ADL: The Final Line of Defense

This sharp market crash and wave of liquidations sparked a public debate.

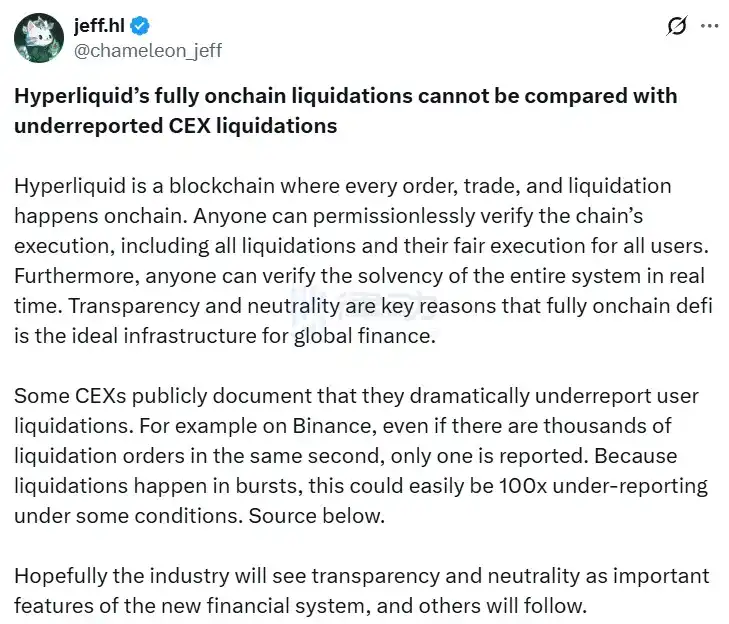

Hyperliquid founder Jeff Yan openly accused on social media: “Some centralized exchanges significantly underreport user liquidations. For instance, on Binance, even if thousands of liquidation orders occur in the same second, only one is reported. Because liquidations are sudden events, the actual underreported number can easily be 100 times higher in certain scenarios.”

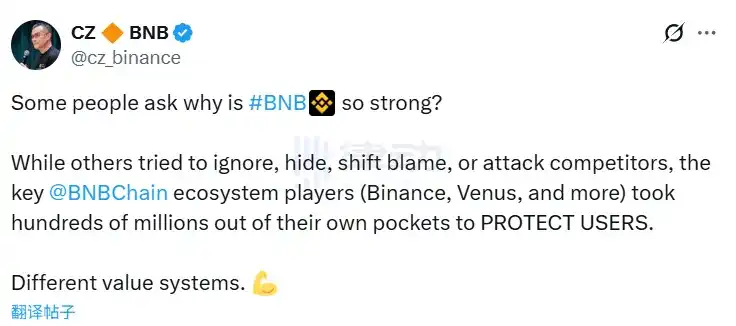

His comments delivered a direct rebuke to CZ, who soon appeared to respond to Jeff: “While others try to ignore, conceal, deflect, or attack competitors, key players in the BSC ecosystem—Binance, Venus, and others—have spent hundreds of millions of dollars from their own pockets to protect users. Different value systems.”

This dispute quickly split the industry into camps. DeFi veteran Andre Cronje sided with Binance, while Mert, a core Solana community member and CEO of Helius Labs, supported Hyperliquid. The entire sector was divided into two factions.

At its core, this issue highlights the fundamental differences between decentralized and centralized exchanges—most vividly reflected in their approaches to the ADL mechanism.

If not for this major crash and liquidation event, most participants might never have explored the differences between Hyperliquid and Binance’s ADL models. But these distinctions epitomize the radically different risk management philosophies of decentralized versus centralized platforms.

ADL: The Final Safeguard

ADL, or Auto-Deleveraging, is the last line of defense for crypto trading platforms. When liquidation losses exceed the insurance fund’s capacity, the platform initiates this protocol, forcibly closing profitable positions to maintain solvency.

It may seem ruthless, but it’s a necessary evil. Without ADL, platforms would face bankruptcy and all user funds would be at risk.

Hyperliquid’s ADL: Rare and Transparent

Let’s look at how ADL works on Hyperliquid.

