交易师投资笔记1

❤️創金社區----2025年11月3日當天分析

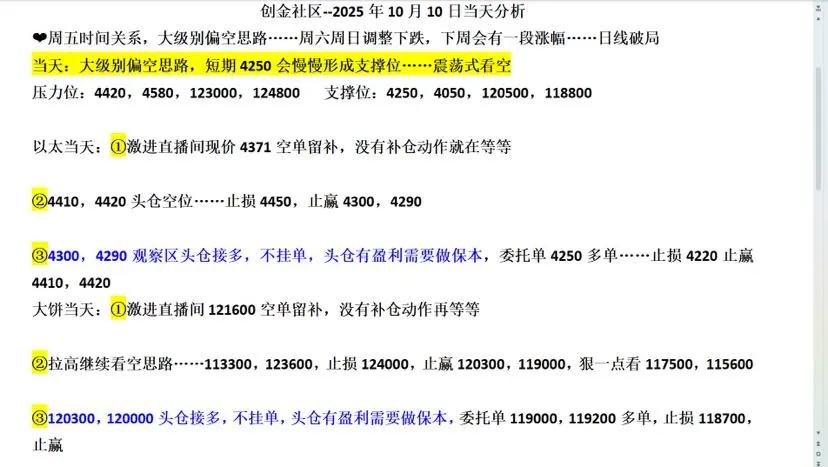

除了消息面,目前技術面看空爲主……一旦破位105000,107000就會有個極速……以太日線頂部很明顯……整體市場經濟不好…短期利率不下來,持有美債的更喫香,現金流不出來,大餅吸金比較大,經濟跟不上……市場環境不好

當天:4小時繼續參考箱體震蕩,行情短期偏弱……今天先空爲主,日內重要支撐3680,3700,107000

中期關鍵支撐:100500,97800【有機會下探,謹防突發黑天鵝插針點位]

壓力位:3930,3980,111500,112500支撐位:3760,3600,107500,104500

以太當天:3880,3890空單…止損3920,止贏3730,3668(也是多單進場點,多單止贏3850,3880,3900)

大餅當天:110500,111000空單,止贏107500,106600(也是多單進場點,止贏110500,111000)

日內多空止損各帶日內止損點-大餅 500 點-以太30點附近結合直播和技術,控制倉位管理,僅供參考

查看原文除了消息面,目前技術面看空爲主……一旦破位105000,107000就會有個極速……以太日線頂部很明顯……整體市場經濟不好…短期利率不下來,持有美債的更喫香,現金流不出來,大餅吸金比較大,經濟跟不上……市場環境不好

當天:4小時繼續參考箱體震蕩,行情短期偏弱……今天先空爲主,日內重要支撐3680,3700,107000

中期關鍵支撐:100500,97800【有機會下探,謹防突發黑天鵝插針點位]

壓力位:3930,3980,111500,112500支撐位:3760,3600,107500,104500

以太當天:3880,3890空單…止損3920,止贏3730,3668(也是多單進場點,多單止贏3850,3880,3900)

大餅當天:110500,111000空單,止贏107500,106600(也是多單進場點,止贏110500,111000)

日內多空止損各帶日內止損點-大餅 500 點-以太30點附近結合直播和技術,控制倉位管理,僅供參考