Regulation: The Highest Wall Prediction Markets Must Climb

Key Takeaways

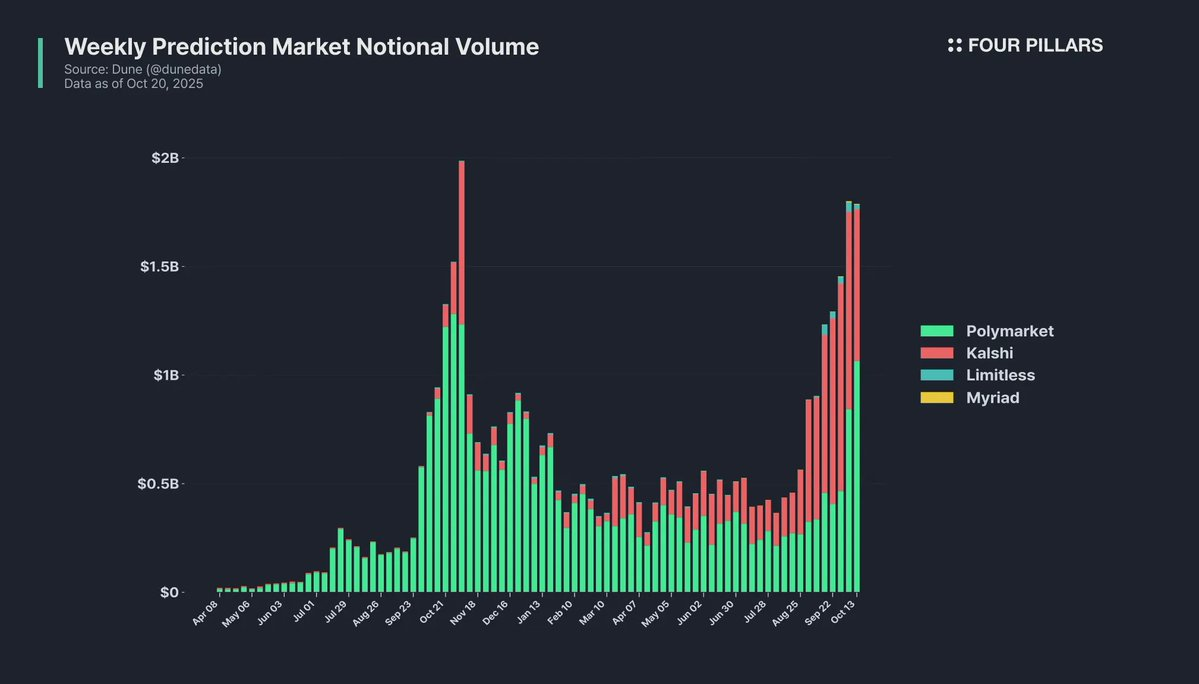

- The growth of prediction markets has made regulatory compliance a key competitive advantage, as demonstrated by Kalshi’s rapid rise. While Polymarket was blocked from the U.S. market due to CFTC sanctions, Kalshi, with its formal licenses, captured the leading position through aggressive marketing and market expansion.

- The fragmentation of the global regulatory environment constrains the expansion of prediction markets, with conservative approaches from Asian countries being a major obstacle. While the U.S. shows signs of regulatory relaxation under the Trump administration, countries like Korea, Singapore, and Thailand either classify prediction markets as illegal gambling or directly block access.

- Decentralization and demonstrating the public value of prediction markets could be key to resolving regulatory issues in conservative countries. Reducing market manipulation risks through intersubjective decision protocols like EigenLayer and emphasizing utility as academic and economic hedging tools is necessary to clearly distinguish them from gambling.

1. The Changing Landscape of Prediction Markets Due to Regulation

1.1 The Rapid Rise of Kalshi

The direct catalyst for this rapid growth was its appearance in the popular animated series “South Park.” In September this year, South Park aired an episode satirizing the prediction market industry, prominently featuring Kalshi and showing characters using the Kalshi mobile app. Immediately after the episode aired, Kalshi’s market share showed a sharp upward trend, confirming that public attention translated into actual user growth.

