Satoshitalks

No content yet

Satoshitalks

Happy Thursday.

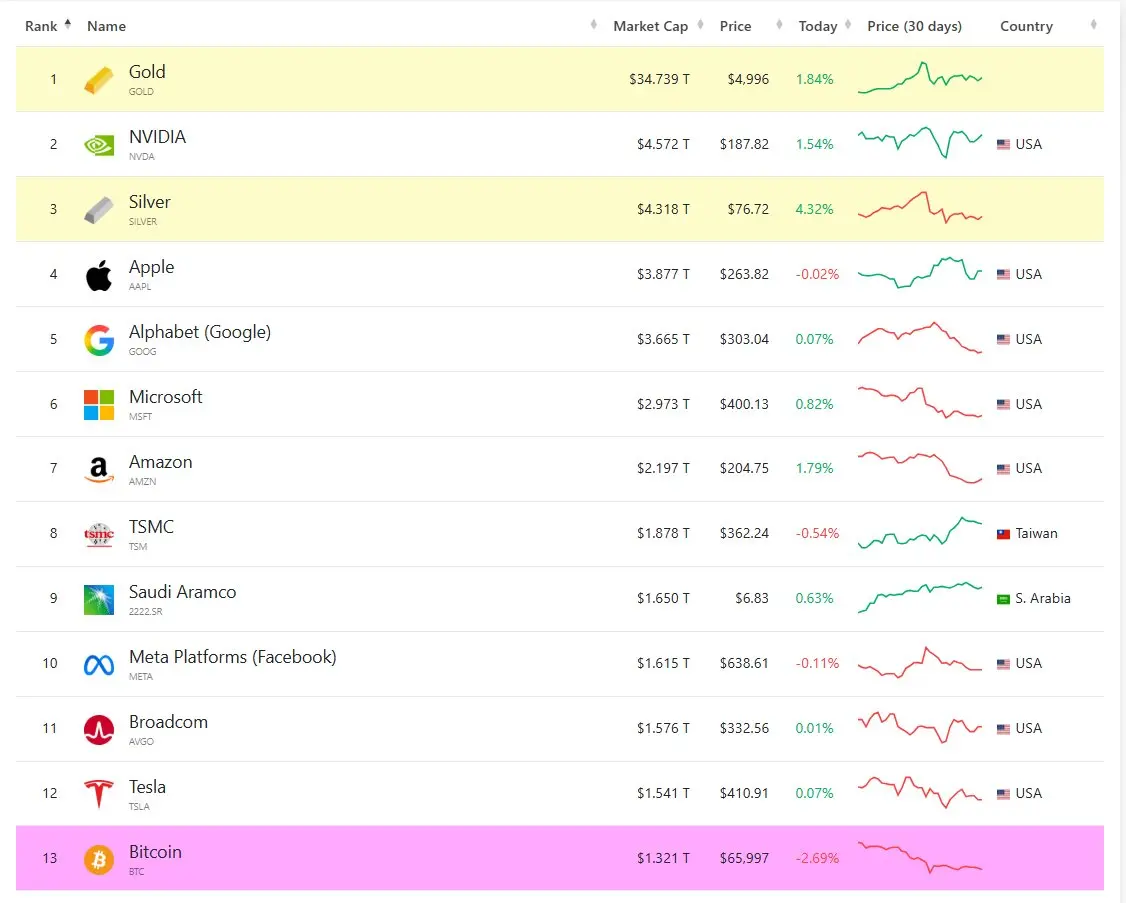

Crypto is red across the board 🔴

BTC slipping.

Alts bleeding.

Sentiment cooling.

Dip… or deeper move loading? 👇

👇

Crypto is red across the board 🔴

BTC slipping.

Alts bleeding.

Sentiment cooling.

Dip… or deeper move loading? 👇

👇

BTC-1.75%

- Reward

- like

- Comment

- Repost

- Share

🚨 Tesla’s robotaxi update:

• 5 new crashes in Dec–Jan

• 14 total since the Austin launch

• ~800,000 paid miles logged

That’s ~1 crash every 57,000 miles — reportedly ~4x more frequent than human drivers, per Electr.

Are robotaxis actually safer than humans yet?

• 5 new crashes in Dec–Jan

• 14 total since the Austin launch

• ~800,000 paid miles logged

That’s ~1 crash every 57,000 miles — reportedly ~4x more frequent than human drivers, per Electr.

Are robotaxis actually safer than humans yet?

- Reward

- 3

- Comment

- Repost

- Share

🚨 Goldman Sachs CEO says he holds “a very small amount” of Bitcoin and is closely watching its development.

Context:

• Net worth estimated at $130M+

• Personal BTC exposure: minimal

Even TradFi leaders are paying attention.

Small allocation… or first step?

Context:

• Net worth estimated at $130M+

• Personal BTC exposure: minimal

Even TradFi leaders are paying attention.

Small allocation… or first step?

BTC-1.75%

- Reward

- 1

- Comment

- Repost

- Share

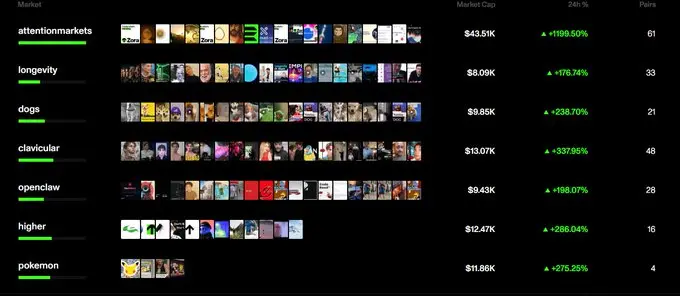

I tried Zora. Here’s my honest take.

Zora has raised ~$70M.

Yet its value has dropped ~34% in the past 3 months and now sits near $90M.

This week they launched “Attention Markets” on Solana — a way to trade what’s trending on social media.

In theory: interesting.

In reality: barely any traction.

The largest market has only ~$43K in liquidity.

Everything else is even smaller.

It doesn’t feel like Polymarket (news-driven).

It feels more like hype trading.

Could it work? Maybe — but only if they shift focus away from pure speculation.

Right now? I’m skeptical.

What am I missing?

Zora has raised ~$70M.

Yet its value has dropped ~34% in the past 3 months and now sits near $90M.

This week they launched “Attention Markets” on Solana — a way to trade what’s trending on social media.

In theory: interesting.

In reality: barely any traction.

The largest market has only ~$43K in liquidity.

Everything else is even smaller.

It doesn’t feel like Polymarket (news-driven).

It feels more like hype trading.

Could it work? Maybe — but only if they shift focus away from pure speculation.

Right now? I’m skeptical.

What am I missing?

ZORA-5.35%

- Reward

- 1

- Comment

- Repost

- Share

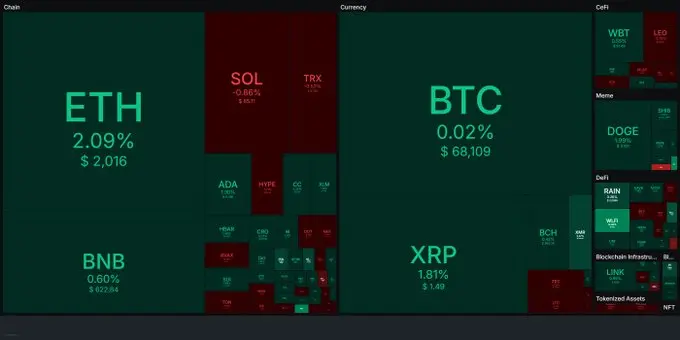

📊 Crypto Market Update:

• BTC: $67.9K–$68.9K

→ Rejected again at $70K

→ ~28% down in February

• ETH: $2,015–$2,030

→ +1.5% today

→ Still far from 2025 highs

• XRP: ~$1.41 (+~1%)

• BNB: ~$627 (+~1–2%)

Selective strength in alts while majors struggle.

Is this consolidation… or distribution?

• BTC: $67.9K–$68.9K

→ Rejected again at $70K

→ ~28% down in February

• ETH: $2,015–$2,030

→ +1.5% today

→ Still far from 2025 highs

• XRP: ~$1.41 (+~1%)

• BNB: ~$627 (+~1–2%)

Selective strength in alts while majors struggle.

Is this consolidation… or distribution?

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thnxx for sharing information about crypto🚨 BREAKING: Berkshire Hathaway cut its Amazon ($AMZN) stake by 77% in Q4 2025, selling ~$1.7B worth of shares.

What this signals:

Major portfolio reshuffle

Risk reduction at scale

Big tech exposure trimmed

When Buffett moves, markets watch.

What this signals:

Major portfolio reshuffle

Risk reduction at scale

Big tech exposure trimmed

When Buffett moves, markets watch.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: Crypto VC Dragonfly closes a $650M fourth fund.

