2025 SUI Price Prediction: Will Sui Reach New Highs in the Coming Year?

Introduction: SUI's Market Position and Investment Value

Sui (SUI), as a leading Layer 1 blockchain designed for scalability and speed, has made significant strides since its inception in 2023. As of 2025, Sui's market capitalization has reached $5.85 billion, with a circulating supply of approximately 3.74 billion coins, and a price hovering around $1.57. This asset, often hailed as the "next-generation blockchain for Web3," is playing an increasingly crucial role in supporting a wide range of decentralized applications with unparalleled speed and low cost.

This article will comprehensively analyze Sui's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SUI Price History Review and Current Market Status

SUI Historical Price Evolution Trajectory

- 2023: SUI launched at $0.1, price fluctuated significantly

- 2024: Market recovery, SUI reached its all-time high of $5.3674

- 2025: Market correction, price dropped from $5.3674 to current $1.5655

SUI Current Market Situation

As of December 15, 2025, SUI is trading at $1.5655, ranking 28th in the global cryptocurrency market. The token has experienced a 3.52% decline in the past 24 hours, with a trading volume of $5,702,775. SUI's market capitalization stands at $5,850,064,287, representing 0.48% of the total crypto market. The circulating supply is 3,736,866,360 SUI, which is 37.37% of the maximum supply of 10 billion tokens. Despite the recent downturn, SUI has shown resilience, with a 0.37% increase in the last hour. However, longer-term trends indicate a more bearish sentiment, with a 12.6% decrease over the past 30 days and a substantial 64.92% decline year-over-year.

Click to view the current SUI market price

SUI Market Sentiment Indicator

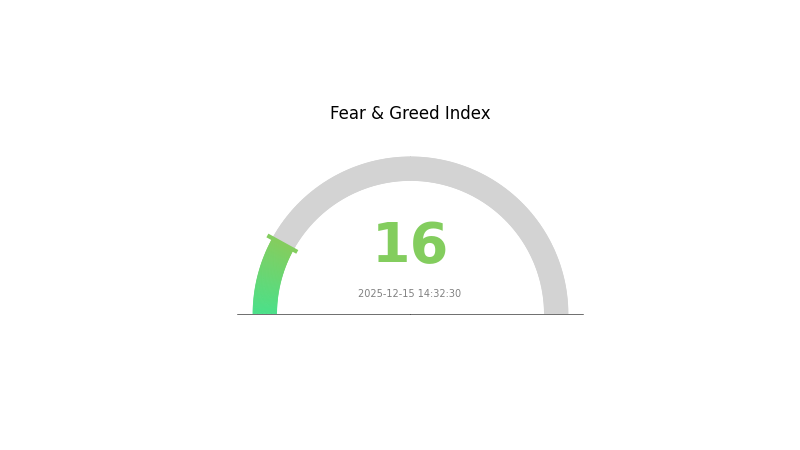

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often precedes potential buying opportunities, as historically, extreme fear has signaled market bottoms. However, investors should exercise caution and conduct thorough research before making any decisions. The current market climate may present both risks and opportunities for those with a long-term perspective on SUI and the broader cryptocurrency landscape.

SUI Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for SUI tokens. The top address holds an astonishing 10,005.81% of the total supply, while the second and third largest holders possess 4,933.91% and 2,555.62% respectively. This extreme concentration raises significant concerns about the centralization of SUI's ecosystem.

Such a distribution pattern suggests potential vulnerabilities in the market structure. With a small number of addresses controlling vast amounts of tokens, the risk of market manipulation and price volatility increases substantially. These large holders, often referred to as "whales," have the capacity to significantly impact token prices through their trading activities.

This concentration also reflects a low level of decentralization within the SUI network, potentially compromising its resilience and stability. The disproportionate distribution may hinder broader adoption and could be a point of concern for investors and regulators alike. It underscores the importance of monitoring address distribution as a key indicator of network health and market dynamics in the cryptocurrency space.

Click to view the current SUI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3852...ccfa3f | 1000581153.34K | 10005.81% |

| 2 | 0xa0d2...080b02 | 493391206.85K | 4933.91% |

| 3 | 0xac89...458e48 | 255562404.85K | 2555.62% |

| 4 | 0xab5d...4209d6 | 25714404.89K | 257.14% |

| 5 | 0xc0d4...fb116b | 8586934.68K | 85.87% |

| - | Others | 69925265.19K | -17738.35% |

II. Key Factors Influencing SUI's Future Price

Supply Mechanism

- Token Unlocking: Periodic token unlocks may increase supply and potentially impact price

- Historical Pattern: Previous unlocks have led to short-term price volatility

- Current Impact: Upcoming unlocks in 2025-2026 may create selling pressure

Institutional and Whale Dynamics

- Institutional Holdings: Bitwise 10 Crypto Index ETF allocated 0.24% to SUI, enhancing institutional exposure

- Enterprise Adoption: Increasing integration of Sui Network in DeFi and IoT applications

Macroeconomic Environment

- Monetary Policy Impact: Global interest rate changes and economic events influence SUI's price trends

- Inflation Hedge Properties: SUI's performance as a potential hedge against inflation remains to be seen

Technical Development and Ecosystem Building

- Developer Fund: Sui Network launched a fund to boost DeFi applications and increase Total Value Locked

- zkTunnels Integration: Supports real-time, fee-less operations in IoT robots, enhancing blockchain applications in real-world industries

- Ecosystem Growth: Total Value Locked (TVL) in Sui increased by nearly 70% in the past month, reaching approximately $2.06 billion

- Developer Activity: Despite market downturns, SUI's developer momentum remains strong, with over 1,400 monthly active developers as of mid-2025, a 219% increase from early 2024

III. SUI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.08 - $1.30

- Neutral prediction: $1.30 - $1.80

- Optimistic prediction: $1.80 - $2.13 (requires strong adoption and market growth)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $1.50 - $3.01

- 2028: $2.33 - $2.71

- Key catalysts: Ecosystem expansion, technological advancements, and broader crypto market trends

2030 Long-term Outlook

- Base scenario: $2.54 - $2.93 (assuming steady growth and adoption)

- Optimistic scenario: $2.93 - $3.40 (with accelerated ecosystem development and market penetration)

- Transformative scenario: $3.40+ (under extremely favorable market conditions and breakthrough use cases)

- 2030-12-31: SUI $2.92 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.13221 | 1.5678 | 1.08178 | 0 |

| 2026 | 2.2755 | 1.85 | 1.0545 | 18 |

| 2027 | 3.01162 | 2.06275 | 1.50581 | 31 |

| 2028 | 2.71479 | 2.53719 | 2.33421 | 62 |

| 2029 | 3.22997 | 2.62599 | 1.89071 | 67 |

| 2030 | 3.39645 | 2.92798 | 2.54734 | 87 |

IV. Professional Investment Strategies and Risk Management for SUI

SUI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SUI during market dips

- Set a target exit price or time frame

- Store SUI in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor SUI's correlation with overall crypto market trends

- Set strict stop-loss orders to manage downside risk

SUI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 1 blockchains

- Options strategies: Consider using put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SUI

SUI Market Risks

- High volatility: SUI price can experience significant fluctuations

- Competition: Intense competition from other Layer 1 blockchains

- Market sentiment: Susceptible to overall crypto market trends

SUI Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory changes

- Global regulatory disparities: Varying treatment across jurisdictions

- Compliance costs: Increasing regulatory requirements may impact adoption

SUI Technical Risks

- Network congestion: Potential scalability issues during high demand

- Smart contract vulnerabilities: Risk of exploits or bugs in the protocol

- Technological obsolescence: Rapid advancements in blockchain technology

VI. Conclusion and Action Recommendations

SUI Investment Value Assessment

SUI presents a promising long-term value proposition as a scalable Layer 1 blockchain, but faces short-term risks due to market volatility and competition.

SUI Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the technology ✅ Experienced investors: Consider a balanced approach with regular DCA ✅ Institutional investors: Conduct thorough due diligence and consider OTC options

SUI Trading Participation Methods

- Spot trading: Buy and hold SUI on Gate.com

- Staking: Participate in SUI staking programs for passive income

- DeFi: Explore decentralized finance opportunities within the SUI ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will SUI reach 10 dollars?

SUI has potential to reach $10 if its ecosystem grows and market conditions improve. Analysts predict this outcome based on current trends.

How high will SUI go in 2025?

SUI is projected to reach around $5.05 on average in 2025, with a potential peak of $6.25.

Can SUI reach 20 USD?

Yes, SUI could potentially reach $20 USD. This would require significant market growth and widespread adoption of the Sui network. While possible, it remains speculative and depends on future developments in the crypto market.

What is the future potential of SUI?

SUI's future potential lies in its ecosystem growth, particularly in DeFi, NFTs, and gaming sectors. Increasing transaction volume suggests strong market adoption and promising prospects.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is PAX Gold (PAXG) a good investment?: A Comprehensive Analysis of Returns, Risks, and Suitability for Modern Portfolios

Is Pumpfun (PUMP) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Outlook for 2024

USD1 vs DOGE: Which Cryptocurrency Investment Strategy Will Dominate the Market in 2024?

XAUT vs CHZ: A Comprehensive Comparison of Gold-Backed and Gaming Tokens in the Crypto Market

What is NEAR: A Complete Guide to Understanding the NEAR Protocol and Its Ecosystem