However, the fundamental reason such bold marketing was possible lies in Kalshi’s regulatory status. While Polymarket was blocked from U.S. user access due to CFTC sanctions, Kalshi, as a legally licensed platform, could exclusively target the U.S. market. Regulatory compliance became not just a means to avoid legal risks, but a strategic asset enabling aggressive marketing and partnerships.

Kalshi’s case demonstrated that regulatory compliance in prediction markets is not merely a constraint but a core competitive element. However, regulation of prediction markets remains one of the least discussed topics within the community. This article aims to examine the complex regulatory environment for prediction markets and what efforts are needed to address it.

2. Regulation of Prediction Markets and Major Platforms’ Responses

2.1 Regulation of Prediction Markets

In the United States, the Commodity Futures Trading Commission (CFTC) oversees prediction markets, which are regulated under the Commodity Exchange Act (CEA). The services provided by prediction markets are legally classified as ‘event contracts’ or ‘binary options,’ treated as derivatives that pay either 0 or a fixed amount depending on whether the underlying event occurs.

Current prediction markets require extensive procedural and structural regulatory compliance:

- CEA Compliance: Requires fair governance, oversight mechanisms, and anti-fraud measures. All exchanges must submit and receive approval for detailed rulebooks implementing these core principles.

- Event Type Restrictions: Markets related to terrorism, assassination, war, gaming, or illegal activities are prohibited. Economic indicators or weather-related contracts are generally permitted.

- Regulatory Oversight Committee: Must establish a regulatory oversight committee composed of individuals without past legal issues, responsible for regulatory program oversight, personnel management, and annual report preparation.

- Trade Data Storage: All trading data must be stored in an accessible database for 5 years according to CFTC regulations.

- Market Manipulation Prevention: The CEA strictly prohibits non-competitive trading, wash trading, spoofing, front-running, etc., requiring platforms to build sophisticated systems to detect and prevent these activities.

Additionally, each prediction market exchange operates disciplinary panels and appeals committees to ensure fair procedures and must establish fair market outcome determination mechanisms.

Regarding outcome determination mechanisms, Kalshi and Polymarket have taken different approaches. Kalshi uses a centralized method with its own outcome review committee to make final market determinations, while Polymarket introduced a decentralized system called UMA Oracle. UMA uses an optimistic resolution mechanism where proposed outcomes are automatically accepted if there are no disputes during a 2-hour challenge period, with disputes resolved through voting by UMA token holders.

2.2 Regulatory Ambiguity

However, interpreting prediction markets as a form of gambling creates regulatory boundary ambiguities. There are particular conflicts between the Unlawful Internet Gambling Enforcement Act (UIGEA) and CFTC regulations. While UIGEA excludes CFTC-regulated activities from sanctions, this creates opportunities for regulatory arbitrage that could bypass state gambling regulations and taxes. In October 2025, the Pennsylvania Gaming Control Board warned Congress about conflicts between federal derivatives law and state existing gaming regulatory authority, highlighting the potential for ongoing state-federal conflicts.

Conflicts over sports or entertainment-related markets are particularly acute. When Kalshi launched sports markets in January 2025, six states including Nevada, New Jersey, and Maryland immediately issued cease-and-desist orders. They claimed Kalshi’s services constituted unlicensed betting in violation of state gambling laws, while Kalshi responded citing federal preemption principles.

2.3 Regulatory Challenges Faced by Prediction Market Protocols

2.3.1 Polymarket

Source: Cointelegraph

Polymarket grew rapidly after its June 2020 launch, but in January 2022 received a decisive CFTC enforcement action requiring it to pay a $1.4 million fine and block U.S. users for operating as an unregistered exchange. Polymarket subsequently operated only for non-U.S. countries for two years. The CFTC determined that Polymarket’s services constituted ‘swaps’ under CEA definitions and could only be offered on exchanges registered as Designated Contract Markets (DCM) or Swap Execution Facilities (SEF).

