- Trending TopicsView More

1.9K Popularity

36.8K Popularity

26.8K Popularity

5.7K Popularity

201.9K Popularity

- Hot Gate FunView More

- MC:$767.3KHolders:7161

- MC:$714.6KHolders:10602

- MC:$703.9KHolders:131

- MC:$146.7KHolders:3266

- MC:$76.1KHolders:7354

- Pin

- 📣 Creators, Exciting News!

Gate Square Certified Creator Application Is Now Live!

How to apply:

1️⃣ Open App → Tap [Square] at the bottom → Click your avatar in the top right

2️⃣ Tap [Get Certified] under your avatar

3️⃣ Once approved, you’ll get an exclusive verified badge that highlights your credibility and expertise!

Note: You need to update App to version 7.25.0 or above to apply.

The application channel is now open to KOLs, project teams, media, and business partners!

Super low threshold, just 500 followers + active posting to apply!

At Gate Square, everyone can be a community leader! � - 🚀 #GateNewbieVillageEpisode3 ✖️ @CryptoSelf

📈 Share your trading journey | 💡 Discuss market insights | 🤝 Be part of the Gate Family

⏰ Event Date: Oct 17 04:00 – Oct 24 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square + @CryptoSelf

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode3

3️⃣ Share your learning journey, trading insights, or personal growth stories

— The more genuine and inspiring your post, the higher your chance to win!

🎁 Rewards

3 lucky winners → $50 Futures Trial Voucher

✨ Every lesson counts—join us on Gate Square and grow smarter together! - Dear Gate Square users, we’re excited to announce a brand-new upgrade to our user interface! The new version is simpler, smoother, and packed with many thoughtful new features. Update now and explore what's new! What do you think of the new Gate Square experience? Which features do you like most? Have you noticed any surprises or improvements? Share your experience now to split a $100 prize pool!

🎁 We'll select 10 lucky users, each winning $10 Futures Voucher!

How to participate:

1⃣️ Follow Gate_Square;

2⃣️ Create a post with the hashtag #MyGateSquareUpgradeExperience, sharing your feedback a - 💥 Gate Square Event: #PostToWinFLK 💥

Post original content on Gate Square related to FLK, the HODLer Airdrop, or Launchpool, and get a chance to share 200 FLK rewards!

📅 Event Period: Oct 15, 2025, 10:00 – Oct 24, 2025, 16:00 UTC

📌 Related Campaigns:

HODLer Airdrop 👉 https://www.gate.com/announcements/article/47573

Launchpool 👉 https://www.gate.com/announcements/article/47592

FLK Campaign Collection 👉 https://www.gate.com/announcements/article/47586

📌 How to Participate:

1️⃣ Post original content related to FLK or one of the above campaigns (HODLer Airdrop / Launchpool).

2️⃣ Content mu - 🎒 Gate Square “Blue & White Travel Season” Merch Challenge is here!

📸 Theme: #GateAnywhere🌍

Let’s bring Gate’s blue and white to every corner of the world.

— Open the gate, Gate Anywhere

Take your Gate merch on the go — show us where blue and white meet your life!

At the office, on the road, during a trip, or in your daily setup —

wherever you are, let Gate be part of the view 💙

💡 Creative Ideas (Any style, any format!)

Gate merch displays

Blue & white outfits

Creative logo photography

Event or travel moments

The more personal and creative your story, the more it shines ✨

✅ How to Partici

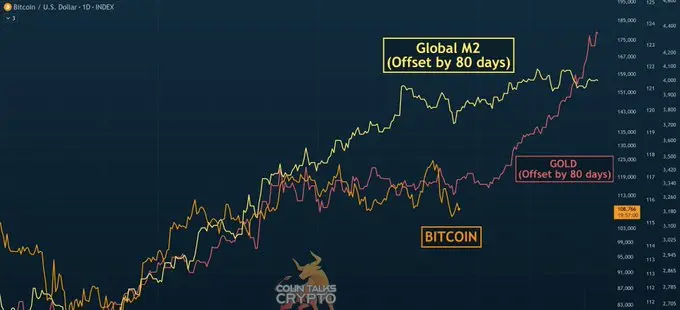

Gold Jumps First, Bitcoin Often Follows Next on the 80-Day Cue – Analyst

Bitcoin’s next leg may take its cue from gold’s run, according to an analyst who tracked the historical pattern where gold leads Bitcoin by about 80 days. His latest overlay compares BTC, gold, and Global M2 and shows gold sprinting while Bitcoin lags.

The read is simple in that if the lead-lag holds, the handoff window for BTC sits in late December to January, but the timing depends on when gold’s momentum cools and how global liquidity signals line up.

Why the gold lead matters now

Gold jumped to fresh records into October and pulled sentiment with it. In the analyst’s cycle work, an advancing gold line often precedes a delayed BTC push, which traders treat as a timing tell rather than a price target.

Bitcoin and Global Liquidity

The comparison chart places Global M2 as a central indicator of liquidity’s role in Bitcoin’s price behavior. Historically, when M2 expands, liquidity flows into risk assets, often lifting Bitcoin’s value.

The analyst observed that M2’s trends tend to lead Bitcoin’s price action by about 80 days, highlighting Bitcoin’s sensitivity to global monetary expansion.

From January 2024, after the launch of Bitcoin Spot ETFs, Bitcoin and M2 moved together, showing a tighter link between institutional liquidity and crypto markets. Yet, over the past three months, that relationship has weakened, becoming the weakest since ETF approval, indicating a possible decoupling phase.

What weakening correlation signals near peaks

Backtests show decoupling near prior cycle peaks. The pattern does not predict exact tops, but it warns that BTC can lag gold and M2 before making a late-cycle push. That is why the next few months matter.

A firm policy-driven liquidity cue could tighten the M2 link again and pull forward the BTC move. If liquidity stays patchy while gold cools, the follow-through slides into early 2026.

What could shift BTC’s path next