Trending Topics

View More19.55K Popularity

43.19K Popularity

12.79K Popularity

9.86K Popularity

38.63K Popularity

Hot Gate Fun

View More- MC:$3.54KHolders:10.00%

- MC:$3.54KHolders:10.00%

- MC:$3.61KHolders:20.00%

- MC:$3.54KHolders:10.00%

- MC:$3.6KHolders:20.09%

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693

[Forex] Bank of Japan aims for a rate hike of up to 1% and yen appreciation | Yoshida Toh's Forex Daily | Moneyクリ Monex Securities' investment information and media useful for money.

Did the Bank of Japan aim to raise the policy interest rate to 1% early on?

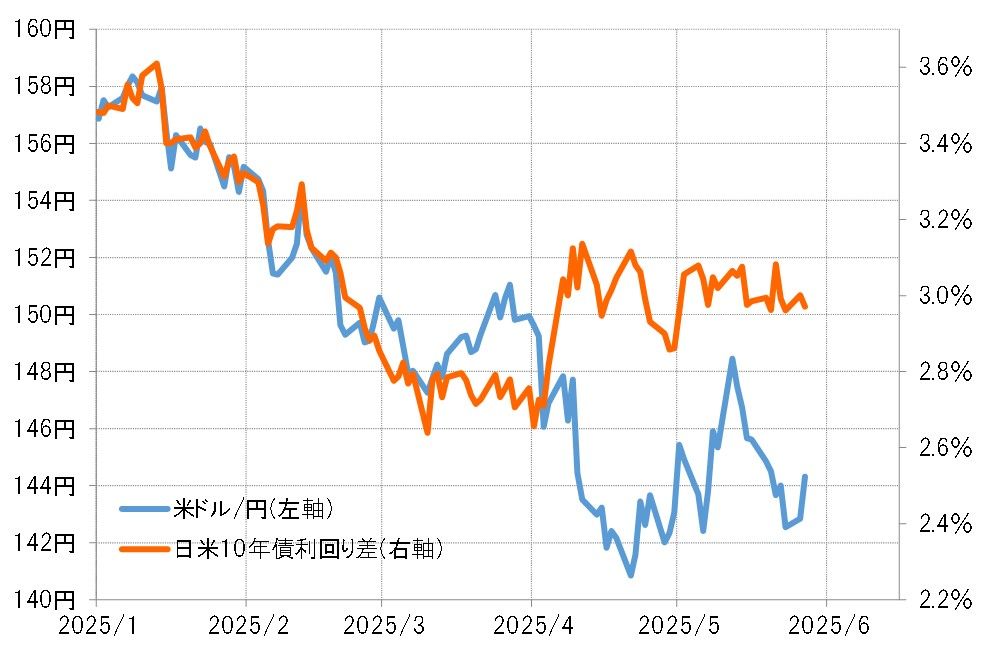

The movement that saw the US dollar weaken and the yen strengthen to 146 yen by March 2025 was in line with the narrowing of the interest rate differential between Japan and the US (refer to Chart 1). However, this narrowing of the interest rate differential was somewhat unusual as it involved a significant rise in Japanese interest rates while US interest rates were declining (refer to Chart 2). For this reason, I have previously considered that this was the result of the Japanese financial authorities moving to guide interest rates higher in response to unofficial yen appreciation requests from the Trump administration.

[Figure 1] USD/JPY and the US-Japan 10-Year Bond Yield Spread (From January 2025) Source: Created by Monex Securities from Refinitiv data

Source: Created by Monex Securities from Refinitiv data

[Figure 2] Trends in 10-Year Bond Yields in Japan and the United States (September 2024 onwards) Source: Created by Monex Securities from data provided by Refinitiv.

However, one insider familiar with the situation explained that it was necessary to raise Japan’s policy interest rate, which is extremely low compared to global policy interest rates, as soon as possible, at least to 1%.

Source: Created by Monex Securities from data provided by Refinitiv.

However, one insider familiar with the situation explained that it was necessary to raise Japan’s policy interest rate, which is extremely low compared to global policy interest rates, as soon as possible, at least to 1%.

What caused the Bank of Japan to suddenly shift to a “hawkish” stance?

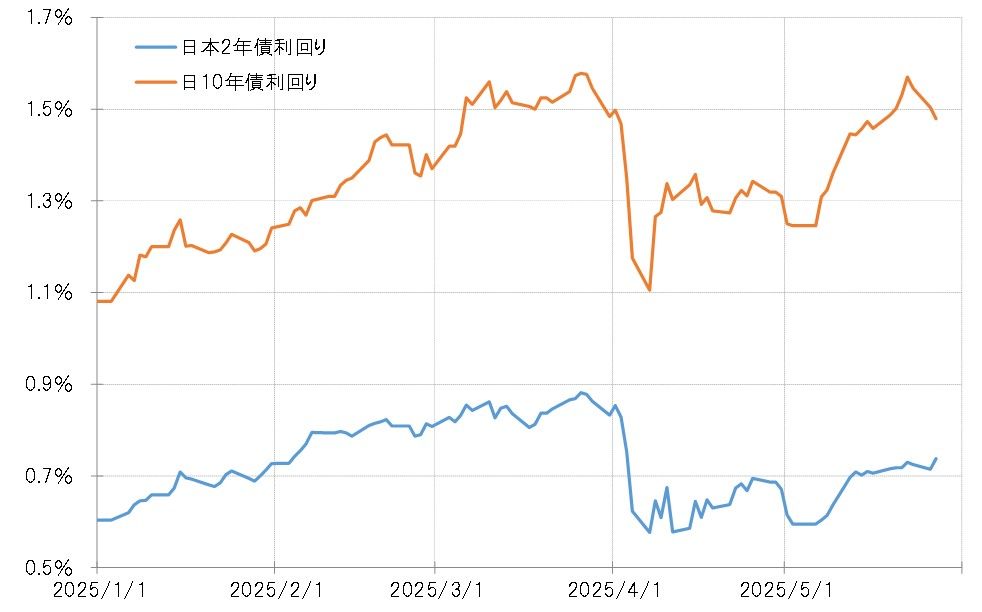

The Bank of Japan moved to raise interest rates in January, increasing the policy interest rate to 0.5%. However, the rise in the 2-year bond yield, which incorporates monetary policy, continued, reaching around 0.9% by March (see Chart 3). This was seen as the interest rate market pricing in two further rate hikes of 0.25% each within the year, moving to raise the policy interest rate to 1%.

[Figure 3] Japan’s 2-year and 10-year bond yields (from January 2025) Source: Created by Monex Securities based on data from Refinitiv.

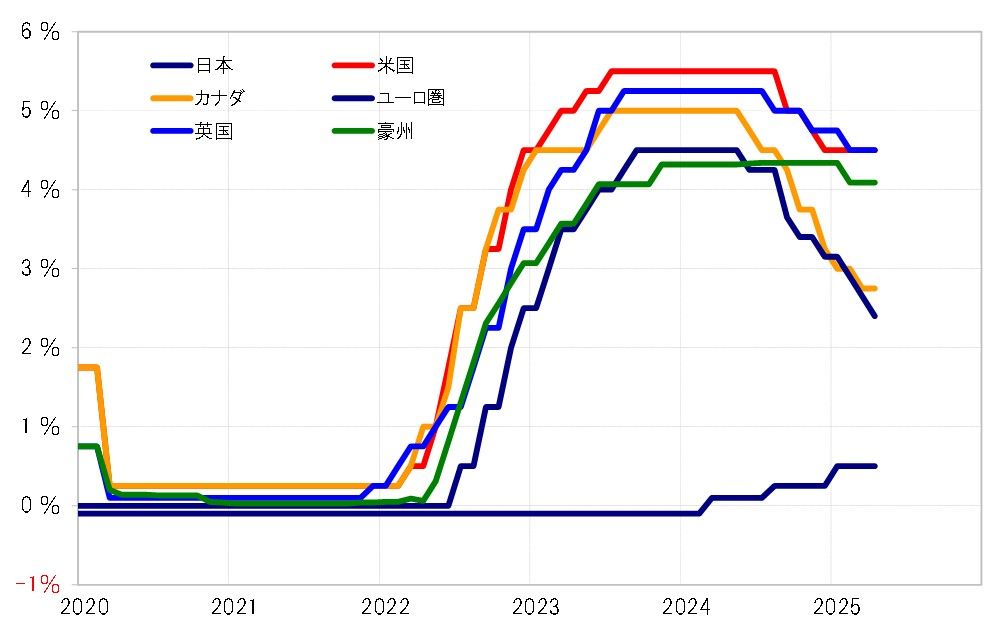

At that time, there were quite a few voices that could not understand why the Bank of Japan suddenly leaned towards a “hawkish” stance. Considering that even the Eurozone, which has relatively low policy interest rates among advanced countries, still has a policy interest rate above 2%, it is undeniable that Japan’s policy interest rate is exceptionally low, but it is difficult to understand why this point suddenly became highlighted (see Figure 4).

Source: Created by Monex Securities based on data from Refinitiv.

At that time, there were quite a few voices that could not understand why the Bank of Japan suddenly leaned towards a “hawkish” stance. Considering that even the Eurozone, which has relatively low policy interest rates among advanced countries, still has a policy interest rate above 2%, it is undeniable that Japan’s policy interest rate is exceptionally low, but it is difficult to understand why this point suddenly became highlighted (see Figure 4).

[Figure 4] Trends in Policy Interest Rates in Advanced Countries (2020 onwards) Source: Created by Monex Securities based on Refinitiv data.

The following remarks by Finance Minister Mimura on February 26 were reported. “[Mimura] acknowledged that the BOJ has sent a message on the outlook for monetary policy in light of the current economy, and he himself believes that there is basically no discrepancy between that message and the market’s perception that seems to be behind it,” he said.

Source: Created by Monex Securities based on Refinitiv data.

The following remarks by Finance Minister Mimura on February 26 were reported. “[Mimura] acknowledged that the BOJ has sent a message on the outlook for monetary policy in light of the current economy, and he himself believes that there is basically no discrepancy between that message and the market’s perception that seems to be behind it,” he said.

Reading this straightforwardly, it would imply that it is endorsing the movements in the interest rate market that incorporate a policy interest rate hike of up to 1%. That said, why has the Bank of Japan suddenly aimed for an early policy interest rate hike of up to 1%?

Was there U.S. pressure behind the Bank of Japan’s “hawkish” stance?

On February 5, the U.S. Treasury Department announced that Treasury Secretary Janet Yellen held a direct phone call with Bank of Japan Governor Kazuo Ueda. Considering that the basic counterparts are the U.S. Treasury Secretary and the Japanese Finance Minister, as well as the Chair of the Federal Reserve and the Bank of Japan Governor, it could be seen as an unusual combination. However, it is noteworthy that there may have been requests for a reconsideration of low Intrerest Rate policies towards the Bank of Japan during this time.

Since April, the so-called “tariff shock” has caused a global stock market crash, leading to a significant retreat in expectations for an early interest rate hike by the Bank of Japan. However, with stock prices recently returning to levels seen before the “tariff shock”, expectations for additional interest rate hikes by the Bank of Japan are resurfacing in response to the stabilization of the financial markets. If we consider that the Bank of Japan aimed for an early interest rate hike up to 1% by March as seen so far, attention will likely be focused on how far it will rebound.