Trending Topics

View More97.95K Popularity

46.57K Popularity

26.54K Popularity

8.74K Popularity

5.07K Popularity

Hot Gate Fun

View More- MC:$3.56KHolders:20.00%

- MC:$3.53KHolders:20.04%

- MC:$3.5KHolders:10.00%

- MC:$3.5KHolders:10.00%

- MC:$3.49KHolders:10.00%

Pin

🎉 Share Your 2025 Year-End Summary & Win $10,000 Sharing Rewards!

Reflect on your year with Gate and share your report on Square for a chance to win $10,000!

👇 How to Join:

1️⃣ Click to check your Year-End Summary: https://www.gate.com/competition/your-year-in-review-2025

2️⃣ After viewing, share it on social media or Gate Square using the "Share" button

3️⃣ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Generous Prizes:

1️⃣ Daily Lucky Winner: 1 winner per day gets $30 GT, a branded hoodie, and a Gate × Red Bull tumbler

2️⃣ Lucky Share Draw: 10🔥 Gate Square Event | #PostToWinLaunchpadKDK 🔥

KDK | The latest Gate Launchpad spotlight token

Before: stake USDT to join

Now 👉 just post for a chance to win KDK!

🎁 Gate Square exclusive: 2,000 KDK total rewards up for grabs

🚀 Launchpad star project — big potential ahead 👀

📅 Event Duration

Dec 19, 04:00 – Dec 30, 16:00 (UTC)

📌 How to Join

Post on Gate Square (text, images, analysis, or opinions)

Content should relate to KDK price predictions at launch, project insights, or your understanding of the Gate Launchpad mechanism

Add one hashtag: #发帖赢Launchpad新币KDK 或 #PostToWinLaunchpadKDK

�🎨 Gate AI Creation Contest | One Sentence, Draw Your 2026

On Gate Square, anyone can be a visual creator — truly zero barriers to entry.

With just one sentence, generate an image and bring your vision of 2026 to life.

Create and post your work using Gate Square AI Creation for a chance to win the Gate Year of the Horse New Year Gift Box.

📅 Duration

Dec 17, 2025, 10:00 – Jan 3, 2026, 18:00 UTC

🎯 How to Join

1. Go to Gate Square → Create Post → AI Creation

2. Enter one sentence to generate your image

3. Post with #GateAICreation

🏆 Rewards

5 winners: Gate Year of the Horse New Year

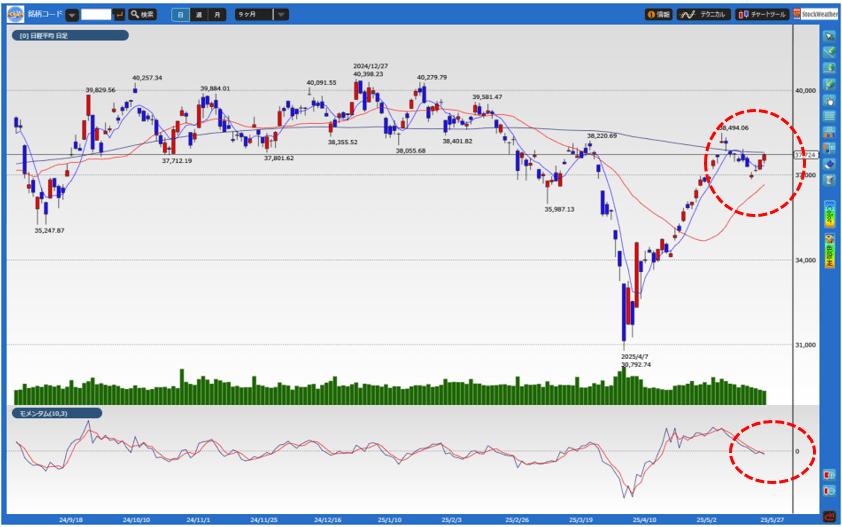

[Japanese Stocks] A week to watch whether it can recover and maintain above the 200-day Moving Average | Hiroyuki Fukunaga's Technical Analysis Course You Can Ask Now | Manekuri Media for Investment Information and Financial Assistance from Monex Securities

The 5-day Moving Average has changed to an upward trend; attention is on whether the rebound will continue.

In the previous column, it was explained that by comparing the stock prices of the Nikkei average with the stock prices from n days prior using the “three moving averages,” if it can maintain around 37,500 yen for the time being, it is expected that the 5-day Moving Average will change to an upward trend and provide support. Along with this, the rise of the 25-day Moving Average is expected to continue, and it seems that there is a possibility of once again surpassing and maintaining 38,000 yen. In fact, there was a moment when it fell below the 37,500 yen level, but it quickly recovered back to the 37,500 yen level, resulting in the 5-day Moving Average changing to an upward trend.

Moreover, the upward-changing 5-day Moving Average has become a support, and as of May 27, it has closed with three consecutive rises in trading. Given this situation, if it can maintain above the upward-changing 5-day Moving Average, it seems likely to recover and maintain the 38,000 yen level.

On May 27, it closed close to the gently declining 200-day Moving Average, and if it maintains above the 5-day Moving Average, it is expected that it will also surpass the 200-day Moving Average. At the same time, it seems possible to maintain above the intraday high set on May 13.

[Chart] Nikkei Average Stock Price (Daily) Source: Created by Invest Trust from i-chart

*The periods for the Moving Avarage are set to 5 days (blue line), 25 days (red line), and 200 days (gray line).

※The trading volume is in the prime market

*The momentum period is set to 10 days (blue line), and the 3-day Moving Avarage of the momentum (red line) is also displayed.

Source: Created by Invest Trust from i-chart

*The periods for the Moving Avarage are set to 5 days (blue line), 25 days (red line), and 200 days (gray line).

※The trading volume is in the prime market

*The momentum period is set to 10 days (blue line), and the 3-day Moving Avarage of the momentum (red line) is also displayed.

Attention is needed as the momentum continues to decline.

In this context, looking at the momentum that indicates the strength of rising and falling trends, both the momentum and its Moving Avarage, which is the signal, are fluctuating just below the 0 line, which is the dividing line for judging the strength of rising and falling trends. Therefore, whether the decline of the two lines continues is a point of focus.

If the decline of the two lines continues, even if there are moments above the 200-day Moving Average, it is likely that it cannot be maintained and will be pushed back down, or it may fall below the upward 5-day Moving Averages. Therefore, caution is necessary regarding high entry prices and sudden drops.

Moreover, if it reverses downward and falls below the 5-day Moving Average, it is possible that it could drop to or below the approaching upward 25-day Moving Average. Therefore, investors holding buy positions need to be cautious of potential losses or their expansion.

On the other hand, if the momentum remains limited even as it declines, or if it changes direction and rises, there is a possibility that the upward momentum will strengthen, surpassing the 200-day Moving Average and also exceeding the high of May 13. Therefore, it is important to pay attention to the direction and level of momentum to assist in trading decisions.