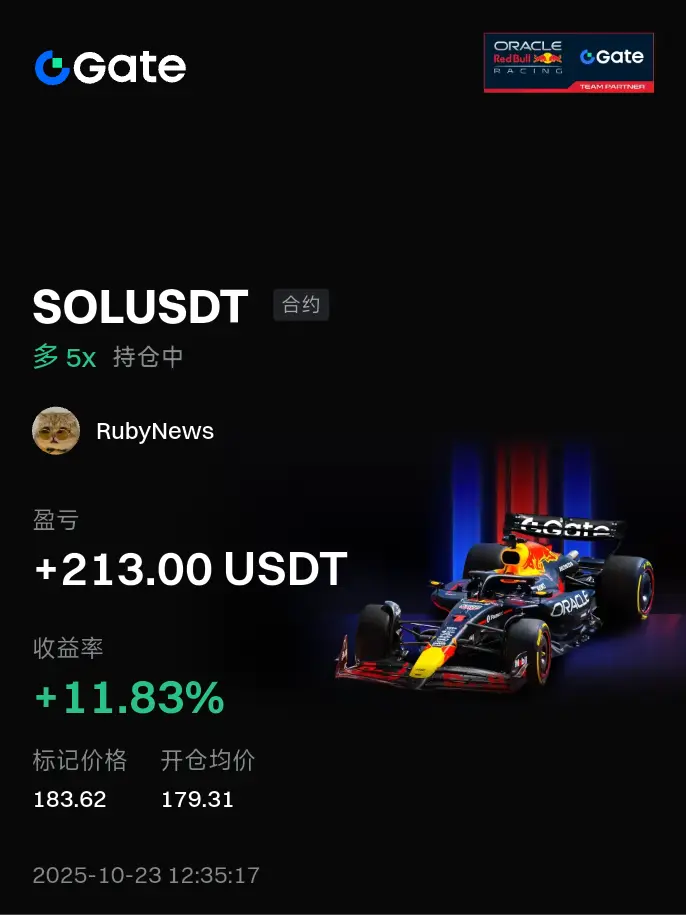

The bull run is just the beginning.

