[O usuário compartilhou um Space. Verifique o aplicativo para obter mais detalhes.]

FortuneCat

Siga, não se perca! Um jogador experiente em contratos que não gosta de falar, faz super curto prazo.

Marcar

FortuneCat

Seguindo o que fiz, ganhei uma fortuna!

Ver original

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Relatório do dia, ai! Estão a ganhar dinheiro às escondidas novamente.

Ver original

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

BTC **ordem curta**:

#———————-

Se o preço voltar a subir para a faixa de 119.000 a 120.000, pode-se fazer uma ordem curta com uma posição leve, com um stop loss em 124.500 e um objetivo entre 117.500 e 116.000.

- **Oportunidade de ordem longa**: Após uma correção para 116,000–117,500 e estabilização, posicionar-se para uma ordem longa, stop loss em 115,300, objetivo 121,000–122,000.

---

Oportunidade de ordem curta do Ethereum**: Vender a descoberto ao ser rejeitado na recuperação para 4,700–4,750, stop loss em 4,800, alvo em 4,500–4,450.

- **Oportunidade de compra**: Se cair para 4,200–4,250 e

Ver original#———————-

Se o preço voltar a subir para a faixa de 119.000 a 120.000, pode-se fazer uma ordem curta com uma posição leve, com um stop loss em 124.500 e um objetivo entre 117.500 e 116.000.

- **Oportunidade de ordem longa**: Após uma correção para 116,000–117,500 e estabilização, posicionar-se para uma ordem longa, stop loss em 115,300, objetivo 121,000–122,000.

---

Oportunidade de ordem curta do Ethereum**: Vender a descoberto ao ser rejeitado na recuperação para 4,700–4,750, stop loss em 4,800, alvo em 4,500–4,450.

- **Oportunidade de compra**: Se cair para 4,200–4,250 e

- Recompensa

- 1

- 1

- Repostar

- Compartilhar

6 de agosto de 2025

Análise de mercado do Bitcoin (BTC)**

Tendência atual**

- **Preço**: Reportado atualmente **$113,877** (queda de 0,76% nas últimas 24 horas), intervalo de flutuação diário **$112,000–$115,800**.

- **Nível chave**:

- **Suporte**: $113,750 (ponto SAR de 4H) → **$112,000** (linha de defesa long/short) → $111,000 (suporte de canal).

- **Resistência**: $114,500–$115,500 (grupo EMA) → $116,155 (resistência super tendência).

#### **Sinal Técnico**

- **Estrutura levemente baixista**:

- O preço no gráfico de 4 horas está abaixo de todas as EMAs, o MACD está em queda com

Ver originalAnálise de mercado do Bitcoin (BTC)**

Tendência atual**

- **Preço**: Reportado atualmente **$113,877** (queda de 0,76% nas últimas 24 horas), intervalo de flutuação diário **$112,000–$115,800**.

- **Nível chave**:

- **Suporte**: $113,750 (ponto SAR de 4H) → **$112,000** (linha de defesa long/short) → $111,000 (suporte de canal).

- **Resistência**: $114,500–$115,500 (grupo EMA) → $116,155 (resistência super tendência).

#### **Sinal Técnico**

- **Estrutura levemente baixista**:

- O preço no gráfico de 4 horas está abaixo de todas as EMAs, o MACD está em queda com

- Recompensa

- 5

- 1

- Repostar

- Compartilhar

FortuneCat :

:

Meus irmãos, finalmente foi liberado, fui bloqueado N vezes em um dia, e até antes da meia-noite é válido.Integração dos **últimos pontos, análise técnica e estratégias de negociação** do Bitcoin (BTC) e do Éter (ETH) em 3 de agosto de 2025, com base nas dinâmicas do mercado e em dados multidimensionais:

---

### 📉 **Últimos níveis e situação do mercado**

1. **Bitcoin (BTC)**

- Durante o período de negociação asiática, caiu temporariamente abaixo do suporte de **$112,000**.

- **Volatilidade intradiária**: após atingir o mínimo de **$112,584**, houve uma leve recuperação, mas não conseguiu superar efetivamente a resistência de **$113,000**.

2. **Ethereum (ETH)**

- O mercado abriu a ca

Ver original---

### 📉 **Últimos níveis e situação do mercado**

1. **Bitcoin (BTC)**

- Durante o período de negociação asiática, caiu temporariamente abaixo do suporte de **$112,000**.

- **Volatilidade intradiária**: após atingir o mínimo de **$112,584**, houve uma leve recuperação, mas não conseguiu superar efetivamente a resistência de **$113,000**.

