Gate Research Daily Report: BTC Turns Weaker Around $111K | AVNT Soars 361% in 24 Hours to Lead the Market

Crypto Market Overview

BTC ( -0.35% | Current Price: 110,974 USDT )

After a surge, BTC has experienced a noticeable short-term decline, with the current price hovering around $110,974.7. The short-term moving averages (MA5, MA10) have turned downward and broken below MA30, indicating a weakening of short-term bullish momentum. The volume has significantly increased during the decline, indicating that the bears have taken the initiative. If the price continues to fluctuate below $111,000, it may further dip to $110,000 for support. However, if it can quickly stabilize and reclaim MA30, it may return to the $112,000 - $113,000 range. Overall, the short-term trend of BTC is weakening, and caution is needed for further pullbacks.

ETH ( +0.5% | Current Price: 4,309 USDT )

ETH has been fluctuating around $4,300 recently and is currently quoted at $4,309.62. The short-term moving averages (MA5 and MA10) are close to each other, and the price is near MA30, indicating that the short-term direction is still unclear. The volume increases when the price dips locally, but the rebound energy is insufficient, indicating intense competition between bulls and bears. If the price can break through $4,340 and increase in volume, it is expected to challenge the pressure zone of $4,380 - $4,400 again; if it falls below $4,280, it may trigger further pullback, testing the low point of $4,237. Overall, ETH is currently in a period of fluctuation and accumulation, and the direction needs to be confirmed by the volume.

GT ( -0.99% | Current Price: 16.66 USDT )

GT has experienced a short-term decline after continuous fluctuations, and the current price is reported at $16.663. The short-term moving averages (MA5, MA10) have crossed below the MA30 and are still trending downward, indicating a continuation of the weak pattern. The trading volume significantly increased during the decline, while the volume was insufficient during the rebound, indicating a bearish trend. If the price falls below the $16.6 mark, it may further test the support range of $16.3-16.0; if it can stabilize and break through $16.8 again, it is expected to ease the downward pressure. Overall, GT’s short-term trend is weak, and it is currently dominated by bears, so defensive operations are needed.

