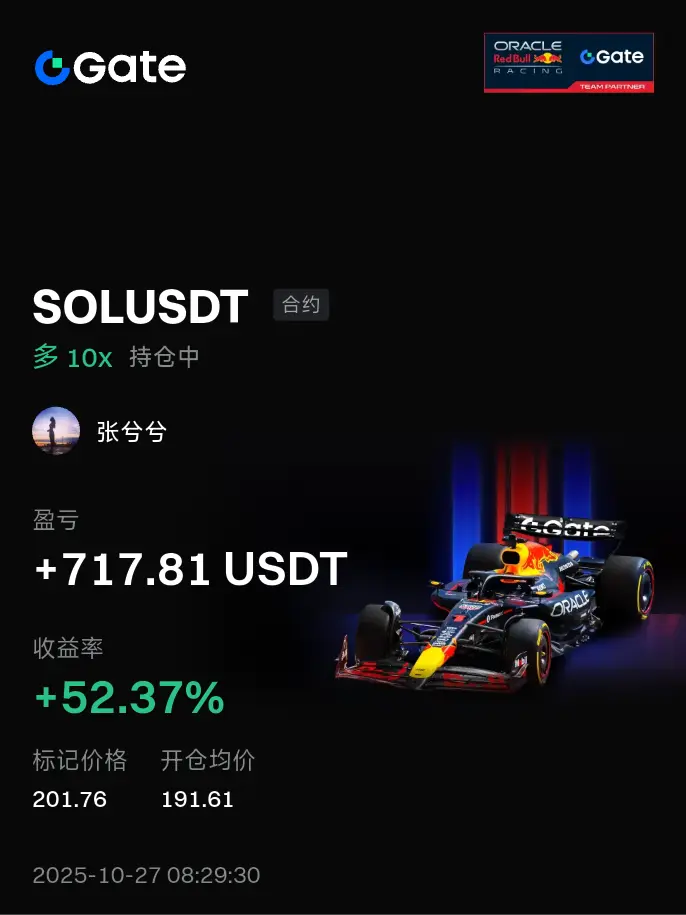

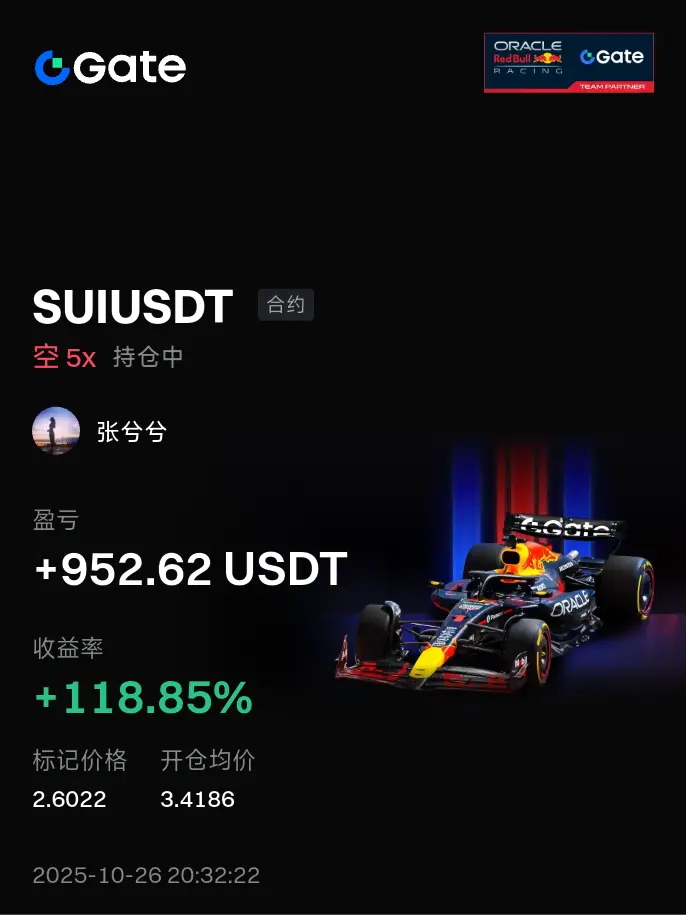

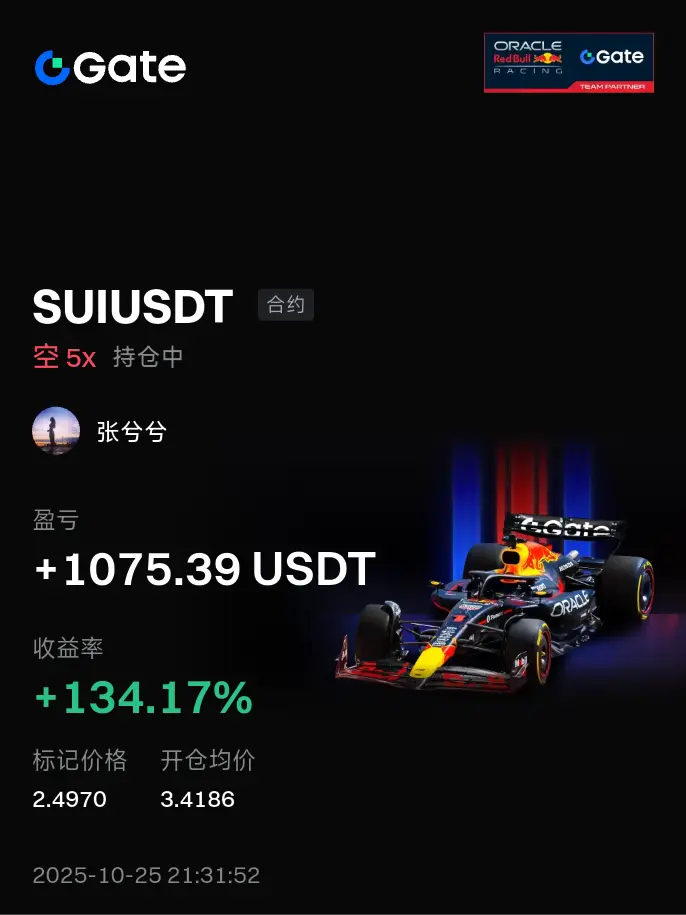

ZhangXixi

I am a trader with five years of experience in bull and bear markets. In trading, I focus on intraday short-term and trend capturing, and I have developed a high win-rate entry method. I once turned a 20 U experience fund into 10,000 U in just three months.

· Philosophy: Strictly control drawdown, stable compound interest, refuse to go all in, and persist in withdrawing funds.

· Method: Create a win-rate entry model, focusing on position management and precise entry signals.

· Goal: To grow together with you into an emotionally stable trader unaffected by market fluctuations.

ZhangXixi

From the daily chart of BTC, it shows a steady step-up structure, with long positions' momentum continuing to be released. Since the bottom started to rebound, the price has gradually broken through key middle band resistance, and the overall trend is strong. In the short term, it is essential to closely observe the breakout strength of 120000; if it successfully holds above, it is expected to open a new round of rising space. From a medium to long-term perspective, this round of pump has the potential to create new highs, and the trend direction is clear. Firmly adopt the pullback go long

BTC2.73%

- Reward

- 2

- 1

- Repost

- Share

OdellPumpBanana :

:

Get in! 🚗The crypto world is about to open a new chapter! The Fed is highly likely to cut interest rates on Thursday, and now Bit has just broken through the 112,000 threshold that it has been stuck at for several months. The next target is 114,000, and then up to the old pit at 115,800.

But first, we need to see if it can hold its ground at 112,000—at least 111,500—without backing down again.

I plan to wait for it to swing around 114,000 or 115,800, take a small short position, nibble a bit on the pullback and run, not being greedy;

View OriginalBut first, we need to see if it can hold its ground at 112,000—at least 111,500—without backing down again.