2. **Ethereum (ETH)**

- O mercado abriu a ca

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

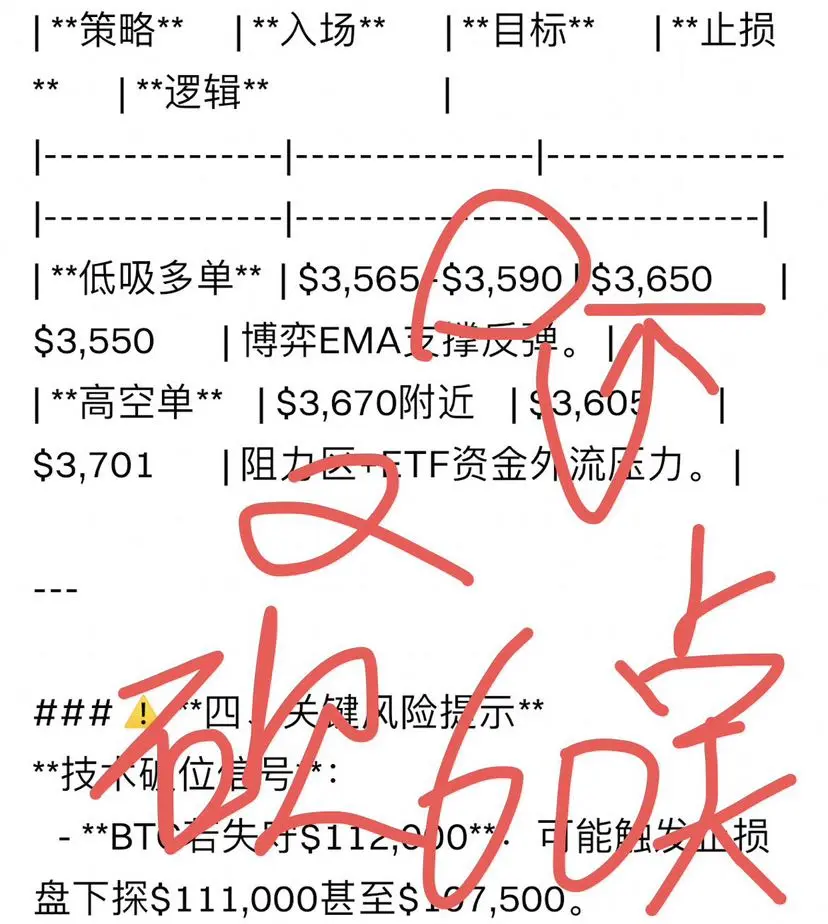

Organização abrangente das últimas cotações, análises de mercado e recomendações de estratégia para Bitcoin (BTC) e Ethereum (ETH) em 2 de agosto de 2025:

---

####📉 **Últimos pontos e dinâmicas de mercado**

1. **Bitcoin (BTC)**

- **Preço atual**:**$112,968**(Queda de **2.69%** nas últimas 24 horas),mínima diária atingiu **$112,722**,rompendo o nível de suporte chave **$113,000**。

- **Quebra técnica**: Perdeu o suporte de **$114,000–$115,000**, o próximo suporte chave é **$110,000** (nível psicológico) e **$107,000**.

2. **Ethereum (ETH)**

- **Preço Atual**: **$3,494** (Queda de

Ver original---

####📉 **Últimos pontos e dinâmicas de mercado**

1. **Bitcoin (BTC)**

- **Preço atual**:**$112,968**(Queda de **2.69%** nas últimas 24 horas),mínima diária atingiu **$112,722**,rompendo o nível de suporte chave **$113,000**。

- **Quebra técnica**: Perdeu o suporte de **$114,000–$115,000**, o próximo suporte chave é **$110,000** (nível psicológico) e **$107,000**.

2. **Ethereum (ETH)**

- **Preço Atual**: **$3,494** (Queda de

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Organização abrangente das últimas cotações, análises de mercado e recomendações de estratégia para Bitcoin (BTC) e Ethereum (ETH) em 2 de agosto de 2025:

---

### 📉 **Últimos pontos e dinâmicas de mercado**

1. **Bitcoin (BTC)**

- **Preço atual**:**$112,968**(Queda de **2.69%** nas últimas 24 horas),mínima diária atingiu **$112,722**,rompendo o nível de suporte chave **$113,000**。

- **Quebra técnica**: Perdeu o suporte de **$114,000–$115,000**, o próximo suporte chave é **$110,000** (nível psicológico) e **$107,000**.

