October will determine the outcome: SEC's final ruling on altcoin ETFs

In October 2025, the U.S. Securities and Exchange Commission (SEC) will deliver final rulings on at least 16 spot cryptocurrency exchange-traded fund (ETF) applications, covering tokens beyond Bitcoin and Ethereum, including SOL, XRP, LTC, DOGE, ADA, and HBAR. The SEC has recently withdrawn multiple delay notices and is expediting approvals with new universal ETF listing standards, shortening the review period to less than 75 days.

Crypto journalist Eleanor Terrett reported that the SEC requested issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 filings, as these documents are no longer required following the adoption of the universal ETF listing standards.

Since spot Bitcoin and Ethereum ETFs were approved, substantial capital inflows have fueled price increases. The market now speculates whether the upcoming ETFs will be approved. If so, similar price effects may follow.

October Deadlines for Multiple Token ETF Decisions

As compiled by Twitter analyst Jseyff, several altcoin spot ETF final deadlines fall throughout October. The first up is Canary’s LTC ETF, with an October 2 deadline.

Next are Grayscale’s Solana and LTC trust conversions, due October 10, followed by WisdomTree’s XRP fund on October 24.

According to Bloomberg ETF analyst James Seyffart’s approval watchlist, the SEC could issue decisions at any point before the final deadline.

Applicants include Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. BlackRock and Fidelity are not participating in this round, but their absence does not diminish the significance—successful approvals could pave the way for larger products.

Since approving spot BTC and ETH ETFs, the SEC has not approved any other token ETFs, consistently postponing decisions. However, the upcoming final deadlines will require a definitive Yes or No outcome.

Market participants are watching with anticipation.

The SEC’s initial rulings on Litecoin and SOL are expected to influence market expectations for subsequent ETF applications.

Approval Probabilities

In late July, the SEC’s new listing standards focused on crypto ETP eligibility and operational mechanisms. Physical creation and redemption are now allowed, enabling authorized participants to exchange ETP shares for actual crypto assets instead of cash.

The SEC also announced listing standards for spot ETFs, set to take effect in October 2025, aiming to streamline the process. Under the universal standard, crypto assets must be listed on the futures markets of major exchanges, such as Coinbase, for a minimum of six months. This is intended to ensure sufficient liquidity and market depth and to prevent manipulation.

Litecoin, one of the oldest altcoins, is considered a top candidate for early approval due to its maturity and non-security status. In a recent interview, Litecoin founder Charlie Lee said he expects a spot LTC ETF to launch soon, citing the SEC’s approval of universal standards and LTC’s inclusion among the ten qualifying assets.

Lee discussed LTC’s outlook under evolving regulations, highlighting the SEC’s recent approval of universal crypto ETF standards as a key driver and emphasizing Litecoin’s eligibility for fast-track approval.

Currently, Polymarket shows a 93% probability of Litecoin’s spot ETF being approved this year.

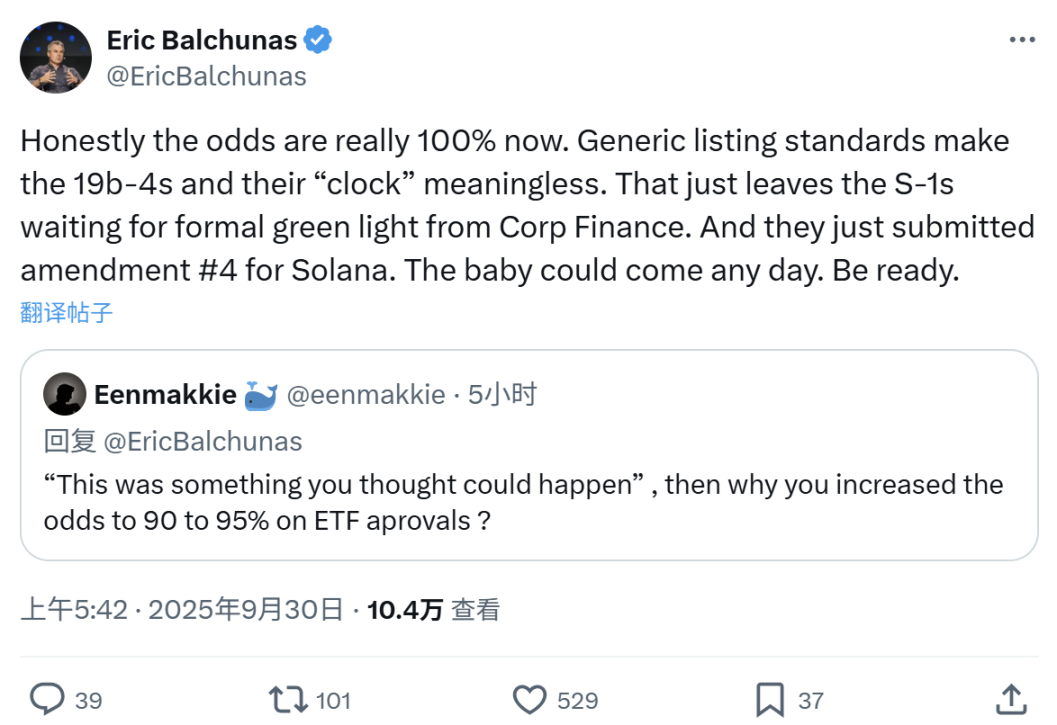

For SOL’s spot ETF, Bloomberg ETF analyst Eric Balchunas said, “Honestly, the approval odds for a SOL spot ETF are now close to 100%. The universal ETF listing standards have made 19b-4 filings and their timelines irrelevant; only the S-1 form remains. The launch could occur at any time; stakeholders should remain prepared.”

ADA is the last token awaiting a decision at the end of October, with Polymarket giving it a 93% chance of ETF approval.

The SEC’s early October decisions will serve as a market indicator.

Previously, the SEC approved the Hashdex Crypto Index ETF, and the Hashdex Nasdaq Crypto Index U.S. ETF (NCIQ) recently added support for XRP, SOL, and XLM, enabling U.S. investors to invest in BTC, ETH, XRP, SOL, and XLM through a single investment vehicle.

The SEC also approved the Bitwise 10 Crypto Index Fund’s conversion to an ETF, comprising BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Will Approvals Boost Token Prices?

Bitfinex analysts previously predicted that ETF approvals could spark a new altcoin season or rally, providing traditional investors with greater crypto exposure.

However, some analysts disagree.

Bloomberg ETF analyst James Seyffart noted that current market rallies are driven by digital asset financial companies (DATCOs), not traditional token price surges. Seyffart explained that institutional investors prefer diversified crypto portfolio products over single altcoin ETFs. He emphasized that institutional capital favors regulated crypto products over direct token holdings. This structural shift could permanently change altcoin rally patterns.

Statement:

- This article is republished from [Foresight News]. Copyright is held by the original author [1912212.eth, Foresight News]. For republishing concerns, please contact the Gate Learn team, which will address inquiries in accordance with our established protocols.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be reproduced, distributed, or copied without proper attribution to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?