ROOT vs SOL: The Battle for Blockchain Supremacy in Cross-Chain Interoperability

Introduction: ROOT vs SOL Investment Comparison

In the cryptocurrency market, The Root Network vs Solana comparison has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different crypto asset positions.

The Root Network (ROOT): Launched in 2023, it has gained market recognition for its focus on the open metaverse and enhanced asset interoperability.

Solana (SOL): Since its inception in 2017, it has been hailed as a high-performance blockchain protocol, becoming one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will provide a comprehensive analysis of the investment value comparison between ROOT and SOL, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

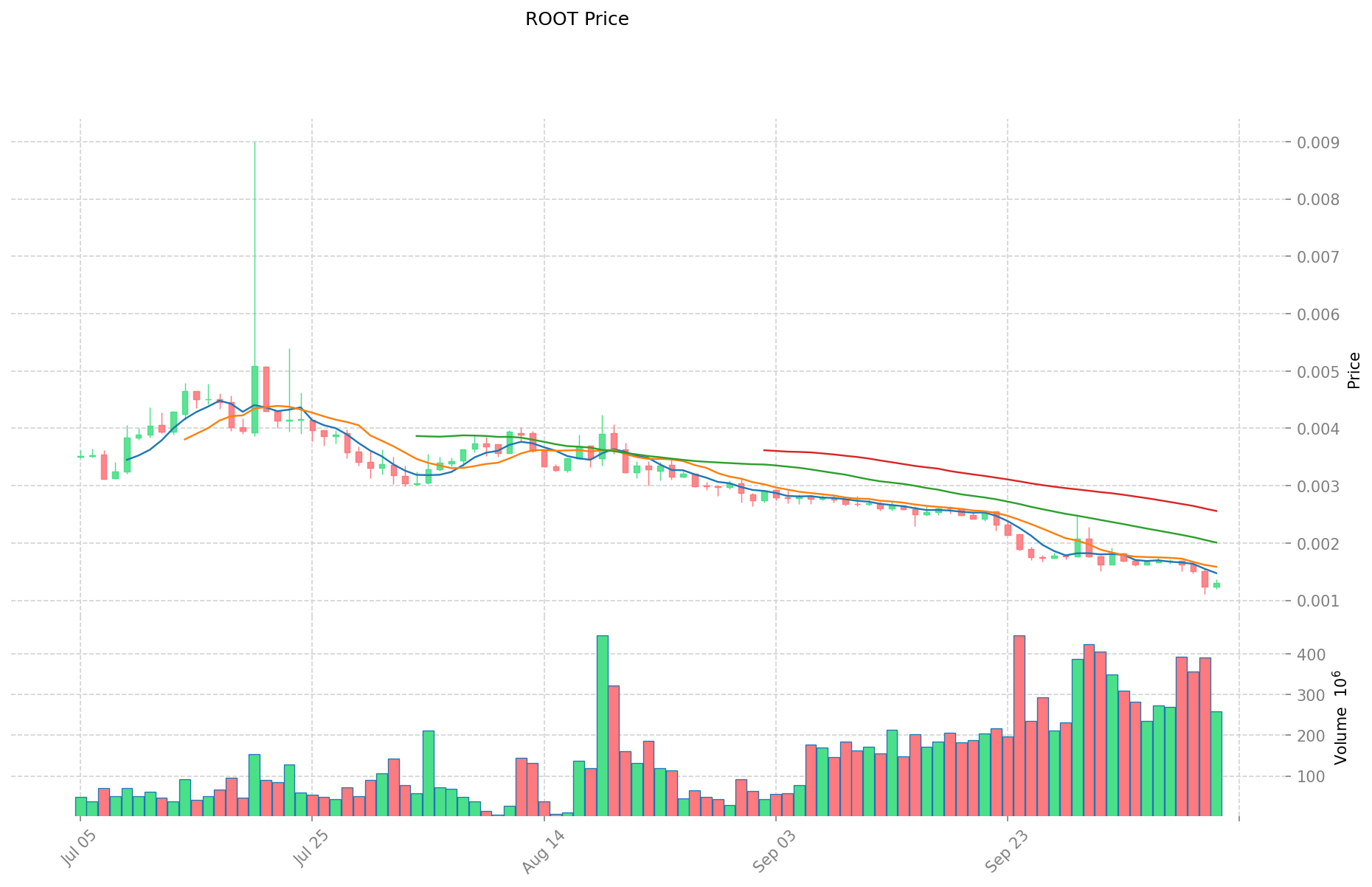

I. Price History Comparison and Current Market Status

The Root Network (ROOT) and Solana (SOL) Historical Price Trends

- 2025: SOL reached its all-time high of $293.31 on January 19, 2025, driven by increased adoption and ecosystem growth.

- 2020: SOL experienced significant price growth, rising from under $1 to over $16 by the end of the year due to increased interest in its high-performance blockchain.

Current Market Situation (October 12, 2025)

- ROOT current price: $0.001324

- SOL current price: $176.35

- 24-hour trading volume: ROOT $335,663.59 vs SOL $345,193,685.57

- Market Sentiment Index (Fear & Greed Index): 24 (Extreme Fear)

Click to view real-time prices:

- View ROOT current price Market Price

- View SOL current price Market Price

Key Factors Influencing ROOT vs SOL Investment Value

Supply Mechanism Comparison (Tokenomics)

- SOL: Hardware expansion-focused strategy with periodic network overload issues

- ROOT: Limited information available in the provided materials

- 📌 Historical Pattern: Price dynamics appear linked to network performance and market adoption.

Institutional Adoption and Market Applications

- Institutional Holdings: Based on available data, some wallets with larger SOL balances suggest potential institutional interest

- Enterprise Adoption: Solana shows growing transaction fee revenue, with some sources suggesting it's beginning to compete with Ethereum in blockchain space market

- Regulatory Attitudes: Limited information in the provided materials

Technical Development and Ecosystem Building

- SOL Technical Development: Hardware-focused scaling strategy that carries higher risk according to sources

- ROOT Technical Development: Limited information in the provided materials

- Ecosystem Comparison: Solana demonstrates liquidity pools functionality with automatic ratio adjustments based on price changes

Macroeconomic and Market Cycles

- Inflation Performance: TornBank emphasizes savings and compound interest as investment fundamentals, suggesting stability as a foundation

- Monetary Policy Effects: Limited information in the provided materials

- Geopolitical Factors: Limited information in the provided materials

III. 2025-2030 Price Prediction: ROOT vs SOL

Short-term Prediction (2025)

- ROOT: Conservative $0.0009233 - $0.001319 | Optimistic $0.001319 - $0.00146409

- SOL: Conservative $142.074 - $175.4 | Optimistic $175.4 - $259.592

Mid-term Prediction (2027)

- ROOT may enter a growth phase, with expected price range of $0.00080744398625 - $0.00209935436425

- SOL may enter a bull market, with expected price range of $191.722724 - $287.584086

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- ROOT: Base scenario $0.001514456144284 - $0.002194863977223 | Optimistic scenario $0.002194863977223 - $0.002875271810162

- SOL: Base scenario $301.479969003206 - $350.5581034921 | Optimistic scenario $350.5581034921 - $501.298087993703