2. **Ethereum (ETH)**

- **Preço Atual**: **$3,494** (Queda de

Ver original---

### 📉 **Últimos pontos e dinâmicas de mercado**

1. **Bitcoin (BTC)**

- **Preço atual**:**$112,968**(Queda de **2.69%** nas últimas 24 horas),mínima diária atingiu **$112,722**,rompendo o nível de suporte chave **$113,000**。

- **Quebra técnica**: Perdeu o suporte de **$114,000–$115,000**, o próximo suporte chave é **$110,000** (nível psicológico) e **$107,000**.

2. **Ethereum (ETH)**

- **Preço Atual**: **$3,494** (Queda de

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Ai, o ponto estava muito certo, me bloqueou!

Ver original

- Recompensa

- 2

- 2

- Repostar

- Compartilhar

FortuneCat :

:

OKVer projetos

Fechamento perfeito!!!

Ver original

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

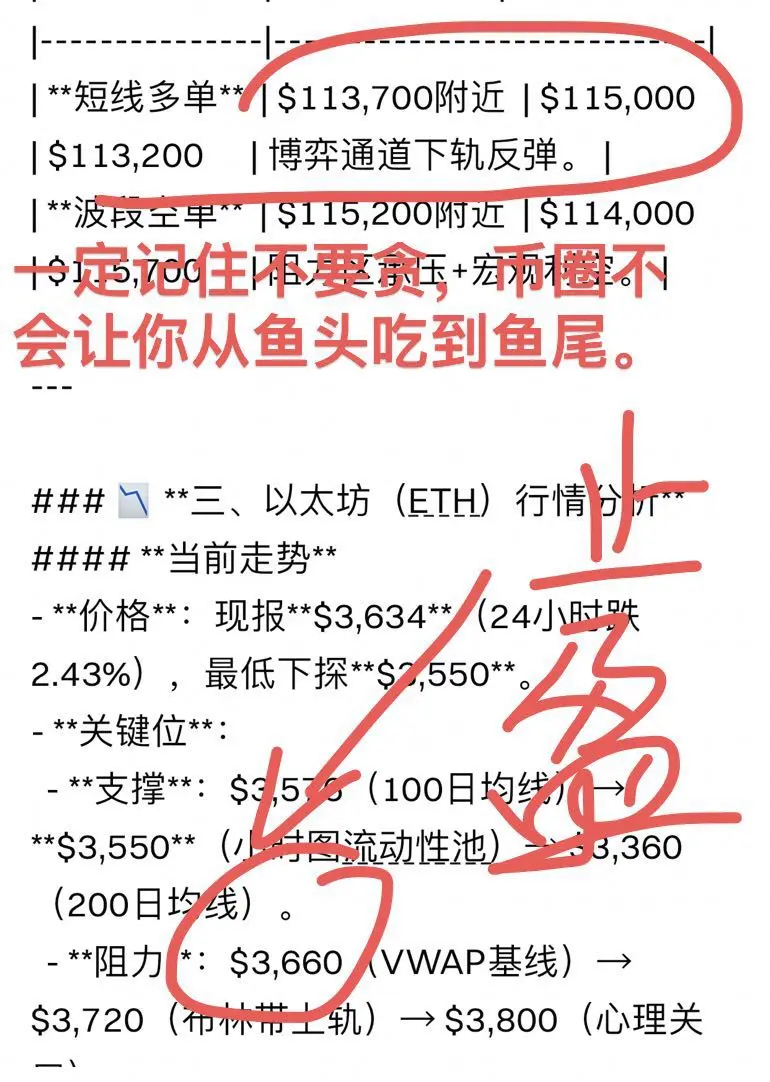

1 de agosto de 2025 (hoje) resumo das últimas cotações, análise de mercado e dinâmicas de mercado do Bitcoin (BTC) e do Ethereum (ETH):

---

### 📉 **Últimos níveis e dinâmica do mercado**

1. **BitCoin (BTC)**

- **Atual**: Durante o período asiático, caiu abaixo do suporte chave de **$115,000**.

- **Volatilidade intradiária**: Aceleração da tendência de baixa após a queda abaixo de **$117,000** de madrugada, atingindo um mínimo de **$116,963**, com o aumento de 24 horas a diminuir para **0.44%** (volatilidade significativamente aumentada).

2. **Ethereum (ETH)**

- **Preço Atual**:**

Ver original---

### 📉 **Últimos níveis e dinâmica do mercado**

1. **BitCoin (BTC)**

- **Atual**: Durante o período asiático, caiu abaixo do suporte chave de **$115,000**.

- **Volatilidade intradiária**: Aceleração da tendência de baixa após a queda abaixo de **$117,000** de madrugada, atingindo um mínimo de **$116,963**, com o aumento de 24 horas a diminuir para **0.44%** (volatilidade significativamente aumentada).

2. **Ethereum (ETH)**

- **Preço Atual**:**

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

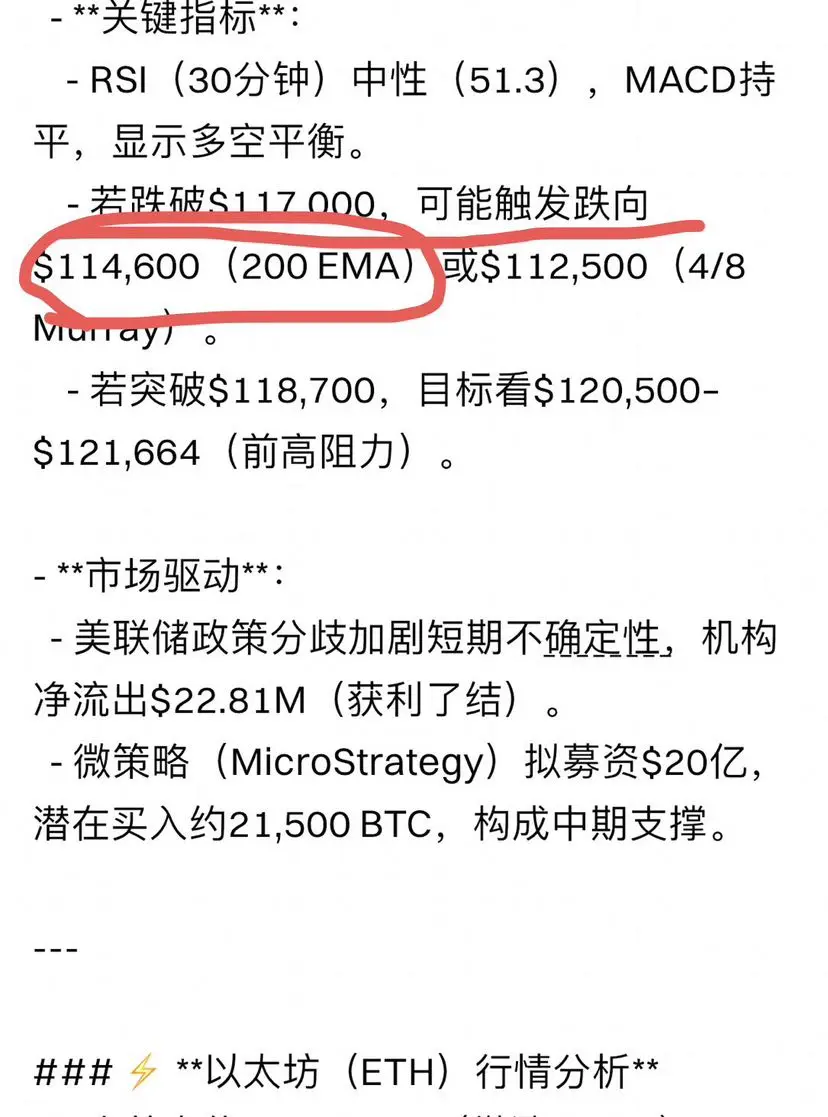

31 de julho de 2025, Bitcoin (BTC) e Ethereum (ETH) estão ambos em uma fase crítica de consolidação técnica, enquanto o mercado aguarda um rompimento direcional. Abaixo estão a análise abrangente e os níveis-chave:

---

### ⚡️ **Análise de mercado do Bitcoin (BTC)**

- **Nível atual**: $117,950 (próximo ao equilíbrio durante o período asiático)

- **Estrutura técnica**:

- **Padrão de triângulo convergente**: o gráfico de 4 horas mostra o preço comprimido entre $117,000 (suporte dinâmico) e $118,700 (resistência), a direção da quebra determinará a tendência de curto prazo.

- **Médias móveis e

Ver original---

### ⚡️ **Análise de mercado do Bitcoin (BTC)**

- **Nível atual**: $117,950 (próximo ao equilíbrio durante o período asiático)

- **Estrutura técnica**:

- **Padrão de triângulo convergente**: o gráfico de 4 horas mostra o preço comprimido entre $117,000 (suporte dinâmico) e $118,700 (resistência), a direção da quebra determinará a tendência de curto prazo.

- **Médias móveis e

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Análise em tempo real, análise técnica e interpretação de eventos-chave do Bitcoin (BTC) e Ethereum (ETH) em 30 de julho de 2025, com um resumo das últimas dinâmicas de mercado:

- **Bitcoin (BTC)**: reporta **116,978 dólares**; queda de **0.94%** no dia, com um mínimo de 24 horas atingindo **116,800 dólares**.

- **Ethereum (ETH)**: Reporta um intervalo de **3,746–3,760 dólares** com uma queda de **1.08%** nas últimas 24 horas, e um total de **856 mil dólares** em posições longas liquidadas na última hora (representando 83% do total das liquidações).

---

### 📊 **Análise Técnica e Tendências Ch

Ver original- **Bitcoin (BTC)**: reporta **116,978 dólares**; queda de **0.94%** no dia, com um mínimo de 24 horas atingindo **116,800 dólares**.

- **Ethereum (ETH)**: Reporta um intervalo de **3,746–3,760 dólares** com uma queda de **1.08%** nas últimas 24 horas, e um total de **856 mil dólares** em posições longas liquidadas na última hora (representando 83% do total das liquidações).

---

### 📊 **Análise Técnica e Tendências Ch

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Análise abrangente dos pontos-chave e do mercado de BTC e ETH até 26 de julho de 2025:

---

### 📊

| **Indicador** | **BTC** | **ETH** |

|----------------|-----------------|-----------------|

| **Preço Atual** | $117,629 | $3,725 |

| **Variação nas 24 horas** | -0,60% | +0,44% |

| **Acumulado esta semana** | -0,10% | +3,70% |

| **Intervalo de flutuação recente** | $116,500-$120,200 | $3,530-$3,858 |

---

### 📈 **Análise Técnica: Tendências e Sinais Chave**

#### **BTC: Alta volatilidade, intensificação da luta entre comprador

Ver original---

### 📊

| **Indicador** | **BTC** | **ETH** |

|----------------|-----------------|-----------------|

| **Preço Atual** | $117,629 | $3,725 |

| **Variação nas 24 horas** | -0,60% | +0,44% |

| **Acumulado esta semana** | -0,10% | +3,70% |

| **Intervalo de flutuação recente** | $116,500-$120,200 | $3,530-$3,858 |

---

### 📈 **Análise Técnica: Tendências e Sinais Chave**

#### **BTC: Alta volatilidade, intensificação da luta entre comprador

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Junte-se ao Gate Connect, verifique o KYC UAB para participar no sorteio e divida uma enorme quantidade de prêmios!

https://www.gate.io/activities/gate-io-gateconnect-flash-lottery?ch=ConnectDraw_20250303&invite_uid=20343654&nk_name=W君莫笑&ref=20343654

Ver originalhttps://www.gate.io/activities/gate-io-gateconnect-flash-lottery?ch=ConnectDraw_20250303&invite_uid=20343654&nk_name=W君莫笑&ref=20343654

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Em 6 de fevereiro, James Butterfill, diretor de pesquisa da CoinShares, escreveu: "Devido ao fluxo contínuo de fundos para a Ethereum esta semana, o investimento dos compradores nas quedas já atingiu US $ 740 milhões até o momento".

Mas até onde esperar, aguarde para comprar novamente. Lembre-se!!!

Mas até onde esperar, aguarde para comprar novamente. Lembre-se!!!

ETH2.82%

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

A estreia do Federal Reserve no ano novo está chegando, cuidado com as surpresas de Powell!

A Reserva Federal anunciará a decisão sobre as taxas de juros às 3h (hora de Pequim) na quinta-feira. O mercado já precificou em grande parte a expectativa de que o banco central permanecerá inalterado neste mês. No entanto, como esta é a primeira reunião do ano e a primeira desde a posse de Trump, é necessário prestar atenção nas declarações do presidente do Federal Reserve, Jerome Powell, durante a conferência de imprensa, bem como quaisquer pistas que possam ser reveladas. Espera-se uma volatilidade

A Reserva Federal anunciará a decisão sobre as taxas de juros às 3h (hora de Pequim) na quinta-feira. O mercado já precificou em grande parte a expectativa de que o banco central permanecerá inalterado neste mês. No entanto, como esta é a primeira reunião do ano e a primeira desde a posse de Trump, é necessário prestar atenção nas declarações do presidente do Federal Reserve, Jerome Powell, durante a conferência de imprensa, bem como quaisquer pistas que possam ser reveladas. Espera-se uma volatilidade

TRUMP0.96%

- Recompensa

- curtir

- 1

- Repostar

- Compartilhar

GateUser-3fe82411 :

:

Haverá uma tendência de redução das taxas de juros, desta vez, não há aumento nem redução.Feliz Ano Novo, o mercado subiu 102 após o salto durante o dia, oscilando de um lado para o outro. Por favor, aguarde as notícias das 3 da manhã. #荣誉积分新年抽奖,赢Macbook、精美周边等好礼!# #你最近购入哪个山寨币?# #加密市场回调#

Ver original- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar