Is sUSD (SUSD) a good investment?: Analyzing the Potential and Risks of this Stablecoin in the Crypto Market

Introduction: sUSD (SUSD) Investment Status and Market Outlook

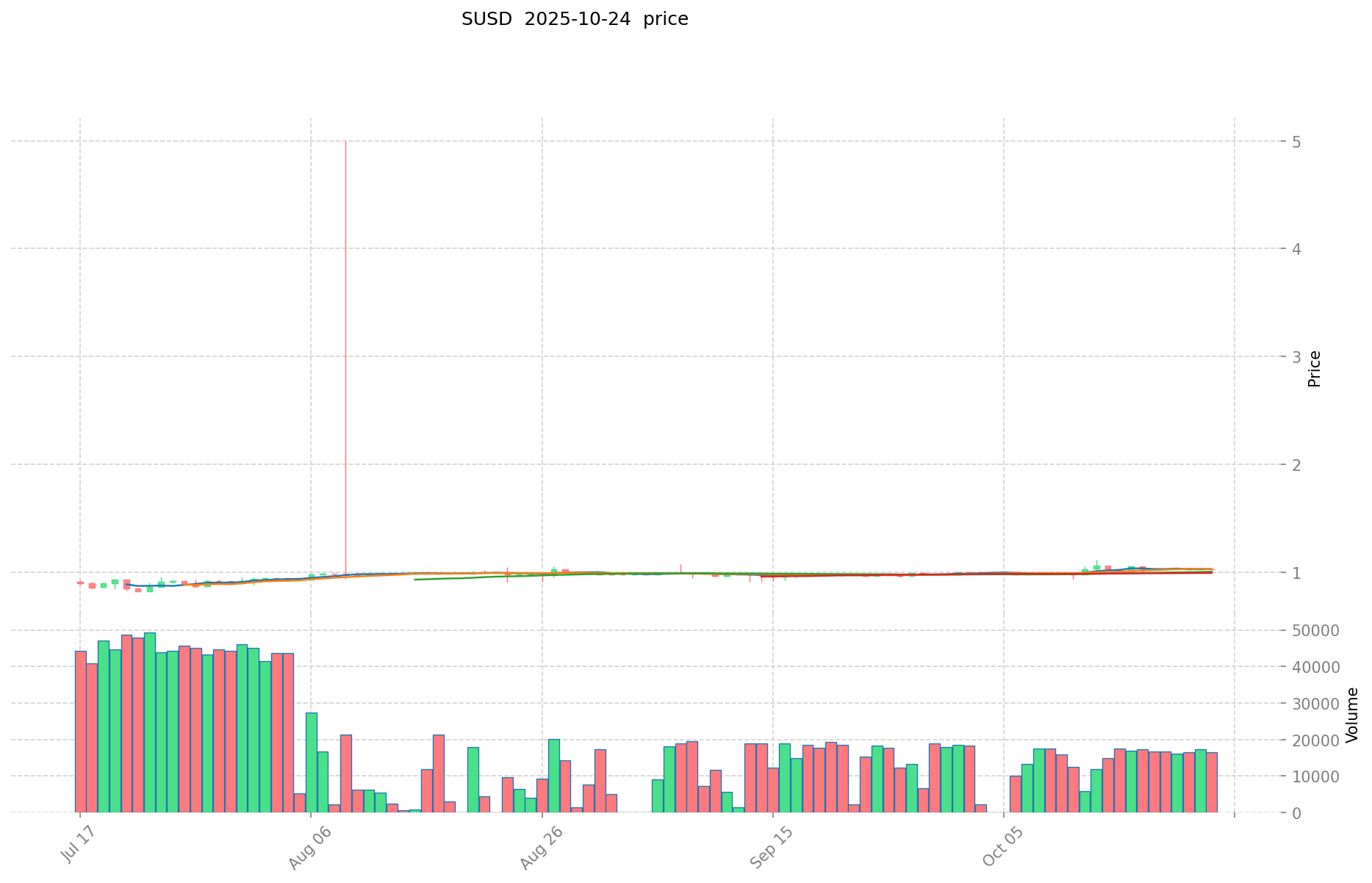

SUSD is an important asset in the cryptocurrency field. As of 2025, SUSD's market capitalization has reached $44,738,369.98, with a circulating supply of approximately 43,549,469.47 tokens, and the current price maintaining around $1.0273. With its position as a stablecoin, SUSD has gradually become a focal point for investors discussing "Is sUSD(SUSD) a good investment?" This article will comprehensively analyze SUSD's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. sUSD (SUSD) Price History Review and Current Investment Value

sUSD (SUSD) Historical Price Trends and Investment Returns

- 2020: Historical high price of $2.45 reached on February 18

- 2020: Historical low price of $0.429697 recorded on March 18

- 2025: Current price stabilized around $1.0273

Current sUSD Investment Market Status (October 2025)

- sUSD current price: $1.0273

- 24-hour trading volume: $17,130,780.42

- Circulating supply: 43,549,469.47 SUSD

Click to view real-time SUSD market price

II. Key Factors Influencing Whether sUSD(SUSD) is a Good Investment

Supply Mechanism and Scarcity (SUSD investment scarcity)

- Direct minting in issuer's wallet → Impacts price and investment value

- Historical pattern: Supply changes have driven SUSD price fluctuations

- Investment significance: Scarcity is crucial for supporting long-term investment

Institutional Investment and Mainstream Adoption (Institutional investment in SUSD)

- Institutional holding trend: Limited data available

- Notable companies adopting SUSD → Enhances its investment value

- Impact of national policies on SUSD investment prospects

Macroeconomic Environment's Impact on SUSD Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital gold" positioning

- Geopolitical uncertainties → Increase demand for SUSD investment

Technology and Ecosystem Development (Technology & Ecosystem for SUSD investment)

- Synthetix protocol upgrades: Improve network performance → Enhance investment appeal

- Expansion of ecosystem applications → Support long-term value

- DeFi applications driving investment value

III. SUSD Future Investment Forecast and Price Outlook (Is sUSD(SUSD) worth investing in 2025-2030)

Short-term SUSD investment outlook (2025)

- Conservative forecast: $0.56 - $0.80

- Neutral forecast: $0.80 - $1.03

- Optimistic forecast: $1.03 - $1.46

Mid-term sUSD(SUSD) investment forecast (2027-2028)

- Market phase expectation: Potential growth phase with increased adoption

- Investment return forecast:

- 2027: $0.89 - $1.73

- 2028: $1.29 - $1.93

- Key catalysts: DeFi ecosystem expansion, improved liquidity, platform upgrades

Long-term investment outlook (Is SUSD a good long-term investment?)

- Base case scenario: $1.58 - $2.48 (Steady growth in DeFi adoption)

- Optimistic scenario: $2.48 - $3.50 (Widespread integration in major DeFi protocols)

- Risk scenario: $0.90 - $1.50 (Regulatory challenges or loss of market share)

Click to view SUSD long-term investment and price prediction: Price Prediction

2025-10-24 - 2030 Long-term Outlook

- Base scenario: $1.58 - $2.48 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $2.48 - $3.50 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $3.50 (In case of breakthrough developments in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $3.72 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.458198 | 1.0269 | 0.564795 | 0 |

| 2026 | 1.27982547 | 1.242549 | 0.96918822 | 20 |

| 2027 | 1.72782651195 | 1.261187235 | 0.89544293685 | 22 |

| 2028 | 1.92791386678275 | 1.494506873475 | 1.2852759111885 | 45 |

| 2029 | 2.293021895972692 | 1.711210370128875 | 0.992502014674747 | 66 |

| 2030 | 2.482624004982971 | 2.002116133050783 | 1.581671745110119 | 94 |

IV. How to invest in sUSD

sUSD investment strategy

- HODL sUSD: Suitable for conservative investors seeking stable value preservation

- Active trading: Relies on technical analysis and short-term fluctuations

Risk management for sUSD investment

- Asset allocation ratio: Conservative: 1-5% of portfolio Aggressive: 5-10% of portfolio Professional: 10-20% of portfolio

- Risk hedging plan: Diversify with other stablecoins and crypto assets

- Secure storage: Use hardware wallets like Ledger or Trezor for long-term holding

V. Risks of investing in stablecoins

- Market risk: Potential loss of peg to USD

- Regulatory risk: Uncertainty in stablecoin regulations across jurisdictions

- Technical risk: Smart contract vulnerabilities, oracle failures

VI. Conclusion: Is stablecoin a Good Investment?

- Investment value summary: sUSD offers stability but limited upside potential compared to other cryptocurrencies.

- Investor advice: ✅ Beginners: Use as a store of value or to avoid crypto volatility ✅ Experienced investors: Utilize for trading pairs and liquidity provision ✅ Institutional investors: Consider for treasury management and low-risk exposure to crypto markets

⚠️ Note: Cryptocurrency investments carry high risk. This article is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is sUSD and how does it work? A: sUSD is a stablecoin created on the Synthetix protocol. It is designed to maintain a 1:1 peg with the US dollar, providing stability in the volatile cryptocurrency market. sUSD is created when users stake SNX tokens as collateral, allowing them to mint sUSD.

Q2: Is sUSD a good investment in 2025? A: As of 2025, sUSD is considered a relatively stable investment option with its price hovering around $1.0273. However, being a stablecoin, it offers limited potential for significant price appreciation. It's more suitable for value preservation and as a hedge against crypto market volatility rather than for high-growth investment.

Q3: What are the main risks of investing in sUSD? A: The main risks of investing in sUSD include market risk (potential loss of peg to USD), regulatory risk (uncertain regulations across jurisdictions), and technical risk (smart contract vulnerabilities or oracle failures). It's important to consider these factors when deciding to invest in sUSD.

Q4: How can I invest in sUSD? A: You can invest in sUSD by purchasing it on cryptocurrency exchanges that list the token. For long-term holding, it's recommended to store sUSD in secure hardware wallets like Ledger or Trezor. You can also use sUSD in DeFi applications for yield farming or liquidity provision.

Q5: What is the long-term price prediction for sUSD? A: The long-term price prediction for sUSD from 2025 to 2030 ranges from a base scenario of $1.58 - $2.48 to an optimistic scenario of $2.48 - $3.50. However, as a stablecoin, sUSD is designed to maintain a price close to $1, so significant price appreciation is not typically expected.

Q6: How does sUSD compare to other stablecoins? A: sUSD is similar to other stablecoins in its goal of maintaining a stable value. However, it's unique in that it's part of the Synthetix ecosystem, which allows for the creation of synthetic assets. Compared to more widely adopted stablecoins like USDT or USDC, sUSD may have lower liquidity and market capitalization.

Q7: What role does sUSD play in a diversified crypto portfolio? A: sUSD can play a valuable role in a diversified crypto portfolio by providing stability and reducing overall volatility. It can be used as a safe haven during market downturns, for trading pairs, or as part of a yield farming strategy in DeFi applications. The recommended allocation varies based on risk tolerance, ranging from 1-5% for conservative investors to 10-20% for more aggressive portfolios.

Share

Content