FEI vs MANA: Comparing Two Decentralized Stablecoins in the DeFi Ecosystem

Introduction: FEI vs MANA Investment Comparison

In the cryptocurrency market, the comparison between FEI and MANA has always been an unavoidable topic for investors. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency asset positioning.

FEI (FEI): Since its launch in 2021, it has gained market recognition for its decentralized stablecoin mechanism.

MANA (MANA): Since its inception in 2017, it has been hailed as a pioneer in blockchain-based virtual worlds, representing one of the leading projects in the metaverse space.

This article will comprehensively analyze the investment value comparison between FEI and MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, while attempting to answer the question investors care most about:

"Which is the better buy right now?"

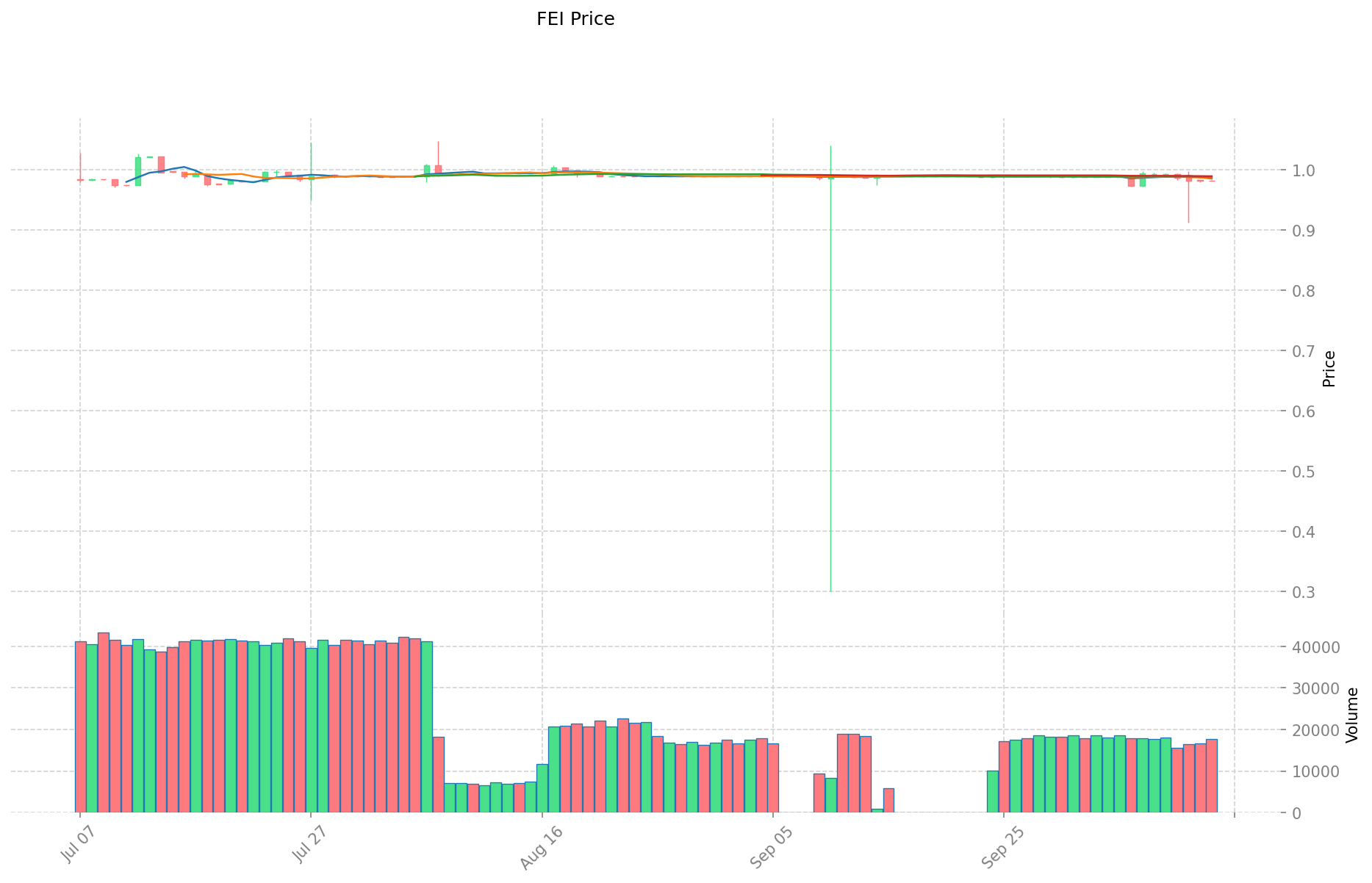

I. Price History Comparison and Current Market Status

FEI (Coin A) and MANA (Coin B) Historical Price Trends

- 2023: FEI experienced significant volatility, reaching a low of $0.15544 on December 30, 2023.

- 2024: MANA saw a notable price increase, hitting its all-time high of $5.85 on March 16, 2024.

- Comparative analysis: During the recent market cycle, FEI dropped from its high of $5.55 to a low of $0.15544, while MANA has shown more stability, currently trading at $0.2837.

Current Market Situation (2025-10-14)

- FEI current price: $0.9823

- MANA current price: $0.2837

- 24-hour trading volume: FEI $17,423.30 vs MANA $727,520.53

- Market Sentiment Index (Fear & Greed Index): 38 (Fear)

Click to view real-time prices:

- Check FEI current price Market Price

- Check MANA current price Market Price

II. Core Factors Affecting FEI vs MANA Investment Value

Supply Mechanisms Comparison (Tokenomics)

- FEI: Protocol Controlled Value (PCV) model where the protocol maintains reserves backing the token, with algorithmic stabilization mechanisms

- MANA: Fixed supply of 2.19 billion tokens with deflationary elements through LAND purchases in Decentraland

- 📌 Historical Pattern: FEI aims for stability while MANA's value fluctuates with Metaverse adoption and virtual land demand.

Institutional Adoption and Market Applications

- Institutional Holdings: MANA has attracted more institutional interest due to its established position in the Metaverse space

- Enterprise Adoption: MANA has partnerships with major brands for virtual experiences, while FEI remains focused on DeFi applications

- Regulatory Attitudes: Both face varied regulatory approaches, with metaverse tokens like MANA generally facing less direct scrutiny than stablecoins like FEI

Technical Development and Ecosystem Building

- FEI Technical Upgrades: Integration with Tribe DAO ecosystem and development of PCV mechanisms

- MANA Technical Development: Ongoing improvements to Decentraland platform, metaverse infrastructure, and creator tools

- Ecosystem Comparison: MANA has a developed ecosystem within Decentraland with NFTs, virtual land, and social experiences; FEI focuses on DeFi applications and stability mechanisms

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: FEI designed for stability regardless of inflation, while MANA could benefit from metaverse growth during high inflation periods

- Macroeconomic Monetary Policy: Interest rates affect FEI's stability mechanisms, while MANA is more influenced by tech adoption cycles

- Geopolitical Factors: Increasing digital and virtual world adoption could benefit MANA, while economic uncertainty may increase demand for alternative stablecoins like FEI

III. 2025-2030 Price Prediction: FEI vs MANA

Short-term Prediction (2025)

- FEI: Conservative $0.72 - $0.98 | Optimistic $0.98 - $1.44

- MANA: Conservative $0.22 - $0.28 | Optimistic $0.28 - $0.30

Mid-term Prediction (2027)

- FEI may enter a growth phase, with prices estimated at $1.14 - $1.96

- MANA may enter a growth phase, with prices estimated at $0.23 - $0.50

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- FEI: Base case $1.46 - $2.08 | Optimistic case $2.08 - $2.85

- MANA: Base case $0.53 - $0.57 | Optimistic case $0.57 - $0.64

Disclaimer: This analysis is based on historical data and projections. Cryptocurrency markets are highly volatile and unpredictable. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

FEI:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.443834 | 0.9822 | 0.717006 | 0 |

| 2026 | 1.61331261 | 1.213017 | 1.17662649 | 23 |

| 2027 | 1.96429907895 | 1.413164805 | 1.14466349205 | 43 |

| 2028 | 1.94204173327125 | 1.688731941975 | 1.5874080254565 | 71 |

| 2029 | 2.341849020533831 | 1.815386837623125 | 1.670155890613275 | 84 |

| 2030 | 2.847706562837514 | 2.078617929078478 | 1.455032550354934 | 111 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.295672 | 0.2843 | 0.221754 | 0 |

| 2026 | 0.40888026 | 0.289986 | 0.24068838 | 2 |

| 2027 | 0.4961950446 | 0.34943313 | 0.2306258658 | 23 |

| 2028 | 0.583483440474 | 0.4228140873 | 0.325566847221 | 49 |

| 2029 | 0.63396744249762 | 0.503148763887 | 0.4025190111096 | 77 |

| 2030 | 0.64247065660731 | 0.56855810319231 | 0.528759035968848 | 100 |

IV. Investment Strategy Comparison: FEI vs MANA

Long-term vs Short-term Investment Strategy

- FEI: Suitable for investors focused on DeFi applications and stability mechanisms

- MANA: Suitable for investors interested in metaverse potential and virtual economy growth

Risk Management and Asset Allocation

- Conservative investors: FEI 70% vs MANA 30%

- Aggressive investors: FEI 40% vs MANA 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- FEI: Volatility in the stablecoin market, potential de-pegging events

- MANA: High volatility tied to metaverse adoption and speculation

Technical Risk

- FEI: Scalability, network stability, smart contract vulnerabilities

- MANA: Platform security, virtual world infrastructure stability

Regulatory Risk

- Global regulatory policies may have different impacts on stablecoins (FEI) and metaverse tokens (MANA)

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- FEI advantages: Stability mechanism, DeFi integration, potential for consistent value

- MANA advantages: Established metaverse presence, partnerships with major brands, growth potential in virtual economies

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight tilt towards FEI for stability

- Experienced investors: Opportunistic investment in MANA during market dips, maintain FEI for portfolio stability

- Institutional investors: Strategic allocation to both, with MANA for long-term metaverse exposure and FEI for liquidity management

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between FEI and MANA? A: FEI is a stablecoin focused on maintaining a stable value through its Protocol Controlled Value model, while MANA is a token used in the Decentraland metaverse platform. FEI aims for price stability, whereas MANA's value fluctuates based on metaverse adoption and virtual land demand.

Q2: Which coin has shown better price performance recently? A: MANA has shown more stability in recent market cycles. While FEI dropped from a high of $5.55 to a low of $0.15544, MANA reached an all-time high of $5.85 in March 2024 and is currently trading at $0.2837.

Q3: How do the supply mechanisms of FEI and MANA differ? A: FEI uses a Protocol Controlled Value model with algorithmic stabilization mechanisms to maintain its value. MANA has a fixed supply of 2.19 billion tokens with deflationary elements through LAND purchases in Decentraland.

Q4: Which coin has attracted more institutional interest? A: MANA has attracted more institutional interest due to its established position in the Metaverse space and partnerships with major brands for virtual experiences.

Q5: What are the long-term price predictions for FEI and MANA by 2030? A: For FEI, the base case prediction is $1.46 - $2.08, with an optimistic case of $2.08 - $2.85. For MANA, the base case prediction is $0.53 - $0.57, with an optimistic case of $0.57 - $0.64.

Q6: How should investors allocate their portfolio between FEI and MANA? A: Conservative investors might consider allocating 70% to FEI and 30% to MANA, while aggressive investors might opt for 40% FEI and 60% MANA. The specific allocation should depend on individual risk tolerance and investment goals.

Q7: What are the primary risks associated with investing in FEI and MANA? A: For FEI, risks include volatility in the stablecoin market and potential de-pegging events. For MANA, risks involve high volatility tied to metaverse adoption and speculation. Both face technical risks such as smart contract vulnerabilities and regulatory uncertainties.

Bitcoin And AUD

What is PAXG: Understanding the Gold-Backed Digital Asset and Its Role in Modern Investment Portfolios

2025 USD1Price Prediction: Comprehensive Analysis and Forecast of Key Market Factors Influencing Digital Currency Values

Ondo Finance: What It Is and How ONDO Token Works

USDT Loan Without Collateral: How It Works and Where to Get One

Falcon Finance (FF): What It Is and How It Works

Meaning of Transaction ID in Crypto

What Does SPWN Mean in the Crypto Industry?

Sei and Xiaomi Partner to Pre-Install Crypto Wallets on New Smartphones in 2026

Gemini Gets CFTC Approval, What This Means for Crypto Prediction Markets

State Street & Galaxy Launch Solana-Based Tokenized Liquidity Fund SWEEP in 2026