Gate Ventures Research Insights: Stablecoins Sintéticos Baseados em Estratégia – Lego Financeiro Construído sobre Taxas de Juros

TL;DR

As stablecoins sempre ocuparam uma posição de destaque na indústria cripto. O desenvolvimento inicial foi protagonizado por stablecoins algorítmicas, como a AMPL da Ampleforth e a UST (LUNA) da Terra. Esses projetos buscavam superar a dependência de reservas em dólar americano, utilizando mecanismos algorítmicos para criar stablecoins indexadas ao USD e impulsionar a adoção em cripto e DeFi, alcançando inclusive usuários tradicionais fora do universo blockchain. A Ampleforth focava em criar uma unidade de liquidação totalmente nativa do ambiente cripto—sem manter a paridade 1:1 com o USD—enquanto a TerraUSD (UST) objetivava garantir a estabilidade do dólar para permitir aplicações de pagamentos e reserva de valor em maior escala.

Com o início da Ethena, as stablecoins DeFi passam a ser referência não só em estabilidade de preço, como também fonte de rendimento. Surge uma nova geração de “stablecoins estruturadas por estratégia”, que basicamente encapsula estratégias de hedge ou produtos de rendimento conservador em tokens negociáveis denominados em US$1. O USDe da Ethena assemelha-se a uma cota de fundo, gerando retorno via estratégia delta-neutra—comprando stETH e vendendo contratos perpétuos—com o rendimento distribuído aos detentores como sUSDe. Devido à semelhança com fundos de hedge, esses stablecoins são classificados como valores mobiliários por reguladores como o BaFin, da Alemanha.

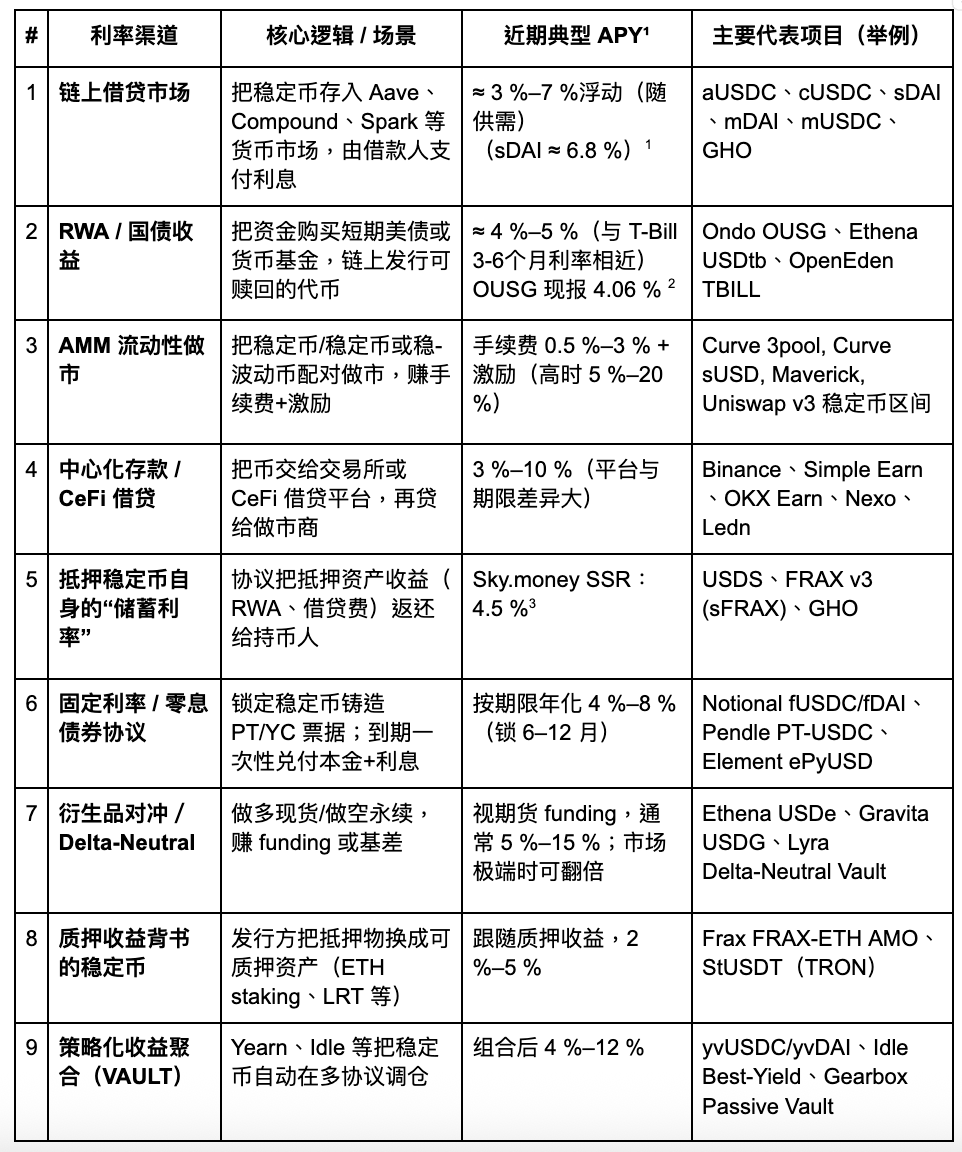

Este relatório categoriza os mecanismos de geração de rendimento em stablecoins em nove tipos: empréstimos on-chain, ativos do mundo real (RWA), market making via AMM, depósitos CeFi, taxas de poupança de protocolo (ex.: DSR), notas de taxa fixa, hedging de derivativos, rendimentos de staking e cofres agregadores de estratégias. Atualmente, esses canais proporcionam rendimentos anuais entre 3% e 8%, com picos de dois dígitos em períodos excepcionais (como desindexação do USDC ou forte aumento de funding rates).

Ainda que stablecoins estratégicas pareçam commodities, as diferenças cruciais estão em três pontos: sustentabilidade do rendimento, transparência e compliance regulatório. Stablecoins com lastro em RWA, como USDY e OUSG, estão avançadas em conformidade, com algum reconhecimento regulatório, embora o potencial de alta seja limitado pela estrutura do mercado de Treasuries americano. Stablecoins ligadas a derivativos, como USDe, oferecem flexibilidade e maior potencial de rendimento, mas dependem do interesse aberto (OI) dos mercados de contratos perpétuos, elevando a sensibilidade à volatilidade.

Pendle firma-se como a principal infraestrutura deste novo ciclo. O protocolo divide ativos de rendimento entre tokens de principal fixo (PT) e tokens de rendimento variável (YT), construindo um mercado de taxas de juros on-chain e habilitando operações de hedge padronizadas e transferência de rendimento. À medida que mais projetos de stablecoin utilizam Pendle na gestão de fluxo de caixa, seu TVL, volume negociado e sistema de incentivos tendem a crescer de forma consistente.

A expectativa é que as próximas stablecoins de estratégia evoluam para modelos modulares, orientados à compliance e com renda transparente. Projetos com fontes de rendimento únicas, mecanismos robustos de resgate e alta liquidez do ecossistema formarão a nova base de “fundos de mercado monetário on-chain”. Entretanto, esses produtos podem ser enquadrados como valores mobiliários por reguladores, criando desafios substanciais de conformidade.

Stablecoins Estruturadas por Estratégia

Stablecoins que geram rendimento utilizam diversos canais de receita: protocolos de empréstimo, mineração de liquidez, arbitragem neutra de mercado, retornos de Treasuries RWA, estratégias de opções, cestas de stablecoins e rendimentos de staking. A seguir, um resumo dos principais modelos:

Gate Ventures

Vamos analisar o cenário atual e os fatores que impulsionam canais inovadores de rendimento para avaliar o potencial futuro dessa tendência.

Mercados de Empréstimos On-Chain

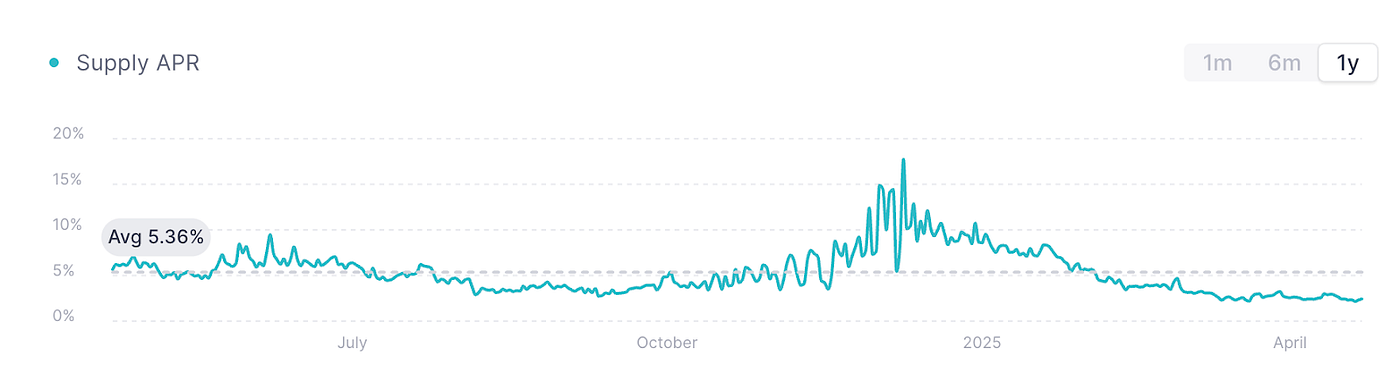

AAVE V3 USDC, fonte: AAVE

O gráfico acima ilustra as taxas de empréstimo do USDC no AAVE V3 (rede Ethereum), considerado referência para taxas on-chain. Em meio ao enfraquecimento do mercado e à baixa demanda por capital, a atividade de empréstimos caiu drasticamente, mantendo taxas próximas a 2% desde o início do ano.

AAVE também lançou o stablecoin GHO, nativo e apoiado por sobrecolateralização, com taxas ajustadas conforme a demanda de mercado. Embora as principais stablecoins no AAVE possam gerar rendimento, apenas via empréstimos—o que limita a eficiência do capital. No momento, a taxa de empréstimo do GHO varia entre 2% e 4%, acompanhando os ciclos do mercado. Em períodos de alta, as taxas podem subir para 10%–20%, mas com alta volatilidade. O Pendle oferece formas de liquidar esses juros antecipadamente, principalmente em cenários de volatilidade intensa.

Mercados RWA (Treasuries)

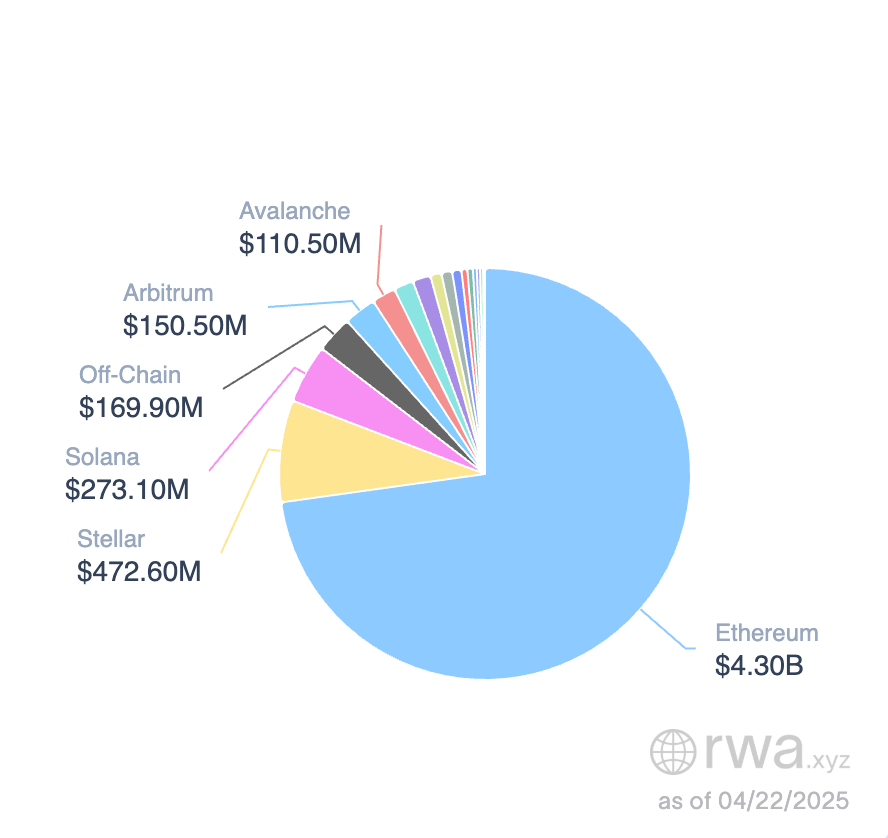

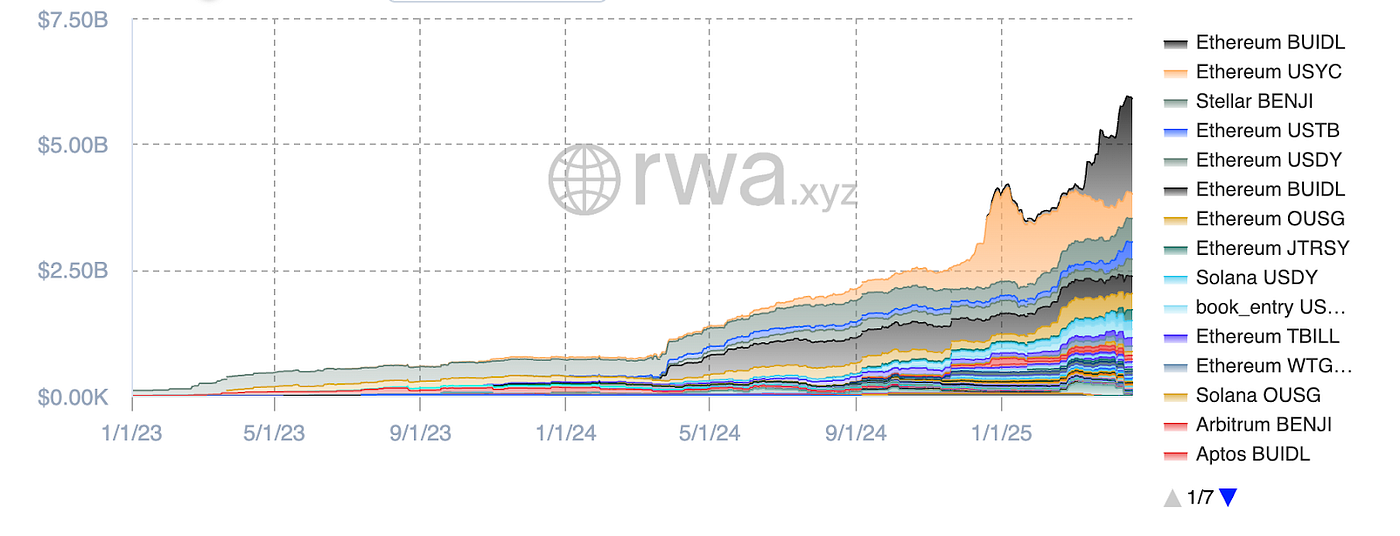

Stablecoins no mercado RWA, fonte: RWA.xyz

Stablecoins lastreadas em Treasuries dos EUA vêm ganhando destaque, com um mercado estimado em torno de US$5,9 bilhões. O ecossistema Ethereum concentra mais de 80% do volume. O BUILD da BlackRock lidera entre os stablecoins lastreados em Treasuries (32%, aproximadamente US$1,9B), seguido pelo USYC da Circle (US$490M) e o BENJI da Franklin Templeton.