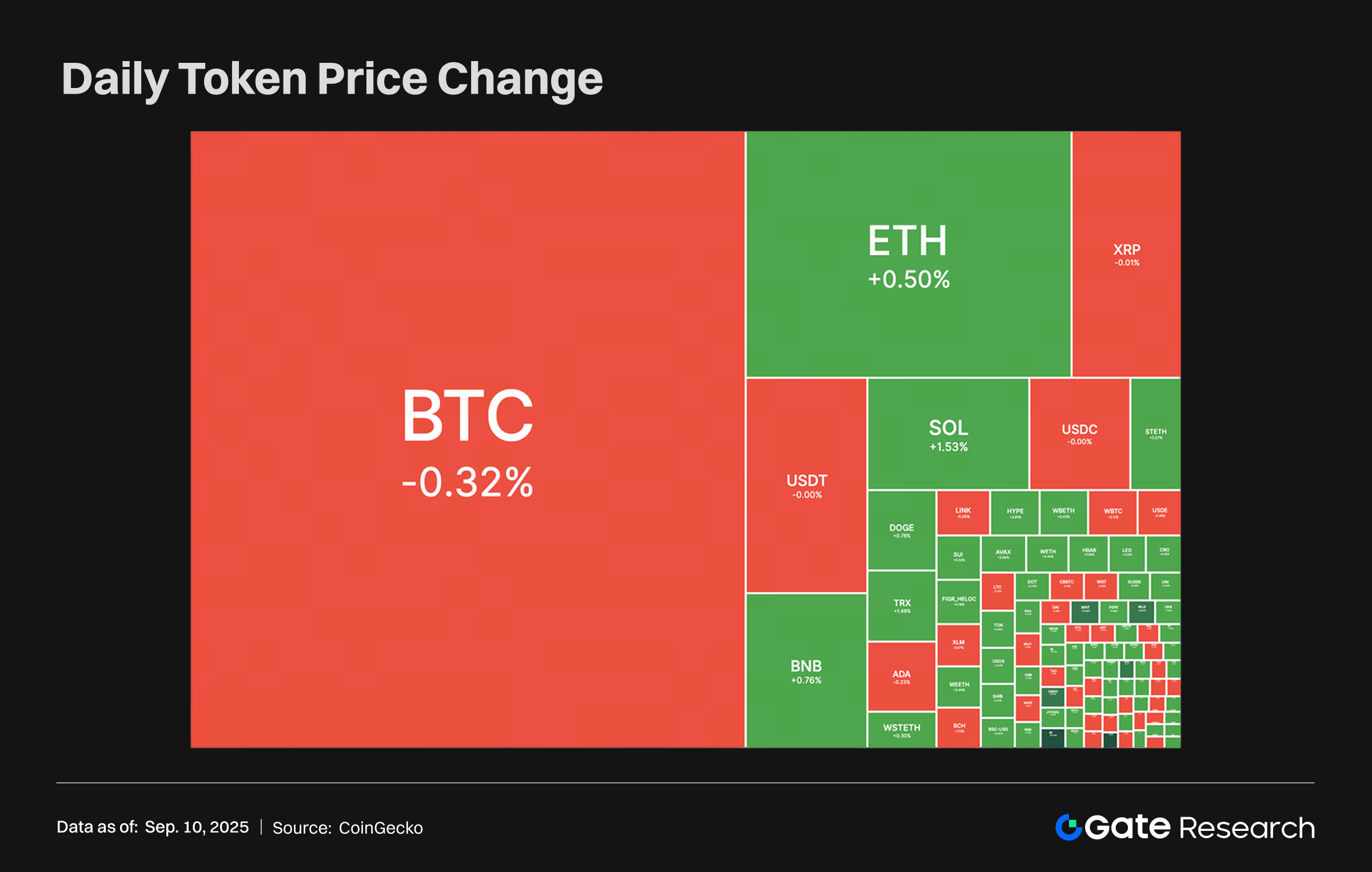

Tokens Heatmap

The cryptocurrency market showed slight fluctuations, with BTC slightly down 0.32% and ETH slightly up 0.50%. SOL performed well, rising 1.53%. Stablecoins USDT and USDC remained almost unchanged, and the overall market remained stable. Some small currencies such as DOGE and LINK rose slightly, but the overall market activity level was average, and investors were cautious.

AVNT – Avantis (+361.27%, Circulating Market Cap: $49M)

According to Gate market data, the current price of the AVNT token is $0.2311, with an increase of approximately 361.27% in the past 24 hours. Avantis is a decentralized perpetual contract exchange aimed at high-leverage trading of cryptocurrency and real-world assets (RWA), including foreign exchange, commodities, indices, and upcoming stocks. Supported by Pantera and Coinbase, Avantis is the most traded decentralized exchange on the Base platform and introduces institutional-grade products to the DeFi field, allowing users to trade with up to 500 times leverage in a transparent and permissionless environment.

Avantis, as an important derivative platform within the Base ecosystem system, quickly attracted market attention with the launch of the AVNT token airdrop checker. Starting from September 9th, over 65,000 wallets can participate in the airdrop. The narrative focuses on large-scale user participation, effectively increasing the community’s active level and token circulation. Meanwhile, the project has just completed an $8 million financing round led by Founders Fund and Pantera Capital, and the market is full of anticipation for its prospects of combining on-chain and real-world macro asset trading. The dual boost of funds and narrative has rapidly increased its popularity. According to Gate market data, the AVNT token is currently priced at $0.2311, with a 24-hour surge of 361.27%. During this period, the trading volume has significantly increased, with a concentration of funds flowing in and a surge in bullish sentiment.

BID – CreatorBid (+60.51%, Circulating Market Cap: $35M)

According to Gate market data, the current price of BID token is $0.1313, an increase of 60.51% in 24 hours. CreatorBid (BID) is a pioneering platform at the intersection of blockchain technology and digital content markets, utilizing the power of artificial intelligence to provide a decentralized market, allowing creators, artists, and influencers to monetize and tokenize their works. The platform has a variety of unique features, from the integration of its artificial intelligence to strategic partnerships that enhance its market position, and focuses on personalized content experiences based on artificial intelligence.

CreatorBid’s recent innovations focus on providing agents with highly flexible and customized startup infrastructure. Key highlights include fundraising and allocation mechanisms, phased token economics, and decreasing exit tax (DET) planning functions. These tools not only enhance the team’s control over funds and token circulation, but also enhance the security and liquidity of the ecosystem through the combination of Conviction Vault and decentralized exchanges. In addition, the project has opened up a dual-track mechanism of fixed price release and community voting, allowing the project to receive strategic support from curators while retaining the option to go live independently. The narrative emphasizes decentralization and freedom, attracting market attention. According to Gate market data, the BID token is currently priced at $0.1313, up 60.51% in 24 hours, with a concentration of funds flowing in, and the market sentiment rapidly heating up, indicating a clear bullish sentiment.

XPIN – XPIN Network (+52.01%, Circulating Market Cap: $33M)

According to Gate market data, the current price of the XPIN token is $0.002186, with an increase of about 52.01% in the past 24 hours. The XPIN Network is redefining global connectivity as an AI-driven decentralized communication infrastructure, combining decentralized wireless technology with community-centered innovation. XPIN is unique in its asset class, combining decentralized governance and support for real-world applications, which is different from purely speculative counterfeit products. It adds another layer of appeal for short-term traders focused on utility-driven demand and speculative interests in the DePIN field.

XPIN’s recently launched FreeData Plan has become the core of the narrative, emphasizing the global free connection service without borders or operator restrictions, covering 149 countries and regions. The network automatically switches through Xtella.AI to ensure that users always maintain the best connection experience. The concept of this decentralized wireless network highlights its vision of fairness, security, and low cost. At the same time, the participation model of users as builders further strengthens community consensus. With XPIN’s deposit scale exceeding 900 million tokens and the annualized return rate of loyalty deposits reaching 400%, the market heat has been quickly ignited. According to Gate market data, XPIN token is currently trading at $0.002186, up 52.01% in 24 hours. The trading volume has significantly increased, and strong bullish sentiment has driven concentrated capital inflows.

Hotpot Insights

Asset Entities Merges with Strive Enterprises to Form Bitcoin Finance Company, Plans to Raise $1.50 billion to Purchase BTC

Marketing company Asset Entities (ASST) announced that its shareholders have approved a merger with Strive Enterprises, owned by Vivek Ramaswamy, the former head of the US Government Efficiency Department. The plan is to establish a financial company focused on Bitcoin. The majority of shareholders voted in favor of the transaction, and the new company will be renamed Strive, Inc. and continue to trade under the stock code ASST. Additionally, the company plans to raise up to $1.5 billion to purchase Bitcoin on a large scale and build a core asset reserve.

This move not only reflects the trend of traditional enterprises accelerating their transformation towards Bitcoin Asset Allocation, but also highlights the increasingly stable position of Bitcoin among institutional investors. By focusing its business core on Bitcoin, Strive, Inc. is expected to further attract the attention of Capital Markets and open up new growth space for the company. However, at the same time, how to achieve a balance between fundraising and Bitcoin price fluctuations will still be a key consideration for the company’s future operations. Investors also need to pay attention to the stability and compliance risks of its long-term strategic execution.

Kiln exits the Ethereum verification node in an orderly manner to ensure the safety of stakers in response to the SwissBorg event

Staking infrastructure provider Kiln announced that it has launched a plan to orderly exit all its Ethereum (ETH) verification nodes after the SwissBorg-related Solana incident to strengthen the security protection of customer assets. The official stated that the exit process is expected to take 10 to 42 days, depending on the validator’s situation, and withdrawals will be completed within a maximum of 9 days after the exit according to the network arrangement. During this period, validators can still receive rewards. Kiln emphasized that once potential infrastructure risks are discovered, they will take immediate action. The decision to exit the node is a responsible measure to ensure the safety of stakers. Currently, Kiln has suspended some staking services, including Dashboard, Widget, and API.

This action not only demonstrates Kiln’s ability to respond quickly and control risks after the incident, but also highlights the security challenges faced by staking infrastructure in the multi-chain ecosystem. By actively exiting the verification node, Kiln sends a signal: in the complex and ever-changing encrypted market environment, user asset security always takes priority over short-term returns.

ALT5 Sigma adjusts Eric Trump’s position, holds huge equity in WLFI to strengthen market layout

According to Forbes, ALT5 Sigma disclosed in its filing with the US Securities and Exchange Commission (SEC) that, following discussions with Nasdaq, it has adjusted the position of Eric Trump, the son of Trump, from a proposed director to a board observer to comply with its listing rules. At the same time, ALT5 Sigma holds approximately 38% of the company’s interests in World Liberty Financial, as well as up to 22.5 billion WLFI tokens, and enjoys approximately 75% of the token sales revenue.

This move not only shows ALT5 Sigma’s active adjustment of its governance structure under the compliance framework, but also highlights its deep participation and voice over in the WLFI project. By mastering large-scale token equity and revenue distribution rights, the company is expected to occupy a dominant position in the future token economy and business expansion. However, the concentration of huge tokens may also bring market volatility and regulatory risks. Investors need to carefully evaluate the relevant uncertainties while paying attention to its potential returns.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- Gate, https://www.gate.com/launchpool/BSU?pid=355

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Foresightnews, https://foresightnews.pro/news/detail/83730

- Foresightnews, https://foresightnews.pro/news/detail/83726

- Foresightnews, https://foresightnews.pro/news/detail/83724

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review