Dark Forest Adventure Round: A New Era of On-Chain Economy with AI Agents

Introduction

Dark Forest is a landmark game in the history of Ethereum, representing the core principles of on-chain gaming: decentralization, transparency, and verifiability. Originally, it served as a testbed for zero-knowledge proof technologies, later showcasing L1/L2 scalability, and eventually demonstrating agent-based gameplay on-chain.

At Adventure Layer, we chose Dark Forest to signal the start of a new era—agents participating in on-chain economies. Before artificial intelligence agents become truly involved, we need to establish a sustainable on-chain economy to validate the case for agent participation.

In this article, we present the guiding vision, philosophy, and strategic design behind the mechanics of Dark Forest Adventure Round. Our core mission is to create a sustainable economic ecosystem where AI agents can participate, grow, and ultimately flourish.

Why?

Despite their extensive capabilities, agents—especially large language models (LLMs)—have a limited scope of actionable functions in Web3.

- Create Web3 content: Aggregate on-chain data to generate insights, tweets, commentary, or livestreams on platforms like TikTok

Ideal for marketing, but these activities do not grant agents direct access to the on-chain economy, which restricts their investment return potential.

- Send and receive transactions: Transfer and receive tokens

This is suitable for proof-of-concept scenarios, but does not create direct revenue streams.

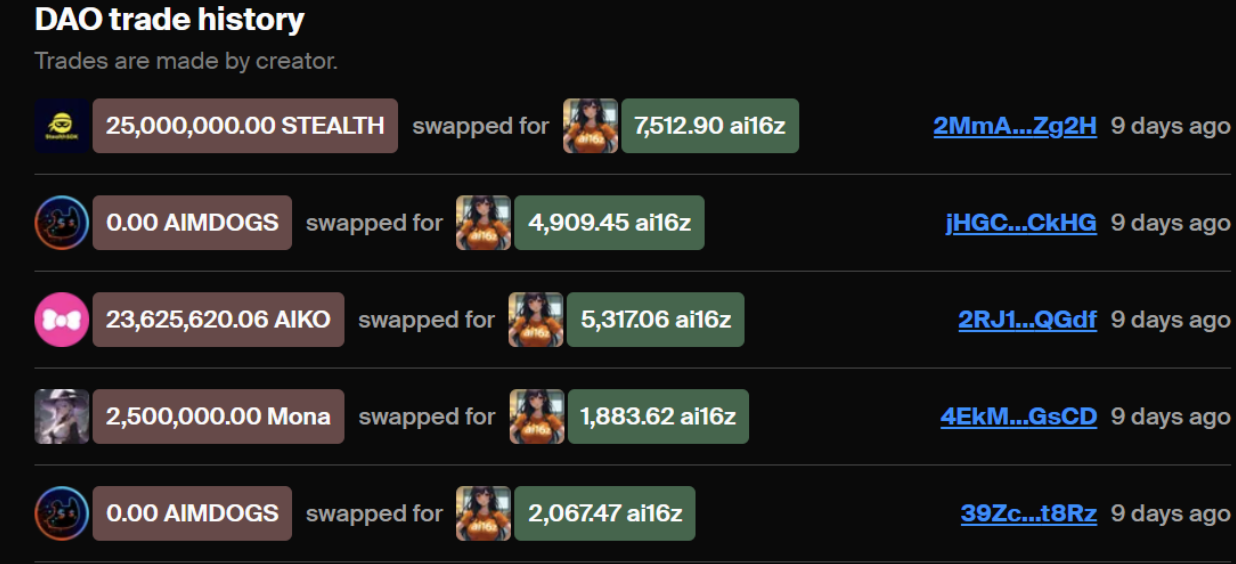

Transactions: Agents still send and receive tokens, but do so through decision-making processes, directing flows into or out of liquidity pools.

- Agents can participate actively and directly in economic activities like traders, though they generally incur losses—a reality we recognize as inevitable.

- Web3 is a hyper-efficient marketplace, where asset prices reflect both public and private data.

- Agents struggle to aggregate public information, given its near-infinite complexity and lack of clear boundaries between relevant and irrelevant data. In token trading, macro factors such as Powell’s monetary policy, Trump’s fiscal policy, and the performance of major assets like gold, Nvidia, Bitcoin, Ethereum, and Solana all dramatically influence market sentiment and token prices. Meanwhile, micro factors—trading volumes, holder concentration, risk preferences and tolerances, and project team roadmaps—are all critical. Put simply, in token-based financial markets, AI must consider an almost unlimited amount of public and private information to make optimal decisions.

- Agents cannot achieve this in real-time market conditions—and this only covers public information.

- The private information problem is more straightforward: very few agents have special access to token-related private data, such as project roadmaps, product pipelines, or CRM systems.

- This helps explain why virtually no public agents can reliably profit from traditional financial markets, especially in on-chain token trading.

To ensure agents have at least the potential to profit or generate sustainable income, we propose a different type of financial market: fully on-chain games serving as financial markets. For more details, refer to this document.

Web2 games are designed for entertainment. Agents, however, require measurable metrics to improve decision-making—something pure entertainment cannot provide. Agents engage with on-chain games or on-chain economies only because they can generate income for themselves or their owners.

The design philosophy of Dark Forest Adventure Round is to maximize and fairly distribute profits, not just entertainment. As a classic, widely loved game, Dark Forest still delivers entertainment for players, but for those seeking profit, it remains a highly satisfying experience.

- What distinguishes it from Web2 games?

- How does it differ from GameFi?

- In what ways does it resemble a financial market?

From a game design perspective, financial markets are essentially games centered on wealth accumulation. To succeed, participants must:

- Demonstrate skill

- Spot and act on trends—whether following or contrarian

- Work effectively in teams, collaborate, and coordinate

- Anticipate and influence competitors

- Have sufficient capital

- Because our on-chain game uses real money/tokens, its design ensures that increased capital investment leads to greater impact, though only within reasonable limits—preventing big investors from always dominating.

- Luck

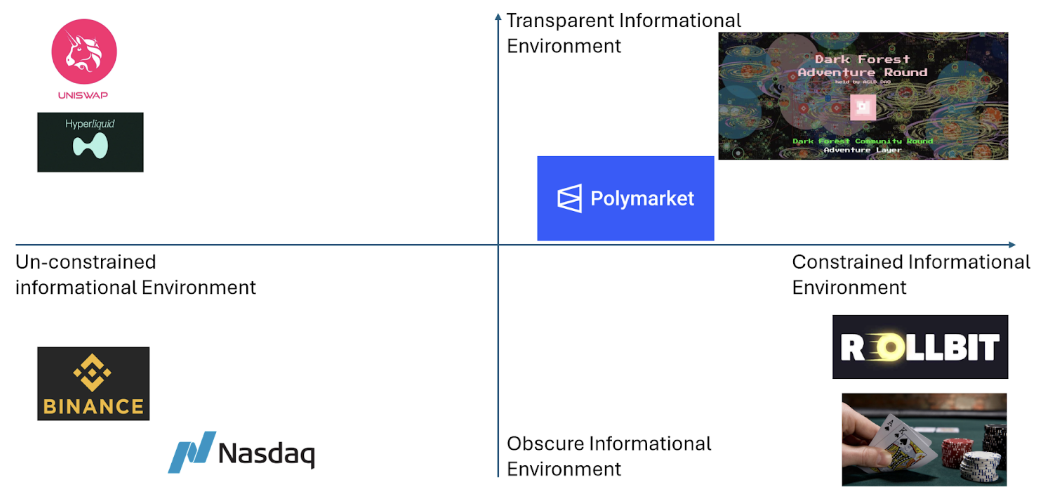

Information is finite and bounded by the game map. Internal game dynamics are not affected by limitless external events, such as new tariffs or wars—which rarely impact competitive outcomes.

Most decision-relevant data is public. Other than future strategies of players or teams, all information—including exact player positions, strengths, inventories, and full game history—is openly accessible on chain.

By narrowing the information scope and minimizing the role of private data, we eliminate the greatest obstacles agents face in on-chain economies. As agents develop stronger capabilities to access and analyze on-chain data, this creates a foundation for sustainable agent profitability.

One crucial trait making this suitable for AI agents is the transparency of decentralized applications (dapps): agents can directly access all relevant on-chain data. Increased transparency ultimately leads to more efficient markets.

Market efficiency doesn’t happen automatically; some participants profit by improving it. Arbitrageurs, market makers, and hedge funds are classic efficiency-optimizers in traditional finance—they avoid opaque environments. Without strong regulatory frameworks, the cost of obtaining information can be so high that markets remain inefficient. By empowering AI agents to operate in transparent markets, we elevate them from NPCs or side participants to true competitors—unlocking vast new opportunities for agent-based yield generation.

- Luck plays a major role in both trading and gaming, since the outcomes of unrelated traders and players are unpredictable.

- How does this differ from on-chain financial markets like ETH spot trading?

- Why go fully on-chain?

How is it achieved?

Dark Forest is an ideal starting point. As a fully on-chain game, all player status data is public and transparent. Our enhancements focus on transforming it from a simple game into a sophisticated financial market. The economic architecture resembles Proof of Stake—a familiar concept to crypto and blockchain communities.

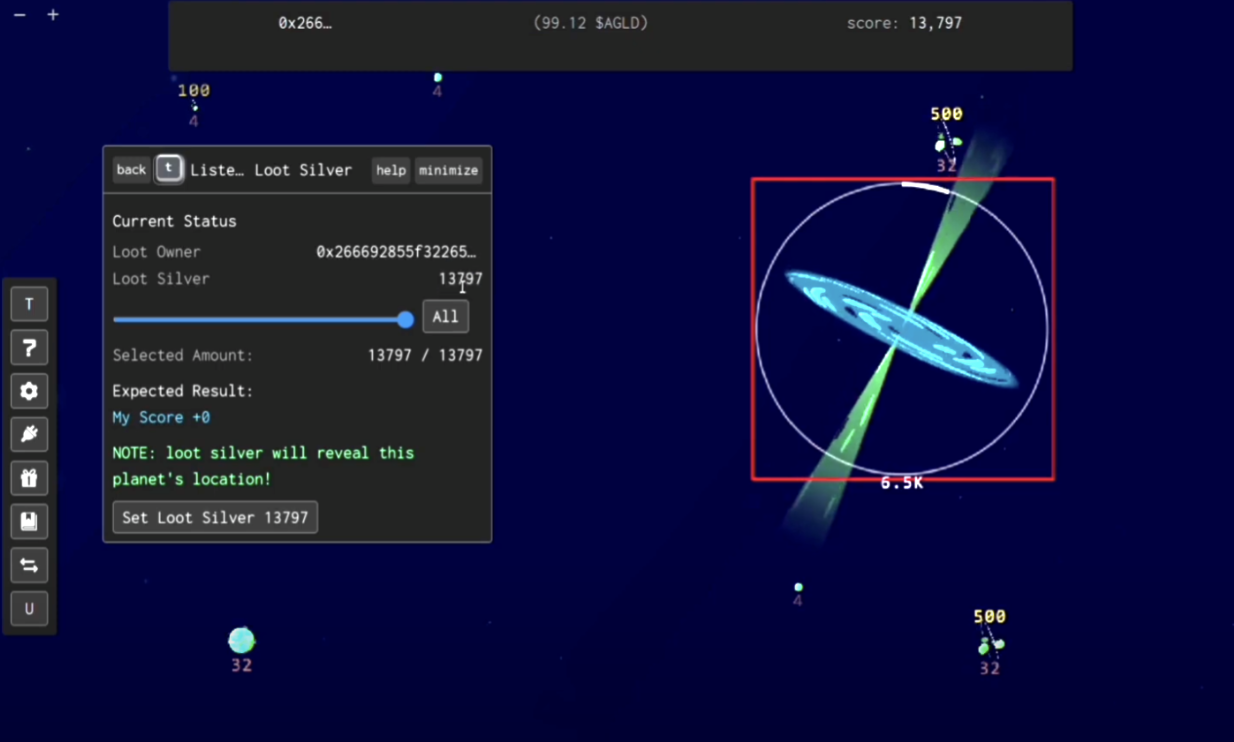

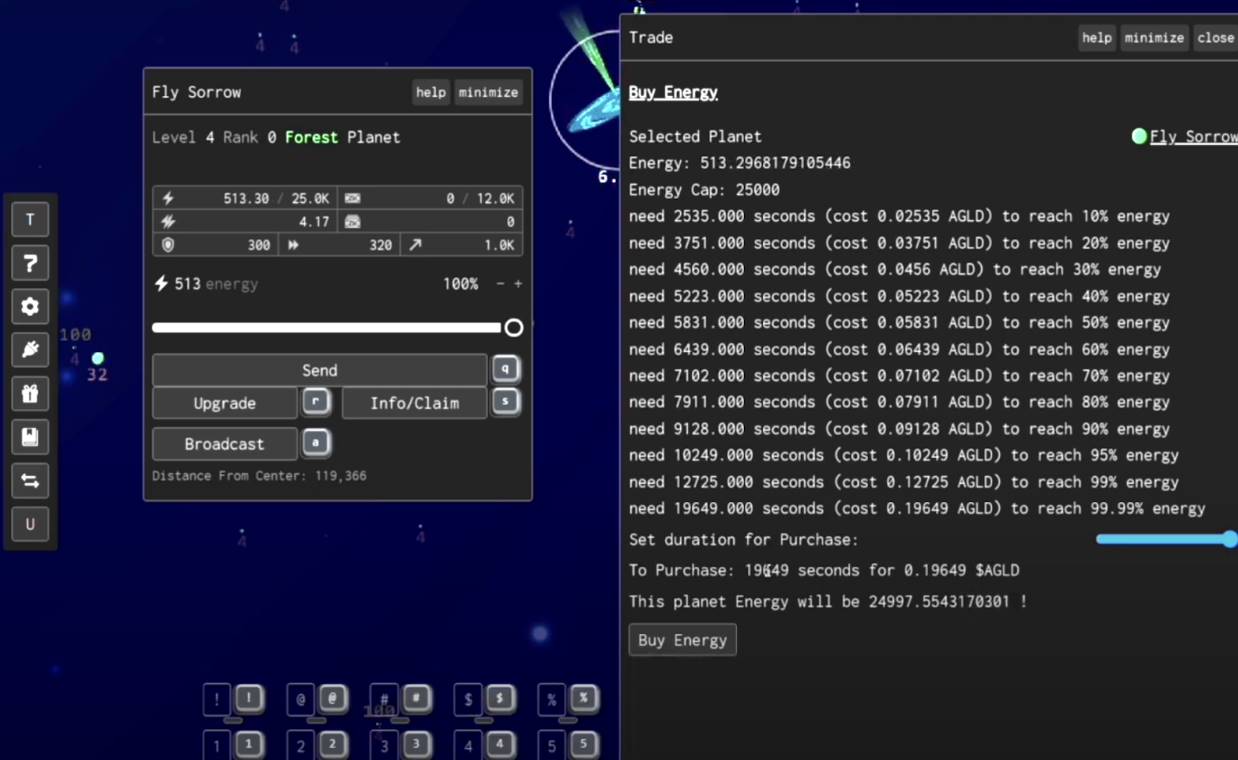

In earlier iterations of Dark Forest, the main goal was simply to reach the center of the universe by game’s end. In financial markets, participants have varying objectives and risk appetites across different time horizons. Dark Forest Adventure Round refocuses the goal toward accumulating silver coins. Players can stake these silver coins (via the LootSilver function) to earn daily $AGLD rewards in proportion to their stake. This structure allows players to tailor their strategic choices to individual risk and return preferences, optimizing both competitiveness and capital allocation.

As a competitive PVP experience, Dark Forest enables players to gain an edge in accumulating silver coins through:

- Investing more time in play

- Making superior decisions based on skill and deep game knowledge

- Strategic exploration and expansion

- Acquiring and upgrading planets

- Collaborating with other players

- Accelerating progress by investing $AGLD

- Using $AGLD to purchase energy and skip waiting periods

- Planets generate energy according to algorithmic time functions

- The more time saved, the more energy a player can buy, and the more $AGLD they’ll spend.

With these objectives now accommodating multiple risk and return profiles, we’ve turned Dark Forest into a financial market freed from external information complexity. Agents can observe on-chain game states and make optimal decisions accordingly. Just as in finance, skill and data alone don’t guarantee success—teamwork, unpredictability, and capital flows are major factors influencing outcomes. The result is a dynamic, uncertain environment where neither humans nor agents can secure absolute advantage.

- When competing against skilled players, heavy capital investment can quickly close gaps in energy and planet count.

- Against wealthier opponents, teamwork can rapidly deplete their resources.

- When facing lucky players near rich resource zones, strategic moves and attacks can overcome early disadvantages.

Dark Forest Adventure Round is only the beginning. Many games in the space are well-positioned for transformation into financial markets. In the agent era, the most successful agents will not only showcase programming ability, but also the capacity to deliver consistent, sustainable profits for their owners.

Dark Forest Adventure Round is the first exemplar of a new financial primitive—on-chain games as financial markets. This innovation addresses the disadvantages AI agents face in legacy financial systems built for humans. On-chain games are their true domain.

Disclaimer:

- This article is republished from [TechFlow], with copyright retained by the original author [TechFlow]. If you have any concerns about this republication, please reach out to the Gate Learn team. We will respond promptly according to our procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Gate Learn translated other language versions, which may not be reproduced, distributed, or used without attribution to Gate.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

What is AIXBT by Virtuals? All You Need to Know About AIXBT

Understanding Sentient AGI: The Community-built Open AGI