2025 HGET Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: HGET's Market Position and Investment Value

Hedget (HGET), as a decentralized protocol for options trading, has been playing an increasingly crucial role in the DeFi sector since its inception. As of 2025, HGET's market capitalization has reached $86,941.88, with a circulating supply of approximately 1,751,448 tokens, and a price hovering around $0.04964. This asset, known as a "risk-reducing DeFi protocol," is making significant contributions to the field of decentralized finance options trading.

This article will provide a comprehensive analysis of HGET's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HGET Price History Review and Current Market Status

HGET Historical Price Evolution

- 2020: HGET launched, reaching its all-time high of $15.44 on September 13, 2020

- 2021-2024: Price experienced significant volatility and overall downward trend

- 2025: Price reached its all-time low of $0.03825506 on October 18, 2025

HGET Current Market Situation

As of November 29, 2025, HGET is trading at $0.04964, with a 24-hour trading volume of $12,951.66. The token has seen a significant decline of 9.46% in the past 24 hours. HGET's market capitalization currently stands at $86,941.88, ranking it at 5056 in the global cryptocurrency market.

The token is experiencing bearish momentum across various timeframes:

- 1-hour change: -1.05%

- 7-day change: -3.04%

- 30-day change: -18.3%

- 1-year change: -45.26%

These figures indicate a consistent downward trend for HGET in both short-term and long-term perspectives. The token is currently trading 99.68% below its all-time high and 29.76% above its all-time low.

Click to view the current HGET market price

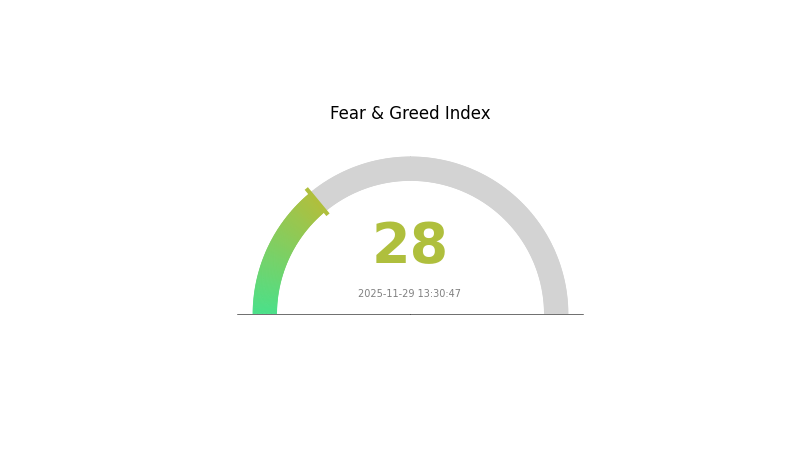

HGET Market Sentiment Index

2025-11-29 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market sentiment can shift quickly, and staying informed is key to making well-timed decisions in the volatile crypto space.

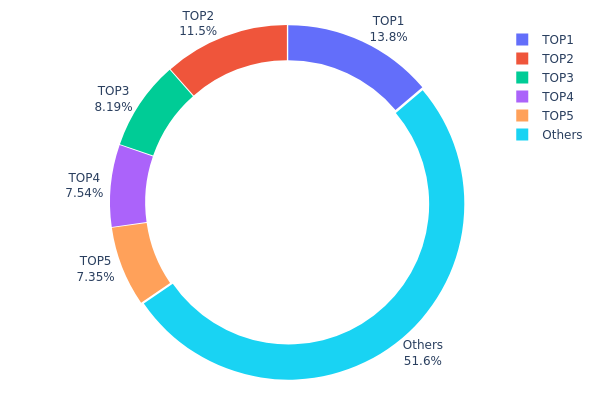

HGET Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of HGET tokens among different wallet addresses. According to the data, the top 5 addresses collectively hold 48.4% of the total HGET supply, with the largest holder possessing 13.81%. This indicates a relatively high concentration of tokens among a few key addresses.

While this level of concentration is not uncommon in the crypto market, it does raise some concerns about potential market manipulation and price volatility. The top holders have significant influence over the token's supply and could impact market dynamics if they decide to sell or accumulate large portions of their holdings. However, it's worth noting that 51.6% of the tokens are distributed among other addresses, suggesting a degree of decentralization beyond the top holders.

This distribution pattern reflects a market structure where major players have substantial control, but there's still room for broader participation. The current holdings distribution suggests that HGET's on-chain structure has moderate stability, though it may be susceptible to large price swings if top holders make significant moves.

Click to view the current HGET Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x75e4...37132a | 312.68K | 13.81% |

| 2 | 0x0d07...b492fe | 260.63K | 11.51% |

| 3 | 0x4d5e...3285f0 | 185.39K | 8.19% |

| 4 | 0xfe3c...d603a4 | 170.70K | 7.54% |

| 5 | 0x22d5...981c55 | 166.38K | 7.35% |

| - | Others | 1167.65K | 51.6% |

II. Key Factors Affecting HGET's Future Price

Supply Mechanism

- Fixed Supply: HGET has a fixed total supply, which creates scarcity and potentially supports long-term value.

- Current Impact: The limited supply may contribute to price stability or appreciation if demand increases.

Technical Development and Ecosystem Building

- Ecosystem Applications: HGET is part of the Hedget decentralized options trading platform, providing utility within its ecosystem.

III. HGET Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04717 - $0.04914

- Neutral prediction: $0.04914 - $0.05283

- Optimistic prediction: $0.05283 - $0.05651 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual recovery and growth

- Price range forecast:

- 2026: $0.04015 - $0.06339

- 2027: $0.05346 - $0.06392

- Key catalysts: Increasing adoption of HGET token, potential partnerships

2028-2030 Long-term Outlook

- Base scenario: $0.06101 - $0.0866 (assuming steady market growth)

- Optimistic scenario: $0.0866 - $0.10364 (assuming strong market performance)

- Transformative scenario: $0.10364 - $0.11431 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: HGET $0.11431 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05651 | 0.04914 | 0.04717 | -1 |

| 2026 | 0.06339 | 0.05283 | 0.04015 | 6 |

| 2027 | 0.06392 | 0.05811 | 0.05346 | 17 |

| 2028 | 0.0781 | 0.06101 | 0.05186 | 22 |

| 2029 | 0.10364 | 0.06956 | 0.04173 | 40 |

| 2030 | 0.11431 | 0.0866 | 0.07794 | 74 |

IV. Professional Investment Strategies and Risk Management for HGET

HGET Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate HGET tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor HGET's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

HGET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Options strategies: Use put options to protect against downside risk

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and never share private keys

V. Potential Risks and Challenges for HGET

HGET Market Risks

- High volatility: HGET's price can experience significant fluctuations

- Limited liquidity: Lower trading volumes may lead to slippage

- Competition: Other DeFi projects may offer similar or superior options trading solutions

HGET Regulatory Risks

- Uncertain regulatory landscape: Changing regulations may impact HGET's operations

- Compliance issues: Potential challenges in adhering to evolving financial regulations

- Cross-border restrictions: Different jurisdictions may impose varying rules on crypto derivatives

HGET Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the protocol

- Scalability challenges: Increased network congestion may lead to higher gas fees

- Oracle dependence: Reliance on external data sources for accurate pricing information

VI. Conclusion and Action Recommendations

HGET Investment Value Assessment

HGET offers exposure to the growing DeFi options market but faces significant competition and regulatory uncertainties. Its long-term value proposition depends on continued innovation and adoption, while short-term risks include high volatility and potential technical challenges.

HGET Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research

✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Evaluate HGET as part of a diversified crypto derivatives portfolio

HGET Trading Participation Methods

- Spot trading: Purchase HGET tokens on Gate.com

- DeFi participation: Engage with the Hedget protocol for options trading

- Staking: Explore potential staking opportunities if offered by the protocol

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Hydra Coin a good investment?

Yes, Hydra Coin shows potential as a good investment. Its innovative technology and growing adoption in the Web3 space suggest promising future value appreciation.

Will hot coin reach $1?

It's possible, but unlikely in the near future. HGET would need significant growth and adoption to reach $1, which may take years if it happens at all.

How high will helium hnt go?

Helium (HNT) could potentially reach $50-$75 by 2025, driven by increased IoT adoption and network expansion.

What is the target price for hut in 2025?

Based on market analysis and growth projections, the target price for HUT in 2025 is estimated to be around $15 to $20. This prediction considers potential market trends and technological advancements in the crypto space.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Exploring Promising Future NFT Projects

Understanding the Role and Functionality of Blockchain Nodes

Top Blockchain Mining Pools for New Crypto Enthusiasts

Exploring Omnichain Solutions in the LayerZero Ecosystem

Ultimate Guide to Bored Ape Yacht Club NFT Collectibles