U.S. stocks are playing a new kind of AI roulette game

Recently, a joke has been circulating among U.S. equity investors:

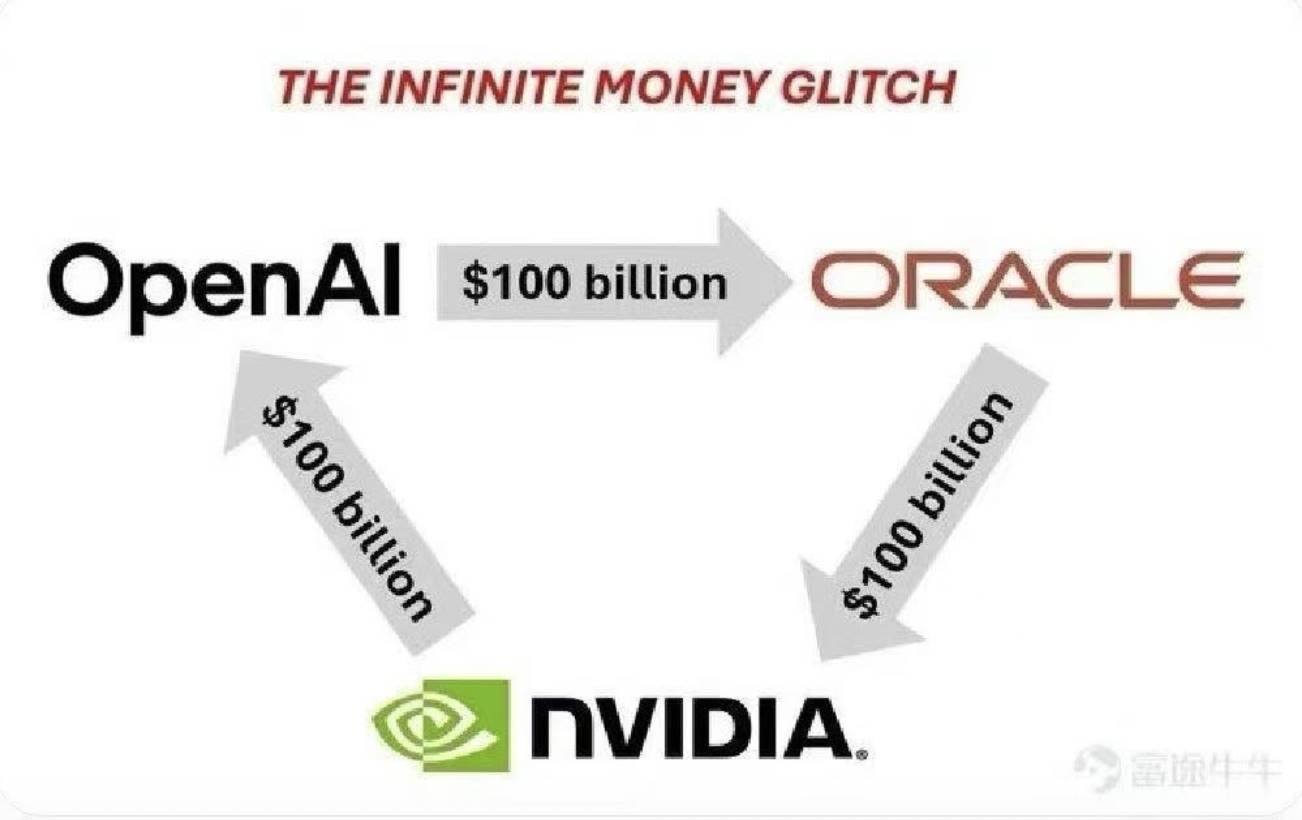

“OpenAI invests $100 billion in Oracle for cloud services; Oracle invests $100 billion in Nvidia for GPUs; then Nvidia invests $100 billion in OpenAI to build AI systems. So, who’s actually putting up the $100 billion?”

Of course, this is just a humorous hypothetical scenario—the amounts and facts differ greatly from reality, and these three firms aren’t actually cycling the same capital. Still, it points to a new closed-loop in capital formation.

In this loop, each transaction is backed by actual contracts or investments. Capital markets amplify every move, catalyzing trillions in market cap growth.

Within a single trading session, Oracle’s stock skyrocketed by 36%—its largest single-day jump since 1992. In one day, the company’s market cap soared to $933 billion, and founder Larry Ellison briefly overtook Elon Musk as the world’s richest person.

On September 22, Nvidia and OpenAI announced a strategic partnership, with Nvidia planning up to $100 billion in investments for OpenAI. Nvidia closed up nearly 4%, its market value surpassed $4.46 trillion, and the surge ignited a rally across tech stocks with all three major U.S. indexes hitting new highs.

While $100 billion seems enormous, a single night’s momentum drove the market up by well over a trillion dollars—a textbook case of outsized impact from strategic capital deployment.

Wall Street has discovered a new kind of AI investment cycle.

Triangle Cycle: How Does the Money Move?

In today’s investment labyrinth, three entities anchor a seamless capital cycle: OpenAI, Oracle, and Nvidia.

First Link: OpenAI’s Compute Obsession

OpenAI, the developer of ChatGPT, stands at the center. Every day, OpenAI contends with requests from 700 million users, requiring immense computational horsepower for AI operations.

This year, OpenAI inked the largest-ever tech contract with Oracle—a five-year, $300 billion cloud computing deal. By this agreement, OpenAI commits roughly $60 billion a year to Oracle, about six times Oracle’s typical annual revenue.