Hyperliquid’s ADL is engineered as a multi-layer safety system, activated only when all other protections fail. When a trader’s position falls below the maintenance margin—typically 2% to 5% of the notional value—the system first attempts standard liquidation by matching orders in the order book. If there’s insufficient depth, the position and collateral are transferred to the Hyperliquid Liquidity Provider (HLP) vault.

ADL only triggers when the HLP vault or a specific isolated account drops below zero—meaning unrealized losses have surpassed all available buffers. The exact trigger: insurance fund balance + position margin + unrealized P&L ≤ 0. No fixed percentage threshold exists; activation depends dynamically on maintenance margin violations. For example, with 2x leverage, it might require a price drop of over 50% to trigger ADL.

Hyperliquid’s ADL is deliberately designed to be extremely rare. The first-ever platform-wide ADL occurred on October 11, 2025, more than two years after launch. Previously, ADL happened only occasionally in isolated margin mode.

When ADL is triggered, the system queues liquidations according to a “largest whale first” priority. The formula: mark price ÷ entry price × notional position ÷ account value. While it sounds technical, the logic is straightforward: the mark-to-entry price ratio measures your percentage profit—the higher, the greater your liquidation priority. The notional-to-account value ratio reflects leverage—larger positions relative to account size pose greater systemic risk and are prioritized for ADL.

The algorithm integrates three key factors: unrealized P&L (primary), leverage (secondary), and position size (tertiary). Each asset or perpetual contract has its own on-chain, dynamically updated priority queue—refreshed every three seconds based on mark price and oracle data. Execution uses HyperBFT consensus for sub-second finality. Note: since cross-asset margin is supported, only one side of a hedged position may be closed in some cases.

Compared to centralized platforms, Hyperliquid’s ADL stands out for its decentralized execution—every step is automated by smart contracts on Hyperliquid L1, with no off-chain engines or manual intervention. This guarantees full transparency: all liquidations and ADL events are visible and auditable in real time via the blockchain explorer, eliminating black-box risk.

The platform’s integration with HLP is also noteworthy. ADL-generated proceeds flow back to the community vault, and 97% of trading fees are used to buy back HLP and HYPE tokens. To incentivize liquidity, Hyperliquid charges no liquidation fees, and the HLP vault does not cherry-pick only profitable trades, preventing “toxic liquidity.”

Binance’s ADL: Routine and Opaque

Now let’s examine Binance’s approach.

On Binance’s USDT-margined futures platform, ADL is the last safeguard, activated only after the insurance fund is depleted. Several conditions must be met: the trader’s position reaches bankruptcy (losses exceed maintenance margin and the account is negative); the liquidation order is filled at a poor price, resulting in margin-exceeding losses; and the insurance fund cannot fully cover the shortfall.

Binance does not publish explicit percentage thresholds; the mechanism is dynamic, depending on contract and market conditions. In practice, ADL triggers when the insurance fund is exhausted relative to the bankruptcy amount. Each perpetual contract has its own insurance fund, funded by trading fees and liquidation surplus.

Binance uses an ADL score to prioritize liquidation. For profitable positions, ADL score = P&L percentage × effective leverage (where P&L percentage is unrealized P&L ÷ initial margin × 100, and effective leverage is notional position ÷ wallet balance). For losing positions, the ranking is P&L percentage ÷ effective leverage, with lower priority. The user’s ADL score ÷ total eligible users sets the final rank.

For example, 50% profit and 20x leverage yields an ADL score of 1000; this far exceeds a trader with 20% profit and 10x leverage (score 200), making the former the first to be liquidated.

Binance provides a five-level risk indicator below position details—green bars for low risk (bottom 80% in queue), yellow for moderate risk (60%-80%), orange for high risk (20%-40%), and red for extreme risk (top 20%), meaning you’ll be among the first liquidated in a selloff.

After ADL activation, the system monitors post-liquidation bankruptcies and activates the queue if the insurance fund is insufficient. Inverse profitable positions are ranked by ADL score, and the system forcibly closes the highest-ranked positions at bankruptcy price or better mark price—just enough to offset the deficit. This repeats until the deficit is filled or the queue is exhausted. In extreme cases, if all positions are exhausted and the deficit remains, socialized losses are imposed.

Once closed, affected users’ P&L is realized and the insurance fund may receive surplus. The process is executed by a centralized engine, quickly but not on a public order book. Each contract’s queue updates dynamically, and hedged or low-leverage positions are excluded without user opt-out.

Binance’s notification system is robust: in an ADL event, users receive instant app, email, and SMS alerts detailing the liquidation amount, P&L impact, and reason. Five-level risk indicators warn users prior to ADL, and push alerts can be enabled for high-risk rankings.

Post-event, all ADL actions are recorded in trade history as special executions, and support tickets are automatically generated for user disputes. These notifications are mandatory and cannot be disabled.

Key Mechanism Comparison

Hyperliquid executes ADL via on-chain smart contracts for full decentralization; Binance relies on a centralized risk engine and internal servers. A major difference is transparency: Hyperliquid’s process is fully verifiable and auditable on-chain by anyone. Binance, while publishing its ranking formula, leaves execution details opaque—a semi-transparent black box.

For example, during the October 11 crash, Hyperliquid triggered ADL but founder Jeff Yan confirmed 100% uptime and zero bad debt, publishing all liquidation data. The community saw this as a transparency benchmark. Users noted that while Hyperliquid’s ADL might be “indiscriminate,” it’s at least honest, unlike centralized platforms which may conceal key information.

By contrast, the “black box” operations of centralized exchanges have fueled skepticism. During the October 11 selloff, users accused Binance of “non-ADL agreements” with major clients, shifting ADL risk to regular users—a loss of neutrality. Some traders believe centralized order books may be fabricated, with platforms exploiting liquidation prices and underreporting liquidations by restricting API access.

On ranking algorithms: Hyperliquid uses mark price ÷ entry price × notional position ÷ account value. Binance uses P&L percentage × effective leverage for profitable positions, P&L percentage ÷ effective leverage for losing ones.

Insurance fund structures differ: Hyperliquid’s HLP community pool holds around $3.5 billion with independent sub-vaults. Binance has separate insurance funds for each contract, funded by fees; major contracts like BTC USDT have millions of dollars.

For trigger thresholds: Hyperliquid activates ADL when account value ≤ 0, after standard liquidation and HLP takeover fail. Binance triggers ADL when the insurance fund can’t cover bankruptcy losses—no fixed percentage.

Fee structures: Hyperliquid charges no liquidation fees to boost liquidity; Binance charges 0.015% maker and 0.04% taker fees to fund the insurance pool. For risk alerts, Hyperliquid’s UI displays real-time, on-chain ADL scores; Binance provides a five-bar risk indicator updated in real time.

Manual intervention: Hyperliquid allows virtually no manual intervention except for emergency validator votes (e.g., JELLY token incident). Binance doesn’t officially acknowledge it, but allegations persist about special “non-ADL agreements” for VIP clients.

Data verifiability is the biggest distinction: Hyperliquid is fully auditable on-chain, with public block explorer access; Binance’s data is self-reported, without independent external verification. On speed, Hyperliquid achieves sub-second latency via HyperBFT consensus (100,000 TPS theoretical capacity); Binance’s centralized engine is nearly instantaneous, though it may lag under heavy loads.

On rarity: Hyperliquid deliberately designed ADL to be exceptionally rare, with the first full-account ADL only after two years, and position limits plus order book depth minimize ADL risk. Binance’s ADL is a standard risk tool, with less than 0.1% historical liquidations leading to ADL.

Ultimately, these models reflect two distinct philosophies: Hyperliquid enforces structural transparency via technical architecture, eliminating the possibility of fraud; Binance prioritizes speed and efficiency, relying on centralized control and user trust.

In normal market conditions, these differences may be subtle. But in extreme events—like October 11—the contrast is thrown into sharp relief.

Statement:

- This article is republished from [BlockBeats] and copyright belongs to the original author [律动小工]. If you have any concerns about this republication, please contact the Gate Learn team for prompt handling in accordance with our procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without attributing to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?