2025 AVAAI Price Prediction: Expert Analysis and Future Outlook for Artificial Virtue Assistant AI Token

Introduction: Market Position and Investment Value of AVAAI

AVAAI (AVA) stands as the first flagship AI agent launched through Holoworld AI, a launchpad platform designed to create audiovisual AI agents that come to life through video. Since its inception, AVA has established itself within the AI agent ecosystem with significant backing from prominent investors including Polychain and Nascent. As of December 22, 2025, AVAAI maintains a market capitalization of approximately $9.93 million with a circulating supply of around 999.2 million tokens, trading at approximately $0.009936 per token.

Built on the Solana blockchain, AVAAI represents an emerging asset class in the intersection of artificial intelligence and decentralized technology. The project has demonstrated notable ecosystem development through partnerships with over 25 IP and NFT brands, creating 10,000+ 3D avatar collections including collaborations with prominent names such as Milady, Pudgy Penguins, and L'Oreal. This multifaceted approach positions AVA as a significant player in the AI agent space, contributing to the broader digital transformation of content creation and virtual interaction.

This article provides a comprehensive analysis of AVAAI's price trajectory from 2025 through 2030, examining historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors. By synthesizing these elements, this analysis delivers professional price forecasts and actionable investment strategies for market participants seeking exposure to AI agent technologies.

I. AVAAI Price History Review and Market Status

AVAAI Historical Price Movement Trajectory

- January 2025: AVAAI reached its all-time high (ATH) of $0.338 on January 15, 2025, marking the peak of market enthusiasm for the project.

- October 2025: AVAAI dropped to its all-time low (ATL) of $0.00339 on October 10, 2025, representing a significant correction from previous highs.

- December 2025: The token has recovered modestly, trading in the range of $0.009793 to $0.011045 during the 24-hour period, showing some stabilization after months of decline.

AVAAI Current Market Status

As of December 22, 2025, AVAAI is trading at $0.009936, representing a -6.53% decline over the past 24 hours and a -0.19% change in the last hour. The token demonstrates a 7-day positive momentum of +22.93%, suggesting recent recovery efforts, though the 1-year performance shows a stark -53.16% decline from its launch price of $0.0000858.

The current market capitalization stands at approximately $9.93 million USD with a fully diluted valuation (FDV) of $9.94 million USD, indicating a circulation ratio of 99.92% of the total supply. The 24-hour trading volume is recorded at $621,881.21 USD, with AVAAI maintaining a ranking of 1,182 in the broader cryptocurrency market by market cap.

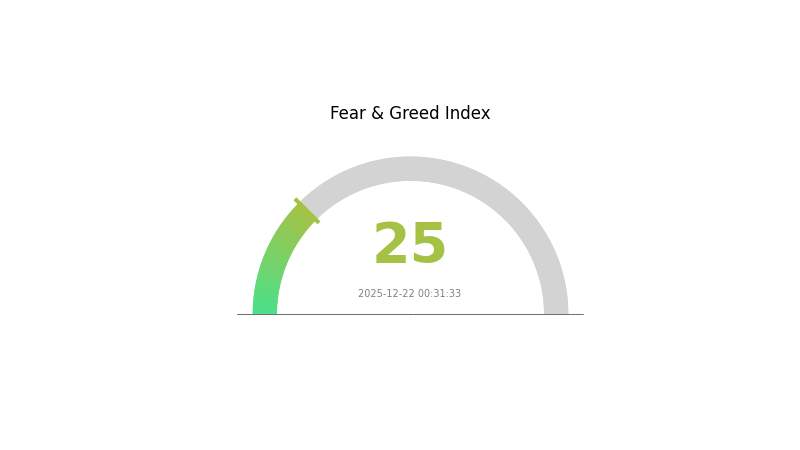

The token is held across 48,687 unique addresses, demonstrating a distributed holder base. Currently, the market sentiment index indicates extreme fear conditions (VIX level: 25), which may be contributing to recent downward price pressure.

Click to view current AVAAI market price

AVAAI Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 25. This indicates intense market pessimism and significant selling pressure. Investors are highly risk-averse, creating potential opportunities for contrarian traders. During periods of extreme fear, historically resilient assets often present accumulation opportunities. However, exercise caution with position sizing. Monitor market developments closely on Gate.com to stay informed about sentiment shifts and make prudent trading decisions during this volatile period.

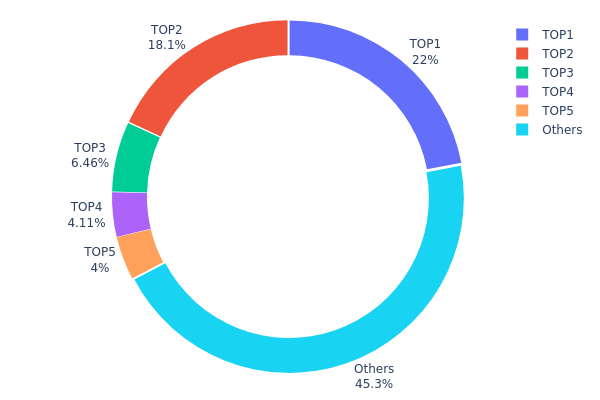

AVAAI Holdings Distribution

Address holdings distribution refers to the concentration of token ownership across different wallet addresses on the blockchain. This metric provides critical insights into the decentralization level of a project and the potential risks associated with wealth concentration, including vulnerability to price manipulation and market volatility triggered by large holder actions.

The current AVAAI distribution data reveals moderate concentration characteristics. The top five addresses collectively control approximately 54.71% of total supply, with the leading address (u6PJ8D...ynXq2w) commanding 22.02% and the second-largest holder (2iwfzt...VLtRhr) accounting for 18.12%. While this concentration is notable, the remaining 45.29% distributed among other addresses suggests a somewhat diversified holder base. The gradual decline in holdings from rank three onwards—where the third-largest address holds 6.46%—indicates that dominance is not exclusively concentrated in a single entity, reducing the immediate risk of centralized control.

From a market structure perspective, this distribution pattern presents both opportunities and considerations. The presence of substantial holdings among the top tier suggests potential institutional or long-term stakeholder involvement, which could provide price stability. However, the combined 54.71% held by major addresses necessitates careful monitoring, as coordinated movements or liquidations by these parties could materially impact market dynamics. The moderately dispersed "Others" segment, representing nearly half of all tokens, indicates an emerging retail and distributed holder ecosystem. This composition suggests AVAAI maintains a balanced tokenomic structure with reasonable decentralization, though continued monitoring of top holder activities remains prudent for assessing long-term market stability.

Click to view current AVAAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 220095.18K | 22.02% |

| 2 | 2iwfzt...VLtRhr | 181077.47K | 18.12% |

| 3 | 5Q544f...pge4j1 | 64583.16K | 6.46% |

| 4 | 9ZPsRW...ZgE4Y4 | 41082.50K | 4.11% |

| 5 | AGVhmr...gHAk8N | 40000.00K | 4.00% |

| - | Others | 452368.74K | 45.29% |

II. Core Factors Affecting AVAAI's Future Price

Technology Development and Ecosystem Building

-

Ecosystem Expansion: The long-term potential of AVAAI depends heavily on the expansion and development of its ecosystem. As the project grows and attracts more developers and users, the adoption rate and utility of the token will increase, which can positively impact its price trajectory.

-

Market Competition: AVAAI operates in a competitive landscape within the AI-focused cryptocurrency sector. The project's ability to differentiate itself and maintain competitive advantages will be crucial for sustained price growth and market relevance.

Note: The provided resources contain limited specific information about AVAAI's supply mechanisms, institutional holdings, enterprise adoption, government policies, and macroeconomic factors. Consequently, these sections have been excluded from this analysis. Investors are advised to conduct further research on official AVAAI channels and Gate.com for more comprehensive market data and updates.

Three、2025-2030 AVAAI Price Prediction

2025 Outlook

- Conservative Prediction: $0.00944 - $0.01213

- Neutral Prediction: $0.00994

- Optimistic Prediction: $0.01213 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Consolidation period with gradual recovery and establishment of new support levels, followed by accelerated growth phase as adoption metrics improve.

- Price Range Prediction:

- 2026: $0.00839 - $0.01136 (potential 11% decline)

- 2027: $0.00582 - $0.01512 (potential 12% recovery and breakthrough)

- Key Catalysts: Technological upgrades, increased institutional adoption, expansion of use cases, and improvement in overall market sentiment toward alternative tokens.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01053 - $0.01632 (assumes steady development and moderate market growth by 2028)

- Optimistic Scenario: $0.01376 - $0.02238 (assumes strong ecosystem expansion and 66% appreciation by 2030)

- Transformative Scenario: $0.02238+ (assumes breakthrough technological advancement, mainstream adoption, and significant macroeconomic tailwinds)

Key Observations: The forecast trajectory indicates a potential recovery pattern from 2026 lows, with cumulative gains of approximately 66% projected by 2030. Price volatility is expected to remain significant, particularly between support levels of $0.00582 and resistance levels approaching $0.02238. Investors should monitor technical breakouts through Gate.com and other major trading platforms for confirmation of these prediction scenarios.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01213 | 0.00994 | 0.00944 | 0 |

| 2026 | 0.01136 | 0.01103 | 0.00839 | 11 |

| 2027 | 0.01512 | 0.0112 | 0.00582 | 12 |

| 2028 | 0.01632 | 0.01316 | 0.01053 | 32 |

| 2029 | 0.01842 | 0.01474 | 0.00766 | 48 |

| 2030 | 0.02238 | 0.01658 | 0.01376 | 66 |

AVAAI Investment Analysis Report

IV. Professional Investment Strategy and Risk Management for AVAAI

AVAAI Investment Methodology

(1) Long-term Hold Strategy

- Suitable for: Investors who believe in the long-term potential of AI agents and the Holoworld ecosystem

- Operational suggestions:

- Accumulate during market downturns when volatility is high, targeting periods when prices show significant corrections

- Hold positions for extended periods (6-12 months or longer) to benefit from potential ecosystem growth and adoption increases

- Regularly review project milestones and partnerships to ensure alignment with investment thesis

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Use the recent trading range (low: $0.009793, high: $0.011045 in 24H) to identify entry and exit points for short-term trades

- Volume Analysis: Monitor 24-hour volume ($621,881.22) relative to historical averages to confirm trend strength and identify breakout opportunities

- Wave trading key points:

- Capitalize on the 7-day bullish trend (22.93% gain) by taking partial profits at resistance levels

- Watch for confirmation signals when price breaks above recent highs, indicating potential momentum continuation

AVAAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio allocation to speculative AI agent tokens

- Active investors: 3-8% allocation for projects with proven partnerships and backing

- Professional investors: 5-15% allocation with hedging strategies and diversified entry points

(2) Risk Hedging Solutions

- Portfolio diversification: Maintain exposure to established cryptocurrencies and stablecoins to offset AVAAI volatility

- Position sizing: Limit individual trade sizes to no more than 2-5% of total trading capital to manage downside risk

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for active trading and frequent transactions with high liquidity needs

- Cold Storage Approach: Use offline storage solutions for long-term holdings exceeding 6-12 months to minimize security risks

- Security considerations: Enable two-factor authentication on exchange accounts, use strong unique passwords, never share private keys or seed phrases, verify contract addresses before transfers

V. Potential Risks and Challenges for AVAAI

AVAAI Market Risk

- High volatility: AVAAI has experienced extreme price fluctuations, declining 53.16% over one year while rising 22.93% over seven days, indicating significant market instability and unpredictable price movements

- Low trading volume: Daily volume of $621,881 is relatively modest, which may result in large slippage during significant buy or sell orders and liquidity constraints

- Early-stage project risk: As a new AI agent token launched through Holoworld, AVAAI lacks the trading history and market maturity of established cryptocurrencies, making future performance highly uncertain

AVAAI Regulatory Risk

- Emerging regulatory framework: AI agents and avatar-based tokens operate in a relatively undefined regulatory space with evolving compliance requirements across different jurisdictions

- Classification uncertainty: Regulatory bodies may classify AVAAI differently across regions, potentially affecting its legal status and trading availability

- Policy changes: Changes to cryptocurrency regulations or AI-specific rules could negatively impact project viability and market demand

AVAAI Technology Risk

- Platform dependency: AVAAI relies on Holoworld AI infrastructure for its utility, meaning any technical failures or security breaches in the platform could severely impact token value

- Scalability concerns: The ability to scale audiovisual AI agent creation across 25+ IP/NFT brands requires continuous technical improvements and may face performance limitations

- Adoption risk: The success of the AI agent ecosystem depends on widespread user adoption and integration with major brands, which remains unproven at scale

VI. Conclusion and Action Recommendations

AVAAI Investment Value Assessment

AVAAI represents a speculative investment in the emerging AI agent and avatar technology space, backed by notable investors including Polychain and Nascent. The project's partnership with over 25 IP/NFT brands demonstrates real-world application potential. However, the 53.16% yearly decline, modest trading volume, and early-stage nature present substantial risks. The token's market cap of approximately $9.9 million reflects early valuation, but investors should recognize this as a high-risk, experimental investment with uncertain long-term prospects.

AVAAI Investment Recommendations

✅ Beginners: Invest only what you can afford to lose completely. Start with a small position (less than 1% of portfolio) to understand the project dynamics before considering larger allocations. Use limit orders on Gate.com to establish positions at favorable prices.

✅ Experienced investors: Consider the project within a diversified portfolio of emerging AI and Web3 tokens. Use technical analysis to identify entry points during pullbacks. Take partial profits during significant rallies (such as the recent 22.93% seven-day gain) to lock in gains.

✅ Institutional investors: Conduct comprehensive due diligence on Holoworld AI's technical capabilities and IP partnership agreements. Establish positions gradually to minimize market impact. Consider the regulatory landscape before significant capital deployment.

AVAAI Trading Participation Methods

- Gate.com Spot Trading: Buy and hold AVAAI on Gate.com's spot market using limit orders to optimize entry prices during volatile periods

- Accumulation Strategy: Set recurring purchases during market weakness to build positions over time and reduce average purchase cost

- Liquidity Monitoring: Before entering trades, verify sufficient liquidity on Gate.com to ensure smooth execution at reasonable slippage levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Avaai coin in 2030?

Based on technical analysis and historical data, Avaai coin is predicted to reach approximately $423.73 USD by 2030, representing a significant increase from current price levels.

What is the prediction of Avaai?

Ava AI (AVAAI) is predicted to reach approximately $0.076472 by 2028, based on growth assumptions. Long-term forecasts suggest continued appreciation over the next five years as the project develops.

What factors influence Avaai token price movements?

Avaai token price is influenced by market sentiment, adoption rates, and AI sector trends. Trading volume, AI tool enhancements, and asset speculation also drive price movements significantly.

What is the current market cap and trading volume of Avaai?

Avaai's current market cap is $10.89 million with a 24-hour trading volume of $11.25 million as of December 22, 2025. The project maintains solid market liquidity and active trading activity.

How does Avaai compare to other AI-based cryptocurrency projects?

Avaai stands out through its community-driven approach and integration with HoloworldAI technology. Unlike many AI projects focusing solely on technical features, Avaai emphasizes active community participation and sustainable growth, positioning itself as a unique player in the AI cryptocurrency space.

What is ACT: A Comprehensive Guide to the American College Testing Exam

Moo Deng (MOODENG): Complete Analysis of the $140M Solana Hippo Token

What is SIREN: Understanding the Advanced Neural Network Representation for Implicit Functions

2025 PIPPINPrice Prediction: Comprehensive Analysis and Forecast of PIPPIN's Future Market Value

ChainOpera AI ($COAI): The driving factors behind its explosive price surge

Is Jelly-My-Jelly (JELLYJELLY) a Good Investment?: Analyzing the Potential and Risks of This Emerging Crypto Token

What are the main security risks and vulnerabilities in HBAR and Hedera smart contracts?

Understanding Cloud Mining: Legality & Regulations in Cryptocurrency

What drives NEAR Protocol price volatility: support levels, resistance zones, and 7.56% fluctuations explained

RSS3 vs NEAR: A Comprehensive Comparison of Two Leading Blockchain Platforms for Web3 Infrastructure

What is a token economic model: NEAR's deflationary design, allocation mechanisms, and governance structure explained