2025 SAND Price Prediction: Analyzing Market Trends and Potential Growth in the Metaverse Economy

Introduction: SAND's Market Position and Investment Value

The Sandbox (SAND), as a leading virtual game world platform, has made significant strides since its inception in 2020. As of 2025, SAND's market capitalization has reached $503,112,810, with a circulating supply of approximately 2,445,857,126 tokens, and a price hovering around $0.2057. This asset, often referred to as the "metaverse pioneer," is playing an increasingly crucial role in the realm of blockchain gaming and digital asset creation.

This article will comprehensively analyze SAND's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SAND Price History Review and Current Market Status

SAND Historical Price Evolution

- 2020: SAND launched, price around $0.03 at its lowest

- 2021: Bull market peak, SAND reached all-time high of $8.40

- 2022-2023: Crypto winter, price declined significantly from highs

SAND Current Market Situation

As of October 17, 2025, SAND is trading at $0.2057. The token has experienced a substantial decline from its all-time high of $8.40, recorded on November 25, 2021. Over the past 24 hours, SAND has seen a 5.51% decrease in value.

The current market capitalization of SAND stands at $503,112,810, ranking it 154th among all cryptocurrencies. With a circulating supply of 2,445,857,126 SAND tokens, representing 81.53% of the total supply of 3 billion, the project maintains a relatively high circulation ratio.

SAND has shown negative price movements across various timeframes:

- 1 hour: -0.77%

- 24 hours: -5.51%

- 7 days: -22.74%

- 30 days: -31.64%

- 1 year: -23.58%

These figures indicate a consistent downward trend in the short to medium term, suggesting bearish sentiment in the market. The token is currently trading closer to its historical low of $0.02897764 than its all-time high, reflecting the challenging market conditions faced by many cryptocurrencies in recent times.

The 24-hour trading volume for SAND is $374,704, which is relatively low compared to its market capitalization, potentially indicating reduced trading activity and liquidity.

Click to view the current SAND market price

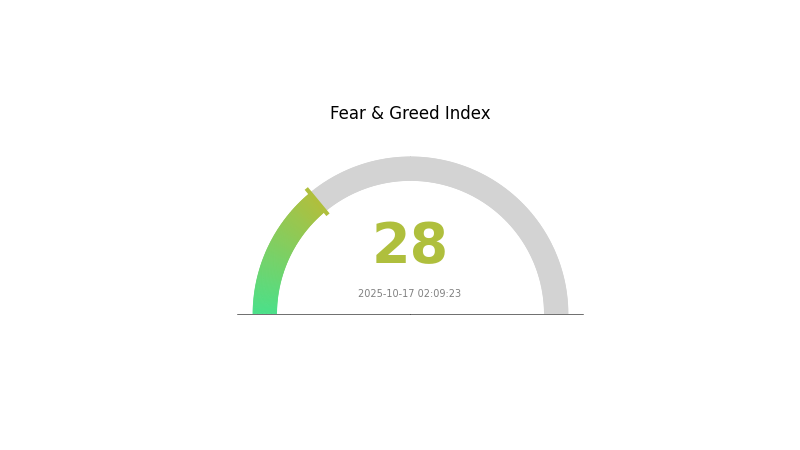

SAND Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The SAND market is currently in a state of fear, with the sentiment index at 28. This indicates a cautious atmosphere among investors. During such periods, some traders may view it as a potential buying opportunity, adhering to the "be greedy when others are fearful" philosophy. However, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions. The crypto market remains volatile, and sentiment can shift rapidly.

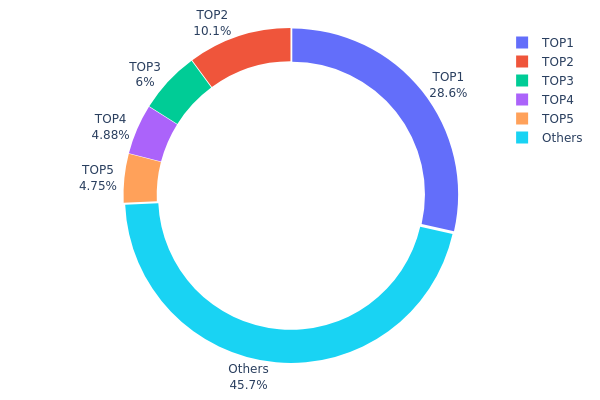

SAND Holdings Distribution

The address holdings distribution data for SAND reveals a significant concentration of tokens among a few top addresses. The top address holds 28.56% of the total supply, while the top 5 addresses collectively control 54.27% of SAND tokens. This high concentration suggests a potential centralization risk within the SAND ecosystem.

Such a distribution pattern could have substantial implications for market dynamics. The concentrated holdings may lead to increased price volatility, as large-scale transactions by these major holders could significantly impact the market. Moreover, this concentration raises concerns about potential market manipulation, as these addresses have the capacity to exert considerable influence on token supply and demand.

From a broader perspective, this distribution reflects a relatively low degree of decentralization in SAND's on-chain structure. While a large portion (45.73%) is held by other addresses, the dominance of a few major holders could potentially undermine the project's stability and governance decentralization efforts. This situation warrants close monitoring by investors and stakeholders in the SAND ecosystem.

Click to view the current SAND Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca97...48c00c | 856995.77K | 28.56% |

| 2 | 0x40ec...5bbbdf | 302692.78K | 10.08% |

| 3 | 0x2f24...e72a35 | 180019.68K | 6.00% |

| 4 | 0x5026...e8f705 | 146447.30K | 4.88% |

| 5 | 0x5f5b...fa2a67 | 142501.07K | 4.75% |

| - | Others | 1371343.39K | 45.73% |

II. Key Factors Affecting SAND's Future Price

Supply Mechanism

- Continuous Buying Pressure: SAND experiences ongoing buying pressure due to various factors, including the popularity of the metaverse narrative.

Institutional and Whale Dynamics

- Enterprise Adoption: The Sandbox ecosystem's development and partnerships influence SAND's value potential.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, SAND may be viewed as a potential hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- Ecosystem Development: The continued growth and value creation within The Sandbox ecosystem directly impact SAND's price potential.

- Ecosystem Applications: The Sandbox platform hosts various DApps and ecosystem projects that contribute to SAND's utility and demand.

III. SAND Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.19121 - $0.20560

- Neutral forecast: $0.20560 - $0.22000

- Optimistic forecast: $0.22000 - $0.23438 (requires favorable metaverse adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.17973 - $0.31217

- 2028: $0.23318 - $0.29079

- Key catalysts: Metaverse expansion, gaming industry partnerships, improved blockchain scalability

2030 Long-term Outlook

- Base scenario: $0.29957 - $0.32212 (assuming steady metaverse growth)

- Optimistic scenario: $0.32212 - $0.40000 (assuming widespread metaverse adoption)

- Transformative scenario: $0.40000 - $0.47674 (assuming revolutionary metaverse applications)

- 2030-12-31: SAND $0.47674 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23438 | 0.2056 | 0.19121 | 0 |

| 2026 | 0.25299 | 0.21999 | 0.18039 | 6 |

| 2027 | 0.31217 | 0.23649 | 0.17973 | 14 |

| 2028 | 0.29079 | 0.27433 | 0.23318 | 33 |

| 2029 | 0.36168 | 0.28256 | 0.26843 | 37 |

| 2030 | 0.47674 | 0.32212 | 0.29957 | 56 |

IV. SAND Professional Investment Strategies and Risk Management

SAND Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in the metaverse concept

- Operational suggestions:

- Accumulate SAND tokens during market dips

- Participate in The Sandbox ecosystem to gain additional benefits

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor The Sandbox ecosystem developments for potential price catalysts

SAND Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple metaverse and gaming tokens

- Options strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SAND

SAND Market Risks

- Volatility: High price fluctuations common in the crypto market

- Competition: Increasing number of metaverse projects may dilute market share

- Adoption risk: Slow user adoption of The Sandbox platform could impact token value

SAND Regulatory Risks

- Uncertain regulations: Potential for stricter crypto regulations globally

- Tax implications: Changing tax laws may affect SAND token holders

- Security token classification: Risk of being classified as a security in some jurisdictions

SAND Technical Risks

- Smart contract vulnerabilities: Potential for exploits in The Sandbox's smart contracts

- Scalability issues: Ethereum network congestion could affect platform performance

- Cybersecurity threats: Risk of hacks or attacks on The Sandbox ecosystem

VI. Conclusion and Action Recommendations

SAND Investment Value Assessment

SAND offers long-term potential in the growing metaverse sector but faces short-term volatility and adoption challenges. The token's value is closely tied to The Sandbox's success and the broader acceptance of virtual worlds.

SAND Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Explore partnerships within The Sandbox ecosystem for additional value creation

SAND Trading Participation Methods

- Spot trading: Purchase SAND tokens on Gate.com for direct ownership

- Staking: Participate in SAND staking programs for passive income

- Ecosystem participation: Engage in The Sandbox platform to potentially earn SAND tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can SAND reach $10?

Yes, SAND could potentially reach $10 if the metaverse trend continues to grow and The Sandbox maintains its strong position in the market.

Does SAND crypto have a future?

SAND crypto shows potential with a projected profit of $2,261.99 by November 2025. Market conditions are neutral, and long-term prospects remain speculative but promising.

How much will SAND be worth in 2030?

Based on statistical projections, SAND could be worth around $0.0801 by mid-2030 and approximately $0.0621 by the end of 2030.

Can sandbox reach $5?

Yes, Sandbox (SAND) could potentially reach $5 by 2029, based on current market trends and community support. This forecast aligns with existing price projections and market analysis.

TLM vs LTC: Comparing Two Cryptocurrency Investment Strategies in a Volatile Market

POLIS vs AVAX: Comparing Governance Models and Ecosystem Development in Next-Generation Blockchain Platforms

SUKU vs SAND: Comparative Analysis of Two Leading Blockchain Platforms in the Metaverse Economy

SHPING vs SAND: A Comprehensive Comparison of Two Leading Blockchain Tokens in the Digital Economy

Is Sandbox (SAND) a good investment?: Evaluating the potential of this metaverse token in the evolving crypto landscape

Is Affyn (FYN) a good investment?: Analyzing the Potential and Risks of this Blockchain-based Metaverse Project

Cysic: Zero-Knowledge Infrastructure Platform for AI and Decentralized Computing

US Bank Regulator OCC Facilitates National Banks Cryptocurrency Trading

ASTER Spot Trading Guide: Real-Time Price Analysis and Trading Volume Insights

Twenty One Capital Bitcoin Stock Falls 25% Following Cantor Equity Merger

Dropee Daily Combo December 10, 2025