2025 PROVE Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of PROVE

Succinct (PROVE) is building a decentralized prover network that enables anyone to construct blockchain applications and infrastructure secured by cryptographic truth rather than trust. Since its launch in August 2025, PROVE has quickly established itself as a critical infrastructure provider in the zero-knowledge proof ecosystem. As of December 2025, PROVE has achieved a market capitalization of $71.04 million with a circulating supply of 195 million tokens, currently trading at $0.3643. This innovative asset, recognized for its role in unifying the proof supply chain, is increasingly playing a vital role in powering rollups, coprocessors, and other applications leveraging zero-knowledge proof technology.

This article will provide a comprehensive analysis of PROVE's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for crypto investors.

Succinct (PROVE) Market Analysis Report

I. PROVE Price History Review and Current Market Status

PROVE Current Market Performance

As of December 18, 2025, PROVE is trading at $0.3643, representing a market capitalization of approximately $71.04 million with a fully diluted valuation of $364.3 million. The token has a circulating supply of 195 million tokens out of a total supply of 1 billion tokens, representing 19.5% circulation.

The 24-hour price movement shows a decline of 5.24%, with the token trading between a 24-hour low of $0.3592 and a 24-hour high of $0.3856. Over the past week, PROVE has experienced a more significant downturn of 17.99%, while the 30-day performance reflects a steeper decline of 27.70%. In the 1-hour timeframe, the token shows a modest gain of 0.8%.

From an all-time perspective, PROVE reached its historical peak of $1.80 on August 6, 2025, indicating that the current price represents a substantial pullback of approximately 79.8% from its peak valuation. The token's recent low of $0.3592 was established on December 17, 2025, positioning current levels near the lower end of recent trading ranges.

The trading volume in the 24-hour period stands at $405,132.21, while PROVE is listed across 39 exchanges globally. With 8,335 token holders, the project maintains a market dominance of 0.011%. Current market sentiment indicates extreme fear conditions (VIX reading of 16 as of December 17, 2025), reflecting broader market anxiety that may be influencing the recent price weakness across the cryptocurrency sector.

Click to view current PROVE market price

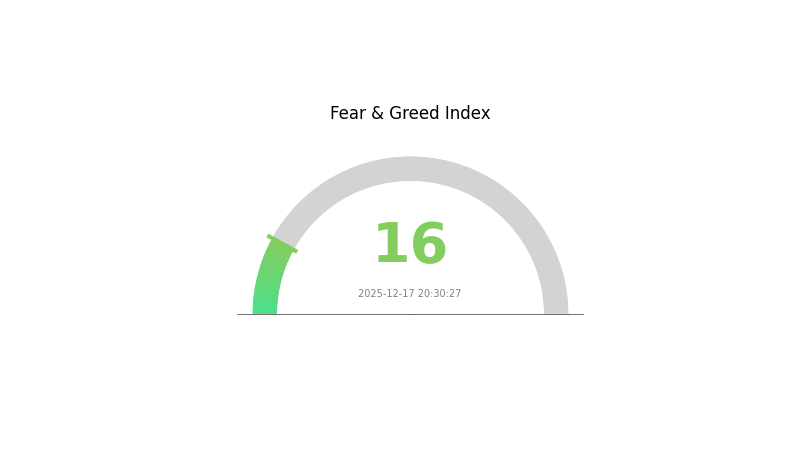

PROVE Market Sentiment Index

2025-12-17 Fear & Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 16. This significant decline reflects heightened investor anxiety and pessimism across the digital asset space. Such extreme fear conditions historically present contrarian opportunities for long-term investors, as markets often recover from oversold conditions. However, caution remains warranted as underlying market pressures continue. Monitor volatility carefully and consider your risk tolerance before making investment decisions on Gate.com's platform.

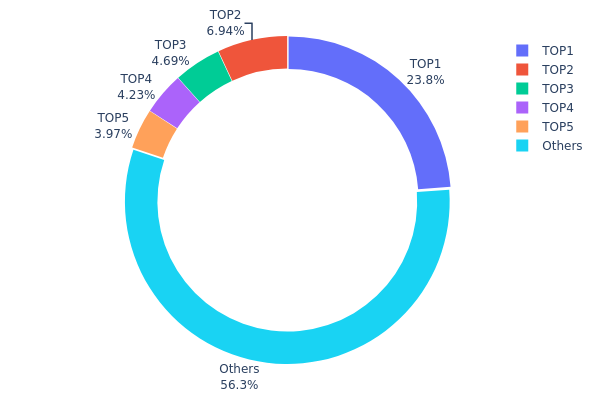

PROVE Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, serving as a critical metric for assessing the degree of decentralization and potential market manipulation risks. By analyzing the top holders and their respective percentages of total supply, investors can gauge the distribution efficiency and stability of the project's tokenomics structure.

PROVE's current holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively control approximately 43.63% of the circulating supply, with the largest single holder commanding 23.82% of all tokens. This concentration level indicates that while significant wealth is distributed among major stakeholders, the token is not excessively dominated by a single entity. The remaining 56.37% dispersed across other addresses suggests a reasonably distributed ecosystem, which is a positive indicator for long-term market stability and reduced single-point-of-failure risk.

From a market dynamics perspective, this distribution pattern presents a balanced profile. The top five holders possess sufficient influence to potentially impact short-term price movements through coordinated transactions, yet the majority stake held by dispersed addresses provides a stabilizing counterweight. The moderate concentration suggests that PROVE maintains adequate decentralization to support organic market development while preserving sufficient holder stability to prevent severe volatility spikes. This structural composition indicates a relatively healthy on-chain ecosystem, with governance decisions and supply-side pressures likely to reflect a broader consensus rather than unilateral actions by concentrated stakeholders.

Click to view current PROVE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcb91...2fe819 | 238256.81K | 23.82% |

| 2 | 0x0d67...bbd5c6 | 69412.85K | 6.94% |

| 3 | 0xfb4c...666836 | 46901.77K | 4.69% |

| 4 | 0x2f69...13cee4 | 42275.70K | 4.22% |

| 5 | 0x52b6...58db0a | 39666.11K | 3.96% |

| - | Others | 563486.76K | 56.37% |

II. Core Factors Affecting PROVE's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Economic cycles driven by monetary policy and global liquidity conditions play a significant role in cryptocurrency price movements. Shifts in monetary policy regimes can substantially influence market dynamics and investor sentiment toward digital assets.

-

Market Sentiment and Narratives: Strong market narratives and investor sentiment are key drivers of price fluctuations. Changes in market perception and prevailing investment themes can trigger substantial price movements independent of fundamental developments.

Market Dynamics and Participation

-

New Market Entrants: The entry of new market participants and speculative activity (including leveraged positions) can amplify price volatility and create momentum in either direction.

-

Innovation Cycle Continuation: Ongoing innovation cycles and technological developments within the blockchain ecosystem support sustained market interest and potential price appreciation.

III. 2025-2030 PROVE Price Forecast

2025 Outlook

- Conservative Forecast: $0.3249 - $0.3651

- Base Case Forecast: $0.3651

- Optimistic Forecast: $0.3797 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing institutional interest and protocol adoption maturation

- Price Range Forecast:

- 2026: $0.3203 - $0.4022

- 2027: $0.3098 - $0.5267

- 2028: $0.3428 - $0.5073

- Key Catalysts: Protocol upgrades, ecosystem expansion, increasing DeFi integration, and growing market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.3607 - $0.5372 (assumes steady adoption and moderate market growth)

- Optimistic Scenario: $0.5346 - $0.7427 (assumes breakthrough in enterprise adoption and significant network effects)

- Transformative Scenario: $0.7427+ (extreme favorable conditions including mainstream institutional adoption and major protocol milestones)

- 2030-12-18: PROVE reaches $0.7427 (approaching long-term target with 39% cumulative gain from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.3797 | 0.3651 | 0.32494 | 0 |

| 2026 | 0.40219 | 0.3724 | 0.32027 | 2 |

| 2027 | 0.52673 | 0.3873 | 0.30984 | 6 |

| 2028 | 0.50728 | 0.45701 | 0.34276 | 25 |

| 2029 | 0.53518 | 0.48215 | 0.41465 | 32 |

| 2030 | 0.74265 | 0.50867 | 0.35607 | 39 |

Succinct (PROVE) Professional Investment Strategy and Risk Management Report

IV. PROVE Professional Investment Strategy and Risk Management

PROVE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with 6-12 month+ time horizons seeking exposure to zero-knowledge proof infrastructure; developers and enterprises building on ZK-based applications

- Operational Recommendations:

- Accumulate PROVE tokens during price weakness to build a core position aligned with the protocol's adoption cycle

- Monitor Succinct's proof generation activity metrics and rollup partnership announcements as leading indicators for token utility expansion

- Maintain holdings through market volatility cycles to capture potential upside as ZK technology adoption accelerates in blockchain scaling solutions

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Deploy around $0.36 (recent low) and $0.39 (24H high) to identify entry/exit points with defined risk parameters

- Volume Analysis: Monitor 24H trading volume trends ($405,132 baseline) to confirm price movements and identify liquidity conditions

- Wave Operation Key Points:

- Trade price pullbacks toward support levels when positive news regarding Succinct's prover network expansion emerges

- Exit positions near resistance levels or during extended rallies exceeding 15-20% gains to lock in profits

PROVE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Active Investors: 3-7% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Distribute PROVE purchases over 4-8 week periods to reduce timing risk and average acquisition costs

- Profit-Taking Strategy: Establish sell targets at 20-30% gains to systematically reduce exposure and capture realized returns

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for active trading and frequent transactions with convenient on-chain interactions

- Cold Storage Approach: Transfer PROVE tokens to hardware wallets or secure self-custody solutions for long-term holdings exceeding 6 months

- Security Considerations: Enable all available security features including two-factor authentication; never share private keys or seed phrases; verify all contract addresses before token transfers; be cautious of phishing attempts targeting cryptocurrency holders

V. PROVE Potential Risks and Challenges

PROVE Market Risk

- High Volatility: PROVE has experienced 27.70% decline over 30 days, indicating significant price fluctuations that can lead to substantial losses for leveraged or undercapitalized investors

- Liquidity Concentration: With $405,132 in 24H volume, trading depth may be limited, potentially causing slippage during large transactions

- Competition Intensification: Emerging competitors in the ZK proof generation space could reduce Succinct's market share and pricing power

PROVE Regulatory Risk

- Evolving Regulatory Framework: Classification and regulatory treatment of ZK infrastructure tokens remains uncertain across major jurisdictions

- Compliance Requirements: Future regulatory mandates could impact operational flexibility or impose restrictions on token utility

- Cross-Border Restrictions: Certain jurisdictions may restrict access to PROVE or Succinct's services, affecting token demand and adoption

PROVE Technical Risk

- Protocol Vulnerabilities: Zero-knowledge proof systems depend on complex cryptographic implementations vulnerable to potential exploits or mathematical breakthroughs

- Network Dependency: Succinct's prover network effectiveness relies on sufficient validator participation and infrastructure reliability

- Integration Complexity: Adoption delays or technical friction in rollup and coprocessor integrations could slow revenue generation and token utility expansion

VI. Conclusion and Action Recommendations

PROVE Investment Value Assessment

PROVE represents a foundational infrastructure token in the zero-knowledge proof ecosystem at an early adoption phase. With a fully diluted valuation of $364.3 million and 19.5% circulating supply ratio, the token captures demand from rollups, coprocessors, and applications requiring decentralized proof generation. However, recent 27.70% monthly decline and modest 24H trading volume suggest caution regarding near-term momentum. The value proposition depends on sustained ZK adoption and Succinct's ability to maintain competitive pricing and network reliability. Long-term potential exists but subject to significant execution and regulatory uncertainties.

PROVE Investment Recommendations

✅ Beginners: Start with small positions (1-2% portfolio allocation) through dollar-cost averaging via Gate.com to gain exposure without timing risk; focus on understanding Succinct's core value proposition before expanding commitment

✅ Experienced Investors: Consider 3-5% allocations with active monitoring of protocol metrics; implement disciplined entry points near support levels and predetermined exit targets; maintain hedging strategies given volatility

✅ Institutional Investors: Conduct comprehensive due diligence on Succinct's technical architecture, team credentials, and competitive positioning; establish 5-10% allocations as portfolio diversification within blockchain infrastructure sector; engage with project team on partnership opportunities

PROVE Trading Participation Methods

- Exchange Trading: Execute spot purchases on Gate.com leveraging established liquidity and security infrastructure

- Accumulation Strategy: Deploy regular purchases during downturns to build positions aligned with long-term ZK infrastructure adoption thesis

- Liquidity Provision: Consider participation in PROVE liquidity pools to generate yield, balancing potential returns against impermanent loss risk

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and conduct thorough independent research. Consult qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

How high can Sol go in 2025?

Solana (SOL) is predicted to reach around $364 by end of 2025, with potential to climb to $482 depending on blockchain adoption and ecosystem growth. Long-term forecasts suggest it could reach $500 within 5-10 years as developer adoption expands.

Can XRP hit $100 in 5 years?

While XRP reaching $100 in 5 years is theoretically possible with significant adoption and market growth, it remains highly speculative. Current price levels and market conditions make this target challenging but not impossible for long-term investors.

Can pi coin reach $100?

Pi Coin reaching $100 depends on network adoption, ecosystem development, and market conditions. While early supporters envision significant growth potential, achieving such valuation requires substantial mainstream adoption and real-world utility expansion.

How much will 1 pi be worth in 2025?

Based on current market analysis and growth forecasts, 1 Pi Network is expected to be worth approximately $0.20061 in 2025, reflecting steady annual growth trends in the network's valuation.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Guide to Buying Bitcoin in the UK: Simple Steps to Get Started

Top NFT Wallets for Beginners: Secure Your Digital Collectibles

Nepal's Crypto Challenges: Trading Ban Sparks Increase in Fraud

ZK Rollups Explained: Enhancing Blockchain Scalability Through Zero-Knowledge Solutions

Majority Stake in BNB Allegedly Held by Prominent Crypto Figure