I plan to wait for it to swing around 114,000 or 115,800, take a small short position, nibble a bit on the pullback and run, not being greedy;

- Reward

- 3

- 2

- Repost

- Share

GoldMedalLecturer :

:

Beautiful womanView More

- Reward

- 1

- 1

- Repost

- Share

MarlboroCowboy :

:

Can BTC still fall? The Bollinger Bands for 1 hour and 4 hours are almost touching the upper band. I was trapped after shorting at 110500.For spot players, as long as you determine that you want to participate in this bull run, Bitcoin will rise to at least $150,000. If you have a position, you can ignore the pullbacks along the way. If you have bullets, increase the position with each pullback; if you don't have bullets, just hold on and wait for the rise until the bull run arrives, then consider exiting in batches. Swing trading is exhausting, it tests your mindset, and it's very difficult to outperform long term.

According to historical data, hundredfold coins generally have the following characteristics:

Market value

According to historical data, hundredfold coins generally have the following characteristics:

Market value

BTC2.73%

- Reward

- 3

- 3

- Repost

- Share

ManySweets :

:

Hold on tight, we are about to To da moon 🛫View More

#Gate广场新手村第四期

As a newcomer who has not been in the market for long, my investment growth story is actually quite "typical"—from chasing highs and selling lows to learning to wait, from emotional trading to gradually understanding signals.

I still remember my first time trading futures. I rushed in with my entire position because of FOMO (Fear of Missing Out), and I was forcibly liquidated in just 15 minutes. That was when I realized that trading is not gambling, but a battle of understanding and mindset. Later, I started to calm down and learn about candlesticks, trends, and position managem

View OriginalAs a newcomer who has not been in the market for long, my investment growth story is actually quite "typical"—from chasing highs and selling lows to learning to wait, from emotional trading to gradually understanding signals.

I still remember my first time trading futures. I rushed in with my entire position because of FOMO (Fear of Missing Out), and I was forcibly liquidated in just 15 minutes. That was when I realized that trading is not gambling, but a battle of understanding and mindset. Later, I started to calm down and learn about candlesticks, trends, and position managem

- Reward

- 3

- 1

- Repost

- Share

ManySweets :

:

Hold on tight, we are about to To da moon 🛫Not just another Token, but a pioneer of AI + Web3.

