Contracts in the crypto world are a digital game, but more so a contest of the human heart—here, the easiest thing to lose is not direction, but initial intent. Understanding when to enter and exit is key: do not lose your composure in profit, and do not lose your ambition in loss; setting a stop loss is not to limit your flight, but to enable you to fly further. The market is always there, and opportunities are never exhausted, but the principal capital is only one. Do not let greed occupy your reason, and do not miss good opportunities out of fear; fluctuations are the norm, and maintaining

View OriginalYunChe_sDiscussionA

Every night at 9 PM, broadcasting until 11 PM, a small tip for market observation each day. Teaching a man to fish is better than giving him a fish. Free benefits continue, the live channel is permanently free with Dan.

YunChe_sDiscussionA

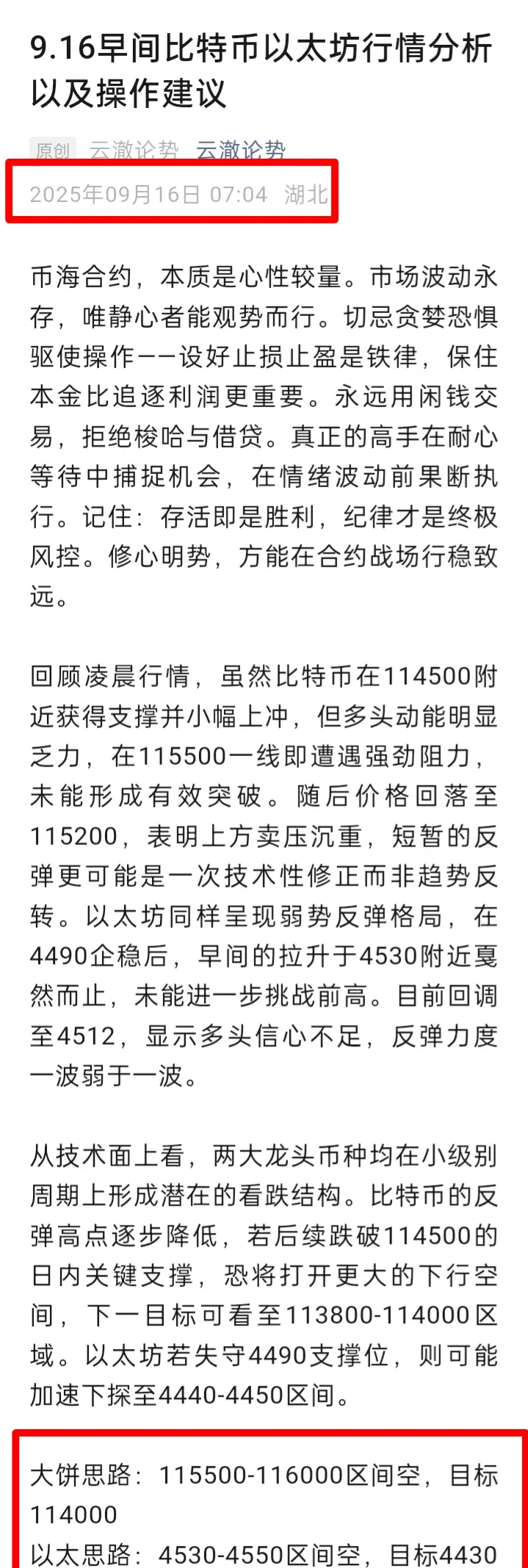

Looking back at the afternoon market, Ethereum has shown a one-sided downward trend, with a cumulative drop of over 100 points, and short positions continue to dominate the market. Our long order set up in the afternoon was unfortunately stopped out after the price fell below the key support at 4540, and the subsequent short order we took the opposite position on successfully captured over 30 points of profit and locked in profits.

The current coin price has run to around 4510, showing a clear weak pattern from a technical perspective. The 4-hour level has continuously closed with bearish cand

View OriginalThe current coin price has run to around 4510, showing a clear weak pattern from a technical perspective. The 4-hour level has continuously closed with bearish cand

- Reward

- like

- Comment

- Repost

- Share

From the perspective of multi-timeframe interconnection, BTC is currently in a typical strong consolidation phase. The daily chart shows a clear rising structure. After breaking through the key resistance level of 115,000, it formed a strong consecutive bullish candle pattern, validating the effectiveness of long positions momentum. The current price consolidation in the range of 116,500-117,000 resonates with the Fibonacci 76.4% pullback level support.

The small time frame chart shows that the 4-hour chart has completed a corrective step, with each pullback not breaking the previous low, form

View OriginalThe small time frame chart shows that the 4-hour chart has completed a corrective step, with each pullback not breaking the previous low, form

- Reward

- like

- Comment

- Repost

- Share

The path of contracts is to cultivate the heart above all. The battlefield of the crypto world is never a simple Bull vs Bear Battle; it is the ultimate test of human nature and discipline. True guidance is not about magical advocates, but about a trading system that teaches you to understand Candlestick language, establish Position management, identify risk signals, and remind you to restrain greed while providing calmness in times of fear. We insist on not promising returns, not mythologizing the market, and only providing round-the-clock risk control warnings, logical reviews, and mindset g

View Original

- Reward

- 1

- 1

- Repost

- Share

不能再手贱了 :

:

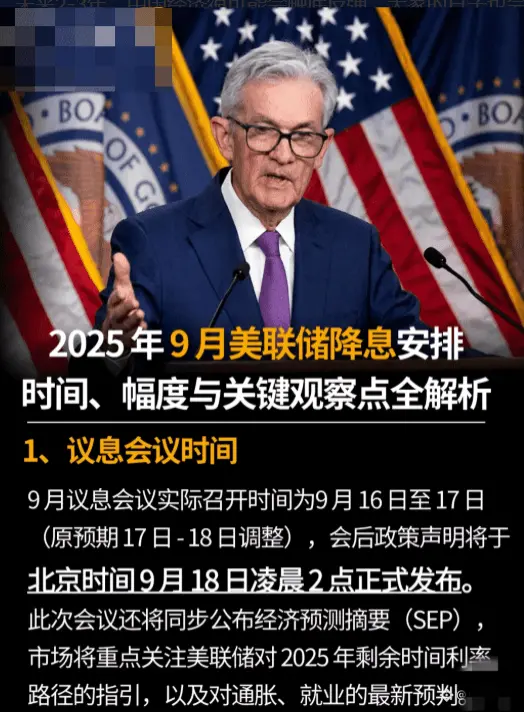

Quack quack quack quack quack quack quack quackThe Fed cuts interest rates, and the financial markets are changing dramatically!

Family, big news! At 2:00 AM Beijing time on September 18th, the Fed's monetary policy meeting concluded, making a shocking decision in the financial world: it lowered the target range for the federal funds rate by 25 basis points, bringing it to 4.00% - 4.25%, and restarted the interest rate cuts that had been paused since last December!

This rate cut has stirred up quite a commotion in the market. First, let's look at the voting results: passed 11 - 1, with the only dissenting vote coming from the new b

Family, big news! At 2:00 AM Beijing time on September 18th, the Fed's monetary policy meeting concluded, making a shocking decision in the financial world: it lowered the target range for the federal funds rate by 25 basis points, bringing it to 4.00% - 4.25%, and restarted the interest rate cuts that had been paused since last December!

This rate cut has stirred up quite a commotion in the market. First, let's look at the voting results: passed 11 - 1, with the only dissenting vote coming from the new b

BTC-1.91%

- Reward

- like

- Comment

- Repost

- Share

The crypto world contracts are not a casino, but a battlefield that requires precise calculations. Remember these 8 iron rules: control leverage within 5 times, calculate the liquidation price before opening a position; set a stop loss line of 3%-5%, refuse to hold a losing position; only trade with the trend, buy on pullbacks in a bullish trend, and short on rebounds in a bearish trend; a single position should not exceed 10% of total funds, take profit in batches; filter out noise and stick to your strategy; closely monitor the BTC/ETH indicators; in extreme market conditions, hedging can be

View Original

- Reward

- 1

- 5

- 1

- Share

GateUser-db3cdbfa :

:

Buy to Earn 💎View More

- Reward

- like

- 1

- Repost

- Share

Wenwen :

:

Steadfast HODL💎True top traders win not by technique but by mindset. The path to mastery lies in: keeping your heart rate below 80 during a plummet or big dump, not revenge trading after getting liquidated, strictly taking profit at 50% unrealized gains, and maintaining strategy consistency after five consecutive stop losses. Remember: the market never lacks opportunities; what it lacks is the capital to survive. It's better to miss a tenfold opportunity than to mistakenly place a trade that drops to zero. Prepare a plan for each trade in advance, set automatic execution to refuse emotional interference,

View Original

- Reward

- like

- Comment

- Repost

- Share

Date: [Instant Date]

Time: Every night 20:30-22:00 (Beijing Time)

Platform: [Gate] 🎤 Host: [Yunche Lunshe A]( Senior On-Chain Analyst) #BTC战略储备市场影响#

🌟 Live Highlights:

1️⃣Key Data Alert for Tonight

2️⃣ BTC/ETH Key Position Long and Short Game Analysis

3️⃣ A daily tip for market watching

View OriginalTime: Every night 20:30-22:00 (Beijing Time)

Platform: [Gate] 🎤 Host: [Yunche Lunshe A]( Senior On-Chain Analyst) #BTC战略储备市场影响#

🌟 Live Highlights:

1️⃣Key Data Alert for Tonight

2️⃣ BTC/ETH Key Position Long and Short Game Analysis

3️⃣ A daily tip for market watching

- Reward

- 1

- Comment

- Repost

- Share

In the crypto world, contracts are a battle of the mind, and those who are impatient will ultimately be consumed by the market. Remember: Position is mindset; excessive leverage is a shortcut to destruction, and reasonable planning is the foundation for longevity. Always set a stop loss for every order, and know when to take profits—there are always opportunities in the market; what's lacking is capital to survive until tomorrow. Do not chase the price or sell with bearish market; do not guess the top or bottom; the trend is your only fren. Admit mistakes promptly when losing, and learn to

View Original

- Reward

- 1

- 1

- Repost

- Share

CarryingAHoeAndPlayi :

:

Indeed, in the crypto world, there is no technology to make money; you just need to identify the direction and go all in.Understanding the essence of leverage as a double-edged sword, each trade must not exceed 5% of the principal, and never operate at Full Position. Eliminate FOMO emotions; there are always opportunities in the market—after a loss, forcibly stop trading for 4 hours, and when in profit, maintain clear records of the environmental factors behind the success. Before opening a position, ask yourself three soul-searching questions: Does it align with the trading system? Is the stop loss reasonable? Can the risk-reward ratio reach 1:3? If the market's heartbeat accelerates, immediately reduce the

View Original

- Reward

- like

- Comment

- Repost

- Share

Some people don't even know what rollover is or how to operate it.

Rollover can be simply described as a desperate maneuver of "not accepting losses and stubbornly adding more money to hold on."

1. You borrow money to buy coins: using 10x leverage (for example, you put in 1000 yuan and borrowed 9000 yuan) to buy Bitcoin, with a total position of 10,000 yuan.

2. Price crash: It dropped by 5%, and you directly lost 500 yuan, leaving only 500 yuan of principal (about to be forcibly liquidated).

3. You got anxious: you didn't want to take the loss, so you added 2000 yuan to top up the marg

Rollover can be simply described as a desperate maneuver of "not accepting losses and stubbornly adding more money to hold on."

1. You borrow money to buy coins: using 10x leverage (for example, you put in 1000 yuan and borrowed 9000 yuan) to buy Bitcoin, with a total position of 10,000 yuan.

2. Price crash: It dropped by 5%, and you directly lost 500 yuan, leaving only 500 yuan of principal (about to be forcibly liquidated).

3. You got anxious: you didn't want to take the loss, so you added 2000 yuan to top up the marg

BTC-1.91%

- Reward

- 1

- Comment

- Repost

- Share

Recently, the crypto world market has been like a roller coaster, with rapid rises and falls followed by frequent rebounds in the market. Many investors have been trapped due to not adjusting their strategies in time. In the face of this situation, blindly panicking or waiting idly are not good strategies; mastering scientific breakeven methods is the key. Below are four practical breakeven ideas to help investors turn passivity into proactivity in a volatile market.

1. Decisive Stop Loss: The Survival Rule When Trends Reverse

When the market trend clearly reverses and there is significant dow

View Original1. Decisive Stop Loss: The Survival Rule When Trends Reverse

When the market trend clearly reverses and there is significant dow

- Reward

- 2

- 5

- Repost

- Share

Market fluctuations create opportunities; closely following trends and strictly adhering to discipline are the core of contract profitability. Sticking to systematic trading is much more likely to achieve stable win rates than relying on intuition.

After the morning Bitcoin pullback near 114900, it received strong support, followed by a surge from the bulls that broke through the 116000 mark, reaching a high of 116800. The price is currently in a consolidation phase, which is a healthy technical buildup. The hourly moving averages are in a bullish arrangement, and the volume is well-matched, i

View OriginalAfter the morning Bitcoin pullback near 114900, it received strong support, followed by a surge from the bulls that broke through the 116000 mark, reaching a high of 116800. The price is currently in a consolidation phase, which is a healthy technical buildup. The hourly moving averages are in a bullish arrangement, and the volume is well-matched, i

- Reward

- like

- Comment

- Repost

- Share

Although the market experienced a downturn in the early morning, BTC quickly received buying support at the key support levels of 115,000 USD and Ether at 4,580 USD, showing a "V-shaped" rebound. This indicates that the bullish defense strength in this area is strong, successfully validating the effectiveness of the bottom and laying a technical foundation for the subsequent rebound.

The current price has returned above the key levels of BTC 115500/Ether 4615, and the short-term downside risk has eased. Next, we need to pay attention to whether the price can stabilize above 116000 and 4650. If

View OriginalThe current price has returned above the key levels of BTC 115500/Ether 4615, and the short-term downside risk has eased. Next, we need to pay attention to whether the price can stabilize above 116000 and 4650. If

- Reward

- 1

- Comment

- Repost

- Share

Success requires effort and time; only through continuous hard work can one achieve good results. Be grateful for every setback and difficulty, as they are opportunities for your growth. Do what you love, enjoy the process, and success will naturally follow.

This week's market has seen significant volatility, mainly influenced by PPI, CPI, and the number of unemployment claims for the week. Overall, Bitcoin has been dominated by bulls this week, oscillating around 111,000 at the beginning of the week. After waiting for Thursday's news, with favorable PPI data, Bitcoin experienced a sha

View OriginalThis week's market has seen significant volatility, mainly influenced by PPI, CPI, and the number of unemployment claims for the week. Overall, Bitcoin has been dominated by bulls this week, oscillating around 111,000 at the beginning of the week. After waiting for Thursday's news, with favorable PPI data, Bitcoin experienced a sha

- Reward

- like

- Comment

- Repost

- Share