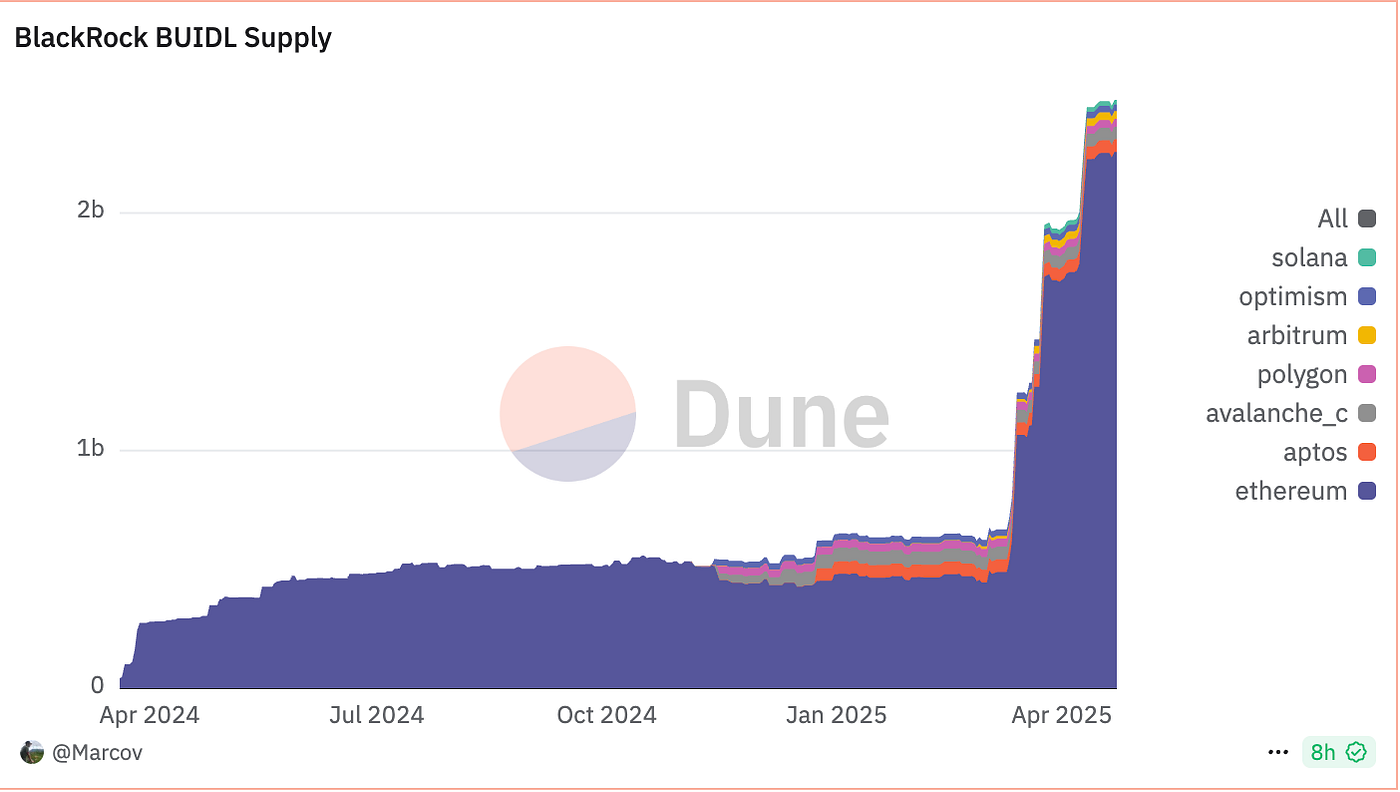

Oferta BUIDL, fonte: Dune

O BUIDL, embora indexado em US$1, não é voltado para pagamentos cotidianos, funcionando como uma cota de fundo que referencia Treasuries de curto prazo, caixa e acordos de recompra overnight. Usuários aderem por meio de USDC/USD, cada BUIDL representa US$1 de principal, com rendimento mensal distribuído via Rebase. Entre os primeiros usuários estão Anchorage Digital Bank NA, BitGo, Coinbase e Fireblocks.

A oferta de BUIDL está acelerando, com assinatura mínima de US$5 milhões. Em 01 de maio de 2025, eram 48 clientes e o AUM alcançou US$2,47 bilhões. Dados da Ondo Finance mostram APY por volta de 4%, compatível com os rendimentos de Treasuries de 3 a 6 meses.

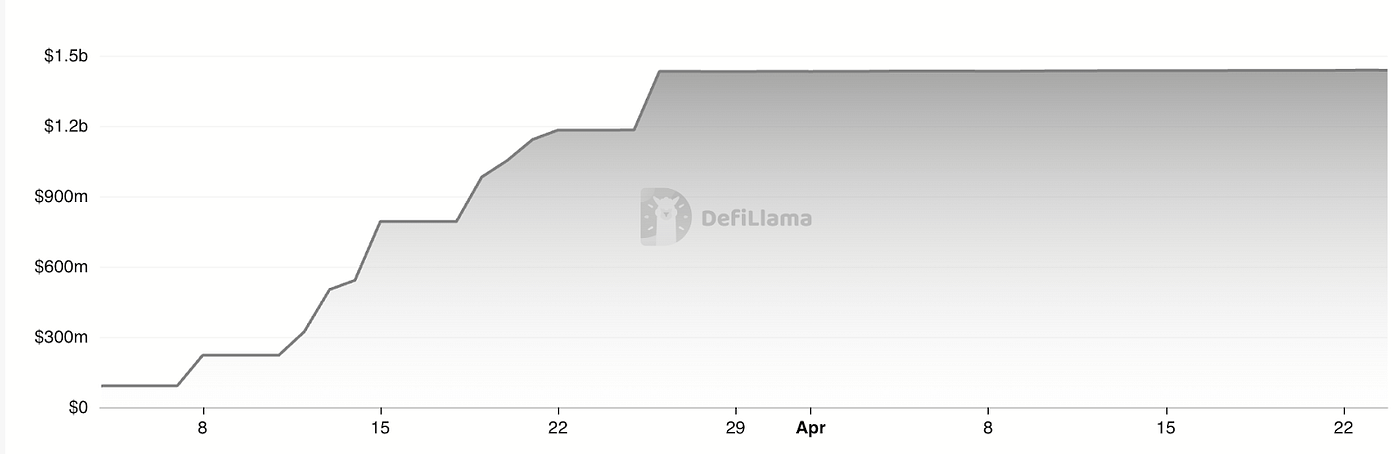

USDtb TVL, fonte: Defillama

O USDtb da Ethena segue um modelo de fundo de mercado monetário, utilizando fundos BUIDL tokenizados como ativos subjacentes e—diferentemente do OUSG da Ondo ou do BUIDL da BlackRock—oferece transferibilidade livre. O AUM do USDtb está em torno de US$1,43B; em parceria com Bybit, o projeto garante liquidez relevante no mercado.

O segmento de stablecoins RWA cresce rapidamente, com valor total próximo de US$5,9 bilhões. O USDtb da Ethena aponta para uma nova direção: se reguladores americanos aprovarem modelos de “stablecoin com rendimento segregado”, o potencial de mercado pode chegar ao montante dos fundos de mercado monetário dos EUA, estimado em US$6 trilhões.

No curto prazo, contudo, os retornos de Treasuries tendem a cair. Como a demanda por stablecoins é movida por taxas, e não por pagamentos, stablecoins de mercado monetário podem ter redução de retorno; no longo prazo, esse segmento continua com grande potencial de crescimento.

“Taxa de Poupança” Nativa de Stablecoin

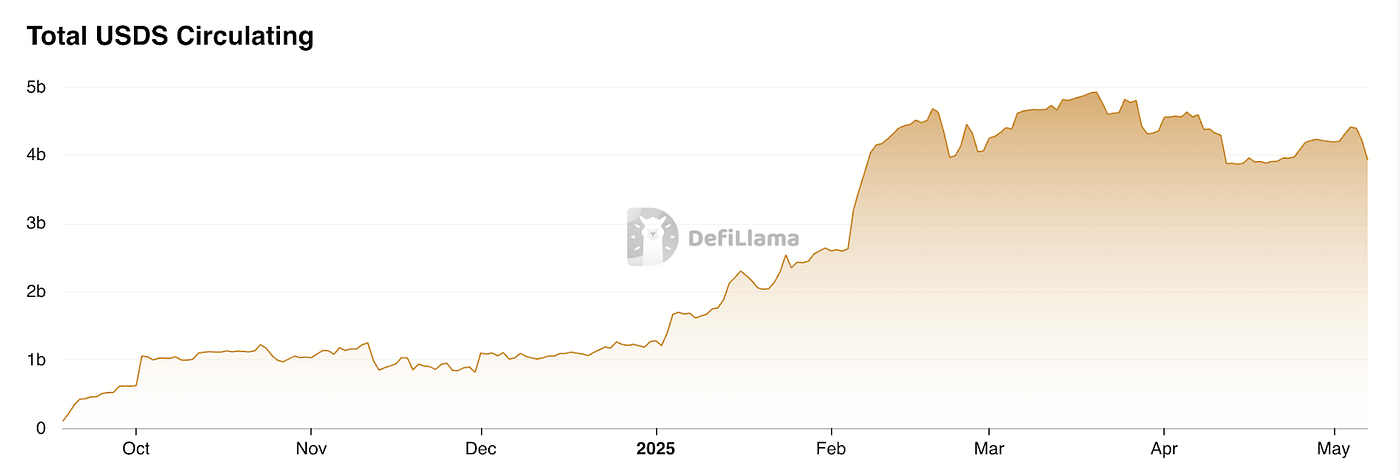

O DSR (Dai Savings Rate) do MakerDAO evoluiu para o SSR (Stablecoin Savings Rate) no Sky.money, permitindo que titulares de USDS recebam receitas do protocolo com taxa anualizada, juros em tempo real por bloco, sem bloqueios ou taxas e com saques livres.

O MakerDAO/Sky.money gera rendimento a partir de lucros do protocolo. Para estimular o uso de USDS no DeFi, Sky.money direciona parte da receita do protocolo para os holders. Atualmente, SSR rende cerca de 4,5% de APY.

Crescimento do USDS, fonte: Defillama

Trata-se de um modelo de stablecoin com “dividendo protocolar”. Em mercados fracos, Sky.money realoca receitas do token original para o USDS para ampliar adoção—potencialmente prejudicando o preço do token nativo. Em ciclos de alta, o compartilhamento moderado do rendimento impulsiona crescimento integrado da cotação do token e do protocolo. Como esse modelo depende de um único protocolo, Sky.money precisa de escala e influência para tornar USDS uma unidade de conta amplamente aceita—um desafio que mostra a ambição do projeto.

Hedge com Derivativos + Rendimentos de Staking

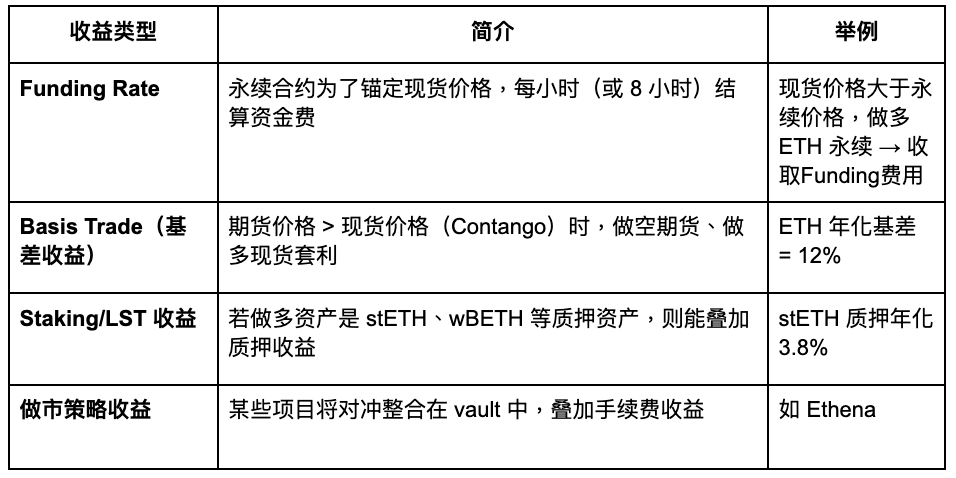

Os rendimentos delta-neutros são gerados por estratégias de derivativos: posições long e short compensatórias, eliminando risco direcional (Delta) e obtendo rendimento via taxas de financiamento ou spreads entre futuros e spot. Perpétuos são os instrumentos principais. Exemplos de estratégia:

Gate Ventures

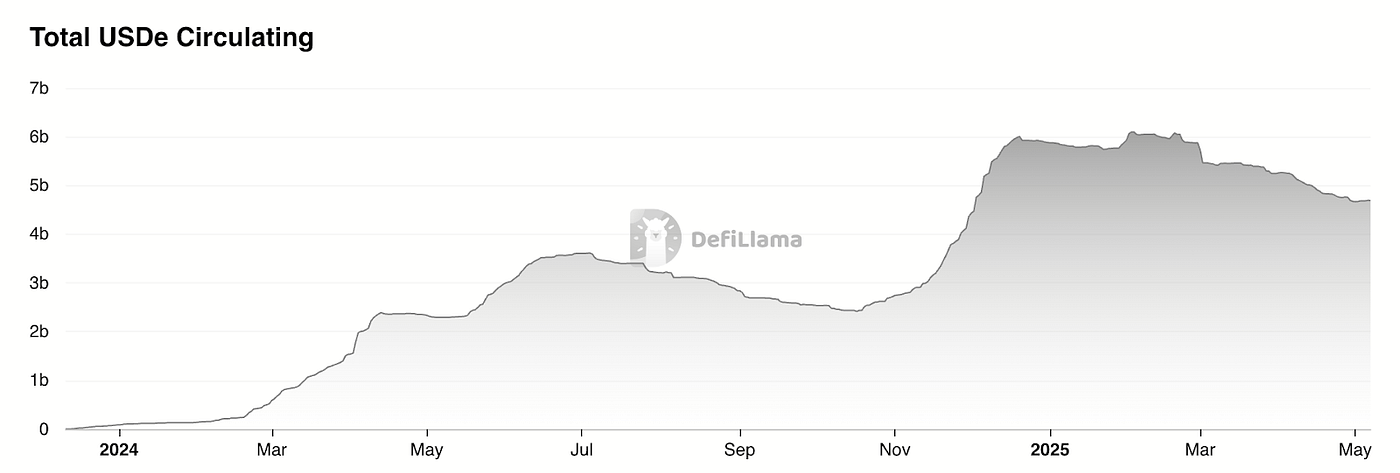

Projetos representativos:

Gate Ventures

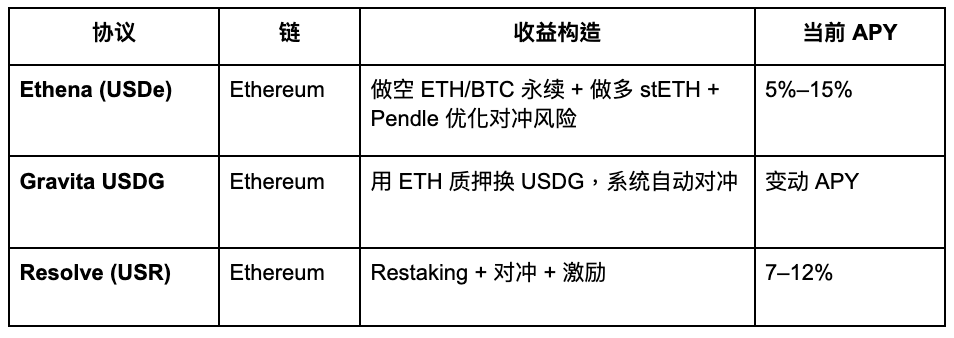

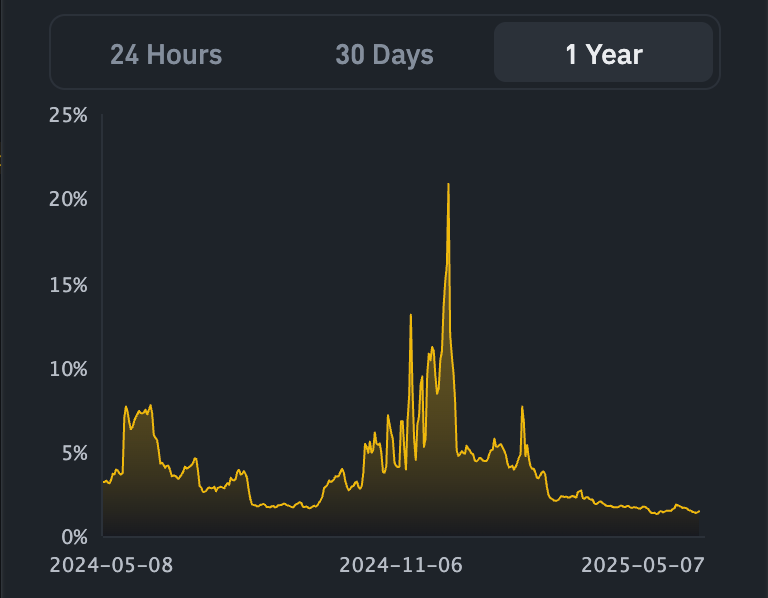

USDe APY, fonte: Exponential.FI

USR APR, fonte: Resolve

Acima, as tendências de rendimento para USDe e USR. O USDe foi o pioneiro em stablecoins delta-neutras; o USR veio depois com taxas superiores para atrair usuários, mas conceitualmente pouco difere da Ethena.

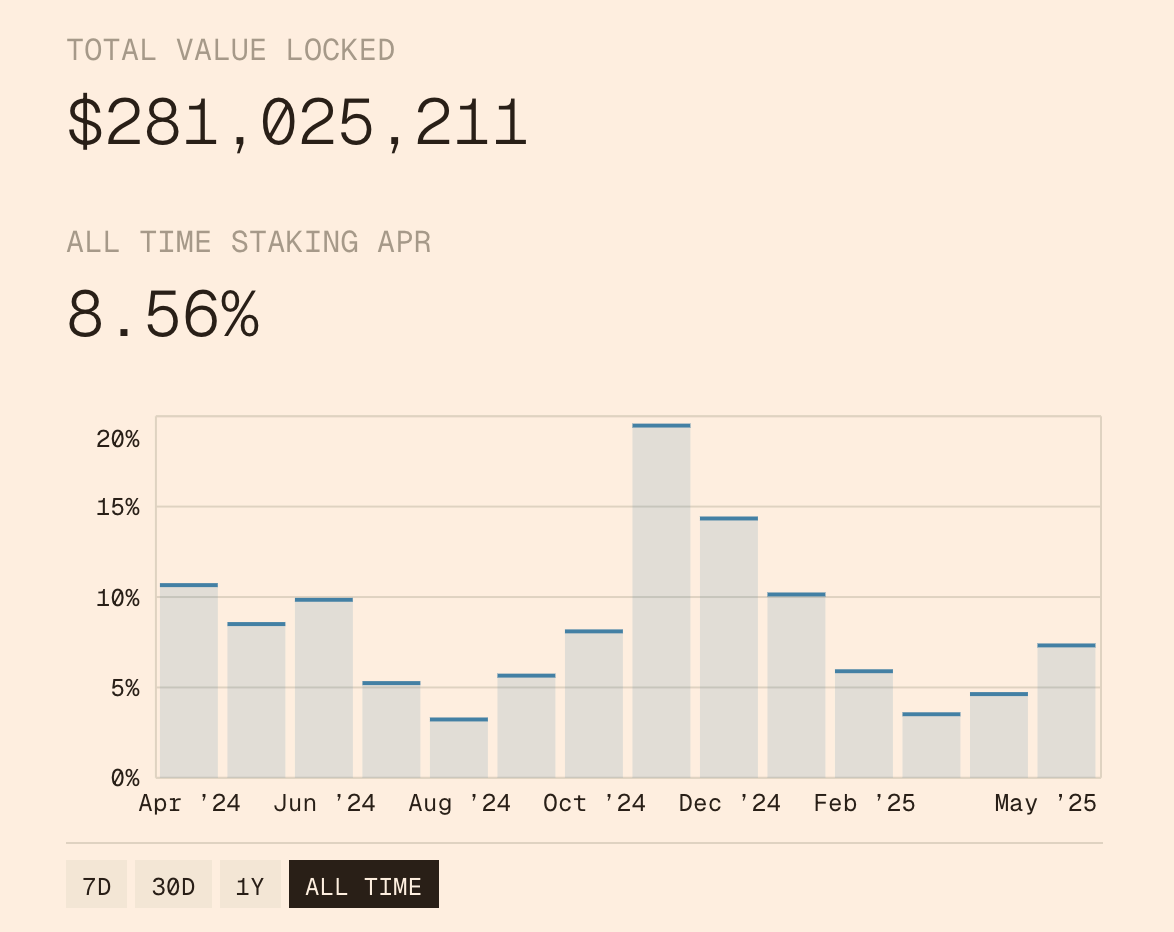

USDe TVL, fonte: Defillama

Dados da Defillama mostram que o market cap do stablecoin da Ethena recuou cerca de 20% após o airdrop, sobretudo por queda dos rendimentos em USDe. No geral, stablecoins enfrentam o desafio do “Lego DeFi”—com pouca demanda externa, funcionando majoritariamente como wrappers para estratégias de arbitragem de taxas de financiamento.

Stablecoins delta-neutras são emitidas por:

- Compra de spot equivalente a US$1 (ou LST)

- Abertura de posição short no mesmo valor, em mercados perpétuos

Emitir US$1 em stablecoin = US$1 em spot + US$1 em short nominal. Logo, o potencial de escala é limitado pelo open interest dos perpétuos.

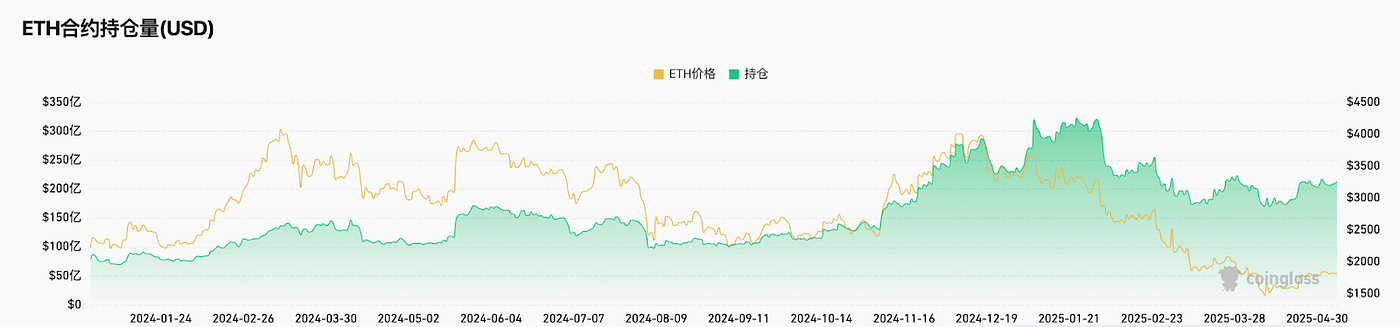

Ethereum OI, fonte: Coinglass

Segundo o Coinglass, o open interest agregado de ETH ultrapassa US$20B nas exchanges. Isso limita o USDe em cerca de US$4B.

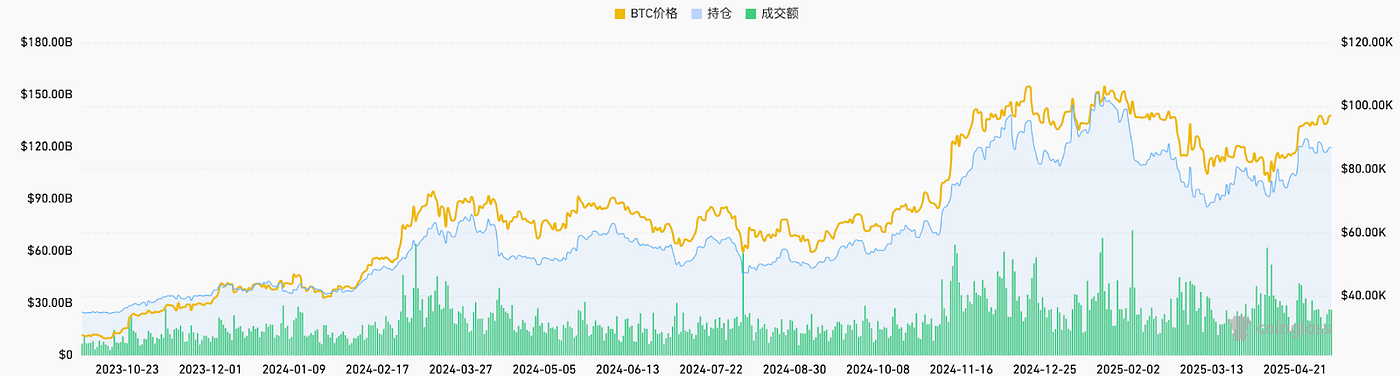

OI de todos os tokens, fonte: Coinglass

Considerando todos os tokens, mercados de hedge contratual podem atingir US$120B; se 20% for endereçável, isso representa US$24B.

Portanto, o potencial de mercado para hedge contratual é de US$24B. Para USDe focado em ETH, o teto estimado é US$4–8B. O fornecimento circulante do USDe é atualmente de aproximadamente US$4,6B e em queda—indicando proximidade do limite.

Cofres Agregadores de Estratégia

O Idle Best-Yield, por exemplo, executa estratégias automáticas em Ethereum e Polygon, realocando fundos para maximizar o rendimento obtido por stablecoins. O HLP da Hyperliquid é outro caso—um pool baseado em estratégias que foca principalmente em fluxos contrapartes neutros. Modelos multi-estratégia podem gerar retornos maiores, embora aumentem a exposição ao risco.

Binance Lança LDUSDT

É necessário atenção máxima aqui: esses ativos funcionam como cotas de hedge fund. Conforme declarou a Binance, LDUSDT não é um stablecoin, mas um novo ativo de margem para usuários do Simple Earn USDT. Trata-se de uma embalagem de USDT, utilizável como margem em contratos e capaz de render o APY do Simple Earn. O rendimento é oriundo do mercado de empréstimos da própria Binance.

APR Simple Earn, fonte: Binance

O USDe da Ethena é potencialmente uma stablecoin inovadora baseada em estratégia. O avanço desses stablecoins indica uma postura mais conservadora do mercado cripto—mas representa progresso. Enquanto modelos anteriores dependiam de incentivos, os atuais sustentam rendimento orgânico diversificado, favorecendo a sustentabilidade. Importante notar que, desconsiderados os pontos e subsídios de airdrop, seus rendimentos não se destacam frente às Treasuries.

Por sua vez, a sinergia do DeFi ainda não foi plenamente utilizada, mantendo stablecoins majoritariamente como ferramentas internas (“Lego DeFi”) em detrimento da adoção em larga escala fora do setor. Listar stablecoins sintéticas em exchanges é fundamental para adoção mainstream no Web3. A Ethena avança rápido—Bybit e Bitget já listaram pares, e a Gate mantém parceria estratégica. Ainda assim, o volume global diário de USDE/USDT permanece abaixo de US$100 milhões.

Panorama dos Projetos de Stablecoin

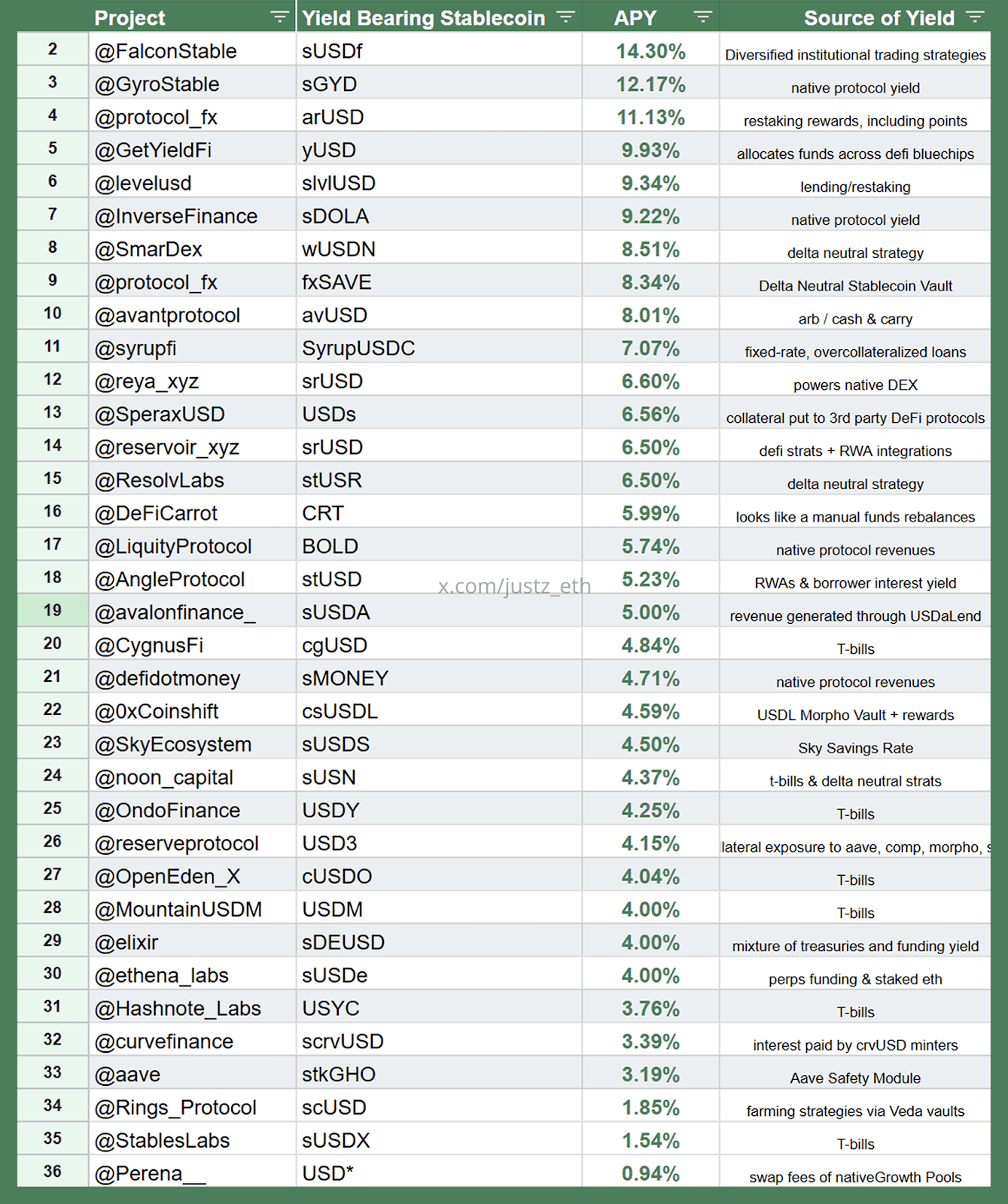

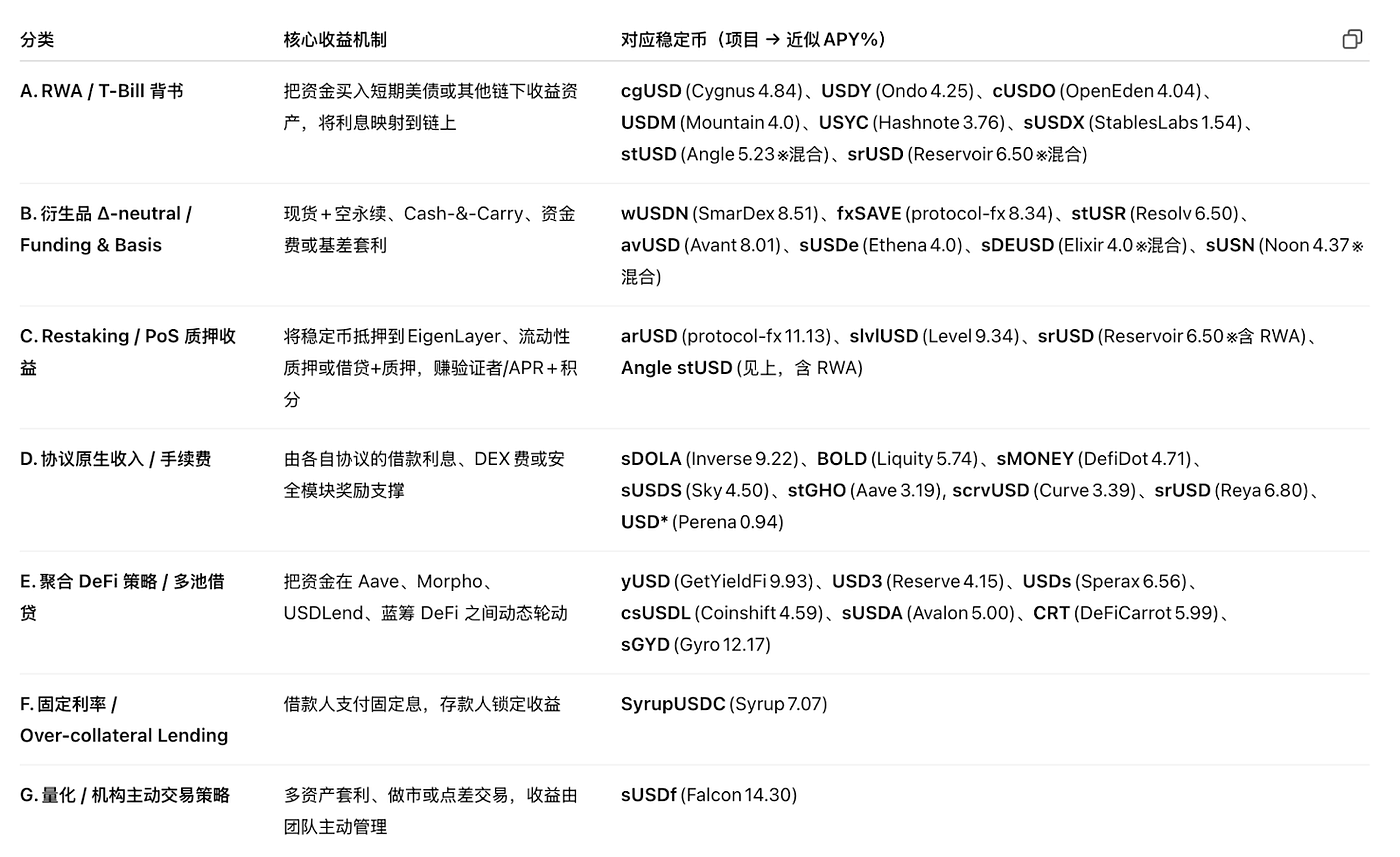

Painel de Stablecoins Sintéticas com Estratégia, fonte: justz_eth

O gráfico acima apresenta a distribuição de stablecoins sintéticas estruturadas por estratégia, com as respectivas fontes de rendimento.

Classificação de Estratégia, fonte: justz_eth

A maioria dos projetos populares de stablecoin ancora rendimentos sintéticos nas categorias de estratégia detalhadas acima. Importante destacar que os dados de TVL podem estar superestimados e certos projetos operam acordos com grandes investidores—esse contexto exige cautela. Essencialmente, essas stablecoins refletem cotas de hedge fund e trazem riscos legais claros de classificação como valores mobiliários.

Stablecoins lastreadas em Treasuries americanas possuem maior participação de mercado, mas dependem de avanços regulatórios e do suporte do setor bancário para adoção real—por isso, essa abordagem é mais promissora. Outras soluções (taxas de empréstimo, taxas de restaking, taxas contratuais livres de risco, receitas de protocolo etc.) têm limites rígidos e devem ser usadas com moderação.

Novos Conceitos de Taxa

Confira ideias para fundadores:

- Inovação em ativos. O BTC, ponte essencial entre TradFi e Web3, possui market cap de trilhões de dólares. Inserir taxas-base em stablecoins com lastro BTC—criando uma stablecoin para o ecossistema Bitcoin—pode ser mais viável do que em outras redes. O principal obstáculo é a infraestrutura insuficiente do BTC. Estratégias de arbitragem off-chain podem ser um ponto de partida, mas permanecem dentro do modelo de hedge fund.

- Inovação em estratégia. Qualquer arbitragem pode ser fonte de rendimento para stablecoin: MEV on-chain, divergências IV-RV, arbitragem de volatilidade de prazo, retornos de GameFi, taxas de segurança EigenLayer AVS ou receitas de dispositivos DePIN podem compor modelos de stablecoin inovadores, criando novas mecânicas de taxa.

No fundo, continuam sendo stablecoins sintéticas baseadas em estratégia—não modelos convencionais com lastro real. O potencial de mercado depende do escopo da estratégia subjacente e do volume do mercado de referência, que ainda é pequeno. Com a expansão do DeFi, esse ramo tem grande margem para crescer—modelos cripto-nativos reagem intensamente às mudanças do mercado on-chain.

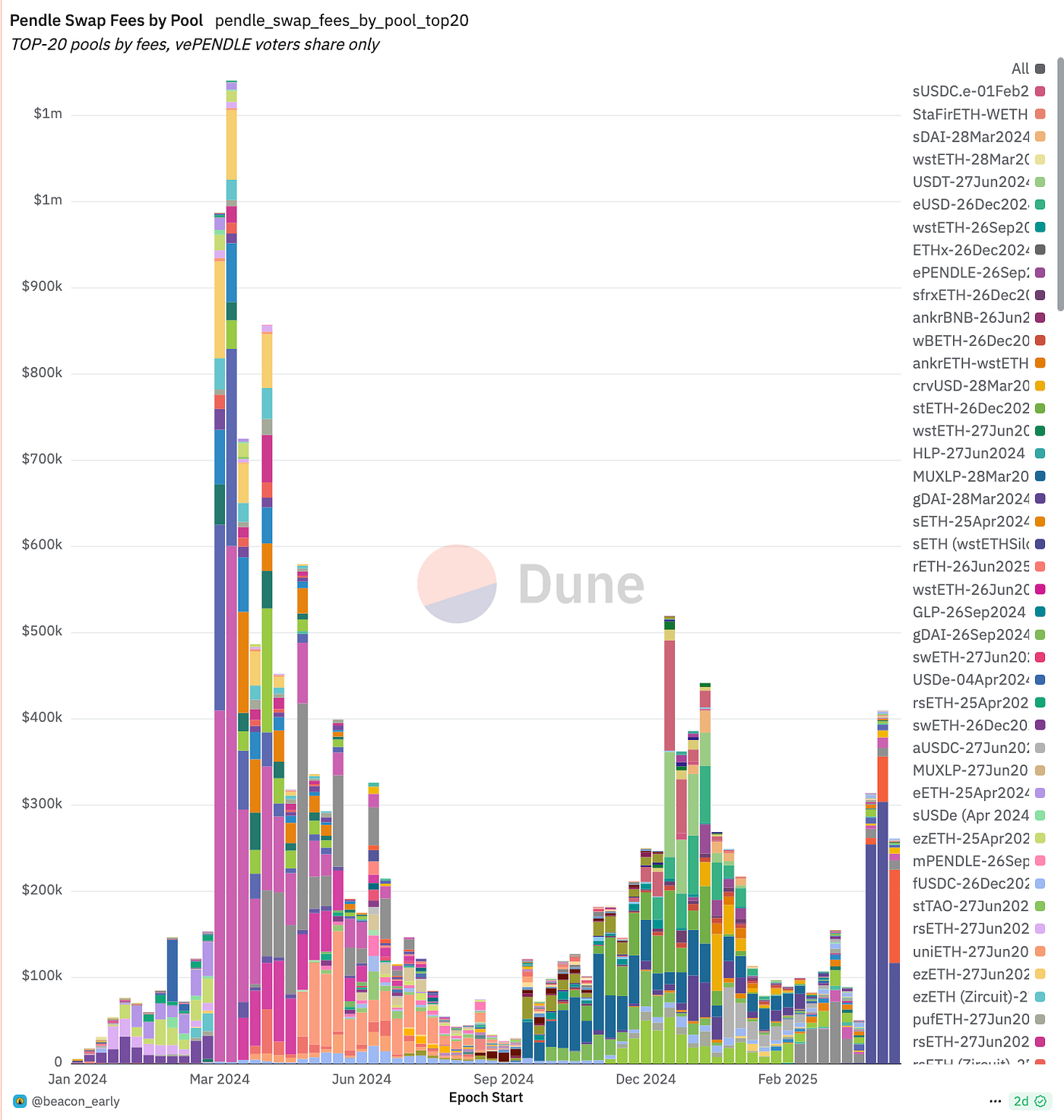

Guerras de Stablecoin: Pendle como Beneficiário

Taxas fixas representam modelo inovador de rendimento, exibindo retornos previsíveis, como títulos zero-cupom no TradFi—emitidos abaixo do valor de face, resgatados na paridade, com rendimento advindo da diferença de preço. No DeFi, o Pendle replica essa lógica, tokenizando o rendimento futuro e permitindo que o usuário:

- Trave rendimento: compra tokens de principal e mantém até o vencimento para retorno garantido;

- Faça especulação: compra tokens de rendimento para apostar em variações de taxa;

- Otimize capital: vende rendimento futuro por liquidez instantânea, conservando a titularidade do principal;

Pendle Snapshot, fonte: pendle

Pendle é um protocolo DeFi dedicado à tokenização do rendimento—separando ativos em tokens de principal e de rendimento para negociação. O Pendle constrói um mercado próprio para rendimento, oferece instrumentos de hedge para emissores de stablecoin e torna possível a oferta de taxas fixas.

No mais recente ciclo de LRT e lançamento do token EigenLayer, o preço do token Pendle caiu. Com a ascensão das stablecoins estratégicas, o TVL do Pendle cresceu fortemente. O Pendle está se tornando a “camada de swap de rendimento” do setor, permitindo que emissores vendam rendimento futuro para hedge instantâneo, enquanto gestores e traders compram ou fazem market making desses fluxos. À medida que stablecoins híbridas delta-neutras e RWA ganham espaço, TVL, volume, taxas e o ecossistema vePENDLE do Pendle sobem consistemente—o protocolo conquista domínio nesse nicho.

Fonte:

- https://defillama.com/yields/pool/13392973-be6e-4b2f-bce9-4f7dd53d1c3a?utm_source=chatgpt.com

- https://ondo.finance/ousg?utm_source=chatgpt.com

- https://defillama.com/yields/pool/c8a24fee-ec00-4f38-86c0-9f6daebc4225?utm_source=chatgpt.com

Disclaimer:

Este conteúdo não constitui oferta, solicitação ou recomendação. Busque sempre aconselhamento profissional independente antes de realizar investimentos. Gate e/ou Gate Ventures podem restringir ou bloquear serviços em determinadas regiões. Consulte os acordos de usuário correspondentes para mais detalhes.

Sobre a Gate Ventures

Gate Ventures é o braço de venture capital da Gate, focado em investir em infraestrutura descentralizada, ecossistemas e aplicações que impulsionam a era Web3. Gate Ventures forma parcerias com líderes globais do setor para fortalecer times inovadores e startups, redefinindo as formas de interação social e financeira.

Website: https://ventures.gate.com/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

Artigos Relacionados

Resumo Semanal de Criptoativos da Gate Ventures (29 de setembro de 2025)

Como os TCGs On-Chain podem impulsionar um novo mercado de US$ 2 bilhões: panorama do setor e expectativas de valorização

Gate Ventures anuncia o compromisso de 20M para apoiar a BNB Incubation Alliance BIA

Resumo Semanal de Criptoativos Gate Ventures (15 de setembro de 2025)

Resumo Semanal de Criptomoedas Gate Ventures (22 de setembro de 2025)