2025 GST Price Prediction: Analyzing Market Trends and Potential Growth Factors for Green Satoshi Token

Introduction: GST's Market Position and Investment Value

Green Satoshi Token (GST), as a key component of the move-to-earn ecosystem, has made significant strides since its inception. As of 2025, GST's market capitalization stands at $2,619,814, with a circulating supply of approximately 1,147,161,857 tokens and a price hovering around $0.002264. This asset, often referred to as the "fitness incentive token," is playing an increasingly crucial role in the gamification of physical activity and health promotion.

This article will comprehensively analyze GST's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GST Price History Review and Current Market Status

GST Historical Price Evolution

- 2022: Launch of STEPN, price reached all-time high of $8.51 on April 29

- 2023: Market consolidation, price fluctuated between $0.1 and $0.5

- 2024: Bear market cycle, price dropped from $0.1 to $0.01

GST Current Market Situation

As of October 15, 2025, GST is trading at $0.002264, with a 24-hour trading volume of $16,328.89. The token has seen a 5.01% increase in the last 24 hours and a 6.94% rise in the past hour. However, it has experienced significant declines over longer periods, with a 13.99% drop in the past week, a 24.93% decrease over the last 30 days, and a 55.64% decline in the past year. The current price is 99.97% below its all-time high of $8.51, recorded on April 29, 2022. GST's market capitalization stands at $2,597,174, ranking it at 2184th in the cryptocurrency market.

Click to view the current GST market price

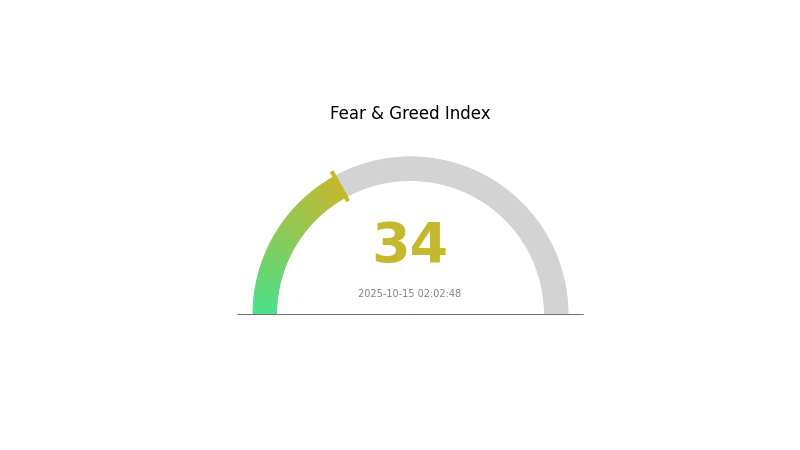

GST Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index at 34. This indicates a cautious sentiment among investors. During such periods, some may view it as an opportunity to buy, following the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade responsibly on Gate.com.

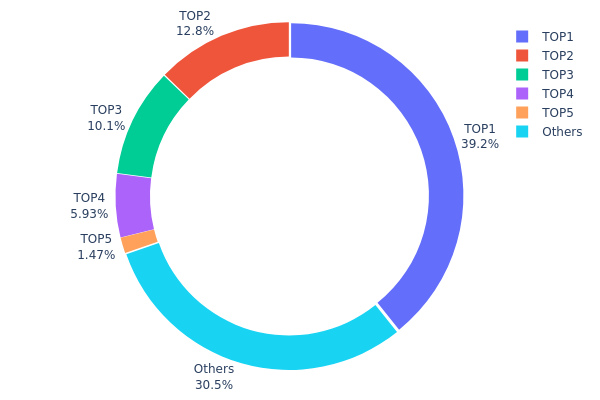

GST Holdings Distribution

The address holdings distribution data for GST reveals a highly concentrated ownership structure. The top address holds a significant 39.21% of the total supply, with the top five addresses collectively controlling 69.52% of all GST tokens. This concentration is particularly noteworthy, as it indicates a potential centralization of power within the GST ecosystem.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With nearly 40% of tokens held by a single address, any large-scale transactions from this holder could lead to significant price volatility. Furthermore, the top five addresses having the ability to influence over two-thirds of the total supply presents a risk of coordinated market actions that could disadvantage smaller holders.

This level of concentration suggests that GST's current on-chain structure may be less decentralized than ideal for a cryptocurrency project. It potentially compromises the network's resilience and could impact decision-making processes if these large holders have disproportionate influence over governance matters. Monitoring the behavior of these top addresses will be crucial for understanding future market dynamics and assessing the long-term stability of GST.

Click to view the current GST Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5566...415432 | 83135.36K | 39.21% |

| 2 | 0x7760...0eb0d2 | 27119.65K | 12.79% |

| 3 | 0x0d07...b492fe | 21486.70K | 10.13% |

| 4 | 0xba5a...d8f6a9 | 12569.36K | 5.92% |

| 5 | 0x08b6...73054c | 3118.88K | 1.47% |

| - | Others | 64548.62K | 30.48% |

II. Key Factors Affecting Future GST Prices

Supply Mechanism

- GST Reform: The Indian government plans to implement a new generation of GST reform, expected to take effect on September 22, 2025. Nearly 400 types of products will benefit from reduced tax rates, aimed at promoting domestic consumption.

- Historical Patterns: Previous GST reforms have typically led to increased consumer spending and economic growth in India.

- Current Impact: The upcoming GST rate reductions, especially for passenger vehicles from 28% to 18%, are expected to make cars more affordable and stimulate consumption across various sectors.

Institutional and Major Player Dynamics

- Institutional Holdings: International credit rating agency S&P has upgraded India's sovereign debt rating from "BBB-" to "BBB", reflecting confidence in India's economic growth and fundamentals.

- Corporate Adoption: Major automotive companies are adjusting their strategies to benefit from the GST reforms, particularly in the electric vehicle sector.

- National Policies: The Indian government is providing assistance to struggling domestic exporters and considering tax reduction measures to mitigate the impact on exports.

Macroeconomic Environment

- Monetary Policy Impact: The Reserve Bank of India has already cut interest rates by 100 basis points this year, with market expectations of further rate cuts before the end of 2025 due to controllable inflation pressures.

- Inflation Hedging Properties: The GST reforms are partly aimed at controlling inflation by making essential goods more affordable.

- Geopolitical Factors: India is actively pursuing trade agreements with various countries, including the EU and UK, to diversify its trade relationships and reduce dependence on any single market.

Technological Development and Ecosystem Building

- Digital Integration: The implementation of electronic invoicing systems and digital tax management platforms is enhancing tax compliance and reducing administrative burdens.

- Economic Reforms: Ongoing reforms in indirect taxation, including the "five taxes into one" initiative, are aimed at simplifying the tax structure and improving ease of doing business.

- Ecosystem Applications: The financial and consumer sectors in India, which form a significant part of the listed companies, are expected to benefit from these reforms and show potential for growth.

III. GST Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00115 - $0.00226

- Neutral prediction: $0.00226 - $0.00251

- Optimistic prediction: $0.00251 - $0.00276 (requires sustained growth in the move-to-earn sector)

2027-2028 Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range forecast:

- 2027: $0.00208 - $0.00348

- 2028: $0.00242 - $0.00433

- Key catalysts: Increased adoption of move-to-earn applications and technological advancements in the GST ecosystem

2029-2030 Long-term Outlook

- Base scenario: $0.00325 - $0.00404 (assuming steady market growth and user adoption)

- Optimistic scenario: $0.00404 - $0.00493 (assuming rapid expansion of the move-to-earn market)

- Transformative scenario: $0.00493+ (under extremely favorable conditions such as mainstream integration of move-to-earn concepts)

- 2030-12-31: GST $0.00404 (78% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00276 | 0.00226 | 0.00115 | 0 |

| 2026 | 0.00344 | 0.00251 | 0.00151 | 10 |

| 2027 | 0.00348 | 0.00298 | 0.00208 | 31 |

| 2028 | 0.00433 | 0.00323 | 0.00242 | 42 |

| 2029 | 0.00431 | 0.00378 | 0.00325 | 66 |

| 2030 | 0.00493 | 0.00404 | 0.00226 | 78 |

IV. GST Professional Investment Strategy and Risk Management

GST Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in the move-to-earn sector

- Operation suggestions:

- Accumulate GST tokens during market dips

- Participate in STEPN ecosystem to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor STEPN ecosystem updates and user adoption rates

GST Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different move-to-earn projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. GST Potential Risks and Challenges

GST Market Risks

- High volatility: GST price can experience significant fluctuations

- Competition: Emerging move-to-earn projects may impact STEPN's market share

- User adoption: Declining interest in move-to-earn apps could affect token value

GST Regulatory Risks

- Unclear regulations: Potential for regulatory actions against move-to-earn projects

- Tax implications: Uncertainty regarding taxation of earned tokens

- Geographical restrictions: Some countries may restrict or ban STEPN usage

GST Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: STEPN network may face congestion during peak usage

- Dependency on mobile devices: Technical issues with smartphones could disrupt usage

VI. Conclusion and Action Recommendations

GST Investment Value Assessment

GST presents a unique opportunity in the move-to-earn space but faces significant volatility and adoption challenges. Long-term potential exists if STEPN continues to innovate, but short-term risks remain high.

GST Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the STEPN ecosystem ✅ Experienced investors: Consider a balanced approach, combining holding and active trading ✅ Institutional investors: Conduct thorough due diligence, potentially explore partnerships with STEPN

GST Trading Participation Methods

- Spot trading: Buy and sell GST on Gate.com

- Staking: Participate in GST staking programs if available

- In-app earning: Use STEPN app to earn GST through physical activities

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will GST reach $1?

It's unlikely for GST to reach $1 soon. Current projections suggest it may not achieve this value in the near future. Long-term predictions remain uncertain.

Is GST a good buy?

GST could be a good buy for investors seeking exposure to move-to-earn projects. Its potential for growth in the fitness-crypto niche makes it an interesting option for diversifying crypto portfolios.

How high can GST go?

GST could potentially reach a high of $0.0380 in late 2024 and up to $0.0513 in 2025, based on current market projections and growth trends.

Is GST token a good investment?

GST token's potential as an investment is uncertain. While it has lost significant value, recent market trends show some signs of recovery, making it a speculative but potentially rewarding option for risk-tolerant investors.

Is Undeads Games (UDS) a good investment?: Analyzing the Potential of this Blockchain Gaming Token

Is StepN (GMT) a good investment?: Analyzing the potential and risks of the move-to-earn crypto project

2025 CATI Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Catizen (CATI) a good investment?: Analyzing the potential and risks of this feline-themed cryptocurrency

2025 FITFI Price Prediction: Navigating the Future of Fitness-to-Earn Tokens in a Volatile Crypto Market

2025 LOA Price Prediction: Bullish Trends and Key Factors Driving the Token's Future Value

Exploring the Role of Smart Contracts in Blockchain Technology

Maximize Passive Income with Fantom Token Staking

Top Choices for Trading Decentralized Cryptocurrencies

Understanding and Minimizing NFT Transaction Costs

Guide to Choosing Top AI Tools for Creating Unique NFTs