What this means:

Big capital still backing crypto

Long-term conviction remains

Next cycle startups getting funded

Bear markets build the next winners.

What this means:

Big capital still backing crypto

Long-term conviction remains

Next cycle startups getting funded

Bear markets build the next winners.

- Reward

- 1

- Comment

- Repost

- Share

🚨 JUST IN: Intesa Sanpaolo discloses $100M in Bitcoin ETF holdings.

What this signals:

Major European bank exposure

Institutional allocation continues

BTC ETFs gaining global traction

Traditional finance keeps leaning in.

What this signals:

Major European bank exposure

Institutional allocation continues

BTC ETFs gaining global traction

Traditional finance keeps leaning in.

BTC-1.75%

- Reward

- 1

- Comment

- Repost

- Share

🚨 RWA boom on @BNBCHAIN :

Market cap just crossed $2B

Up ~50,000% from ~$4M a year ago

Now ~20% of total on-chain RWA value

Ranked #2 chain by RWA market share

Momentum is accelerating.

Market cap just crossed $2B

Up ~50,000% from ~$4M a year ago

Now ~20% of total on-chain RWA value

Ranked #2 chain by RWA market share

Momentum is accelerating.

RWA-1.04%

- Reward

- 2

- Comment

- Repost

- Share

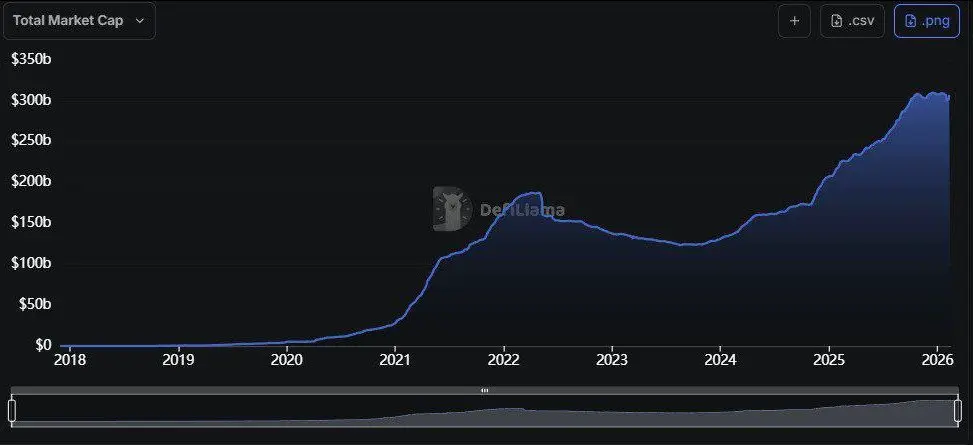

🚨 JUST IN: Stablecoin market cap added $5.5B in the past 7 days.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

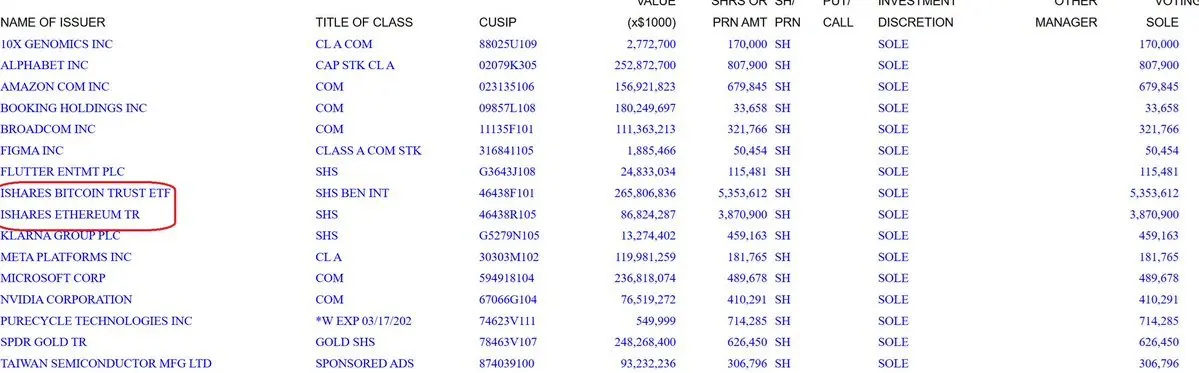

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

👇

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

Happy Monday.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More222.32K Popularity

858.26K Popularity

52.42K Popularity

91.46K Popularity

468.68K Popularity

Pin