2025 年 BILLY 價格預測:市場趨勢與未來成長潛力解析

全面剖析 BILLY 2025-2030 年價格預測,涵蓋歷史價格走勢、未來成長動力與策略性投資思維。深入解析 Solana 鏈 Meme Coin 產業潛在風險與挑戰。不論您是新手還是專業投資人,都能掌握 BILLY 交易及參與的實用觀點與操作建議。緊貼市場情緒和監管動態,深入發掘 BILLY 在 Gate 的投資價值。即時掌握市場脈動,於加密貨幣市場做出高效且明智的投資決策。簡介:BILLY 的市場定位與投資價值

BILLY(BILLY)作為 Solana 區塊鏈上最具萌寵特色的狗狗主題代幣,自問世以來便廣受矚目。截至 2025 年,BILLY 市值為 2,175,000 美元,流通量 10 億枚,價格約 0.002175 美元。「Solana 的萌寵」已逐步在 Solana 生態系的 meme 幣及社群驅動型代幣領域中占有一席之地。

本文將從歷史走勢、市場供需、生態發展及總體經濟等多重面向,系統分析 BILLY 2025 至 2030 年的價格趨勢,並為投資人提供專業預測與操作策略。

一、BILLY 價格歷史回顧與現況

BILLY 歷史價格演變

- 2024 年:BILLY 上市,7 月 21 日創下歷史新高 0.2858 美元

- 2025 年:市場大幅修正,10 月 10 日跌至歷史新低 0.001363 美元

BILLY 目前市場狀況

截至 2025 年 10 月 15 日,BILLY 交易價格為 0.002175 美元,市值達 2,175,000 美元。過去一年,BILLY 累計下跌 95.63%。近 24 小時下跌 3.71%,近 7 日及 30 日分別下跌 21.13% 和 39.72%。

BILLY 流通量為 10 億枚,總量與最大供應量一致,代表所有 BILLY 代幣均已流通,不再有新發行。

近 24 小時交易量為 23,758.02 美元,流動性相較市值偏低。目前市場占有率僅 0.000053%,於整體加密市場中占比極小。

點此查看即時 BILLY 市場價格

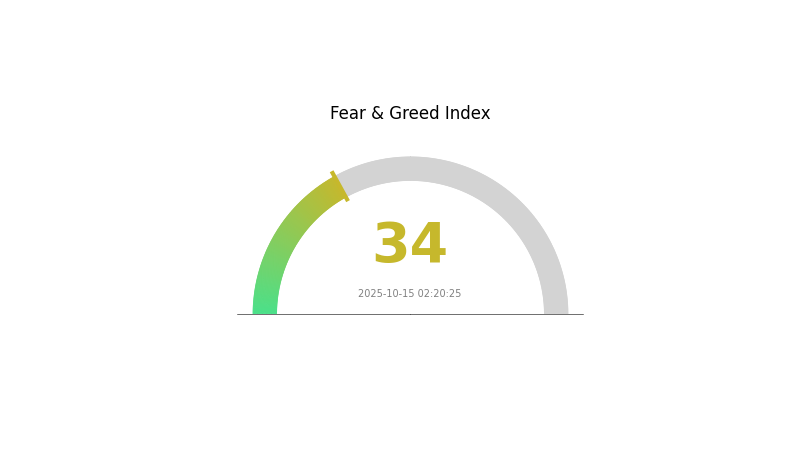

BILLY 市場情緒指標

2025 年 10 月 15 日恐懼與貪婪指數:34(恐懼)

點此查詢最新 恐懼與貪婪指數

目前加密市場處於恐懼階段,BILLY 指數為 34,投資人多持謹慎、觀望態度。建議密切追蹤資訊,避免盲目操作。市場情緒快速變動,恐懼時期常是有備者的機會。建議關注權威管道,分散資產配置,有效控管風險。

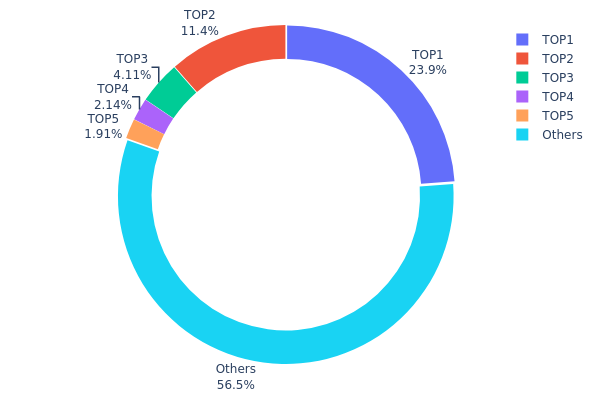

BILLY 持倉分布

BILLY 持倉結構顯示,代幣高度集中於部分主力地址。最大持有者占總供應量 23.85%,前五大地址合計持有 43.43%,分布結構高度中心化。

此集中現象可能增加市場操控及價格劇烈波動風險。單一地址持有近四分之一代幣,若有大額轉移,勢必帶來顯著市場衝擊。主力地址集中也代表少數群體對 BILLY 治理及經濟決策具有較大影響力。

同時,56.57% 代幣分散於「其他」地址,顯示有廣泛小額持有者參與。整體結構兼具中心化與多元化,對市場穩定略有助益,但仍須留意大戶主導風險。

點此查看最新 BILLY 持倉分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 234472.38K | 23.85% |

| 2 | u6PJ8D...ynXq2w | 112524.42K | 11.44% |

| 3 | ASTyfS...g7iaJZ | 40396.89K | 4.11% |

| 4 | HDmzpt...731dpD | 21002.62K | 2.13% |

| 5 | A77HEr...oZ4RiR | 18730.84K | 1.90% |

| - | Others | 555740.90K | 56.57% |

二、影響 BILLY 未來價格的關鍵因素

供應機制

- 年度發行量:BILLY 無總量上限,每年約新增 50 億枚,流動性充足。

- 當前影響:大規模年度增發可能帶來價格下行壓力,亦有助於 BILLY 成為主流支付及流通貨幣。

機構與大戶動態

- 企業採納:部分線上與實體商家已接受 BILLY 支付,應用情境逐步擴大。

總體經濟環境

- 抗通膨屬性:部分投資人將 BILLY 作為潛在抗通膨工具。

技術發展與生態建設

- 社群文化:BILLY 社群及 meme 文化推動用戶參與與採用度。

- 媒體與名人效應:名人背書與媒體曝光對 BILLY 熱度與價格具明顯影響。

- 生態應用:BILLY 支援於 Reddit 等社群平台打賞內容創作者,應用場景不斷豐富。

三、BILLY 2025-2030 價格預測

2025 年展望

- 保守預測:0.00124 - 0.00218 美元

- 中性預測:0.00218 - 0.00231 美元

- 樂觀預測:0.00231 - 0.00244 美元(需市場情緒積極)

2027-2028 年展望

- 市場預期:潛在成長期

- 價格區間預測:

- 2027 年:0.00181 - 0.00345 美元

- 2028 年:0.00209 - 0.00404 美元

- 核心動能:應用拓展與技術創新

2029-2030 年長線展望

- 基準情境:0.00339 - 0.00377 美元(市場穩健成長)

- 樂觀情境:0.00377 - 0.00414 美元(市場強勢)

- 變革情境:0.00414 美元以上(極端利多與廣泛採用)

- 2030 年 12 月 31 日:BILLY 價格或穩定於 0.00363 美元附近

| 年份 | 預測高點 | 預測均價 | 預測低點 | 漲跌幅 |

|---|---|---|---|---|

| 2025 | 0.00244 | 0.00218 | 0.00124 | 0 |

| 2026 | 0.00258 | 0.00231 | 0.00212 | 6 |

| 2027 | 0.00345 | 0.00245 | 0.00181 | 12 |

| 2028 | 0.00404 | 0.00295 | 0.00209 | 35 |

| 2029 | 0.00377 | 0.00349 | 0.00339 | 60 |

| 2030 | 0.00414 | 0.00363 | 0.00185 | 67 |

四、BILLY 專業投資策略與風險控管

BILLY 投資方法論

(1)長線持有策略

- 適用對象:具備風險承受力、長期投資視角的投資人

- 操作建議:

- 於價格回檔時分批布局 BILLY

- 建立定期定額投資計畫,平滑波動影響

- 將代幣安全存放於支援 Solana 的錢包內

(2)主動交易策略

- 技術分析工具:

- 均線指標:辨識趨勢與反轉訊號

- RSI:判斷超買或超賣區間

- 短線操作要點:

- 關注交易量變化,捕捉突破契機

- 嚴格設立停損,管控下行風險

BILLY 風險管理架構

(1)資產配置原則

- 保守型:加密資產配置 1-2%

- 積極型:加密資產配置 3-5%

- 專業型:加密資產配置 5-10%

(2)風險避險措施

- 資產分散:投資多元加密資產及其他類別

- 停損機制:自動賣出以控制損失

(3)安全儲存對策

- 熱錢包建議:Gate Web3 錢包

- 冷儲存:硬體錢包適合長期持有

- 安全措施:啟用雙重認證、強密碼、定期更新軟體

五、BILLY 潛在風險與挑戰

BILLY 市場風險

- 高波動性:價格易劇烈波動

- 流動性有限:大額交易可能顯著影響價格

- Meme 幣屬性:極易受市場情緒波動影響

BILLY 合規風險

- 監理環境不明:Meme 幣可能面臨更嚴格監管

- Solana 網路合規性:政策變動恐影響 BILLY

- 跨境限制:各地法規差異影響流通性

BILLY 技術風險

- 智慧合約漏洞:底層程式碼恐有安全隱憂

- 依賴 Solana 網路:Solana 故障將直接衝擊 BILLY

- 擴展性挑戰:高速成長恐導致基礎設施壓力

六、結論與行動建議

BILLY 投資價值評估

BILLY 屬於 Solana 生態 meme 板塊高風險、高報酬標的,短線具獲利潛力,長線價值仍高度不確定且波動劇烈。

BILLY 投資建議

✅ 新手:僅以可承受損失的小額資金參與

✅ 有經驗者:嚴控風險,將 BILLY 納入多元組合配置

✅ 機構投資人:審慎評估,徹底盡調,僅納入高風險資產配置

BILLY 參與方式

- 現貨交易:於 Gate.com 或其他平台購買 BILLY

- 質押:如生態支援可參加質押獲取收益

- 社群互動:加入 BILLY 社群媒體及活動,取得最新資訊

加密貨幣投資風險極高,本文不構成投資建議。投資人應評估自身風險承受力,建議諮詢專業金融顧問。切勿投入超過可承受損失的資金。

常見問題

Billy 是 meme 幣嗎?

是的,Billy 屬於 Solana 區塊鏈上的 meme 幣,結合狗狗主題與 DeFi 應用,吸引社群投資人參與。

Billy Price 有殘疾嗎?

是的,Billy Price 因 18 歲時意外導致下半身癱瘓,後來成為勵志演說家,鼓舞他人。

2030 年 XRP 價格預估為何?

預期 2030 年 XRP 價格將落在 90 美元至 120 美元區間,屆時將成為重要里程碑,此預測基於當前市場趨勢。

Bill 股票價格預測為何?

根據市場動向與分析師預測,BILL 股票至 2025 年底預估可達 150-180 美元,2026 年仍具成長空間。

分享

目錄