Disclaimer

ROOT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00146409 | 0.001319 | 0.0009233 | 0 |

| 2026 | 0.00154461495 | 0.001391545 | 0.0012245596 | 5 |

| 2027 | 0.00209935436425 | 0.001468079975 | 0.00080744398625 | 11 |

| 2028 | 0.002318832320512 | 0.001783717169625 | 0.001373462220611 | 34 |

| 2029 | 0.002338453209378 | 0.002051274745068 | 0.001189739352139 | 55 |

| 2030 | 0.002875271810162 | 0.002194863977223 | 0.001514456144284 | 66 |

SOL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 259.592 | 175.4 | 142.074 | 0 |

| 2026 | 250.1204 | 217.496 | 165.29696 | 23 |

| 2027 | 287.584086 | 233.8082 | 191.722724 | 32 |

| 2028 | 359.76067734 | 260.696143 | 239.84045156 | 47 |

| 2029 | 390.8877968142 | 310.22841017 | 195.4438984071 | 75 |

| 2030 | 501.298087993703 | 350.5581034921 | 301.479969003206 | 98 |

IV. Investment Strategy Comparison: ROOT vs SOL

Long-term vs Short-term Investment Strategy

- ROOT: Suitable for investors focused on open metaverse and asset interoperability potential

- SOL: Suitable for investors seeking high-performance blockchain exposure and ecosystem growth

Risk Management and Asset Allocation

- Conservative investors: ROOT: 10% vs SOL: 90%

- Aggressive investors: ROOT: 30% vs SOL: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- ROOT: Limited market history and lower liquidity

- SOL: Higher volatility and susceptibility to market sentiment shifts

Technical Risk

- ROOT: Scalability, network stability (limited information available)

- SOL: Hardware-focused scaling strategy, periodic network overload issues

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ROOT advantages: Focus on open metaverse and enhanced asset interoperability

- SOL advantages: Established high-performance blockchain, significant ecosystem growth, higher market capitalization

✅ Investment Advice:

- New investors: Consider a small allocation to SOL as part of a diversified crypto portfolio

- Experienced investors: Explore both ROOT and SOL, with a higher allocation to SOL based on its established track record

- Institutional investors: Focus primarily on SOL due to its larger market cap and liquidity, while monitoring ROOT's development

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between ROOT and SOL? A: ROOT focuses on the open metaverse and asset interoperability, launched in 2023. SOL is a high-performance blockchain protocol launched in 2017, with a larger market cap and higher trading volume.

Q2: Which cryptocurrency has shown better price performance historically? A: Based on the available data, SOL has shown stronger historical price performance, reaching an all-time high of $293.31 in January 2025, while ROOT's price history is more limited.

Q3: How do the current market situations of ROOT and SOL compare? A: As of October 12, 2025, ROOT's price is $0.001324 with a 24-hour trading volume of $335,663.59, while SOL's price is $176.35 with a 24-hour trading volume of $345,193,685.57.

Q4: What are the key factors influencing the investment value of ROOT and SOL? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, and macroeconomic conditions. SOL has more established data in these areas, while information on ROOT is more limited.

Q5: How do the long-term price predictions for ROOT and SOL compare? A: By 2030, ROOT's base scenario price range is predicted to be $0.001514456144284 - $0.002194863977223, while SOL's base scenario range is $301.479969003206 - $350.5581034921.

Q6: What are the main risks associated with investing in ROOT and SOL? A: Both face market risks, technical risks, and regulatory risks. ROOT has limited market history and lower liquidity, while SOL faces higher volatility and potential network overload issues.

Q7: Which cryptocurrency might be more suitable for different types of investors? A: New investors might consider a small allocation to SOL as part of a diversified portfolio. Experienced investors could explore both, with a higher allocation to SOL. Institutional investors may focus primarily on SOL due to its larger market cap and liquidity.

NEON vs THETA: A Comparative Analysis of Next-Generation Neural Network Architectures for AI Applications

2025 JPrice Prediction: Analyzing Market Trends and Future Valuation of J-Assets in the Post-Pandemic Economy

WEN vs XLM: Comparing Performance and Tokenization Efficiency in Large Language Models

PUSH vs SOL: The Battle of Blockchain Scalability Solutions

How Will Solana (SOL) Price Volatility Evolve in 2025?

XYRO vs SOL: Comparing the Future of Decentralized Finance Platforms

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention