Trump Unveils $2000 Tariff Dividend Plan: Markets Rally Amid Inflation Fears

Trump Announces Tariff Dividend Plan

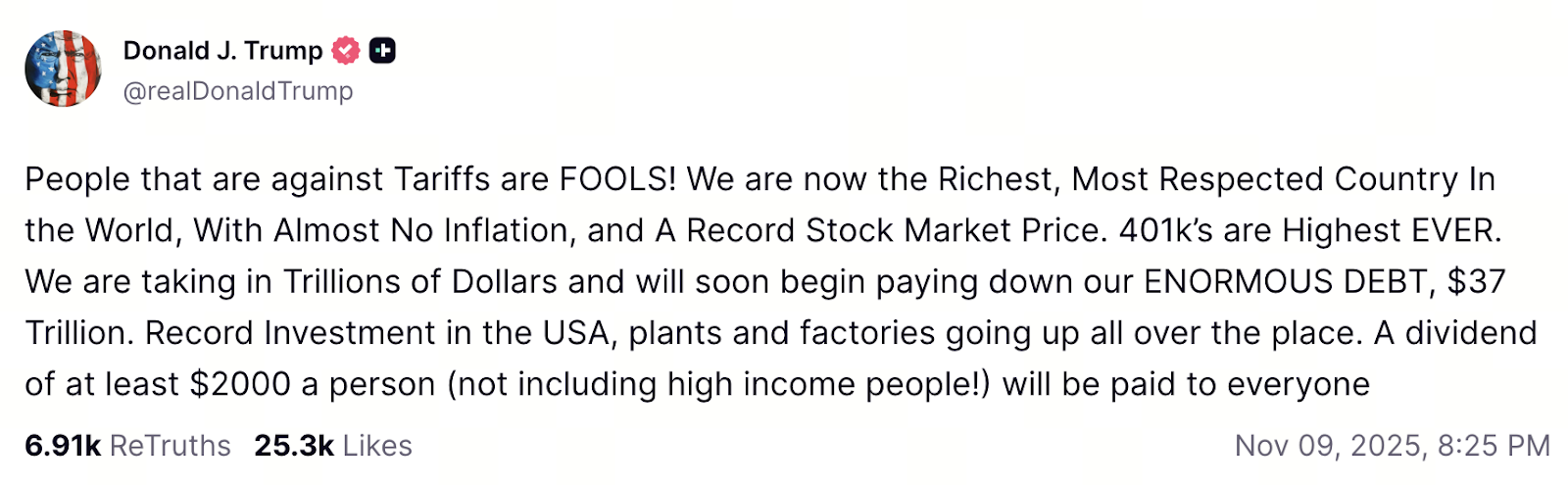

(Source: realDonaldTrump)

On Sunday (local time), former U.S. President Donald Trump announced on Truth Social that most Americans would be eligible for direct cash payments funded by tariff revenues, with each person receiving at least $2,000. Trump clarified that high-income individuals are excluded from the policy, with the goal of returning tariff revenue benefits to the general public.

He also criticized opposition to the proposal, underscoring the president’s legal authority to impose trade restrictions and tariffs. Trump asked pointedly, “A president can halt all trade with a country, but supposedly can’t levy tariffs for national security—is that reasonable?”

Market Skepticism Over Likelihood of Passage

The U.S. Supreme Court is currently reviewing the legality of the tariff plan. Data from market prediction platforms shows that most investors doubt the policy will gain court approval.

- Kalshi estimates the odds of passage at just 23%.

- Polymarket gives an even lower probability—only 21%.

Despite this, analysts remain optimistic about the policy’s potential economic stimulus. Several analysts note that if the plan passes, equities and crypto asset markets will likely see a short-term boost.

Economic Analysis

A research report from The Kobeissi Letter, a financial institution, finds that based on the distribution rate of COVID-19 stimulus checks, roughly 85% of U.S. adults would qualify for the $2,000 tariff dividend. The report also cautions that any fiscal stimulus can trigger two key outcomes:

- Rising national debt — The payout plan would further widen the U.S. fiscal deficit.

- Declining purchasing power of the dollar — Inflationary pressures would erode the real value of the dollar.

Stimulus Spurs Risk Assets Higher

Crypto investors and analysts broadly agree that the tariff dividend will drive short-term capital inflows into the market, particularly into risk assets. Some experts caution that a near-term rally does not guarantee lasting stability; as liquidity increases, markets will eventually face corrections and growing inflation risks.

For further information on Web3, register at: https://www.gate.com/

Conclusion

Trump’s $2,000 tariff dividend proposal has sparked fresh market momentum. It has also sparked renewed debate about the direction of U.S. fiscal policy. If enacted, the plan would serve as a short-term economic catalyst, lifting asset prices and consumer sentiment. However, with national debt climbing and inflation concerns lingering, striking a balance between economic stimulus and stability remains a long-term challenge for both the government and the market.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article