even just the preheating stage

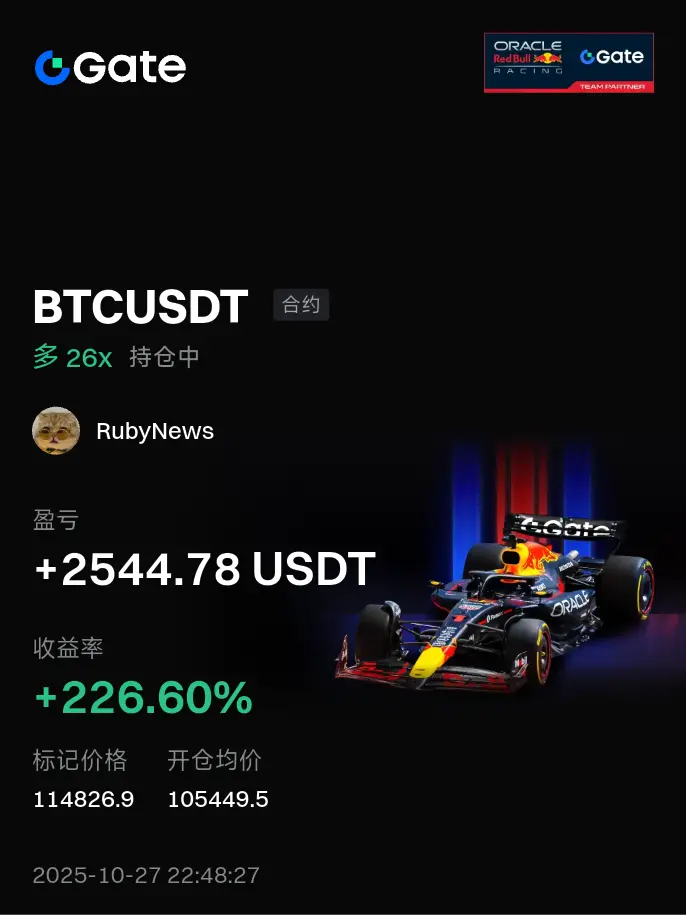

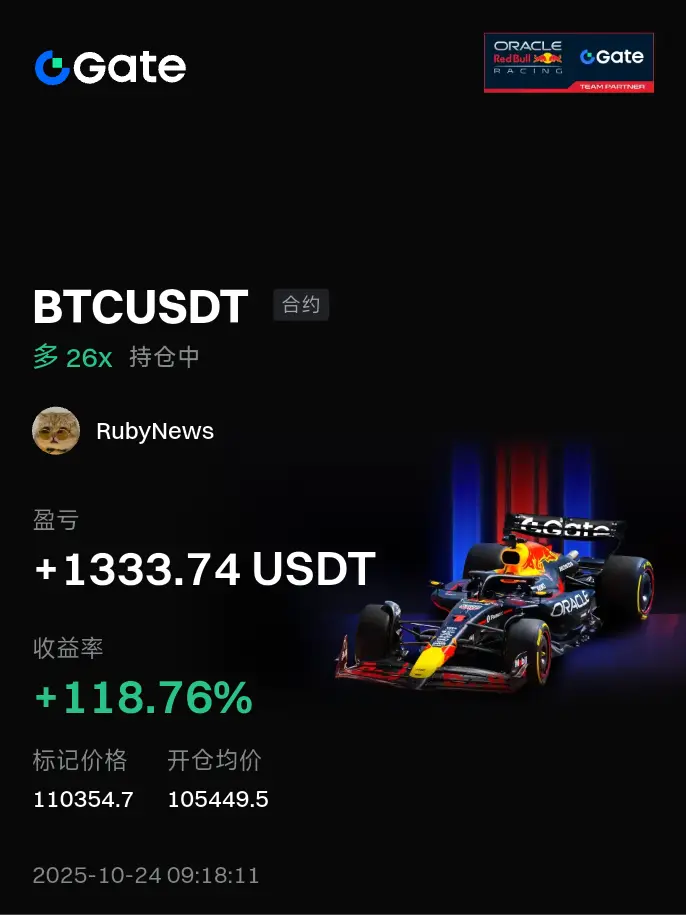

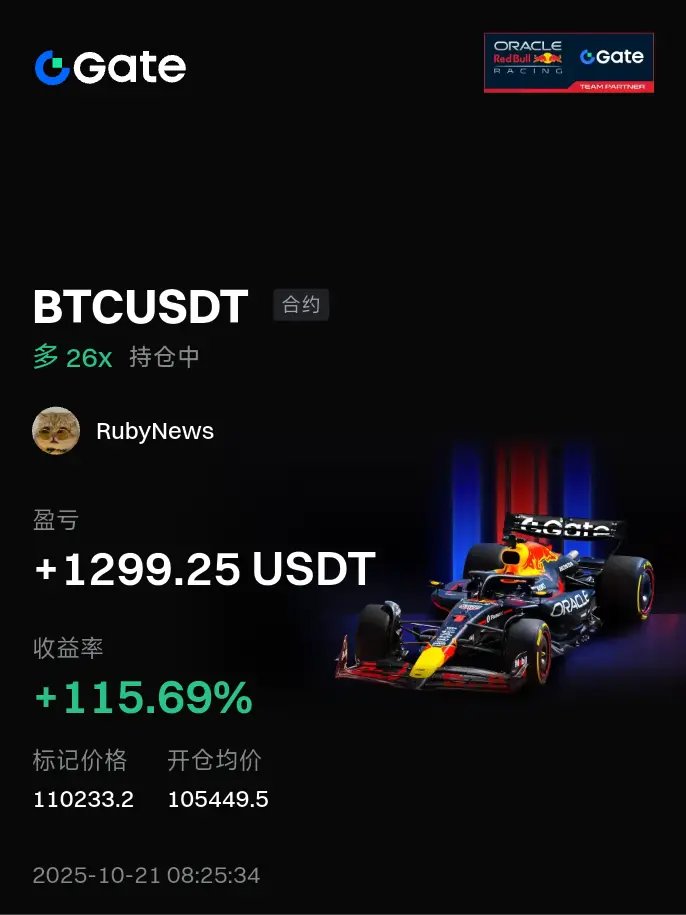

Bitcoin before 126,000 dollars

All are suitable for building positions.

The most explosive phase was after 126000 US dollars.

The mountains call and the sea roars

At that time, the bulls will create one new high after another.

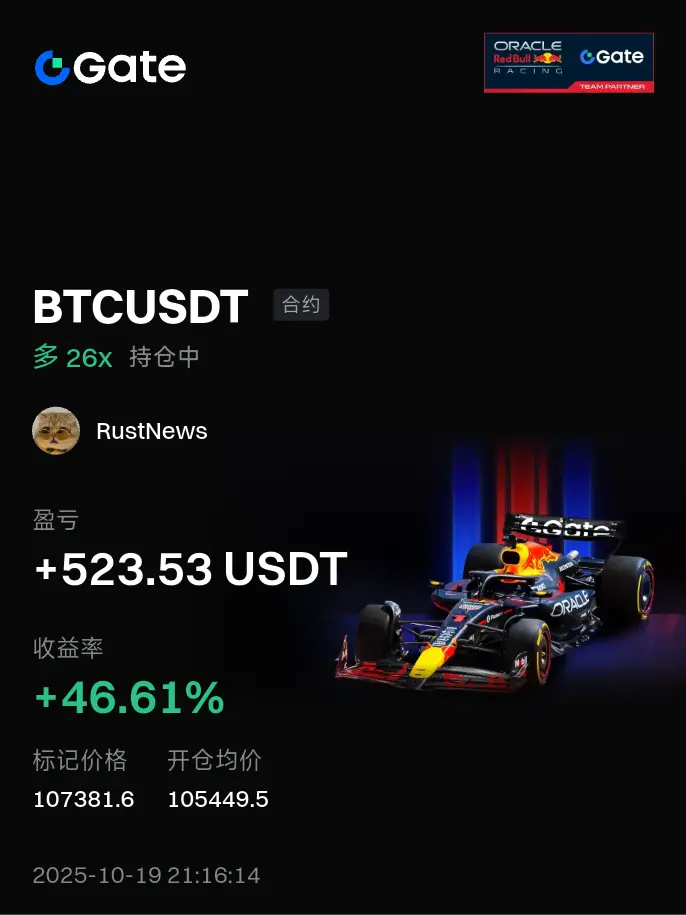

even just the preheating stage

Bitcoin before 126,000 dollars

All are suitable for building positions.

The most explosive phase was after 126000 US dollars.

The mountains call and the sea roars

At that time, the bulls will create one new high after another.

BTC-1.1%