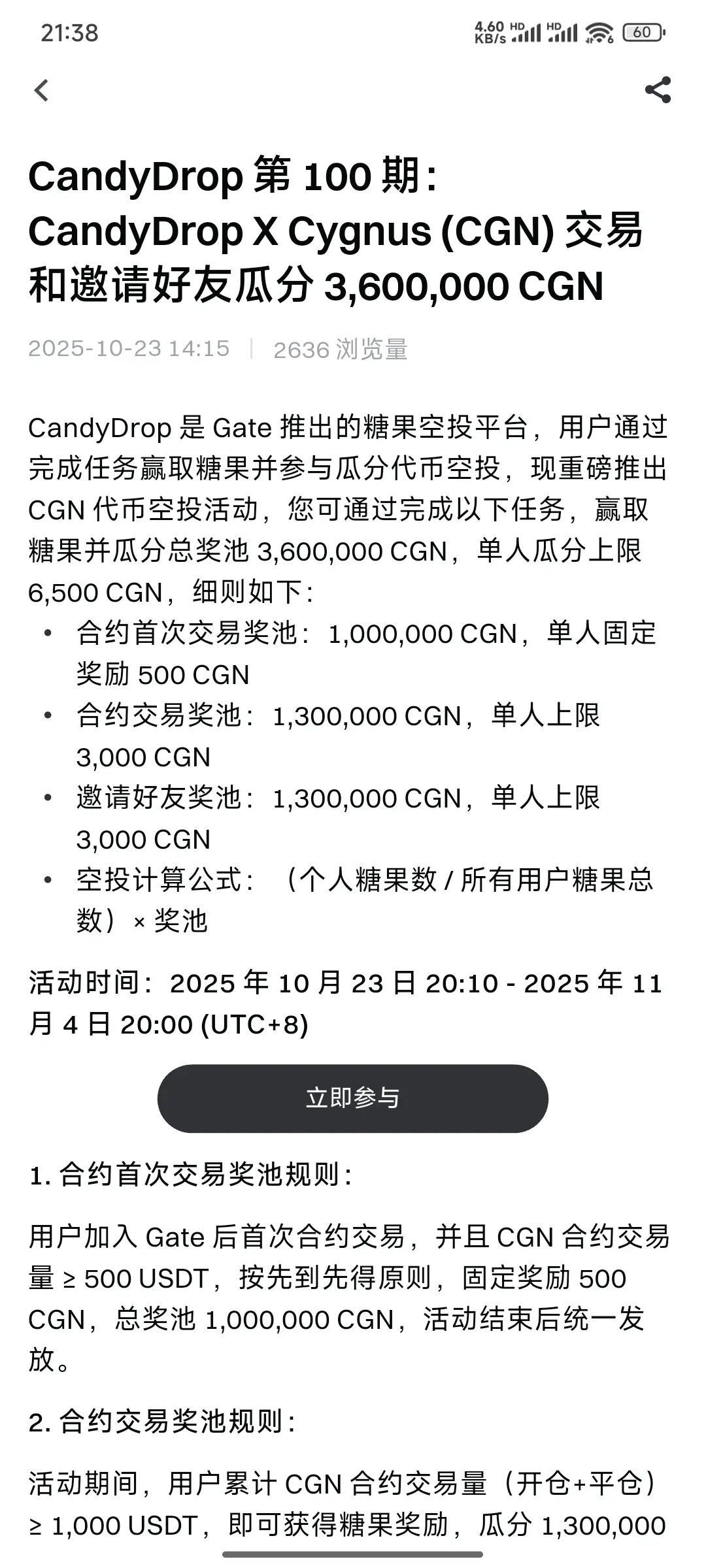

After participating in Launchpool and reading the materials, I understand that CGN is far more than just an ordinary platform coin. Behind it is Cognition AI, whose team developed Devin AI, hailed as the world's first fully autonomous AI software engineer, representing a revolutionary breakthrough. Imagine a future where we can access the ability for AI to automatically program and solve complex problems through the CGN ecosystem. This is undoubtedly a great attempt to bring top-tier AI technology into the Web3 world through token economi

After participating in Launchpool and reading the materials, I understand that CGN is far more than just an ordinary platform coin. Behind it is Cognition AI, whose team developed Devin AI, hailed as the world's first fully autonomous AI software engineer, representing a revolutionary breakthrough. Imagine a future where we can access the ability for AI to automatically program and solve complex problems through the CGN ecosystem. This is undoubtedly a great attempt to bring top-tier AI technology into the Web3 world through token economi

CGN31.68%

- Reward

- 2

- 4

- Repost

- Share

RubyNews :

:

Just go for it💪View More

Position management is indeed a science, and this science does not have a standard answer; ultimately, it must match your capital amount, risk preference, and operating model.

Good position management will result in much smaller drawdowns, and it can also be aggressive during uptrends.

Ultimately, it is essential to strike a balance between aggression and defense, finding a point that suits oneself. Focusing solely on offense without defense will ultimately backfire, while only defending without attacking will make it difficult to achieve good returns.

A person needs at least 5 years to find a

View OriginalGood position management will result in much smaller drawdowns, and it can also be aggressive during uptrends.

Ultimately, it is essential to strike a balance between aggression and defense, finding a point that suits oneself. Focusing solely on offense without defense will ultimately backfire, while only defending without attacking will make it difficult to achieve good returns.

A person needs at least 5 years to find a

- Reward

- 3

- 1

- Repost

- Share

OdellPumpBanana :

:

Hold on tight, we are about to To da moon 🛫Let's talk about the correlation between gold and BTC.

Gold has risen 40% in the last 5 months, the last time it surged like this was from March to August 2020, when it increased by 43%, after which it entered a more than 3-year period of consolidation.

From March to August 2020, BTC rose by 168%, which is more than gold, but it had just recovered from the drop during the 312 crash, and compared to the price before 312, it hasn't risen much.

During those months, the real protagonist was gold.

But after gold peaked and started to fluctuate, BTC rose from around 10,000 all the way to 63,

Gold has risen 40% in the last 5 months, the last time it surged like this was from March to August 2020, when it increased by 43%, after which it entered a more than 3-year period of consolidation.

From March to August 2020, BTC rose by 168%, which is more than gold, but it had just recovered from the drop during the 312 crash, and compared to the price before 312, it hasn't risen much.

During those months, the real protagonist was gold.

But after gold peaked and started to fluctuate, BTC rose from around 10,000 all the way to 63,

BTC2.73%

- Reward

- 4

- 3

- Repost

- Share

Flooddragon :

:

DYOR 🤓View More

The current market is no longer suspenseful; the probability of the Fed cutting interest rates in October has reached 99%, which means they are almost being forced to relent. The standstill has caused the labor participation rate to plummet, and even if the Fed puts on a tough front, they have to bow to policy.

The problem is that the December meeting is hard to predict; inflation is still lurking and they need to gather more data before playing it cool. Ultimately, the main theme for the Americans right now is monetary easing; as long as this thread continues, the market's imagination wil

View OriginalThe problem is that the December meeting is hard to predict; inflation is still lurking and they need to gather more data before playing it cool. Ultimately, the main theme for the Americans right now is monetary easing; as long as this thread continues, the market's imagination wil

- Reward

- 3

- 2

- Repost

- Share

RubyNews :

:

