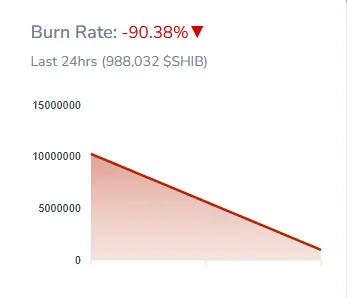

Shiba Inu Burn Activity Appears Dead as Large SHIB Burns Dry Up

Shiba Inu's token burn mechanism, once a major factor for its price potential, is declining as daily burns shrink significantly. Recent data shows only 988,032 SHIB burned in a day, marking a 90.38% drop from previous figures. Despite various initiatives like Shibarium and a burn portal, the circulating supply remains high at 589.24 trillion tokens. The community struggles to reduce supply, with only about 410 trillion tokens burned since inception.

TheCryptoBasic·1m ago

Ethereum L1 Hits 2025 Record with Over 1.9 Million Daily Transactions - U.Today

Major progress

More scaling challenges

According to a recent social media post by Etherscan, the Ethereum network processed a record-breaking 1.91 million transactions on Layer 1 (L1) in a single day. At the same time, the fees are incredibly low at $0.16.

This shows that the network can now

UToday·2m ago

Dogecoin Santa Rally Paused? OI Hits 11,796,875,000 DOGE in Holiday Lull - U.Today

Dogecoin's open interest has dropped 4.03% to $1.51 billion as traders exhibit caution before the holidays. Currently trading between $0.126 and $0.135, Dogecoin's price action is under scrutiny for future movements amid broader market uncertainty.

DOGE-1.14%

UToday·2m ago

Warning: Bitcoin enters "Bear Market Year" in 2026! Fidelity expert reveals "key support level"

Fidelity's Global Macro Research Director Jurien Timmer, who has been long-term optimistic about Bitcoin, has recently become more cautious. He warns that Bitcoin has likely completed another "4-year cycle" and is about to enter a prolonged correction phase, possibly even facing a "Crypto winter."

Jurien Timmer pointed out that, based on historical experience, Bitcoin's price movements have consistently followed repeating cyclical patterns. From historical laws and time structures, this current cycle aligns closely with many previous bull and bear transitions.

He specifically mentioned that Bitcoin reached a historical high of $125,000 in October this year, after approximately 145 months of upward trend, which fully matches the expected range predicted by historical models.

Jurien Timmer stated that Bitcoin's bear market (commonly referred to as "Crypto winter") usually lasts about a year.

区块客·4m ago

Hong Kong Launches New Licensing Rules—What You Need to Know

Hong Kong Advances Crypto Regulatory Framework with New Licensing Regimes

Hong Kong is moving forward in its efforts to strengthen its position as a leading global crypto hub by formalizing licensing requirements for cryptocurrency service providers. Following the conclusion of consultations, the c

CryptoDaily·10m ago

Bitcoin Nears $90K as It Bounces Back Over Gold in Value

Bitcoin Faces Short-term Weakness Amid Diverging Market Trends

Bitcoin’s price momentum remains subdued as traders prepare for further downside, with market indicators highlighting increased short positions and divergent signals from traditional assets like gold. Despite the cryptocurrency’s

CryptoDaily·21m ago

Brazil Backs a R$1.08M Bitcoin Orchestra That Turns Live BTC Prices Into Real-Time Music

Key Takeaways:

Brazil approved a R$1.08 million ($197,000) tax-incentivized project that converts live Bitcoin price data into orchestral music.

A custom algorithm will translate Bitcoin price movements and volatility into melody, rhythm, and tempo during a live performance in Brasília.

The

CryptoNinjas·25m ago

"Using Bitcoin as a means of consumption"... Messari focuses on Starlink's real-life economic system in the growth of BTCFi

The Messari Research Institute, a global cryptocurrency research organization, pointed out in a recent report that the role of Starknet in the Bitcoin-centric decentralized finance ecosystem, known as "BTCFi," is rapidly expanding. In particular, Starknet is accelerating the development of a comprehensive self-custodied economic system that goes beyond simple staking or bridging platforms, covering lending, borrowing, yield strategies, and even real-world expenses.

The total value locked in Starknet has increased from $155 million to nearly $310 million over the past six months, nearly doubling. This is the result of increased bridging of Bitcoin, stablecoins, and native token STRK staking. Especially, lending protocols like Vesu are supplementing staking platforms, attracting users who want to leverage their held BTC as collateral to generate yields. The Messari Institute stated that these platforms offer incentives of up to 100 million STRK.

TechubNews·29m ago

Sweden’s BTC AB Raises $783K to Expand Bitcoin Holdings

BTC AB raises $783K through preference shares to expand its Bitcoin holdings, while Matador Technologies aims for 1,000 BTC by 2026 with up to $58M funding. Upexi files to raise $1B to enhance crypto operations and its Solana treasury.

CryptoFrontNews·35m ago

ZKsync Announces New Protocol Upgrade to Redefine Interoperability and Settlement

ZKsync is set to launch a protocol upgrade in Q1 2026 that will enhance interoperability and settlement operations, temporarily shifting to Ethereum L1. The upgrade will support direct asset transactions and improve cross-chain functionality, aiming to boost adoption and stability in the ecosystem.

BlockChainReporter·37m ago

DeFi has not collapsed, but why has it lost its appeal - ChainCatcher

DeFi is gradually losing its sense of exploration, with participant behaviors becoming highly similar. Returns are seen as basic expectations, and lending has turned into short-term financing. Trust crises are intensifying, making the ecosystem more closed. To reshape its attractiveness in the future, it is necessary to promote the structuring of different user behaviors and avoid further optimizing the existing models.

BTC0.17%

链捕手·39m ago

Kalshi's First Research Report: When Predicting CPI, Collective Intelligence Outperforms Wall Street Think Tanks

Kalshi, a market prediction platform, releases its first research report revealing that its average absolute error in predicting CPI data is 40% lower than traditional consensus expectations. During periods of significant market shocks, its prediction accuracy improves by up to 60%, demonstrating the advantages of "collective intelligence" in the field of economic forecasting.

(Background: CNBC collaboration prediction market Kalshi, real-time odds 2026 fully launched on TV programs and news reports)

(Additional context: From ballet dancer to the youngest female billionaire: How Luana built the billion-dollar prediction market Kalshi)

Table of Contents

Overview

Key Highlights

Background

Methodology

Data

Shock Classification

Performance Metrics

Results: CPI Prediction Performance

Overall Accuracy

動區BlockTempo·45m ago

Token swaps power instant DeFi trades without banks or brokers

Token swaps let users trade crypto directly via DeFi smart contracts and AMMs, tapping liquidity pools for instant, permissionless access to assets and yields.

Summary

Token swaps use smart contracts and AMMs to route trades through liquidity pools instead of order books or centralized

Cryptonews·59m ago

tZERO Adds Stellar, XDC Network, and Algorand to Its Regulated Tokenization Stack

tZERO has announced support for Stellar, Algorand, and the XDC network on its multi-chain tokenization infrastructure.

The new integrations give issuers more choice and add to asset flexibility in their ecosystem, tZERO stated.

tZERO has added Stellar, the XDC network, and Algorand to its mu

CryptoNewsFlash·1h ago

Load More

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28