2025 年 CELO 價格展望:牛市或熊市?深入剖析影響 CELO 未來價值的關鍵因素

引言:CELO 的市場定位與投資價值

CELO(CELO)自 2020 年起,專注於行動端金融服務,展現顯著進展。截至 2025 年,市值為 148,595,200 美元,流通供應量約 584,100,629 枚,現價約 0.2544 美元。身為「行動優先的金融普惠區塊鏈」,CELO 積極拓展無銀行帳戶族群的金融服務,市場影響力持續增強。

本文將系統分析 2025-2030 年間 CELO 價格走勢,結合歷史趨勢、供需結構、生態發展及宏觀經濟等多重因素,為投資人提供專業的價格預測與實用策略。

一、CELO 價格歷史回顧與現況

CELO 歷史價格演變

- 2020 年:以 1 美元發行,正式進入加密市場

- 2021 年:8 月 30 日創下歷史高點 9.82 美元,迎來強勁牛市

- 2025 年:歷經長期熊市,10 月 11 日跌至歷史低點 0.199457 美元

CELO 目前市場概況

截至 2025 年 10 月 19 日,CELO 價格為 0.2544 美元,市值 148,595,200 美元。近 1 小時上漲 2.29%,過去 24 小時則下跌 2.26%。近 7 日及 30 日分別下跌 7.59% 和 20.89%,短期呈現下跌趨勢。年初至今累計下跌 70.23%,價格遠低於歷史高點,顯示明顯市場壓力。

點擊查看最新 CELO 市場價格

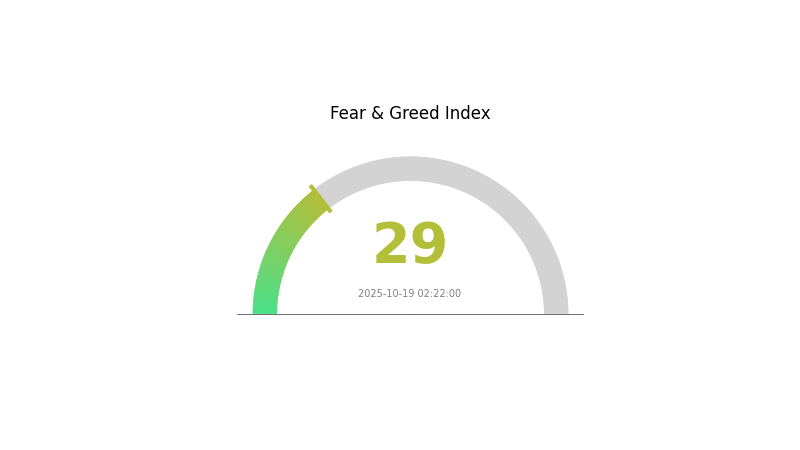

CELO 市場情緒指標

2025-10-19 恐懼與貪婪指數:29(恐懼)

點擊查看即時 恐懼與貪婪指數

目前 CELO 加密市場情緒處於「恐懼」區,恐懼與貪婪指數為 29,反映投資人普遍謹慎。逆勢操作者或有潛在買進契機,但投資前仍應深入調查並綜合評估多項指標。Gate.com 提供完整市場數據,協助投資人因應不確定行情,理性掌握 CELO 市場機會。

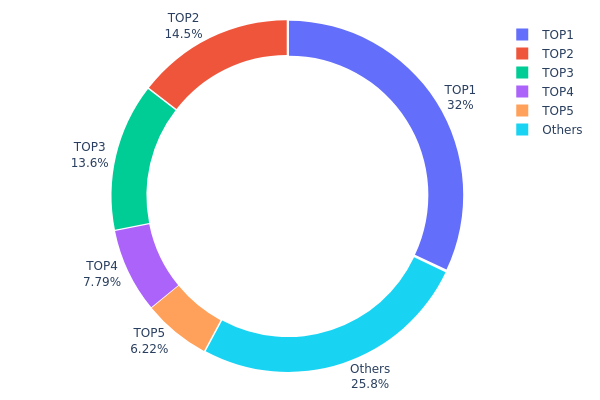

CELO 持幣分布

CELO 持幣高度集中,最大地址持有總供應量 32.03%,前五大地址合計持有 74.18%,去中心化程度及市場操控風險備受關注。

如此結構將加劇價格波動與市場不穩定。大型持有者(「巨鯨」)的交易對價格影響巨大,治理權也高度集中於少數主體,可能影響網絡治理公平性與去中心化原則。

然而,仍有 25.82% CELO 由前五大地址以外錢包持有,顯示一定分散,有助增強網絡韌性並推動去中心化。整體來看,目前鏈上結構和市場行為仍以大戶主導。

點擊查看即時 CELO 持幣分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7A8c...8A434f | 291905.70K | 32.03% |

| 2 | 0x6cC0...03349E | 132285.83K | 14.51% |

| 3 | 0xA5c4...0a87fe | 124208.56K | 13.63% |

| 4 | 0xef26...036Ef1 | 71032.65K | 7.79% |

| 5 | 0x9d65...50a400 | 56687.16K | 6.22% |

| - | Others | 235150.72K | 25.82% |

二、影響 CELO 未來價格的關鍵因素

技術創新與生態建設

- 生態應用:Celo 生態包含多元 DApp,以及金融普惠、行動優先專案,實際應用日益豐富,長期有望推升 CELO 價格。

三、2025-2030 年 CELO 價格展望

2025 年展望

- 保守預估:0.24453-0.2574 美元

- 中性預估:0.2574-0.30 美元

- 樂觀預估:0.30-0.32432 美元(需市場情緒轉正及用戶數成長)

