JackBTC

Disrupting crypto with data, narrative and alpha | Trader × Creator | From charts to mindshare.

JackBtc

- Reward

- like

- Comment

- Repost

- Share

Gate CrossEx Account Now Live

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 4

- 1

- Repost

- Share

Atilss :

:

Jump in 🚀- Reward

- 2

- Comment

- Repost

- Share

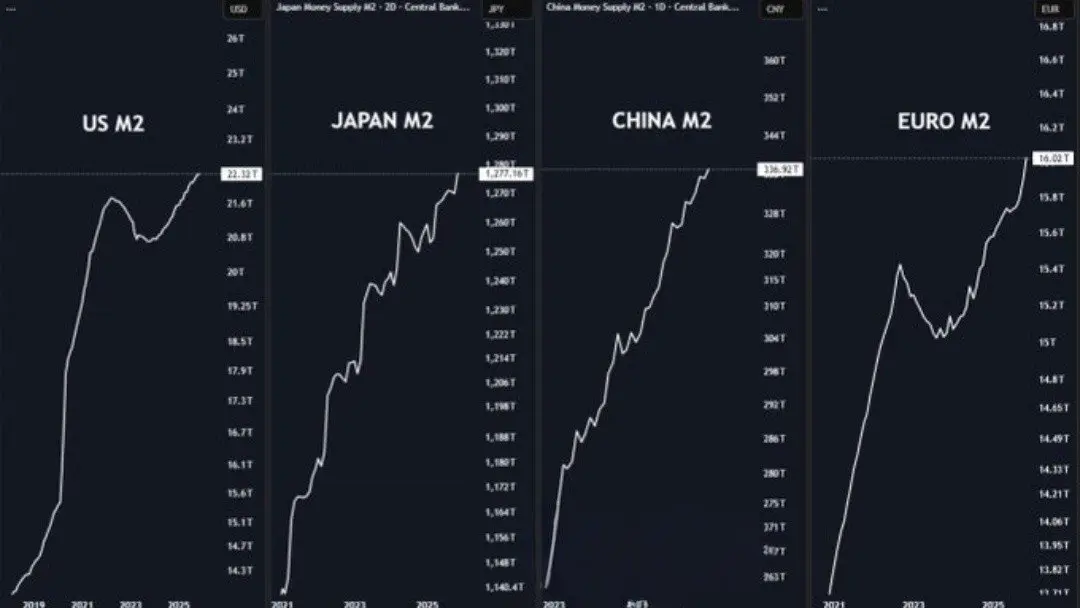

Global liquidity is at record highs.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

BTC-0.75%

- Reward

- 1

- 1

- Repost

- Share

LoveToEatPigTrotterRice :

:

New Year Wealth Explosion 🤑Trending Topics

View More31.19K Popularity

12.37K Popularity

4.06K Popularity

52.91K Popularity

342.3K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.4KHolders:10.00%

- MC:$3.39KHolders:10.00%

- MC:$3.52KHolders:20.52%

- MC:$3.39KHolders:20.00%

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889