2025 NBOT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: NBOT's Market Position and Investment Value

NBOT (NBOT), as a token on the Naka blockchain platform, has made significant progress since its inception in 2019. As of 2025, NBOT's market capitalization has reached $143,951, with a circulating supply of approximately 21,332,428 tokens, and a price hovering around $0.006748. This asset, known for its role in DeFi prediction markets, is playing an increasingly crucial role in synthetic asset trading and liquidity provision.

This article will comprehensively analyze NBOT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. NBOT Price History Review and Current Market Status

NBOT Historical Price Evolution

- 2019: NBOT launched, reaching an all-time high of $0.076389 on June 24

- 2020: Market downturn, price dropped to an all-time low of $0.00190929 on March 13

- 2025: Significant price recovery, with a 60.36% increase over the past year

NBOT Current Market Situation

NBOT is currently trading at $0.006748, with a 24-hour trading volume of $11,610.87. The token has experienced a slight decrease of 0.36% in the last 24 hours. Over the past week, NBOT has seen a more substantial decline of 9.22%, while the 30-day performance shows a significant drop of 24.26%. Despite these short-term downtrends, NBOT has demonstrated strong performance over the past year, with a 60.36% price increase.

The current market capitalization of NBOT stands at $143,951.22, ranking it at 4,527th position in the cryptocurrency market. With a circulating supply of 21,332,428 NBOT tokens out of a total supply of 100,000,000, the token has a circulating ratio of 21.33%. The fully diluted valuation of NBOT is $674,800.00.

Click to view the current NBOT market price

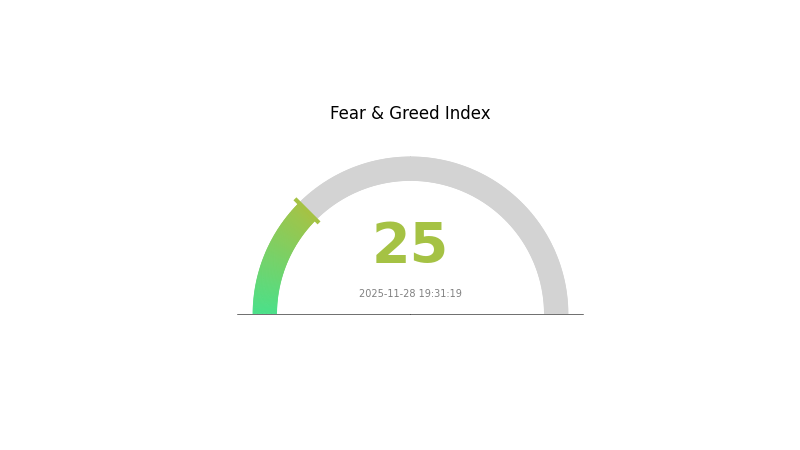

NBOT Market Sentiment Indicator

2025-11-28 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index registering a low 25. This indicates a potentially oversold market, where panic selling may have created buying opportunities. Historically, such extreme fear levels have often preceded market rebounds. However, investors should remain cautious and conduct thorough research before making any decisions. Gate.com offers various tools and resources to help traders navigate these volatile market conditions.

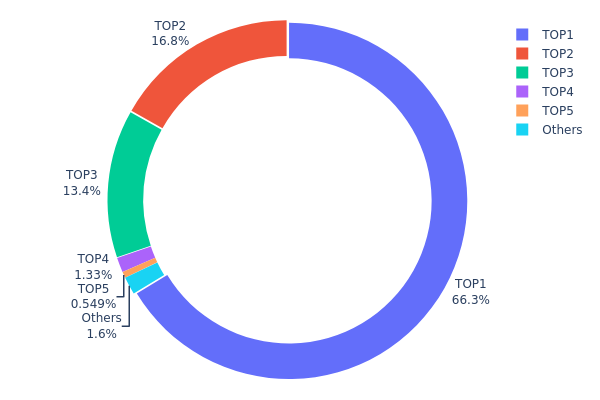

NBOT Holdings Distribution

The address holdings distribution for NBOT reveals a highly concentrated ownership structure. The top address holds a staggering 66.29% of the total supply, followed by two addresses holding 16.81% and 13.40% respectively. This means that just three addresses control over 96% of all NBOT tokens.

Such extreme concentration raises concerns about market manipulation and price volatility. With so much control in so few hands, there's a significant risk of large-scale dumping or artificial price inflation. This centralized distribution also contradicts the principles of decentralization often associated with cryptocurrency projects.

From a market structure perspective, this concentration suggests a lack of widespread adoption and limited liquidity. It may deter potential investors due to fears of market instability and could hinder the token's long-term growth prospects. The current distribution indicates a need for broader token dispersion to achieve a more balanced and resilient ecosystem.

Click to view the current NBOT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd6a8...e8c960 | 66294.10K | 66.29% |

| 2 | 0x0d07...b492fe | 16815.05K | 16.81% |

| 3 | 0x2b72...cb33cb | 13407.32K | 13.40% |

| 4 | 0xfd4d...2cebc4 | 1333.16K | 1.33% |

| 5 | 0xbc4b...205b9d | 549.35K | 0.54% |

| - | Others | 1601.02K | 1.63% |

II. Key Factors Affecting NBOT's Future Price

Supply Mechanism

- Fixed Supply: NBOT has a fixed total supply, which can potentially create scarcity as demand increases.

- Historical Pattern: Limited supply has historically led to price increases in cryptocurrencies with growing adoption.

- Current Impact: The fixed supply may contribute to price appreciation if demand for NBOT continues to grow.

Technical Development and Ecosystem Building

- Ecosystem Applications: NBOT is likely developing decentralized applications (DApps) and ecosystem projects to increase utility and adoption.

III. NBOT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00357 - $0.00673

- Neutral forecast: $0.00673 - $0.00831

- Optimistic forecast: $0.00831 - $0.00989 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00698 - $0.0113

- 2027: $0.00578 - $0.01078

- Key catalysts: Increased adoption and technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.00915 - $0.01102 (assuming steady market growth)

- Optimistic scenario: $0.01102 - $0.01642 (assuming strong bullish trends)

- Transformative scenario: $0.01642+ (under extremely favorable market conditions)

- 2030-12-31: NBOT $0.01642 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00989 | 0.00673 | 0.00357 | 0 |

| 2026 | 0.0113 | 0.00831 | 0.00698 | 23 |

| 2027 | 0.01078 | 0.0098 | 0.00578 | 45 |

| 2028 | 0.0106 | 0.01029 | 0.0071 | 52 |

| 2029 | 0.0116 | 0.01045 | 0.00867 | 54 |

| 2030 | 0.01642 | 0.01102 | 0.00915 | 63 |

IV. NBOT Professional Investment Strategies and Risk Management

NBOT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate NBOT during market dips

- Set price targets and regularly review portfolio

- Store NBOT in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined levels

NBOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use offline storage for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for NBOT

NBOT Market Risks

- High volatility: Significant price fluctuations common in the crypto market

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

NBOT Regulatory Risks

- Regulatory uncertainty: Potential for changing regulations affecting NBOT

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Varying legal status in different jurisdictions

NBOT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible transaction delays during high network activity

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

NBOT Investment Value Assessment

NBOT presents a high-risk, high-potential investment opportunity within the DeFi ecosystem. While it offers innovative features in prediction markets and synthetic asset trading, investors should be aware of the significant volatility and regulatory uncertainties in the cryptocurrency space.

NBOT Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider NBOT as part of a diversified crypto portfolio

NBOT Trading Participation Methods

- Spot trading: Buy and sell NBOT on Gate.com

- DeFi participation: Engage with NBOT-based DeFi products on deerfi.com

- Liquidity provision: Contribute to liquidity pools for potential yield generation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is not coin worth in 2030?

Based on current trends and market projections, NBOT could potentially reach $5 to $10 per coin by 2030, depending on its adoption and technological advancements in the Web3 space.

Does the basic attention token have a future?

Yes, BAT has a promising future. It's integral to the Brave browser ecosystem, rewarding users for viewing ads. With growing privacy concerns, BAT's user-centric model is likely to gain more traction in digital advertising.

Is there a future for near protocol?

Yes, Near Protocol has a promising future. Its scalable and user-friendly blockchain platform continues to attract developers and users, driving innovation in Web3 and DeFi sectors.

What is the price prediction for BOT crypto in 2030?

Based on current trends and market analysis, BOT crypto is predicted to reach $50-$60 by 2030, potentially seeing a 10x growth from its 2025 value.

2025 COTI Price Prediction: Analyzing Market Trends and Future Potential in the Evolving Cryptocurrency Landscape

2025 ROSE Price Prediction: Analyzing Market Trends and Potential Growth for Oasis Network's Native Token

2025 CELO Price Prediction: Bull Run or Bear Market? Analyzing Key Factors for CELO's Future Value

2025 NEWT Price Prediction: Analyzing Market Trends and Growth Potential for Newt Finance in the Evolving DeFi Landscape

2025 CERE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 RADAR Price Prediction: Analyzing Market Trends and Potential Growth Factors

Dropee Daily Combo December 12, 2025

Tomarket Daily Combo December 12, 2025

Guide to Participating and Claiming SEI Airdrop Rewards

Effective Strategies for Algorithmic Trading in Cryptocurrency

Understanding Bitcoin Valuation with the Stock-to-Flow Model