What’s being bought? 4.5 gigawatts of data center capacity—comparable to the power needs of 4 million American homes. Oracle is tasked with building campuses across five states, including Wyoming, Pennsylvania, and Texas.

For OpenAI, this secures the infrastructure and computational capacity required to run models. For Oracle, it locks in a predictable revenue stream over the next five years.

Second Link: Oracle Needs Chips

With OpenAI’s massive order in hand, Oracle faces the challenge: how to actually build all those data centers?

The answer: chips—specifically, GPUs in vast quantities. Oracle plans to invest tens of billions in its Stargate initiative to purchase Nvidia chips. Industry analysts estimate 4.5 gigawatts of compute power demands more than 2 million premium GPUs.

Oracle CEO Safra Catz stated, “The bulk of our capital expenditure is spent on revenue-generating computing devices going into our data centers.”

These revenue-generating computing devices are mostly Nvidia’s H100, H200, and latest Blackwell chips.

Oracle is now one of Nvidia’s top customers.

Third Link: Nvidia Reciprocates

While Oracle is on a chip-buying spree, Nvidia made a significant announcement: a $100 billion investment to help OpenAI build 10 gigawatts (GW) of AI data centers.

This investment is structured in phases: each time OpenAI deploys 1 gigawatt of compute, Nvidia steps in with proportional investment. The first phase is scheduled for late 2026, based on Nvidia’s Vera Rubin platform.

Nvidia CEO Jensen Huang remarked, “A 10-gigawatt data center equates to 4–5 million GPUs—that’s close to our total annual shipment.”

The result? A near-perfect capital cycle:

OpenAI pays Oracle for computing resources; Oracle uses those funds to buy Nvidia chips; Nvidia reinvests part of its earnings in OpenAI.

The Wealth Multiplier—Between Hype and Reality

Oracle’s $300 billion contract sparked a $250 billion surge in market value in just one day; Nvidia’s $100 billion bet brought $170 billion in a single session.

The three firms are mutually endorsing one another, generating a cascade effect in their stock prices.

This rally has an underlying rationale.

For the capital markets, the greatest scarcity is certainty about the future.

The Oracle-OpenAI agreement locks in Oracle’s cloud income for five years, prompting investors to reprice the stock upward.

Meanwhile, Nvidia switched to gigawatt (GW) as its metric. One gigawatt roughly equals a super data center. Ten gigawatts signals a new generation of AI “factories.” This narrative is more compelling than just “number of GPUs sold,” fueling investor imagination.

Nvidia’s investment in OpenAI signals, “I believe this is my future mega-client”; OpenAI signing with Oracle signals, “Oracle can meet my future cloud needs,” facilitating further capital raises; Oracle buying Nvidia chips signals, “Nvidia’s supply is constrained.”

It’s a robust, self-sustaining tech supply chain.

Yet beneath the surface, the cycle has intriguing complexities.

OpenAI’s current annual revenue is around $10 billion, but it has promised $60 billion per year to Oracle. Where will it make up the shortfall?

The answer: ongoing fundraising rounds. In April, OpenAI raised $40 billion, with more funding on the horizon.

In effect, OpenAI spends investor capital to pay Oracle; Oracle turns that money into Nvidia chips; Nvidia, in turn, reinvests in OpenAI. It’s a system propelled by external finance.

Moreover, these deals are largely commitments rather than immediate payments—subject to delay, renegotiation, even cancellation. The market reacts to the size of the promises, not actual cash flow.

That’s the mechanics of modern finance: expectations and commitments can generate exponential wealth effects.

Who Pays the Price?

Returning to the original question: who’s really footing that $100 billion bill?

Ultimately, it’s investors and the debt markets.

Institutions like SoftBank, Microsoft, and Thrive Capital bear the direct costs—they’ve funneled tens of billions into OpenAI, powering the entire capital cycle. Banks and bondholders finance Oracle’s expansion, while ordinary holders of related stocks and ETFs serve as the silent payers at the far end of the chain.

This AI funding cycle is, fundamentally, financial engineering for the age of artificial intelligence. It capitalizes on market optimism about AI’s future, creating a self-perpetuating investment loop.

Within the cycle, everyone appears to win: OpenAI secures computational capacity; Oracle wins long-term contracts; Nvidia enjoys soaring sales and fresh investment prospects. On paper, shareholders watch their wealth multiply.

But all this euphoria relies on a single assumption—that tomorrow’s AI commercialization will justify today’s astronomical investments. If that premise falters, the virtuous cycle can quickly become a perilous spiral.

In the end, those paying for this game are every investor betting on the future of AI—spending today’s capital for a stake in tomorrow’s AI-driven world.

It remains to be seen whether this momentum will continue.

Disclosure: The author holds positions in Nvidia and AMD.

Disclosure:

- This article is sourced from [TechFlow]. Copyright remains with the original author [五一番]. If you have concerns about republication, please contact the Gate Learn team—we’ll handle the process promptly according to our procedures.

- Disclaimer: The views expressed reflect the author’s own opinions and do not constitute investment advice.

- All alternate language versions are translated by the Gate Learn team. Unless Gate is credited, translated content may not be copied, distributed, or plagiarized.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

Dimo: Decentralized Revolution of Vehicle Data

Mind Network: Fully Homomorphic Encryption and Restaking Bring AI Project Security Within Reach