Gate Leveraged ETF Explained: Multiply Market Moves Without Futures

The Role of ETFs Is Evolving

In the early days, ETFs were valued for their simplicity and diversification. Investors could allocate across multiple assets as easily as trading stocks, reducing the risk of holding a single asset. This made ETFs a stable choice for long-term portfolios. As market activity accelerates, however, more traders are seeking tools to amplify directional moves. Basic index tracking no longer satisfies the demands of short-term strategies or trend-based trading. As a result, leveraged ETFs—offering magnified exposure—have become a major focus in the market.

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETF tokens use perpetual contract positions as their underlying structure to maintain a fixed leverage ratio—such as 3x or 5x. However, the user experience is completely different from contract trading.

There’s no need to adjust leverage, calculate margin, or worry about liquidation risk. By simply buying or selling the relevant ETF tokens on the spot market, users can access leveraged gains and losses. The system automatically manages all complex position adjustments in the background.

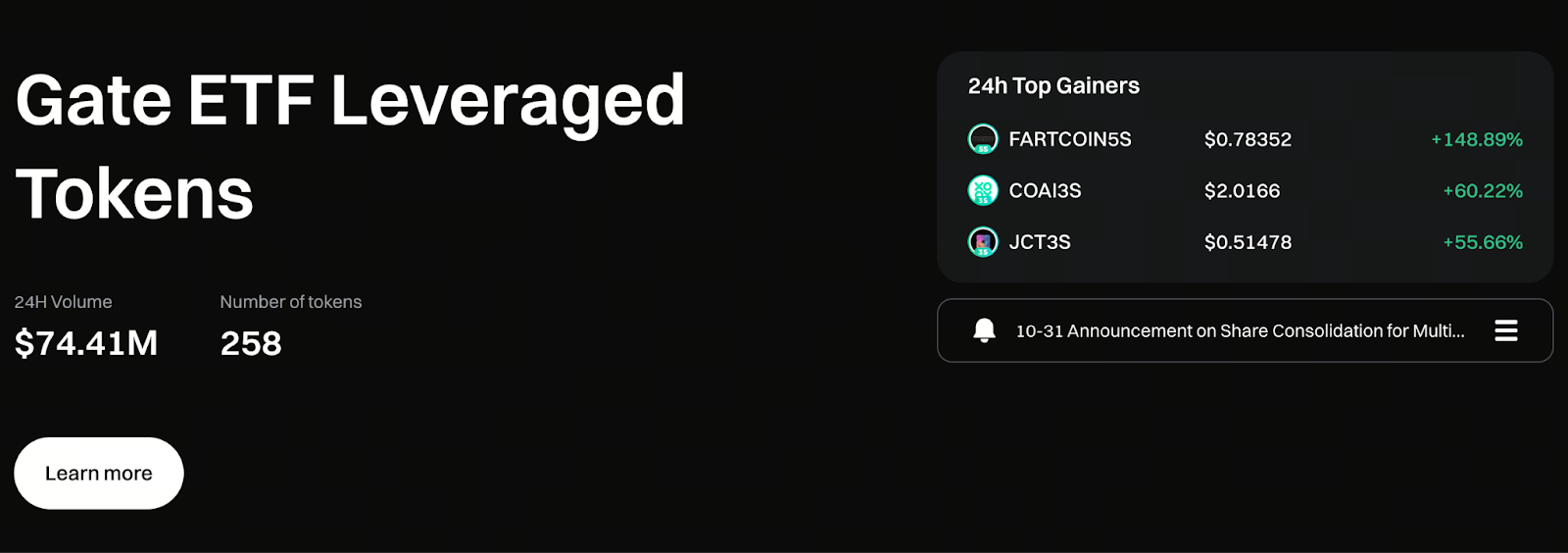

Trade Gate Leveraged ETF tokens now: https://www.gate.com/leveraged-etf

How Is Leverage Kept at a Fixed Multiple?

To prevent leverage from deviating due to market swings, Gate has built several mechanisms into its product design:

1. Perpetual contracts as the foundation

Each leveraged ETF token is backed by an independent perpetual contract position, maintaining the target leverage ratio.

2. Daily automatic rebalancing

After market fluctuations, the system recalibrates position ratios to restore leverage to the target range, ensuring the product’s intended characteristics remain intact.

3. Pure spot trading experience

No need to use contract interfaces or engage in borrowing. The trading logic matches that of standard spot tokens.

4. Daily management fee calculation

The platform charges a 0.1% management fee per day to cover rebalancing, hedging, and contract-related costs.

Why Do Many Traders Choose Leveraged ETFs?

Compared to trading contracts directly, leveraged ETFs offer several clear strategic advantages:

1. Greater trend amplification

When the market moves in a clear direction, leverage can quickly magnify price changes and boost capital efficiency.

2. No risk of forced liquidation

All contract positions are managed by the system, so users aren’t exposed to forced liquidation due to insufficient margin.

3. Compounding effect from rebalancing

If the market continues in one direction, the rebalancing mechanism can naturally increase position size, creating a compounding return structure.

4. More accessible for beginners

There’s no need to master complex contract rules. Operation is intuitive, making leveraged ETFs a suitable first leveraged product.

Key Risks to Understand Before Trading

Even though they are easy to use, leveraged ETFs are high-volatility products. The following risks are significant:

- Amplified gains and losses: Profits are magnified—and so are losses

- Performance drag in sideways markets: Frequent rebalancing can erode returns

- Actual returns may differ from theoretical multiples: Rebalancing and market volatility can cause discrepancies

- Long-term costs accumulate: Management fees and hedging costs reduce final returns

For these reasons, leveraged ETFs are best suited for short-term trades or clear market trends—not for long-term holding.

Why Is a Management Fee Charged?

Maintaining fixed leverage requires the platform to operate continuously in the contract market, including:

- Opening and closing contract fees

- Funding rate expenses

- Slippage losses during rebalancing

The daily 0.1% management fee covers these ongoing costs. Overall, the fee is in line with industry standards for similar products.

Conclusion

Gate Leveraged ETFs add value by transforming complex, high-pressure contract trading into an intuitive spot trading experience. For traders who want to amplify market moves without dealing with contracts, this is a user-friendly solution. However, leverage is always a double-edged sword. Only by understanding rebalancing, cost structures, and market rhythms can leveraged ETFs serve as a strategic asset rather than a drain on capital. Timing and proper use are critical to realizing their full value.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution