2025 MATR1X Price Prediction: Analyzing Future Trends and Potential Growth in the Digital Asset Market

Introduction: MATR1X's Market Position and Investment Value

MATR1X (MATR1X), as a cutting-edge entertainment platform integrating gaming, AI, and esports on WEB3 infrastructure, has made significant strides since its inception. As of 2025, MATR1X's market capitalization stands at $1,204,772, with a circulating supply of approximately 151,353,332 tokens, and a price hovering around $0.00796. This asset, hailed as the "Web3 gaming innovator," is playing an increasingly crucial role in revolutionizing the global gaming and digital content industries.

This article will provide a comprehensive analysis of MATR1X's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MATR1X Price History Review and Current Market Status

MATR1X Historical Price Evolution

- 2024: Initial launch, price reached an all-time high of $0.48293 on August 6

- 2025: Market correction, price dropped to an all-time low of $0.00721 on October 15

- 2025: Current market cycle, price fluctuating between $0.007608 and $0.00833 in the past 24 hours

MATR1X Current Market Situation

As of October 29, 2025, MATR1X is trading at $0.00796, experiencing a 3.86% decrease in the last 24 hours. The token's market capitalization stands at $1,204,772, ranking 2693rd in the overall cryptocurrency market. With a circulating supply of 151,353,332 MATR1X tokens, representing 18.92% of the total supply, the project has a fully diluted valuation of $6,368,000. Trading volume in the past 24 hours reached $62,026, indicating moderate market activity. The token has seen significant volatility, with a 24.21% decrease over the past 30 days and a substantial 97.13% decline over the past year, reflecting the challenging market conditions faced by many cryptocurrencies in this period.

Click to view the current MATR1X market price

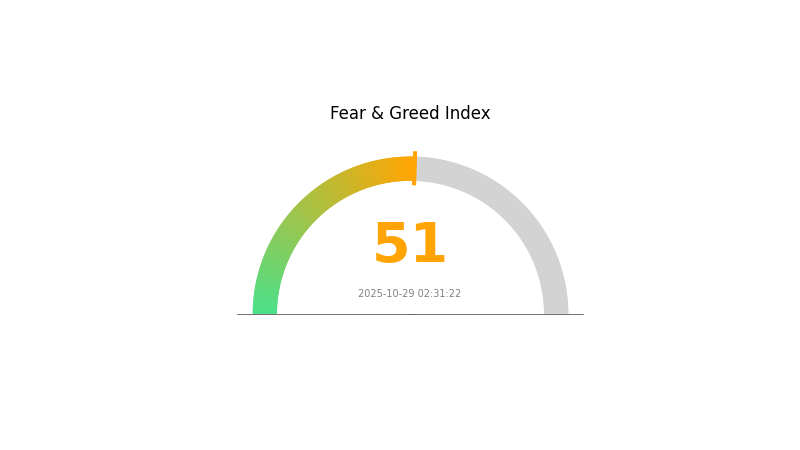

MATR1X Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. While caution is still advised, the neutral reading may present opportunities for strategic trading. Traders should continue to monitor market trends and conduct thorough research before making investment decisions. Remember, a balanced approach is key in navigating the dynamic crypto landscape.

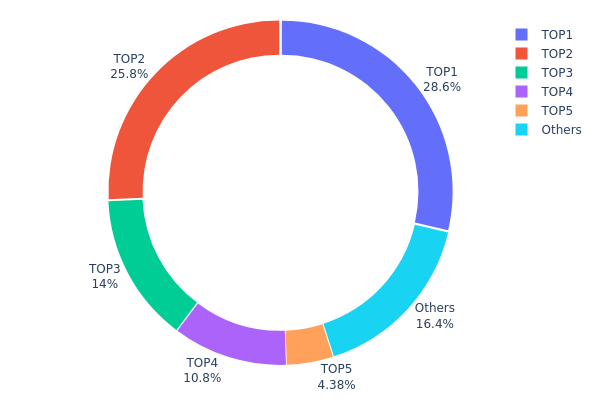

MATR1X Holdings Distribution

The address holdings distribution chart for MATR1X reveals a highly concentrated token ownership structure. The top five addresses collectively hold 83.57% of the total supply, with the largest holder controlling 28.64%. This level of concentration raises concerns about centralization and potential market manipulation.

Such a concentrated distribution can significantly impact market dynamics. The top holders have substantial influence over price movements, potentially leading to increased volatility. Moreover, this concentration may deter smaller investors due to perceived risks of large sell-offs or price manipulation.

From a market structure perspective, the current distribution suggests a relatively low degree of decentralization for MATR1X. While this might provide some stability in terms of large holders' vested interests, it also implies a less diverse ecosystem and potentially limited on-chain activity from a broader user base.

Click to view the current MATR1X Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x730c...467901 | 229166.67K | 28.64% |

| 2 | 0x11b1...c92467 | 206000.00K | 25.75% |

| 3 | 0x8d68...ddbcb6 | 112000.00K | 14.00% |

| 4 | 0x43f8...977e8a | 86480.00K | 10.81% |

| 5 | 0x40ec...5bbbdf | 35008.63K | 4.37% |

| - | Others | 131344.70K | 16.43% |

II. Key Factors Influencing MATR1X's Future Price

Supply Mechanism

- Market Demand: The price of MATR1X is significantly influenced by market demand and adoption rates.

- Current Impact: Changes in supply and demand dynamics are expected to have a substantial effect on MATR1X's price.

Institutional and Whale Dynamics

- Corporate Adoption: Companies integrating MATR1X's blockchain and AI technologies may impact its value.

Macroeconomic Environment

- Inflation Hedge Properties: MATR1X's performance in inflationary environments may affect its price.

Technological Development and Ecosystem Building

- Blockchain and AI Integration: MATR1X's unique fusion of gaming, blockchain, and AI technologies aims to revolutionize digital content, potentially influencing its market value.

- Ecosystem Applications: The development of DApps and ecosystem projects within the MATR1X network could drive price changes.

III. MATR1X Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00603 - $0.00700

- Neutral prediction: $0.00700 - $0.00800

- Optimistic prediction: $0.00800 - $0.00872 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.00508 - $0.01008

- 2027: $0.00644 - $0.00966

- Key catalysts: Project milestones, partnerships, and overall crypto market trends

2028-2030 Long-term Outlook

- Base scenario: $0.00943 - $0.01211 (assuming steady project growth and market stability)

- Optimistic scenario: $0.01211 - $0.01671 (with significant project achievements and favorable market conditions)

- Transformative scenario: $0.01671+ (under extremely favorable conditions and breakthrough innovations)

- 2030-12-31: MATR1X $0.01211 (potential average price, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00872 | 0.00793 | 0.00603 | 0 |

| 2026 | 0.01008 | 0.00833 | 0.00508 | 4 |

| 2027 | 0.00966 | 0.0092 | 0.00644 | 15 |

| 2028 | 0.0132 | 0.00943 | 0.00698 | 18 |

| 2029 | 0.0129 | 0.01132 | 0.00849 | 42 |

| 2030 | 0.01671 | 0.01211 | 0.00702 | 52 |

IV. Professional Investment Strategies and Risk Management for MATR1X

MATR1X Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate MATR1X tokens during market dips

- Regularly review project updates and developments

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

MATR1X Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Position sizing: Limit exposure to MATR1X based on risk tolerance

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MATR1X

MATR1X Market Risks

- High volatility: MATR1X price may experience significant fluctuations

- Competition: Other Web3 gaming platforms may gain market share

- Market sentiment: General crypto market trends can impact MATR1X performance

MATR1X Regulatory Risks

- Uncertain regulations: Changes in crypto regulations may affect MATR1X

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax laws for crypto assets and gaming rewards

MATR1X Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased user demand

- Technological obsolescence: Rapid advancements in blockchain technology

VI. Conclusion and Action Recommendations

MATR1X Investment Value Assessment

MATR1X offers long-term potential in the Web3 gaming and entertainment sector but faces short-term volatility and competitive challenges. The project's success depends on user adoption and technological advancements.

MATR1X Investment Recommendations

✅ Beginners: Start with small, affordable investments to learn about the project ✅ Experienced investors: Consider a balanced approach, allocating based on risk profile ✅ Institutional investors: Conduct thorough due diligence and consider long-term potential

MATR1X Participation Methods

- Token purchase: Buy MATR1X tokens on Gate.com

- Platform engagement: Participate in Matr1x games and ecosystem

- Staking: Explore staking options if available for potential rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would Hamster Kombat coin reach $1?

Based on current trends, Hamster Kombat coin could potentially reach $1 by 2028. This projection considers the growth of blockchain gaming and overall market developments.

Can Monero reach $1 000?

Yes, Monero could potentially reach $1,000. This depends on market conditions, increased adoption, and overall crypto market growth. However, it's not guaranteed and would require significant price appreciation.

Is Matr1x Fire a blockchain game?

Yes, Matr1x Fire is a blockchain game. It's a mobile FPS game built on the Polygon blockchain, featuring 5v5 battles in a Cyberpunk-themed metaverse.

How much is a MATIC coin worth in 2025?

Based on current projections, a MATIC coin is expected to be worth approximately $31.42 in 2025. This represents significant growth from its current price.

2025 B3Price Prediction: Expert Analysis and Forecast for Brazilian Stock Exchange Performance

Is Xterio (XTER) a Good Investment?: Analyzing Performance, Potential, and Risks in the Web3 Gaming Token Market

2025 GM Price Prediction: Analyzing Market Trends and Future Prospects for General Motors Stock

Is The Game Company (GMRT) a good investment?: Analyzing the potential of this emerging player in the mobile gaming industry

2025 BEAT Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 PORTAL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Blockchain Platform

What is DigiByte (DGB): Fundamentals, Technology Innovation, and Roadmap Progress in 2025?

How do competitive analysis and market share comparisons drive cryptocurrency exchange success?

What Are the Main Security Risks and Vulnerabilities in PLEB Token Trading?

ARB Token Unlock Schedule December 2024: Impact on Arbitrum Price and Vesting Guide

How active is the FHE community and ecosystem in 2025 with 100+ developers and 50+ DApps?