In November 2024, the FBI raided CEO Shayne Coplan’s home, raising suspicions about allowing U.S. user access, but the situation reversed dramatically in July 2025. Polymarket acquired QCX LLC, a derivatives exchange with CFTC licenses. Through this acquisition, Polymarket secured DCM and DCO (Derivatives Clearing Organization) licenses, and in September received a no-action letter from the CFTC regarding swap data reporting and recordkeeping requirements, officially re-entering the U.S. market.

2.3.2 Kalshi

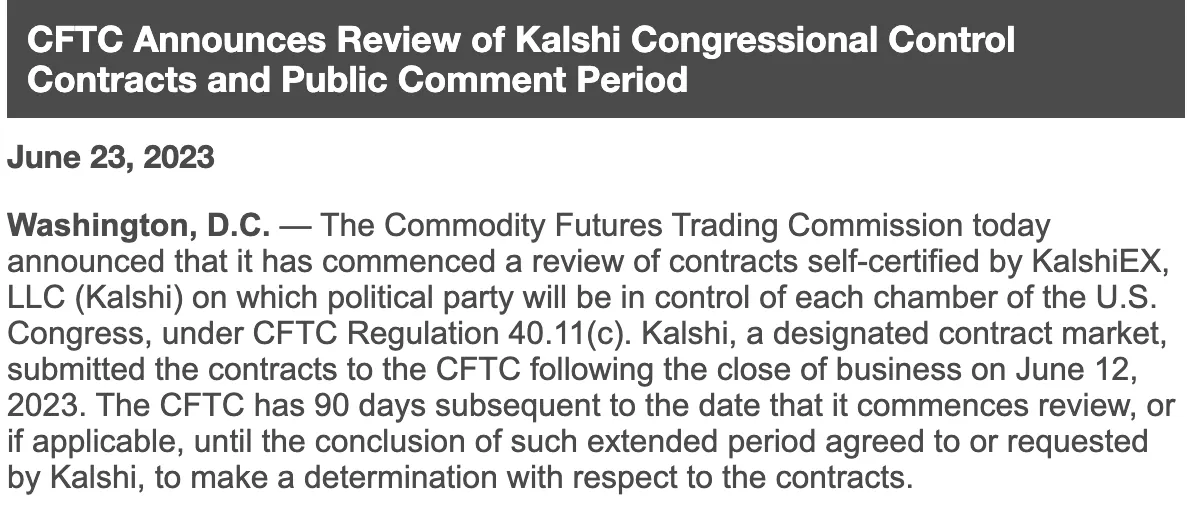

Unlike Polymarket, Kalshi chose a fully compliant regulatory path from the beginning. On November 5, 2020, Kalshi became the first in U.S. history to obtain CFTC-approved DCM status exclusively for event contract trading.

Source: CFTC

However, when Kalshi self-certified and launched a market on congressional control in June 2023, the CFTC argued that such markets constituted betting on games, illegal activities under state law, and contrary to the public interest. Kalshi filed suit in federal court in November that year and achieved legal victory in September 2024. After the CFTC withdrew its appeal, Kalshi was freed from this regulatory issue.

Following the victory, Kalshi aggressively expanded sports prediction markets, launching NFL, NHL, NBA, and NCAA markets across all 50 states in January 2025. This achieved over $500 million in trading volume during March Madness alone, but faced new legal challenges as six states including Nevada and New Jersey issued cease-and-desist orders. Kalshi responded citing federal preemption principles, and in May 2025, a New Jersey federal court ruled in Kalshi’s favor.

2.3.3 Others

Besides Polymarket and Kalshi, various prediction market exchanges have been subject to U.S. government regulation. PredictIt is a notable example, starting as a research project at Victoria University of Wellington, New Zealand in 2014 and receiving a CFTC no-action letter, but operating under strict limits of $850 per contract and 5,000 traders per contract. After the CFTC withdrew the no-action letter in August 2022 and ordered closure, PredictIt received a favorable ruling in July 2025 after lengthy litigation. They subsequently received DCM license approval in September 2025, securing formal status as a derivatives exchange.

Crypto.com introduced sports prediction markets in 16 states through collaboration with Underdog after obtaining margin derivatives licenses in September 2025, but faces state-level challenges including partial defeats in Nevada courts. Railbird, a new prediction market platform, received a no-action letter in August 2025 allowing operation in a narrow scope focused on business-to-business risk hedging.

2.3.4 U.S. Regulatory Relaxation Atmosphere for Prediction Markets

As evident from these cases, while the U.S. government has managed prediction market platforms under very strict standards, the regulatory environment for prediction markets is fundamentally changing with the Trump administration. President Trump showed personal interest by posting Polymarket odds on Truth Social, and Donald Trump Jr. serves as a paid advisor to Kalshi and board member/investor of Polymarket. His company 1789 Capital invested tens of millions of dollars in Polymarket. On September 29, 2025, SEC Chairman Paul Atkins and Acting CFTC Chairman Caroline Pham announced comprehensive harmonization efforts, stating they would review opportunities for event contracts regardless of jurisdictional boundaries and prevent regulatory gaps.

3. Prediction Markets’ Challenge: Fragmentation of the Global Regulatory Environment

While prediction markets are gradually being legalized in the United States, other regions are moving in the opposite direction. This regulatory fragmentation poses serious challenges for global platforms, with conservative approaches in Asian markets particularly constraining global expansion of prediction markets.

3.1 Asian Countries’ Approach to Prediction Markets

Korean regulators show a very conservative attitude toward prediction market platforms. All betting markets are regulated under the National Sports Promotion Act, and all betting sites except “Sports Toto” operated by the Korea Sports Promotion Foundation are considered illegal, with both users and operators subject to punishment. The only permitted Sports Toto provides betting only on very limited sports under government supervision, with maximum bets of only 100,000 KRW (~70 USD) per ticket.

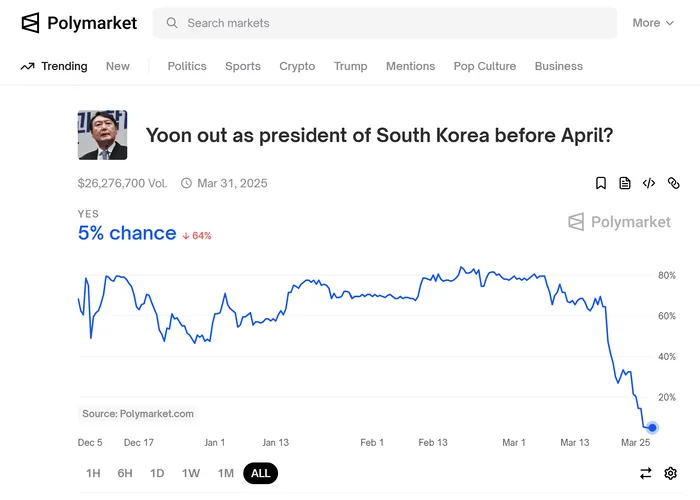

Source: Maeil Business Newspaper, one of the top general economic media in Korea.

Particularly during the impeachment crisis of former President Yoon Suk-yeol in early 2025, numerous contracts based on Korean political issues appeared on Polymarket, drawing significant public and media attention to prediction markets. Korean media unanimously defined Polymarket as “illegal private toto,” emphasizing that under current Korean law, Koreans participating in prediction market betting could be punished for gambling under the principle of personality.

Singapore also considers prediction markets as gambling. The Singapore government took strong action fully blocking Polymarket in January 2025, classifying Polymarket as an unlicensed online gambling operator under the Gambling Control Act. Under this act, users of unlicensed gambling platforms face maximum fines of 10,000 Singapore dollars and up to 6 months imprisonment.

Thailand announced preparations to block Polymarket at a Technology Crime Suppression press conference in January 2025, citing gambling law violations due to cryptocurrency use on gambling platforms.

Thus, Asian countries still take extremely conservative approaches to prediction markets, and considering Asia’s share in the cryptocurrency market, this will be a critical factor for future expansion of prediction market platforms.

3.2 Western Regulatory Cases

France blocked Polymarket in November 2024. The National Gaming Authority (ANJ) determined that Polymarket provided online gaming and betting activities without a French license, specifying that betting activities are not legal in France even when using cryptocurrency.

Canada prohibits prediction market use based on its 2017 ban on binary options under 30 days maturity for retail investors. In April 2025, the Ontario Securities Commission reached a CAD 200,000 settlement with Polymarket-related companies, with Polymarket admitting regulatory violations in Canada.

In contrast, the UK takes a more permissive approach. The Financial Conduct Authority (FCA) is discussing introducing prediction markets to the UK with Robinhood, which stated that the UK and Europe show the strongest demand for prediction market products.

4. Conclusion: The Future of Prediction Markets and Overcoming Regulation Through Decentralization

As examined, the global regulatory environment for prediction markets shows considerable complexity due to different regional approaches and legal interpretations. This fragmentation acts as a significant obstacle for prediction market platforms to expand their global user base and operate stably. Even though decentralized prediction market protocols aim for borderless transactions using blockchain technology, regulatory authorities in various countries—particularly Asian countries highly sensitive to gambling products—still prioritize their domestic laws and are likely to restrict platform operations and user access through domain blocking and direct sanctions against operators. While current platforms like Polymarket and Kalshi have successfully pioneered the U.S. market, the potential of global markets including Asia is difficult to ignore. Without participation from Asian markets, which account for a significant portion of cryptocurrency trading volume, true globalization of prediction markets will remain distant.

For prediction markets to expand globally, efforts are needed to address at least the causes of strict regulation, potentially leading to trial introductions even in regulatory sandboxes.

The main reasons prediction markets currently face strict regulation are:

- Possibility of Market Manipulation: A problem many current prediction markets have—real-time disclosure of voting status can create herd mentality, allowing individuals with large capital to lead initial trends. Additionally, manipulation cannot be ruled out when outcome determination is conducted by a few or lacks transparency.

- Public Opinion Bias from Prediction Markets: If probability manipulation through large capital injection is possible, prediction markets could conversely bias public opinion, indirectly affecting actual event outcomes. This is particularly sensitive in political and social events.

Ambiguous Boundary with Gambling: Since prediction markets operate as betting on probabilistic event outcomes, many regulatory agencies classify them as gambling.

Notably, except for the ambiguous boundary with gambling, the other two problems can be partially addressed through decentralization. For example, decentralized oracle systems using intersubjective decision protocols like EigenLayer can greatly improve outcome determination transparency and manipulation resistance. Structures that incentivize multiple validators to report honest outcomes based on economic incentives while punishing malicious actors through slashing mechanisms can significantly lower market manipulation risks. While challenges to the fairness of existing governance-based decision mechanisms like the UMA protocol continue, EigenLayer provides better fairness through measures for suspected arbitrary manipulation (challenge and slashing, forkable token systems).

The boundary issue with gambling requires a longer-term, strategic approach. Technical solutions alone are insufficient; empirical cases demonstrating prediction markets’ social value must accumulate. Academic prediction markets like the Iowa Electronic Markets (IEM) and Good Judgment Project have already shown higher accuracy than traditional polling in political and economic predictions. Based on these success stories, we must continuously communicate that prediction markets are not mere gambling but information aggregation mechanisms utilizing collective intelligence.

Since grain futures originated in Chicago in 1848, derivatives markets have steadily expanded from agricultural products to financial assets. In our social media age, classifying individual opinions and predictions as a new asset class and offering event contracts based on them may be a natural evolution. As Kalshi co-founder Mansour described prediction markets as “democratization of hedging,” prediction markets are among the most accessible and cost-effective tools for individual investors or SMEs to hedge various risks.

The future of prediction markets depends on constructive dialogue and cooperation between regulators, platform operators, and technology developers. Rather than unconditional prohibition, we need a balanced regulatory framework that embraces innovation while protecting consumers. In the long term, countries that completely ban prediction markets versus those that nurture them under appropriate regulation will show significant competitive differences in information efficiency and financial innovation. We look forward to prediction markets establishing themselves not as mere speculative tools but as key infrastructure in the modern economy for managing uncertainty and utilizing collective intelligence.

Disclaimer:

- This article is reprinted from [FourPillarsFP]. All copyrights belong to the original author [@ SiwonHuh]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?