2027-2028 年展望

- 市場週期預估:有望進入新一輪採納成長期

- 價格區間預測:

- 2027 年:0.21477-0.32065 美元

- 2028 年:0.21498-0.3365 美元

- 主要驅動:應用場景擴展、技術升級、整體市場回溫

2030 年長期預期

- 基準情境:0.32403-0.35158 美元(持續穩健成長)

- 樂觀情境:0.35158-0.4676 美元(生態爆發與市場利多)

- 突破情境:超過 0.4676 美元(需重大技術突破或頂級合作)

- 2030-12-31:CELO 0.35158 美元(較 2025 年具顯著成長空間)

| 年份 | 預測最高價 | 預測平均價 | 預測最低價 | 漲跌幅 |

|---|---|---|---|---|

| 2025 | 0.32432 | 0.2574 | 0.24453 | 1 |

| 2026 | 0.31413 | 0.29086 | 0.26759 | 14 |

| 2027 | 0.32065 | 0.3025 | 0.21477 | 18 |

| 2028 | 0.3365 | 0.31157 | 0.21498 | 22 |

| 2029 | 0.37912 | 0.32403 | 0.23979 | 27 |

| 2030 | 0.4676 | 0.35158 | 0.18634 | 38 |

四、CELO 專業投資策略與風險管理

CELO 投資策略

(1)長期持有策略

- 適合族群:長期投資者及金融普惠理念支持者

- 操作建議:

- 行情回檔時分批買進 CELO

- 參與質押獲取獎勵

- 代幣安全存放於 Gate Web3 錢包

(2)主動交易策略

- 技術分析工具:

- 均線:辨識趨勢與反轉訊號

- 相對強弱指數(RSI):判斷超買超賣區間

- 波段操作重點:

- 關注 CELO 與主流幣種聯動

- 密切關注專案進度及合作動態

CELO 風險管控架構

(1)資產配置建議

- 保守型:1-3%

- 激進型:5-10%

- 專業型:10-15%

(2)風險對沖策略

- 多元配置:涵蓋多種加密資產及傳統市場

- 停損機制:設定限損點,避免重大損失

(3)安全存儲方案

- 熱錢包推薦:Gate Web3 錢包

- 冷存儲推薦:硬體錢包適合長期持有

- 安全措施:啟用雙重驗證,定期安全檢查

五、CELO 可能面臨的風險與挑戰

CELO 市場風險

- 高波動性:加密資產價格劇烈變動

- 流動性風險:大額交易易引發流動性問題

- 競爭壓力:金融普惠區塊鏈平台競品增加

CELO 合規風險

- 全球監管不明朗:各地監管標準差異大

- 合規挑戰:監管環境不斷變化,適應難度高

- 法律歸屬不明:各國對 CELO 定性不一

CELO 技術風險

- 智能合約漏洞:協議有遭攻擊風險

- 網絡壅塞:高峰期擴展性壓力大

- 技術迭代風險:新技術替代威脅

六、結論與行動建議

CELO 投資價值分析

CELO 在金融普惠領域展現獨特競爭力,但須面對短期市場波動與監管不確定性。未來成長仰賴生態採納與技術持續升級。

CELO 投資建議

✅ 新手投資人:建議以小額、分批方式進場,先熟悉市場 ✅ 有經驗投資人:可結合持有與交易,彈性調整部位 ✅ 機構投資人:可考慮深度參與生態與策略合作

CELO 參與方式

- 現貨交易:Gate.com 直接買賣 CELO

- 質押:參與網絡驗證,獲取收益

- DeFi 生態:探索基於 CELO 的去中心化金融應用

加密貨幣投資風險極高,本文不構成任何投資建議。投資人應依自身風險承受能力審慎決策,並建議諮詢專業財經顧問。請勿投入超過自身承受範圍的資金。

常見問題解答

Celo 適合長期投資嗎?

是的,Celo 具有良好長期成長前景。專注行動優先金融方案及永續發展,有望持續擴展加密產業版圖。

Celo 未來漲幅潛力有多大?

若生態及採納度持續提升,2025 年 Celo 價格有望挑戰 10-15 美元區間。

2030 年 CELR 價格預測是多少?

依產業趨勢及成長潛力,2030 年 CELR 價格可望達到 5-7 美元,受惠於生態擴展與區塊鏈創新。

Celo 目前發展狀況如何?

Celo 生態持續壯大,區塊鏈於 DeFi 與行動應用領域落地加深,平台積極拓展合作並持續技術迭代,推升 CELO 代幣熱度。

2025 年 COTI 價格展望:深入分析加密貨幣產業的發展趨勢與未來價值潛力

2025 年 ROSE 價格預測:深入探討 Oasis Network 原生代幣的市場動向與成長潛力

2025 年 NEWT 價格預測:全面剖析 Newt Finance 在不斷發展的 DeFi 領域中的市場動向與成長前景

2025 年 CERE 價格預測:市場趨勢與潛在成長動能解析

2025 年 RADAR 價格預測:市場趨勢分析與潛在成長動能

2025 年 REACT 價格預測:深入剖析去中心化金融生態系統的成長潛力

Dropee每日組合 2025年12月12日

Tomarket Daily Combo 2025年12月12日

SEI 空投獎勵參與與領取指南

加密貨幣領域中,高效的演算法交易策略

以庫存流量模型深入剖析比特幣的估值