- Trending TopicsView More

13.4K Popularity

4.7M Popularity

123.6K Popularity

79.3K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Understanding Cryptocurrency Market Cycles: A Repeating Pattern

The Echoes of 2017: A Familiar Rhythm in the Crypto Market

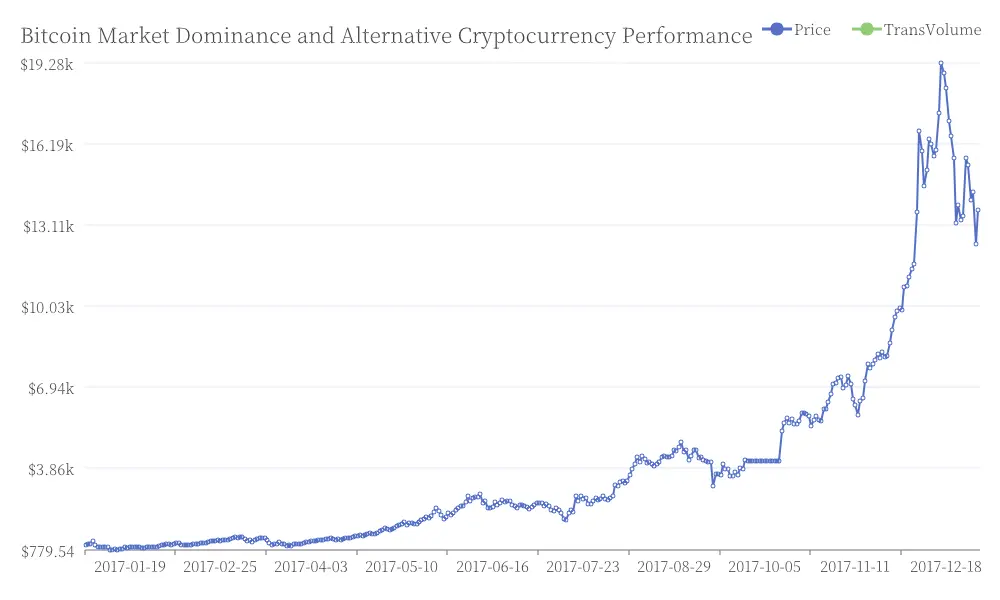

Cryptocurrency markets have a knack for repeating history, and the current charts bear a striking resemblance to the legendary 2017 cycle. Back then, sharp declines shook out less committed investors, only to be followed by explosive rallies that rewrote market history. Fast forward to today, and we're witnessing remarkably similar patterns unfolding almost day by day.

Decoding the 2017 Blueprint in Today's Market

The 2017 cycle saw Bitcoin undergo multiple corrections, ranging from 30% to 40%, each time sparking fear in the market. However, these dips were consistently followed by new all-time highs. In 2025, we're observing a comparable scenario: sharp drops trigger fear spikes, followed by rapid rebounds—a classic setup preceding a potential parabolic phase.

This repetitive pattern is deeply rooted in market psychology. The crypto market is designed to test conviction, with savvy investors accumulating during periods of fear, while less experienced participants often panic-sell. If history indeed rhymes, as it often does in the crypto space, the next significant upward movement could be closer than many anticipate.

Navigating the Crypto Landscape

Looking ahead, investors should brace for near-term volatility. These corrections are an integral part of the market's buildup phase. Once the market processes and moves past the fear, alternative cryptocurrencies typically follow Bitcoin's lead, often experiencing even more dramatic price movements.

Historically, when Bitcoin's market dominance reaches its peak, it often signals the beginning of a period where alternative cryptocurrencies take center stage. This shift in focus can lead to substantial gains across the broader crypto market. Bitcoin Market Dominance and Alternative Cryptocurrency Performance

Bitcoin Market Dominance and Alternative Cryptocurrency Performance

Strategic Accumulation: Top Cryptocurrencies to Consider

If the current market is indeed mirroring the 2017 script, strategic accumulation now could prove to be a transformative investment decision. Several cryptocurrencies stand out with strong narratives and potential: Ethereum continues to serve as the backbone of DeFi, NFTs, and L2 scaling solutions; Solana offers high-speed smart contracts with growing institutional appeal; Avalanche presents a strong Layer-1 platform with an expanding DeFi ecosystem; Injective functions as a DeFi powerhouse with robust tokenomics; and various Meme Coins have historically shown explosive performance during late-cycle runs.

The Cyclical Nature of Crypto Markets

While market dips may appear daunting, historical patterns suggest that these corrections often serve as fuel for future rallies rather than signaling a market collapse. If the current cycle is indeed mirroring 2017, the coming months could potentially deliver the kind of parabolic price movements that have defined cryptocurrency's history.

For investors and enthusiasts, maintaining focus and patience while accumulating wisely could be key. The next significant market breakout may already be written in the historical script of cryptocurrency cycles.

As we navigate through 2025, it's worth remembering that while history doesn't repeat exactly, it often rhymes—and the current market conditions might just be orchestrating a perfect echo of 2017's legendary bull run.