cuts: Most officials expect to maintain easing, but timing and magnitude are uncertain.

35 m

The Federal Reserve expects to purchase $220 billion in short-term government bonds over the next 12 months.

59 m

The Federal Reserve meeting minutes signal a cautious dovish stance, considering further interest rate cuts

3 h

Pin

New Version, Worth Being Seen! #GateAPPRefreshExperience

🎁 Gate APP has been updated to the latest version v8.0.5. Share your authentic experience on Gate Square for a chance to win Gate-exclusive Christmas gift boxes and position experience vouchers.

How to Participate:

1. Download and update the Gate APP to version v8.0.5

2. Publish a post on Gate Square and include the hashtag: #GateAPPRefreshExperience

3. Share your real experience with the new version, such as:

Key new features and optimizations

App smoothness and UI/UX changes

Improvements in trading or market data experience

Your fa🎉 Share Your 2025 Year-End Summary & Win $10,000 Sharing Rewards!

Reflect on your year with Gate and share your report on Square for a chance to win $10,000!

👇 How to Join:

1️⃣ Click to check your Year-End Summary: https://www.gate.com/competition/your-year-in-review-2025

2️⃣ After viewing, share it on social media or Gate Square using the "Share" button

3️⃣ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Generous Prizes:

1️⃣ Daily Lucky Winner: 1 winner per day gets $30 GT, a branded hoodie, and a Gate × Red Bull tumbler

2️⃣ Lucky Share Draw: 10🎨 Gate AI Creation Contest | One Sentence, Draw Your 2026

On Gate Square, anyone can be a visual creator — truly zero barriers to entry.

With just one sentence, generate an image and bring your vision of 2026 to life.

Create and post your work using Gate Square AI Creation for a chance to win the Gate Year of the Horse New Year Gift Box.

📅 Duration

Dec 17, 2025, 10:00 – Jan 3, 2026, 18:00 UTC

🎯 How to Join

1. Go to Gate Square → Create Post → AI Creation

2. Enter one sentence to generate your image

3. Post with #GateAICreation

🏆 Rewards

5 winners: Gate Year of the Horse New Year