As of September 13, 2025, Ethereum (ETH) is performing relatively strong.

On September 13, the price of ETH rose above the $4700 mark, with a 24-hour increase of 3.75%, reaching a new high since August 25. According to data from Coinbase, the 24-hour trading volume of ETH was $40.44 billion, with a market capitalization of $471.43 billion and a circulating supply of 121 million coins, accounting for 12.56% of the total cryptocurrency market capitalization.

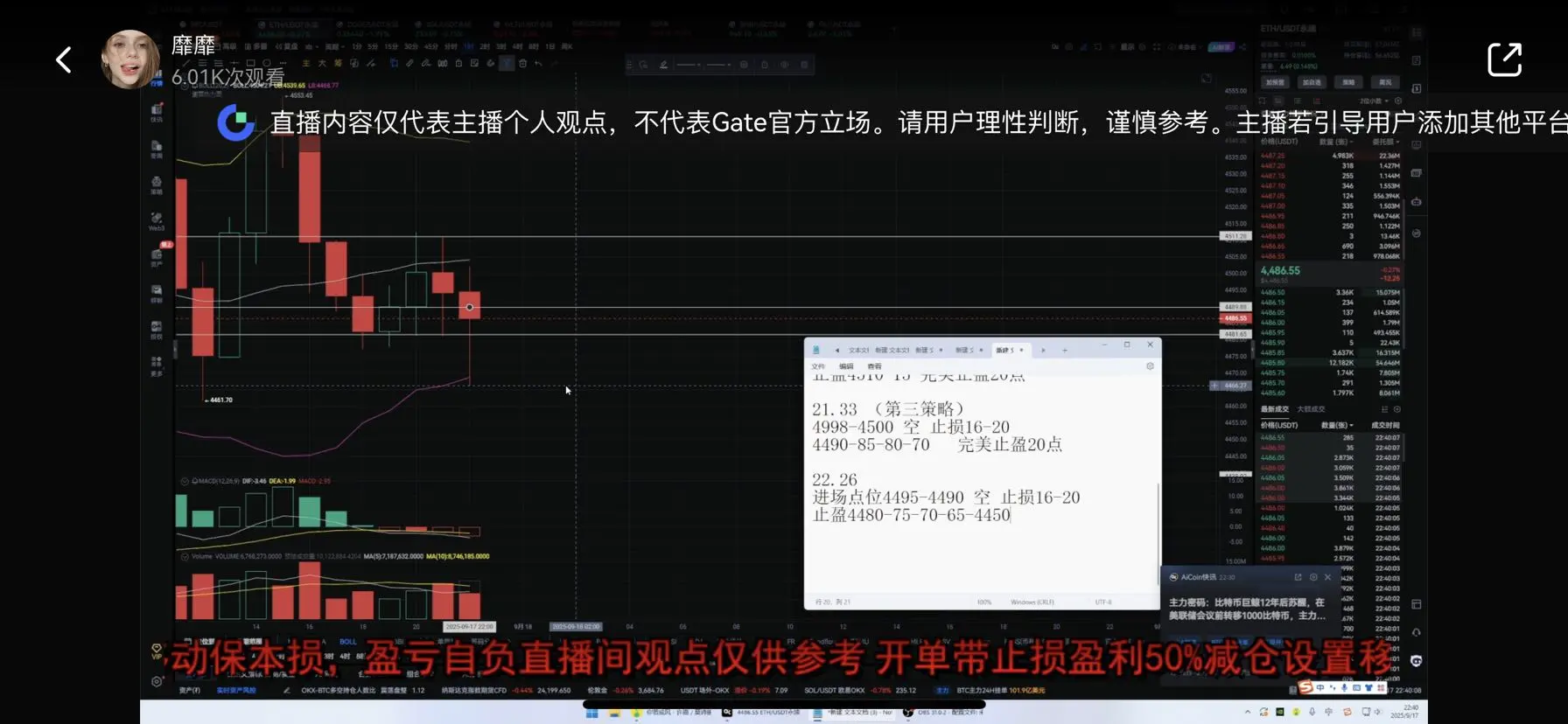

From a technical perspective, ETH is steadily rising on the 4-hour chart, with the 20, 50, and 100-period EMAs forming support around $4372

On September 13, the price of ETH rose above the $4700 mark, with a 24-hour increase of 3.75%, reaching a new high since August 25. According to data from Coinbase, the 24-hour trading volume of ETH was $40.44 billion, with a market capitalization of $471.43 billion and a circulating supply of 121 million coins, accounting for 12.56% of the total cryptocurrency market capitalization.

From a technical perspective, ETH is steadily rising on the 4-hour chart, with the 20, 50, and 100-period EMAs forming support around $4372

ETH-3.28%