2025 LF Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: LF's Market Position and Investment Value

LF Labs (LF) as a Web3 growth and market making firm, has been dedicated to driving innovation and market growth since its inception. As of 2025, LF's market capitalization has reached $333,000, with a circulating supply of approximately 3,000,000,000 tokens, and a price hovering around $0.000111. This asset, known for its focus on market growth, is playing an increasingly crucial role in the Web3 ecosystem.

This article will provide a comprehensive analysis of LF's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LF Price History Review and Current Market Status

LF Historical Price Evolution Trajectory

- 2024: LF launched, price reached ATH of $0.028 on July 10

- 2024: Market correction, price dropped to ATL of $0.00000007388 on June 26

- 2025: Continued downtrend, price declined by 96.48% over the past year

LF Current Market Situation

As of October 31, 2025, LF is trading at $0.000111, experiencing a 6.09% decrease in the last 24 hours. The token's market capitalization stands at $333,000, with a fully diluted valuation of $1,110,000. LF's circulating supply is 3 billion tokens, representing 30% of the total supply of 10 billion tokens.

LF has seen significant price volatility across various timeframes:

- 1-hour change: +0.36%

- 7-day change: -15.90%

- 30-day change: -28.74%

- 1-year change: -96.48%

The token's trading volume in the past 24 hours is $14,582.63, indicating moderate market activity. LF is currently ranked #3829 in the cryptocurrency market, with a market dominance of 0.000028%.

Click to view the current LF market price

LF Market Sentiment Indicator

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the sentiment index at 29. This indicates a cautious atmosphere among investors. During such times, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, market sentiment can shift quickly, and opportunities may arise for those who are prepared. Stay informed, diversify your portfolio, and consider using risk management tools available on platforms like Gate.com to navigate these uncertain waters.

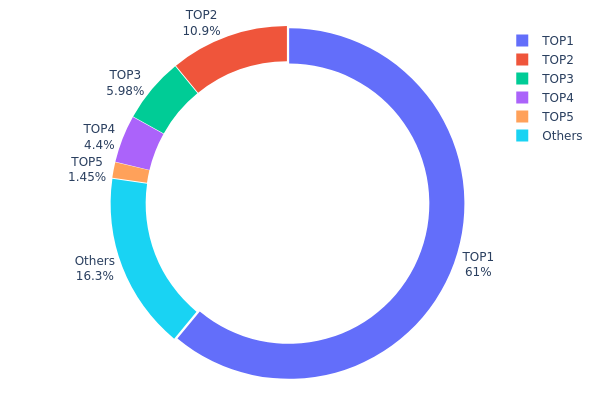

LF Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for LF. The top address holds a staggering 61% of the total supply, while the top 5 addresses collectively control 83.72% of all tokens. This extreme concentration raises concerns about centralization and potential market manipulation.

Such a top-heavy distribution can lead to significant price volatility and market instability. The dominant holders have the power to substantially influence LF's price through large-scale buying or selling actions. Furthermore, this concentration may deter new investors, as it suggests a lack of widespread adoption and poses risks of sudden market movements.

From a market structure perspective, the current distribution indicates a low level of decentralization and potentially compromised on-chain stability. This scenario underscores the importance of monitoring large address movements and emphasizes the need for greater token dispersion to enhance LF's long-term sustainability and market resilience.

Click to view the current LF Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9bae...f39ec6 | 6100000.00K | 61.00% |

| 2 | 0x9642...2f5d4e | 1091246.29K | 10.91% |

| 3 | 0x0d07...b492fe | 598024.60K | 5.98% |

| 4 | 0x4fb3...a83128 | 439600.00K | 4.39% |

| 5 | 0xb373...a1cc12 | 144535.85K | 1.44% |

| - | Others | 1626593.27K | 16.28% |

II. Key Factors Affecting LF's Future Price

Supply Mechanism

- Market Making: LF LABS is committed to shaping the future of Web3 through continuous innovation and strong market-making capabilities.

- Current Impact: The market-making activities of LF LABS are expected to influence the liquidity and price stability of LF tokens.

Institutional and Whale Dynamics

- Whale Manipulation: Due to the relatively small market cap and trading depth, LF is susceptible to manipulation by large holders or "whales," which can lead to significant price volatility.

Macroeconomic Environment

- Policy Impact: External economic factors, such as financial policies and macroeconomic conditions, have a significant influence on LF's price formation mechanism.

Technological Development and Ecosystem Building

- Layer-2 Solutions: The progress of Layer-2 solutions is crucial for LF's technical development. Any delays in implementation could negatively impact market confidence.

- Game Testing: The timely release of game testing versions is important for maintaining investor interest and confidence in the project.

- Ecosystem Applications: The development and success of main DApps and ecosystem projects within the LF network will play a key role in driving adoption and value.

III. LF Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00009 - $0.00011

- Neutral prediction: $0.00011 - $0.00013

- Optimistic prediction: $0.00013 - $0.00016 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00009 - $0.00016

- 2027: $0.00011 - $0.00020

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00020 - $0.00023 (assuming steady market growth)

- Optimistic scenario: $0.00023 - $0.00024 (assuming strong market performance)

- Transformative scenario: $0.00024 - $0.00025 (assuming breakthrough innovations)

- 2030-12-31: LF $0.00023 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00016 | 0.00011 | 0.00009 | 0 |

| 2026 | 0.00016 | 0.00014 | 0.00009 | 22 |

| 2027 | 0.0002 | 0.00015 | 0.00011 | 34 |

| 2028 | 0.00023 | 0.00017 | 0.00017 | 57 |

| 2029 | 0.00025 | 0.0002 | 0.00013 | 81 |

| 2030 | 0.00024 | 0.00023 | 0.0002 | 103 |

IV. Professional Investment Strategies and Risk Management for LF

LF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate LF tokens during market dips

- Set clear investment goals and exit strategies

- Store tokens in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price levels

LF Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement automated sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for LF

LF Market Risks

- High volatility: LF price may experience significant fluctuations

- Limited liquidity: Trading volume may be insufficient for large trades

- Market sentiment: Crypto market trends may impact LF's performance

LF Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may affect LF's operations

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Potential limitations on international transactions

LF Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token's code

- Network congestion: Ethereum network issues may impact transaction speeds

- Technological obsolescence: Emerging technologies may outpace LF's offerings

VI. Conclusion and Action Recommendations

LF Investment Value Assessment

LF Labs presents a high-risk, high-potential investment opportunity in the Web3 growth and market-making sector. While its innovative approach offers long-term value potential, short-term volatility and market risks remain significant concerns.

LF Investment Recommendations

✅ Beginners: Start with small, affordable investments to learn about the market ✅ Experienced investors: Consider LF as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and implement robust risk management strategies

LF Trading Participation Methods

- Spot trading: Buy and sell LF tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving LF tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Flux Crypto have a future?

Yes, Flux Crypto has a promising future. Projections suggest a potential price of $6.25 by 2030, indicating significant growth potential in the coming years.

How high can flux go?

Flux has potential to reach $0.45 by 2030, based on current trends. Its all-time high was $3.33, showing significant upside potential from its current price of $0.1239.

Which crypto boom in 2025 prediction?

Bitcoin, Ethereum, and other major cryptocurrencies are predicted to see significant growth in 2025. Current market trends support forecasts of substantial price increases across the crypto market.

Would hamster kombat coin reach $1?

Based on current predictions, it's unlikely Hamster Kombat will reach $1 by 2030. The coin's growth potential seems limited in the near future.

2025 VSN Price Prediction: Navigating the Future of Digital Assets in a Volatile Crypto Market

2025 REDOPrice Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AKI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

2025 ATEM Price Prediction: Analyzing Market Trends and Future Prospects for the Cryptocurrency

2025 IDOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 NUMI Price Prediction: Will This Crypto Asset Surge or Stagnate in the Coming Years?

What are the major smart contract vulnerabilities and exchange custody risks in crypto security events?

Exploring Solana: Insights into Transaction Fees and Costs

Understanding Solana: Sending and Receiving SOL Tokens Explained

Understanding Cryptocurrency Mining: How It Works Explained

Horizontally Scaling Blockchain Architecture: A Deep Dive into Solana's Innovations