2025 HGPT Price Prediction: Navigating the Future of AI Language Models in a Volatile Market

Introduction: HGPT's Market Position and Investment Value

HyperGPT (HGPT), positioned as a marketplace for AI solutions in the Web3 space, has been making waves since its inception. As of 2025, HGPT's market capitalization stands at $4,221,524, with a circulating supply of approximately 830,845,238 tokens, and a price hovering around $0.005081. This asset, often referred to as the "AI-Web3 bridge," is playing an increasingly crucial role in integrating artificial intelligence solutions with blockchain technology.

This article will provide a comprehensive analysis of HGPT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HGPT Price History Review and Current Market Status

HGPT Historical Price Evolution

- 2024: Initial launch, price reached all-time high of $0.10876 on March 29

- 2024: Market correction, price dropped to all-time low of $0.0038 on February 22

- 2025: Ongoing market fluctuations, price currently at $0.005081

HGPT Current Market Situation

HGPT is currently trading at $0.005081, experiencing a 5.32% decrease in the last 24 hours. The token's market capitalization stands at $4,221,524.65, ranking it at 1669 in the cryptocurrency market. HGPT has a circulating supply of 830,845,238.0952 tokens, which represents 83.08% of its total supply. The 24-hour trading volume is $76,701.35, indicating moderate market activity. HGPT's price is down 24.46% in the past week and 26.97% over the last month, suggesting a bearish short-term trend. The token is currently trading at 95.33% below its all-time high, reflecting significant price depreciation since its peak.

Click to view the current HGPT market price

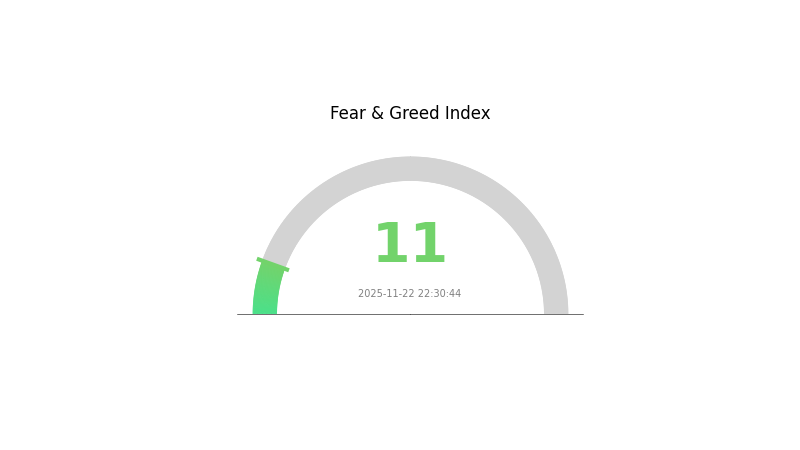

HGPT Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to a mere 11. This suggests widespread panic and pessimism among investors. During such times, it's crucial to remain calm and avoid impulsive decisions. While some may see this as a potential buying opportunity, it's important to conduct thorough research and exercise caution. Remember, market sentiment can shift rapidly, and it's always wise to diversify your portfolio and invest only what you can afford to lose.

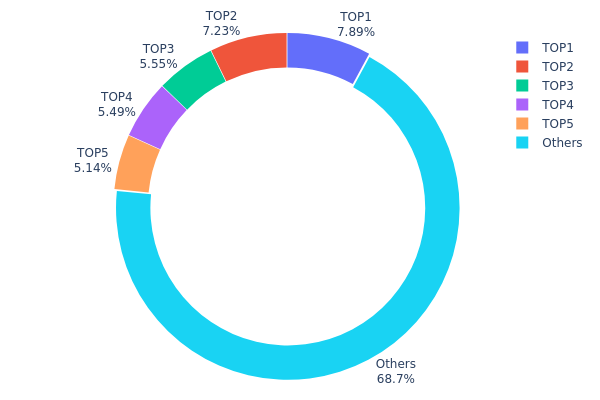

HGPT Holdings Distribution

The address holdings distribution data provides insights into the concentration of HGPT tokens among different wallet addresses. Analysis of this data reveals a moderate level of concentration, with the top 5 addresses holding approximately 31.28% of the total supply. The largest holder possesses 7.88% of HGPT tokens, followed closely by the second-largest at 7.23%.

This distribution pattern suggests a relatively balanced market structure, without extreme centralization. The fact that 68.72% of tokens are held by addresses outside the top 5 indicates a degree of decentralization. However, the presence of several large holders could potentially impact market dynamics, as significant movements from these addresses might influence price volatility.

Overall, the current HGPT holdings distribution reflects a market with a healthy balance between major stakeholders and a broader base of smaller holders. This structure may contribute to market stability while still allowing for organic price discovery and liquidity.

Click to view the current HGPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 78882.83K | 7.88% |

| 2 | 0x2e8f...725e64 | 72303.11K | 7.23% |

| 3 | 0x064e...07635d | 55516.30K | 5.55% |

| 4 | 0x7510...1eef8e | 54875.00K | 5.48% |

| 5 | 0x33af...a4f25f | 51440.00K | 5.14% |

| - | Others | 686982.76K | 68.72% |

II. Core Factors Affecting HGPT's Future Price

Supply Mechanism

- Token Burning: HGPT implements a token burning mechanism to reduce the circulating supply over time.

- Historical Pattern: Previous token burns have typically led to short-term price increases due to reduced supply.

- Current Impact: The ongoing token burning is expected to create deflationary pressure, potentially supporting HGPT's price in the long term.

Institutional and Whale Dynamics

- Institutional Holdings: Several crypto-focused hedge funds have reportedly accumulated significant HGPT positions.

- Corporate Adoption: A number of AI research companies have begun using HGPT tokens to access decentralized AI services.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' decisions on interest rates and quantitative easing may affect HGPT's attractiveness as an investment.

- Inflation Hedging Properties: HGPT has shown some correlation with inflation rates, potentially acting as a partial hedge.

Technological Development and Ecosystem Building

- AI Integration: HGPT is continuously improving its AI algorithms, enhancing the utility of the token in AI-powered applications.

- Ecosystem Applications: Several DApps focusing on decentralized AI services have been built on the HGPT network, expanding its use cases.

III. HGPT Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.00326 - $0.00509

- Neutral estimate: $0.00509 - $0.00618

- Optimistic estimate: $0.00618 - $0.00727 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00569 - $0.00834

- 2028: $0.00409 - $0.00818

- Key catalysts: Technological advancements, increased utility, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00802 - $0.00991 (assuming steady market growth)

- Optimistic scenario: $0.00991 - $0.01179 (assuming strong project performance and market conditions)

- Transformative scenario: $0.01179 - $0.01328 (assuming breakthrough innovations and widespread adoption)

- 2030-11-23: HGPT $0.01328 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00727 | 0.00509 | 0.00326 | 0 |

| 2026 | 0.00859 | 0.00618 | 0.00433 | 21 |

| 2027 | 0.00834 | 0.00738 | 0.00569 | 45 |

| 2028 | 0.00818 | 0.00786 | 0.00409 | 54 |

| 2029 | 0.01179 | 0.00802 | 0.00738 | 57 |

| 2030 | 0.01328 | 0.00991 | 0.00773 | 94 |

IV. HGPT Professional Investment Strategies and Risk Management

HGPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Dollar-cost averaging to mitigate short-term volatility

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

HGPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and Web3 projects

- Option strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for HGPT

HGPT Market Risks

- High volatility: AI token market is subject to rapid price fluctuations

- Competition: Increasing number of AI-focused blockchain projects

- Market sentiment: Susceptible to overall crypto market trends

HGPT Regulatory Risks

- Unclear regulations: AI and crypto regulations are still evolving

- Cross-border compliance: Varying regulatory approaches in different jurisdictions

- Potential restrictions: Future government interventions may impact adoption

HGPT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network load

- Integration issues: Compatibility with existing Web3 infrastructure

VI. Conclusion and Action Recommendations

HGPT Investment Value Assessment

HGPT presents a high-risk, high-reward opportunity in the emerging AI-Web3 sector. Long-term potential exists for significant growth, but short-term volatility and market risks remain high.

HGPT Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding the technology

✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading

✅ Institutional investors: Conduct thorough due diligence and consider HGPT as part of a diversified AI-blockchain portfolio

HGPT Trading Participation Methods

- Spot trading: Buy and hold HGPT tokens on Gate.com

- Staking: Participate in HGPT staking programs if available

- DeFi integration: Explore HGPT-based liquidity pools or yield farming opportunities

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, and Web3 infrastructure have the highest potential for massive growth in the coming years.

Will pi coin reach $100?

It's highly unlikely for Pi coin to reach $100. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.01 to $1.

Which crypto boom in 2025 prediction?

Bitcoin and Ethereum are expected to lead the crypto boom in 2025, with BTC potentially reaching $150,000 and ETH $15,000. Emerging Layer 2 solutions and AI-related tokens may also see significant growth.

Will hamster coin prices increase?

Yes, hamster coin prices are likely to increase in the future due to growing interest in meme coins and potential market trends favoring small-cap cryptocurrencies.

2025 ASM Price Prediction: Future Trajectory Analysis and Key Factors Influencing Market Value

2025 AIL Price Prediction: Navigating the Future of Artificial Intelligence Tokens in a Rapidly Evolving Market

2025 AA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Quantum Financial System: 2025 Launch Date and Market Impact

COAI Crypto: What It Is and How It Works

2025 AICPrice Prediction: Navigating Market Trends and Technological Innovations in the Evolving Digital Asset Landscape

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention