2025 MAYPrice Prediction: Market Analysis and Future Forecasts for Key Commodities

Introduction: MAY's Market Position and Investment Value

Mayflower (MAY), as an AI-driven assistant layer for DeFi on Solana, has been transforming user interactions in the blockchain space since its inception. As of 2025, MAY's market capitalization has reached $8,264,460, with a circulating supply of approximately 217,200,000 tokens, and a price hovering around $0.03805. This asset, often referred to as the "AI-powered DeFi navigator," is playing an increasingly crucial role in enhancing onchain actions and streamlining multichain exploration.

This article will comprehensively analyze MAY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MAY Price History Review and Current Market Status

MAY Historical Price Evolution Trajectory

- 2025: MAY reached its all-time high of $0.07318 on July 4th

- 2025: The token hit its all-time low of $0.03696 on October 7th

- 2025: Market volatility caused price to fluctuate between the high and low points

MAY Current Market Situation

As of October 9, 2025, MAY is trading at $0.03805, showing a 0.5% increase in the last 24 hours. The token's market capitalization stands at $8,264,460, ranking it at 1518 in the global cryptocurrency market. MAY's 24-hour trading volume is $31,266.75, indicating moderate market activity. The current price is 48% below its all-time high and 2.95% above its all-time low, both recorded in 2025. Short-term price trends show a 0.26% increase in the last hour, while longer-term trends indicate a -2.81% decline over the past week and a -9.96% drop in the last 30 days. The token's circulating supply is 217,200,000 MAY, which represents 21.72% of its total supply of 1,000,000,000 MAY.

Click to view the current MAY market price

MAY Market Sentiment Indicator

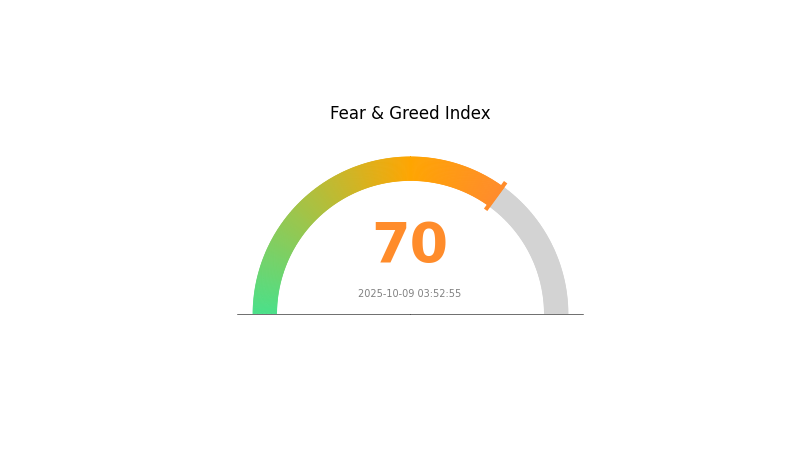

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently showing signs of greed, with the Fear and Greed Index at 70. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, caution is advised as extreme greed can lead to market corrections. Traders should consider taking profits and reassessing their strategies. Remember, market sentiment can shift quickly, so stay informed and manage your risk carefully. Gate.com offers tools to help navigate these market conditions effectively.

MAY Holdings Distribution

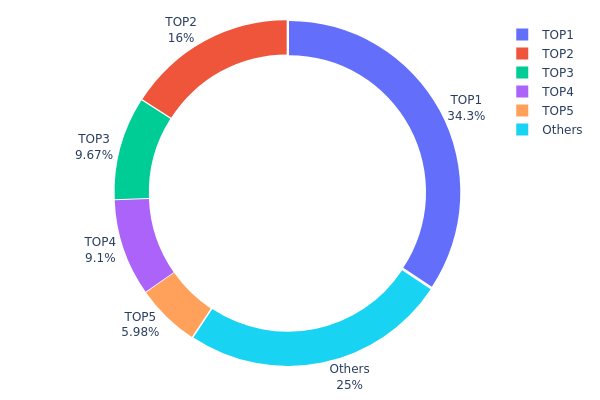

The address holdings distribution data for MAY reveals a highly concentrated ownership structure. The top address holds a significant 34.30% of the total supply, while the top 5 addresses collectively control 74.99% of MAY tokens. This concentration level raises concerns about the token's decentralization and potential market manipulation risks.

Such a concentrated distribution can lead to increased price volatility and susceptibility to large-scale sell-offs. The dominance of a few major holders may also impact governance decisions if MAY employs a token-based voting system. However, it's worth noting that 25.01% of the supply is distributed among other addresses, which provides some level of diversification.

This current distribution pattern suggests that MAY's on-chain structure may be less stable than ideal for a decentralized ecosystem. It indicates a need for wider token distribution to enhance market resilience and reduce the influence of whale accounts on price movements and project governance.

Click to view the current MAY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | E6egfb...FixiJn | 343066.86K | 34.30% |

| 2 | 8Mm46C...zrMZQH | 159557.90K | 15.95% |

| 3 | 7W4fSR...AbiWWi | 96713.24K | 9.67% |

| 4 | Ap1wy7...vuwhzH | 91017.99K | 9.10% |

| 5 | BBQitK...AmU8Kd | 59758.60K | 5.97% |

| - | Others | 249884.60K | 25.01% |

II. Key Factors Influencing MAY's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's decisions, especially regarding interest rates, will be crucial. Market expectations for rate cuts in 2025 have been supporting gold prices. If inflation remains stable and economic data weakens, gold prices could rise further.

-

Inflation Hedging Properties: Gold has shown resilience as an inflation hedge. In 2025, with inflation rates above the Fed's 2% target, investors may continue to view gold as a protective asset.

-

Geopolitical Factors: Ongoing geopolitical tensions, including conflicts in the Middle East and uncertainties surrounding major economies' elections, are driving demand for gold as a safe-haven asset.

Institutional and Major Player Dynamics

-

Institutional Holdings: Central banks, particularly from China and India, continue to show strong gold-buying behavior as they diversify their reserves amidst changing global geopolitical landscapes.

-

Corporate Adoption: There's increasing interest from corporations in holding gold as part of their treasury reserves, especially in the face of economic uncertainties.

Technical Developments and Ecosystem Building

-

Market Sentiment: The breaking of the $3,000 per ounce price barrier has led many analysts to revise their short-term gold price forecasts upward, potentially creating a self-fulfilling prophecy of further price increases.

-

Supply Constraints: Limited growth in gold mining supply is contributing to the bullish outlook for gold prices.

III. MAY Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02854 - $0.03805

- Neutral forecast: $0.03805 - $0.04471

- Optimistic forecast: $0.04471 - $0.05137 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.04394 - $0.05987

- 2028: $0.03569 - $0.06111

- Key catalysts: Technological advancements, broader market trends, and regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $0.05759 - $0.06134 (assuming steady market growth)

- Optimistic scenario: $0.06508 - $0.07054 (assuming strong bullish trends)

- Transformative scenario: $0.07054+ (under extremely favorable market conditions)

- 2030-12-31: MAY $0.06134 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05137 | 0.03805 | 0.02854 | 0 |

| 2026 | 0.05186 | 0.04471 | 0.02414 | 17 |

| 2027 | 0.05987 | 0.04829 | 0.04394 | 26 |

| 2028 | 0.06111 | 0.05408 | 0.03569 | 42 |

| 2029 | 0.06508 | 0.05759 | 0.04262 | 51 |

| 2030 | 0.07054 | 0.06134 | 0.05152 | 61 |

IV. Professional MAY Investment Strategies and Risk Management

MAY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in AI-driven DeFi solutions

- Operation suggestions:

- Accumulate MAY tokens during market dips

- Set price alerts for significant market movements

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Analyze Solana ecosystem developments that may impact MAY

- Monitor trading volume for potential breakouts or trend reversals

MAY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MAY

MAY Market Risks

- High volatility: AI and DeFi sectors are prone to rapid price swings

- Competition: Emerging AI projects may impact MAY's market share

- Solana ecosystem dependency: MAY's performance is tied to Solana's success

MAY Regulatory Risks

- Uncertain regulations: AI and DeFi sectors face potential regulatory scrutiny

- Cross-border compliance: Varying international regulations may impact adoption

- Data privacy concerns: AI-driven solutions may face data protection challenges

MAY Technical Risks

- Smart contract vulnerabilities: Potential security breaches in the protocol

- AI model limitations: Performance may be affected by AI accuracy and reliability

- Scalability issues: Rapid growth could strain the Mayflower AI infrastructure

VI. Conclusion and Action Recommendations

MAY Investment Value Assessment

Mayflower (MAY) presents a unique value proposition in the AI-driven DeFi space on Solana. While it offers long-term potential for revolutionizing user interactions in DeFi, short-term risks include market volatility and technological uncertainties.

MAY Investment Recommendations

✅ Newcomers: Start with small positions, focus on education about AI in DeFi ✅ Experienced investors: Consider MAY as part of a diversified DeFi portfolio ✅ Institutional investors: Evaluate MAY's potential impact on Solana's DeFi ecosystem

MAY Trading Participation Methods

- Spot trading: Buy and sell MAY tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Utilize MAY within the Solana DeFi ecosystem

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is May usually a good month for stocks?

Yes, May is typically a good month for stocks. It's historically one of the best months for the S&P 500, often seeing positive returns.

What crypto will 1000x prediction?

While predicting 1000x gains is speculative, emerging projects like Bitcoin Hyper show potential for massive growth in 2025, attracting attention from Bitcoin whales and investors seeking the next big opportunity in the crypto market.

How much will $1 Bitcoin be worth in 2025?

Based on expert predictions, $1 Bitcoin could be worth around $100,000 to $250,000 by 2025, reflecting significant growth potential in the cryptocurrency market.

What may be the next Bitcoin?

Ethereum is often considered the next Bitcoin due to its advanced technology and growing adoption. Its recent price surge and market interest make it a strong contender as of 2025-10-09.

Share

Content