2025 SWAN Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SWAN's Market Position and Investment Value

Swan Chain (SWAN), as the first AI SuperChain for decentralized AI computing, has made significant strides since its inception in 2021. As of 2025, SWAN's market capitalization has reached $147,490, with a circulating supply of approximately 98,000,000 tokens, and a price hovering around $0.001505. This asset, often hailed as the "Web3-AI Fusion Pioneer," is playing an increasingly crucial role in merging artificial intelligence with blockchain technology.

This article will comprehensively analyze SWAN's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SWAN Price History Review and Current Market Status

SWAN Historical Price Evolution Trajectory

- 2021: SwanChain project initiated, price not available as trading hadn't begun

- 2024: SWAN reached its all-time high of $0.3939 on December 16, marking a significant milestone

- 2025: Market downturn, price dropped to its all-time low of $0.001183 on November 24

SWAN Current Market Situation

As of November 29, 2025, SWAN is trading at $0.001505, experiencing a 7.58% decrease in the last 24 hours. The token has shown volatility with a 18.98% increase over the past week, but a 17.11% decrease in the last 30 days. SWAN's market capitalization stands at $147,490, ranking 4495th in the cryptocurrency market. The circulating supply is 98,000,000 SWAN, which represents 9.8% of the total supply of 1,000,000,000 tokens. The fully diluted market cap is $1,505,000. Trading volume in the last 24 hours amounts to $12,659.15, indicating moderate market activity. The current price represents a significant 96.073% decrease from a year ago, reflecting the challenging market conditions SWAN has faced.

Click to view the current SWAN market price

SWAN Market Sentiment Indicator

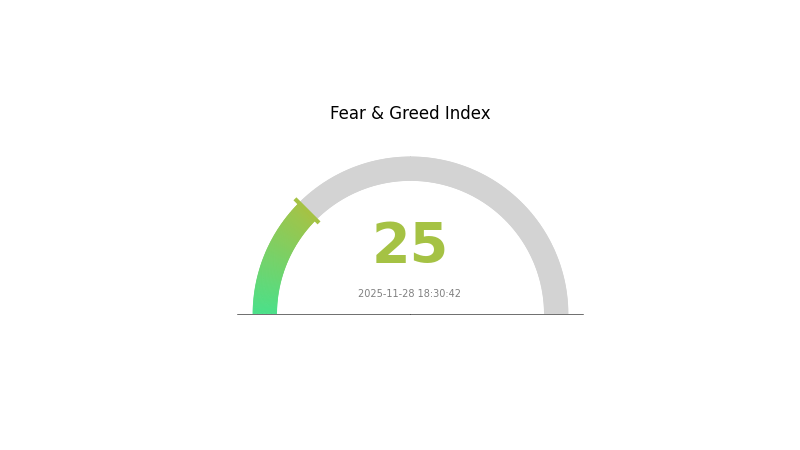

2025-11-28 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the SWAN index registering a low of 25. This signals a period of heightened pessimism and uncertainty among investors. During such times, assets are often undervalued as panic selling takes hold. However, for contrarian investors, this could present potential buying opportunities. It's crucial to remember that market sentiment can shift rapidly, and thorough research is essential before making any investment decisions in this volatile environment.

SWAN Holdings Distribution

The address holdings distribution data for SWAN reveals an interesting pattern in token concentration. With no specific addresses holding significant percentages of the total supply, it suggests a relatively decentralized distribution of SWAN tokens among holders.

This dispersed ownership structure could be indicative of a healthy ecosystem where no single entity has overwhelming control over the token supply. Such a distribution may contribute to reduced volatility and a lower risk of market manipulation, as large-scale sell-offs from a single source are less likely to occur.

However, the absence of major holders could also imply a lack of strong institutional or long-term investor commitment. This may affect the token's stability and long-term growth prospects. Overall, the current distribution pattern reflects a market with potentially good liquidity and trading dynamics, but it may benefit from increased participation from larger stakeholders to enhance market depth and stability.

Click to view the current SWAN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting SWAN's Future Price

Supply Mechanism

- Tokenomics: SWAN utilizes a deflationary model with token burning mechanisms.

- Current Impact: The ongoing token burning is expected to create scarcity and potentially drive up the price over time.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, SWAN may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: SWAN is developing its ecosystem with various DApps and projects aimed at enhancing utility and adoption.

III. SWAN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00138 - $0.00151

- Neutral prediction: $0.00151 - $0.00176

- Optimistic prediction: $0.00176 - $0.00202 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00106 - $0.0021

- 2027: $0.00152 - $0.00212

- Key catalysts: Increased adoption, project developments, market recovery

2028-2030 Long-term Outlook

- Base scenario: $0.00202 - $0.00277 (assuming steady market growth)

- Optimistic scenario: $0.00277 - $0.00388 (assuming strong market performance)

- Transformative scenario: $0.00388+ (extremely favorable market conditions)

- 2030-12-31: SWAN $0.00388 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00202 | 0.00151 | 0.00138 | 0 |

| 2026 | 0.0021 | 0.00176 | 0.00106 | 17 |

| 2027 | 0.00212 | 0.00193 | 0.00152 | 28 |

| 2028 | 0.00267 | 0.00202 | 0.00107 | 34 |

| 2029 | 0.00319 | 0.00235 | 0.00218 | 56 |

| 2030 | 0.00388 | 0.00277 | 0.00205 | 84 |

IV. SWAN Professional Investment Strategies and Risk Management

SWAN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SWAN tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend direction and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AI industry news and SwanChain development updates

- Set strict stop-loss orders to manage downside risk

SWAN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. SWAN Potential Risks and Challenges

SWAN Market Risks

- High volatility: SWAN price may experience significant fluctuations

- Competition: Emerging AI blockchain projects may impact SwanChain's market share

- Market sentiment: Overall crypto market conditions can affect SWAN's performance

SWAN Regulatory Risks

- Uncertain regulations: Evolving AI and blockchain regulations may impact SwanChain

- Cross-border compliance: Varying international regulations could limit global adoption

- Data privacy concerns: Stricter data protection laws may affect AI operations

SWAN Technical Risks

- Smart contract vulnerabilities: Potential bugs in the SwanChain protocol

- Scalability challenges: Handling increased network load as adoption grows

- AI integration complexity: Ensuring seamless integration of AI and blockchain technologies

VI. Conclusion and Action Recommendations

SWAN Investment Value Assessment

SwanChain presents a unique value proposition in the AI-blockchain intersection, offering potential long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

SWAN Investment Recommendations

✅ Beginners: Consider small, gradual investments to gain exposure ✅ Experienced investors: Implement dollar-cost averaging strategy with set price targets ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

SWAN Trading Participation Methods

- Spot trading: Purchase SWAN tokens on Gate.com

- Staking: Participate in SwanChain's staking programs for passive income

- Liquidity provision: Contribute to liquidity pools on supported platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price target for Swan Energy in 2025?

Based on market analysis and growth projections, the price target for Swan Energy in 2025 is estimated to be around $0.75 to $0.85 per token.

Why is Swan energy falling?

Swan energy may be falling due to market volatility, reduced investor confidence, or broader economic factors affecting the crypto sector.

What is the price target for Swandef share in 2030?

Based on current market trends and potential growth, Swandef share could reach $50-$75 by 2030. However, cryptocurrency markets are highly volatile and unpredictable.

Will Swan Energy go up tomorrow?

Based on current market trends and positive sentiment, Swan Energy is likely to see an upward movement tomorrow. However, crypto markets can be volatile, so monitor closely.

2025 QUBIC Price Prediction: Analyzing Market Trends and Growth Potential in the Emerging Cryptocurrency Sector

2025 LUNAI Price Prediction: Potential Growth Trajectory and Market Analysis for the Next Bull Cycle

2025 NIKO Price Prediction: Analyzing Market Trends and Future Prospects for the Automotive Stock

2025 AIX Price Prediction: Emerging Trends and Market Factors Shaping the Future of AIX Cryptocurrency

2025 DOAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

2025 DOPE Price Prediction: Bullish Trends and Key Factors Influencing the Token's Future Value

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention