2025 IDEX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: IDEX's Market Position and Investment Value

IDEX (IDEX) is a decentralized smart contract exchange based on Ethereum, established by Aurora DAO, supporting real-time transactions, high transaction throughput, price limits and market orders. Since its inception in 2019, IDEX has evolved as a key infrastructure in the decentralized finance ecosystem. As of December 2025, IDEX's market capitalization has reached $10.34 million, with a circulating supply of approximately 995.16 million tokens, maintaining a price around $0.01034. This innovative decentralized trading platform is playing an increasingly critical role in enabling peer-to-peer trading and supporting the growth of decentralized finance applications.

This article will provide a comprehensive analysis of IDEX's price trends through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

I. IDEX Price History Review and Current Market Status

IDEX Historical Price Trajectory

- 2021: IDEX reached its all-time high of $0.937763 on September 8, 2021, marking the peak of the token's market performance.

- 2020: IDEX recorded its all-time low of $0.00563813 on March 23, 2020, representing the lowest valuation point in the token's history.

- 2025: Significant downward pressure, with the token declining 80.82% over the past year, currently trading at $0.01034 as of December 22, 2025.

IDEX Current Market Conditions

As of December 22, 2025, IDEX is trading at $0.01034, representing a substantial decline from its historical peak. The token has experienced significant bearish momentum:

- 24-hour performance: Down 3.94%, with trading range between $0.010236 and $0.010929

- 7-day performance: Declined 13.8% over the weekly period

- 30-day performance: Dropped 17.05% in the monthly timeframe

- Year-to-date performance: Plummeted 80.82%, reflecting extended downward pressure

Market metrics:

- 24-hour trading volume: $13,670.24

- Fully diluted market capitalization: $10,340,000

- Circulating supply: 995,161,126.52 IDEX (99.52% of total supply)

- Total supply: 1,000,000,000 IDEX tokens

- Number of holders: 16,742

- Market dominance: 0.00032%

IDEX is currently ranked 1,159 by market capitalization among all cryptocurrencies. The token shows extreme fear sentiment in the current market environment (VIX reading: Extreme Fear as of December 21, 2025).

Click to view current IDEX market price

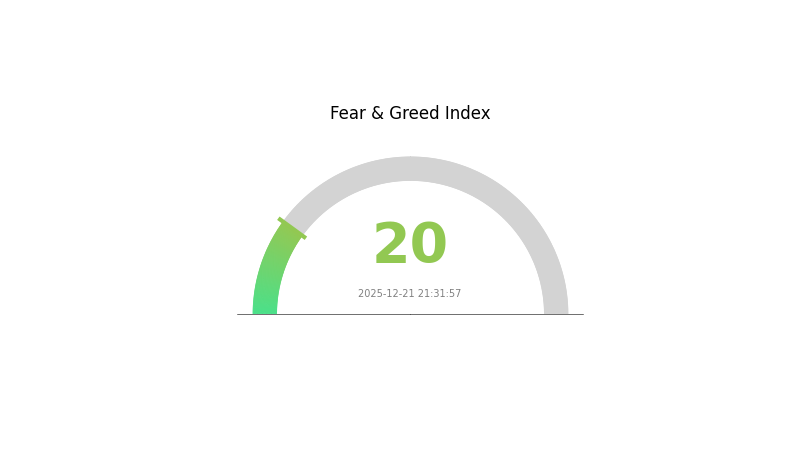

IDEX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 20. This reading signals significant market pessimism and heightened risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. Market downturns can create entry points for those with strong conviction. However, traders should exercise caution and maintain proper risk management strategies. Monitor key support levels and market developments closely before making trading decisions. Consider your risk tolerance and investment timeline carefully during volatile periods.

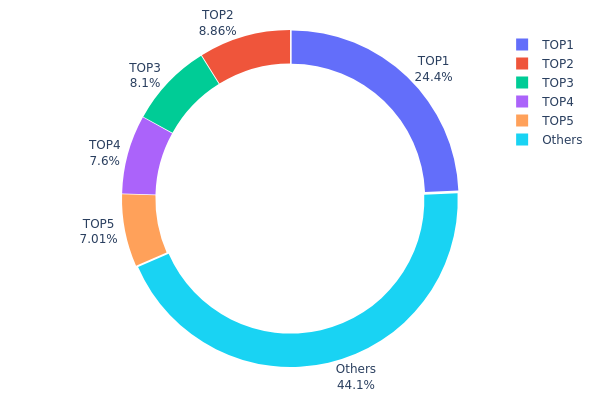

IDEX Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing how IDEX tokens are dispersed among major stakeholders and the broader holder base. This metric serves as a critical indicator of market structure, liquidity dynamics, and potential vulnerability to concentrated selling pressure or market manipulation.

Current analysis of IDEX's top-5 address distribution reveals a moderate concentration pattern. The leading address (0xf977...41acec) commands 24.35% of total holdings, while the subsequent four addresses collectively account for 31.55% of the circulating supply. Combined, these top five addresses control approximately 55.9% of IDEX tokens, indicating a notable degree of wealth centralization. However, the remaining 44.1% distributed among other addresses suggests meaningful participation from dispersed stakeholders, which provides a degree of decentralization balance.

The concentration metrics present a mixed risk profile for market stability. While the top address's substantial holdings could theoretically exert significant pressure on price discovery and liquidity, the absence of extreme concentration (wherein a single entity controls over 50% unilaterally) mitigates systemic vulnerability. The distribution pattern suggests that IDEX maintains reasonable decentralization characteristics, though continued monitoring of large holder movements remains prudent. The relatively healthy participation from smaller addresses indicates active ecosystem engagement, though the market structure remains susceptible to coordinated actions by top-tier stakeholders during periods of elevated volatility.

View the latest IDEX holdings distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 243556.23K | 24.35% |

| 2 | 0xcea6...2a0d13 | 88644.19K | 8.86% |

| 3 | 0x9825...056519 | 80997.17K | 8.09% |

| 4 | 0x247e...702d04 | 76000.00K | 7.60% |

| 5 | 0xad25...e9ea2a | 70098.98K | 7.00% |

| - | Others | 440703.42K | 44.1% |

II. Core Factors Affecting IDEX's Future Price

Supply Mechanism

- Block Reward Halving: IDEX price trends are driven by supply and demand dynamics, with block reward halving representing a critical supply-side event that impacts token availability and market pricing.

- Historical Patterns: Past supply changes through block reward halvings and protocol updates have demonstrated measurable effects on price movements and market cycles.

- Current Impact: Protocol updates and adjustments to token supply mechanics continue to influence price expectations as the network evolves.

Regulatory and Market Adoption

- Regulatory Environment: Real-world events such as regulatory changes play an important role in shaping IDEX's price trajectory and investor sentiment.

- Exchange Operations: The operational status and liquidity availability on cryptocurrency exchanges significantly impact trading volume and price discovery mechanisms.

Macroeconomic Environment

- Market Cycle Evolution: According to Bitwise Chief Investment Officer Matt Hougan, factors that previously drove four-year cycles—including Bitcoin halving impacts, interest rate cycles, and cryptocurrency leverage-driven boom-bust dynamics—are expected to show significantly diminished influence in future market cycles.

- Changing Dynamics: The cryptocurrency market is experiencing a structural shift where traditional economic factors that historically dominated price movements may exert less influence on IDEX and similar digital assets going forward.

Three, 2025-2030 IDEX Price Forecast

2025 Outlook

- Conservative Forecast: $0.00795-$0.01033

- Neutral Forecast: $0.01033

- Bullish Forecast: $0.01436 (requires sustained market interest and positive ecosystem developments)

2026-2028 Medium-Term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth potential

- Price Range Predictions:

- 2026: $0.01123-$0.01814 (19% upside potential)

- 2027: $0.00823-$0.01707 (47% cumulative gain)

- 2028: $0.00953-$0.0181 (56% cumulative gain)

- Key Catalysts: Platform adoption growth, increasing trading volume, strategic partnerships, and broader crypto market recovery momentum

2029-2030 Long-Term Outlook

- Base Case: $0.01096-$0.02004 (65% cumulative gain by 2029, representing steady growth trajectory)

- Bullish Case: $0.01338-$0.02211 (79% cumulative gain by 2030, assuming accelerated ecosystem expansion and mainstream adoption)

- Transformative Case: $0.02211+ (exceptional growth driven by major technological breakthroughs, significant institutional adoption, or major platform innovations)

- 2030-12-22: IDEX projected at approximately $0.02211 (representing substantial multi-year appreciation from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01436 | 0.01033 | 0.00795 | 0 |

| 2026 | 0.01814 | 0.01234 | 0.01123 | 19 |

| 2027 | 0.01707 | 0.01524 | 0.00823 | 47 |

| 2028 | 0.0181 | 0.01616 | 0.00953 | 56 |

| 2029 | 0.02004 | 0.01713 | 0.01096 | 65 |

| 2030 | 0.02211 | 0.01858 | 0.01338 | 79 |

IDEX Investment Strategy and Risk Management Report

IV. IDEX Professional Investment Strategy and Risk Management

IDEX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Retail investors with medium to long-term conviction on decentralized exchange ecosystems

- Operational recommendations:

- Establish initial positions during market downturns when IDEX trades at significant discounts to historical highs

- Implement dollar-cost averaging over 6-12 months to reduce timing risk

- Store tokens securely in self-custody solutions for extended holding periods

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Identify key price zones at $0.010236 (24h low) and $0.010929 (24h high) for entry and exit points

- Volume analysis: Monitor the 24-hour trading volume of $13,670.24 as an indicator of market liquidity and trend confirmation

- Swing trading considerations:

- Capitalize on IDEX's 24-hour price volatility of -3.94% for short-term trading opportunities

- Pay attention to broader market movements, as IDEX shows a 7-day decline of -13.8%, suggesting bearish sentiment persistence

IDEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1.0% of total crypto portfolio

- Active investors: 1.5-3.0% of total crypto portfolio

- Professional investors: 3.0-5.0% of total crypto portfolio (with hedging strategies)

(2) Risk Hedging Solutions

- Position sizing: Allocate only a portion of speculative capital to IDEX given its market cap rank of 1159 and relatively lower liquidity compared to top-tier assets

- Profit-taking strategy: Set predetermined exit points following 20-30% gains to lock in profits before potential reversals

(3) Secure Storage Options

- Self-custody solutions: Use secure hardware wallet implementations or cold storage methods for holdings exceeding $10,000

- Exchange custody: For active traders, maintain trading positions on Gate.com with appropriate security measures including two-factor authentication

- Security best practices: Never share private keys, use hardware wallet backups, and implement multi-signature schemes for large holdings

V. IDEX Potential Risks and Challenges

IDEX Market Risks

- Token concentration: With 99.52% of total supply already in circulation and only 995.16 million IDEX tokens outstanding, there is limited supply elasticity for significant price appreciation

- Historical drawdown severity: IDEX has experienced an 80.82% decline over the past year, reflecting severe bear market pressure and investor skepticism

- Low trading volume: Daily volume of $13,670.24 is relatively thin, which may result in high slippage during larger transactions and price manipulation vulnerabilities

IDEX Regulatory Risks

- Decentralized exchange oversight: Regulatory authorities globally are increasing scrutiny on decentralized trading platforms; changes in DeFi regulations could impact IDEX's operational status

- Compliance uncertainty: Token exchanges and DeFi protocols may face changing regulatory requirements regarding token listings and trading pair offerings

- Jurisdictional restrictions: Certain regions may restrict access to decentralized exchange tokens or DeFi platforms, potentially reducing market accessibility

IDEX Technical Risks

- Smart contract vulnerability: As a decentralized exchange protocol built on Ethereum, IDEX faces inherent risks from smart contract exploits and code vulnerabilities

- Ethereum network dependencies: IDEX's performance and security are directly tied to Ethereum's network conditions, fee structures, and potential protocol changes

- Liquidity pool risks: The exchange's functionality depends on adequate liquidity provision; insufficient liquidity may result in poor price execution and user experience degradation

VI. Conclusion and Action Recommendations

IDEX Investment Value Assessment

IDEX represents a niche play in the decentralized exchange sector with significant risk-reward asymmetry. The token has experienced substantial depreciation (-80.82% annually), reflecting both market headwinds and potential loss of competitive positioning. The project's Aurora DAO governance structure provides some community alignment, but the thin trading volume and concentrated token supply suggest limited near-term price catalysts. Long-term investors should view IDEX as a speculative venture requiring careful position sizing and risk management.

IDEX Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto portfolio) through Gate.com's trading platform to gain exposure while limiting downside risk; prioritize learning about decentralized exchanges before scaling positions

✅ Experienced investors: Consider tactical accumulation during capitulation selling phases; employ technical analysis to identify entry points near support levels; maintain strict stop-loss discipline at 15-20% below entry prices

✅ Institutional investors: Conduct thorough due diligence on Aurora DAO's governance model and competitive positioning; allocate only within diversified DeFi token portfolios; consider direct AURA token evaluation given the 1:1 conversion rate

IDEX Trading Participation Methods

- Gate.com spot trading: Access IDEX through Gate.com's comprehensive trading interface for spot purchases and sales with competitive fee structures

- Direct token acquisition: Purchase IDEX tokens directly on Gate.com and manage self-custody for long-term strategic holdings

- Liquidity provision: Advanced users may provide liquidity on IDEX's decentralized protocol, though this carries additional impermanent loss and smart contract risks

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors must carefully assess their risk tolerance and consult professional financial advisors before making decisions. Never invest more than you can afford to lose.

FAQ

Does the IDEX coin have a future?

Yes, IDEX has strong future potential. The project plans to launch leverage trading and expand to multiple blockchains. With active development roadmap and sustained investor interest, IDEX is positioned for continued growth in the crypto market.

How high can an IDEX coin go?

IDEX could reach $1.3 by 2033, $24.9 by 2040, and $32 by 2050 based on market analysis and price trajectory predictions. Actual prices depend on adoption and market conditions.

Is IDEX worth buying?

Yes, IDEX offers strong value potential. With growing trading volume and increasing adoption in decentralized exchange markets, IDEX demonstrates solid fundamentals. The platform's liquidity, user engagement, and market position suggest attractive investment opportunities for long-term holders seeking exposure to DEX innovation.

Is Idex Corporation a good investment?

IDEX Corporation demonstrates solid fundamentals with strong margins and proven acquisition strategy. The company offers stable value for investors seeking industrial exposure, though growth potential remains moderate. Your investment decision should align with personal financial goals and risk profile.

2025 BYN Price Prediction: Analyzing Economic Factors and Market Trends for Belarus's Currency

2025 BAKE Price Prediction: Will This DeFi Token Rise to New Heights in the Crypto Market?

2025 EUL Price Prediction: Expert Analysis and Market Forecast for Euler Token

2025 STO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

How Has the SwissCheese (SWCH) Price Surged 39.53% in 24 Hours?

2025 SEND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

如何安全購入 USDT:穩定幣購買全攻略

Is RSS3 (RSS3) a good investment?: A Comprehensive Analysis of the Web3 Content Distribution Protocol

Is LAB (LAB) a good investment?: Analyzing the Token's Potential, Risks, and Market Performance in 2024

Is Major (MAJOR) a good investment?: A comprehensive analysis of market potential, risk factors, and future prospects for cryptocurrency investors

Discover BLESS Token: A Comprehensive Guide to Its Idle Computing Network Launch