When the wind meets the mountain, the boat stops at the shore.View More

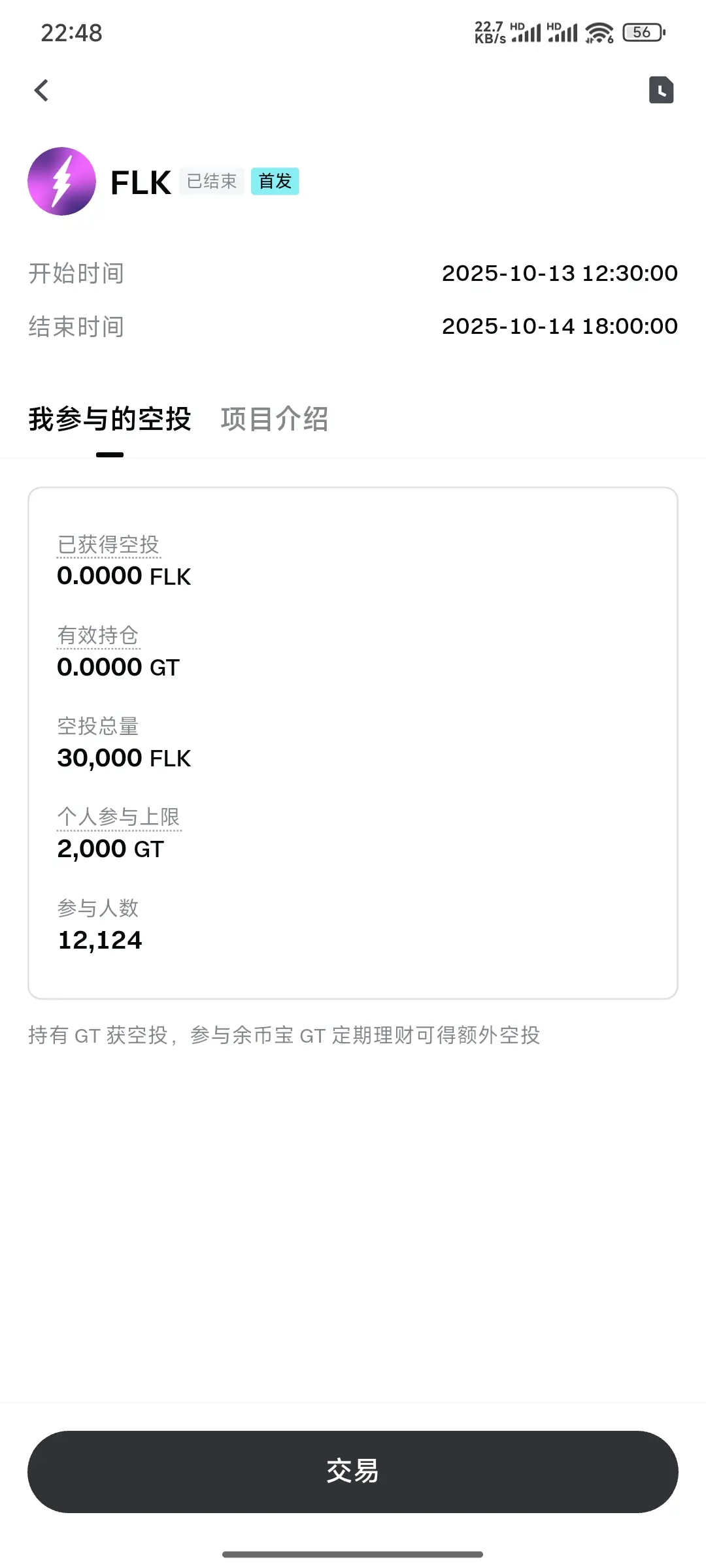

With only one day left in the event, as an old user of Gate, I have almost participated in the entire FLK event, and I have deep feelings about it. I quickly want to share my "dual-line battle" diary and some superficial insights.

On one hand, I firmly seized the opportunity of the #HODLer Airdrop. This is not just a simple "money giveaway", but a return to true ecological supporters. It requires you not only to hold Gate's platform token GT, but also to deeply participate in its ecosystem, such as wealth management, trading, etc. This makes me feel that the FLK project team values the "q

View OriginalOn one hand, I firmly seized the opportunity of the #HODLer Airdrop. This is not just a simple "money giveaway", but a return to true ecological supporters. It requires you not only to hold Gate's platform token GT, but also to deeply participate in its ecosystem, such as wealth management, trading, etc. This makes me feel that the FLK project team values the "q

- Reward

- 5

- 4

- 1

- Share

OdellPumpBanana :

:

Just go for it💪View More

Is BNB going to "blood wash" retail investors? Short-term Cut Loss or long-term lying profits? Jin Zhu will reveal the truth!

News: Long-term bullish, but must endure the "bloody night"!

The BSC network is set to open a "dedicated channel" for BNB. Once liquidity comes in, it will be a definite long-term benefit! But don’t rush in; the short-term market sentiment is more thrilling than a roller coaster—institutions are cashing out at high points, and retail investors are taking over. This plot is even more dramatic than a TV series!

Technical analysis: Short-term bearish, play people for sucke

View OriginalNews: Long-term bullish, but must endure the "bloody night"!

The BSC network is set to open a "dedicated channel" for BNB. Once liquidity comes in, it will be a definite long-term benefit! But don’t rush in; the short-term market sentiment is more thrilling than a roller coaster—institutions are cashing out at high points, and retail investors are taking over. This plot is even more dramatic than a TV series!

Technical analysis: Short-term bearish, play people for sucke

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- 4

- 1

- Repost

- Share

OdellPumpBanana :

:

Thank you for your informationBuying coins mainly follows the market maker; institutional buying ensures profits.

Talk about Mr. Ma's views on the following coins.

1. xrp, market maker, hasn't pumped for years, when it does, it will be more than 10 times.

2. etc, the predecessor of Ethereum, a passionate war machine, with no concept left, only the market maker remains, having a market maker is the biggest concept, 10x coin.

3. Doge is always hyped up in every bull market, and this has been the case for all three rounds.

4. dydx, high recognition, fully adjusted in the bear market, a 10x feeling in the bull market s

View OriginalTalk about Mr. Ma's views on the following coins.

1. xrp, market maker, hasn't pumped for years, when it does, it will be more than 10 times.

2. etc, the predecessor of Ethereum, a passionate war machine, with no concept left, only the market maker remains, having a market maker is the biggest concept, 10x coin.

3. Doge is always hyped up in every bull market, and this has been the case for all three rounds.

4. dydx, high recognition, fully adjusted in the bear market, a 10x feeling in the bull market s

- Reward

- 8

- 7

- Repost

- Share

反者道之动o :

:

Just go for it💪View More

On October 22, 2025, after the big dump of Bitcoin, will the US market reverse after the US stocks? No...

First of all, the key to the reversal certainly lies in firmly standing at the 110,000 and 4,000 levels. Not every day's market will reverse back and forth. This morning, Bitcoin's posture directly experienced a big dump, retracting the overnight gains. Since it has already fallen, it will definitely test downwards again, after all, it is not a slow decline downwards.

Secondly, being bearish is not blind; the main bearish trend is supported by the fact that the decline has not fini

View OriginalFirst of all, the key to the reversal certainly lies in firmly standing at the 110,000 and 4,000 levels. Not every day's market will reverse back and forth. This morning, Bitcoin's posture directly experienced a big dump, retracting the overnight gains. Since it has already fallen, it will definitely test downwards again, after all, it is not a slow decline downwards.

Secondly, being bearish is not blind; the main bearish trend is supported by the fact that the decline has not fini

- Reward

- 3

- Comment

- Repost

- Share

The market data presents a "Evening Star" bearish pattern, which resonates with the short positions arrangement of the moving averages.

At the same time, the 2-hour cycle candlestick has formed a black three soldiers pattern and a flat top, which clearly indicates prominent characteristics of a downward trend.

Short positions around 109,000-109,600, 107,500, 105,000!

#抄底币种推荐

View OriginalAt the same time, the 2-hour cycle candlestick has formed a black three soldiers pattern and a flat top, which clearly indicates prominent characteristics of a downward trend.

Short positions around 109,000-109,600, 107,500, 105,000!

#抄底币种推荐

- Reward

- 2

- 1

- Repost

- Share

ManySweets :

:

Buckle up and hold on, we are about to To da moon 🛫When opening a contract, a stop loss must be set, regardless of position size, regardless of long term or short-term...

Contracts are a double-edged sword; they can be played with but it depends on how you play them. At the same time, I have gained a deep understanding of altcoins and MEME. I will invest significant effort in MEME to seek new Alpha, aiming for high cost-effectiveness to achieve big gains with small investments.

As I mentioned before, MEME has gone to zero with a small bet, but I don't feel sorry for it. Once you catch one, you can turn things around, and that is its charm.

Contracts are a double-edged sword; they can be played with but it depends on how you play them. At the same time, I have gained a deep understanding of altcoins and MEME. I will invest significant effort in MEME to seek new Alpha, aiming for high cost-effectiveness to achieve big gains with small investments.

As I mentioned before, MEME has gone to zero with a small bet, but I don't feel sorry for it. Once you catch one, you can turn things around, and that is its charm.

ETH5.57%

- Reward

- 2

- 4

- Repost

- Share

莹之之 :

:

bullbullbullbullbullbullbullbullbullView More

The thought for Tuesday morning is that the upward movement has stopped, and I will short at the highs first.

After a round of rally yesterday, Bitcoin stalled at 111600, with multiple attempts to break through this level overnight failing. The pressure in this area is relatively strong in the short term. Last night, a short position was initiated near 111500, hitting a low of 109800 in the early morning, easily realizing a space of 1500+ points. Currently, after a round of rebound, the bulls are showing signs of stagnation. As the strength of the bullish rebound weakens, it is not advisable t

View OriginalAfter a round of rally yesterday, Bitcoin stalled at 111600, with multiple attempts to break through this level overnight failing. The pressure in this area is relatively strong in the short term. Last night, a short position was initiated near 111500, hitting a low of 109800 in the early morning, easily realizing a space of 1500+ points. Currently, after a round of rebound, the bulls are showing signs of stagnation. As the strength of the bullish rebound weakens, it is not advisable t

- Reward

- 5

- 6

- Repost

- Share

GateUser-c182469c :

:

Enter a position!🚗Enter a position!🚗Enter a position!🚗Enter a position!🚗Enter a position!🚗View More

In fact, judging that there will be a strong pump market at the end of the year, in addition to the intuitive judgment mentioned on the 17th, there are several other factors:

1. After the global rush to buy gold pushes the gold price to a high level, its investment cost-effectiveness will quickly decline, making BTC, this digital gold, an important choice for both investment and hedging.

2. One or two interest rate cuts at the end of the year still have a good chance of triggering a strong counterattack by the bulls.

3. The fundamentals of BTC and ETH remain unchanged, and the large-scale adop

View Original1. After the global rush to buy gold pushes the gold price to a high level, its investment cost-effectiveness will quickly decline, making BTC, this digital gold, an important choice for both investment and hedging.

2. One or two interest rate cuts at the end of the year still have a good chance of triggering a strong counterattack by the bulls.

3. The fundamentals of BTC and ETH remain unchanged, and the large-scale adop

- Reward

- 5

- 1

- Repost

- Share

ManySweets :

:

Hold on tight, we're about to To da moon 🛫The trend of institutional inflow for BTC and Ether is diverging: Ether is becoming the new favorite for capital in 2025.

BTC and Ether institutional fund flows are showing different trends: the BTC fund holdings have steadily increased from about 1 million BTC to over 1.3 million BTC, clearly indicating that institutions are continuing to buy.

Even though there was a short-term capital withdrawal during the market adjustment, the confidence of long-term investors is still strong, thanks to the surge in ETF scale and the positioning as "digital gold."

Looking at Ether, the fund's holdings

View OriginalBTC and Ether institutional fund flows are showing different trends: the BTC fund holdings have steadily increased from about 1 million BTC to over 1.3 million BTC, clearly indicating that institutions are continuing to buy.

Even though there was a short-term capital withdrawal during the market adjustment, the confidence of long-term investors is still strong, thanks to the surge in ETF scale and the positioning as "digital gold."

Looking at Ether, the fund's holdings

- Reward

- 2

- Comment

- Repost

- Share

Monday morning thoughts, the rebound is not a reversal, short first during the day.

A new week, a new beginning, new hope, new vitality, new opportunities, good morning, wishing everyone good luck!

The weekend was primarily characterized by fluctuations and adjustments, until yesterday afternoon when the market gradually warmed up, pushing the price of Bitcoin above 109,000 in one go. The trend is consistent with our strategy of shorting first and then going long. Currently, Bitcoin is fluctuating around 108,800.

Looking at the 4-hour chart, the Bollinger Bands maintain a downward channel unch

A new week, a new beginning, new hope, new vitality, new opportunities, good morning, wishing everyone good luck!

The weekend was primarily characterized by fluctuations and adjustments, until yesterday afternoon when the market gradually warmed up, pushing the price of Bitcoin above 109,000 in one go. The trend is consistent with our strategy of shorting first and then going long. Currently, Bitcoin is fluctuating around 108,800.

Looking at the 4-hour chart, the Bollinger Bands maintain a downward channel unch

BTC2.73%

- Reward

- 3

- 2

- Repost

- Share

OdellPumpBanana :

:

subscriptionView More