Prévisions sur le prix du Bitcoin : L’achat par les investisseurs particuliers ne suffit pas à contrebalancer les ventes massives des baleines, tandis que le BTC rencontre des difficultés à se maintenir aux environs de 112 000 $.

Les acheteurs particuliers restent actifs, mais font face à la pression des vendeurs institutionnels

Les dernières données révèlent que les investisseurs particuliers — intervenant sur des volumes compris entre 1 000 et 10 000 BTC — continuent d’animer le marché, avec une intensification des achats observée après la forte correction du week-end sur les marchés spot et contrats perpétuels. Sur Coinbase uniquement, les achats nets ont dépassé 101,2 millions de dollars. En parallèle, les investisseurs institutionnels et les grands investisseurs — effectuant des opérations entre 1 million et 10 millions de BTC — poursuivent leur réduction d’exposition. Sur les marchés dérivés de Binance et Coinbase, environ 750 millions de dollars de positions acheteuses ont été liquidés, ce qui affaiblit sensiblement le soutien apporté par les acheteurs particuliers.

Mouvements de prix et perspectives à court terme

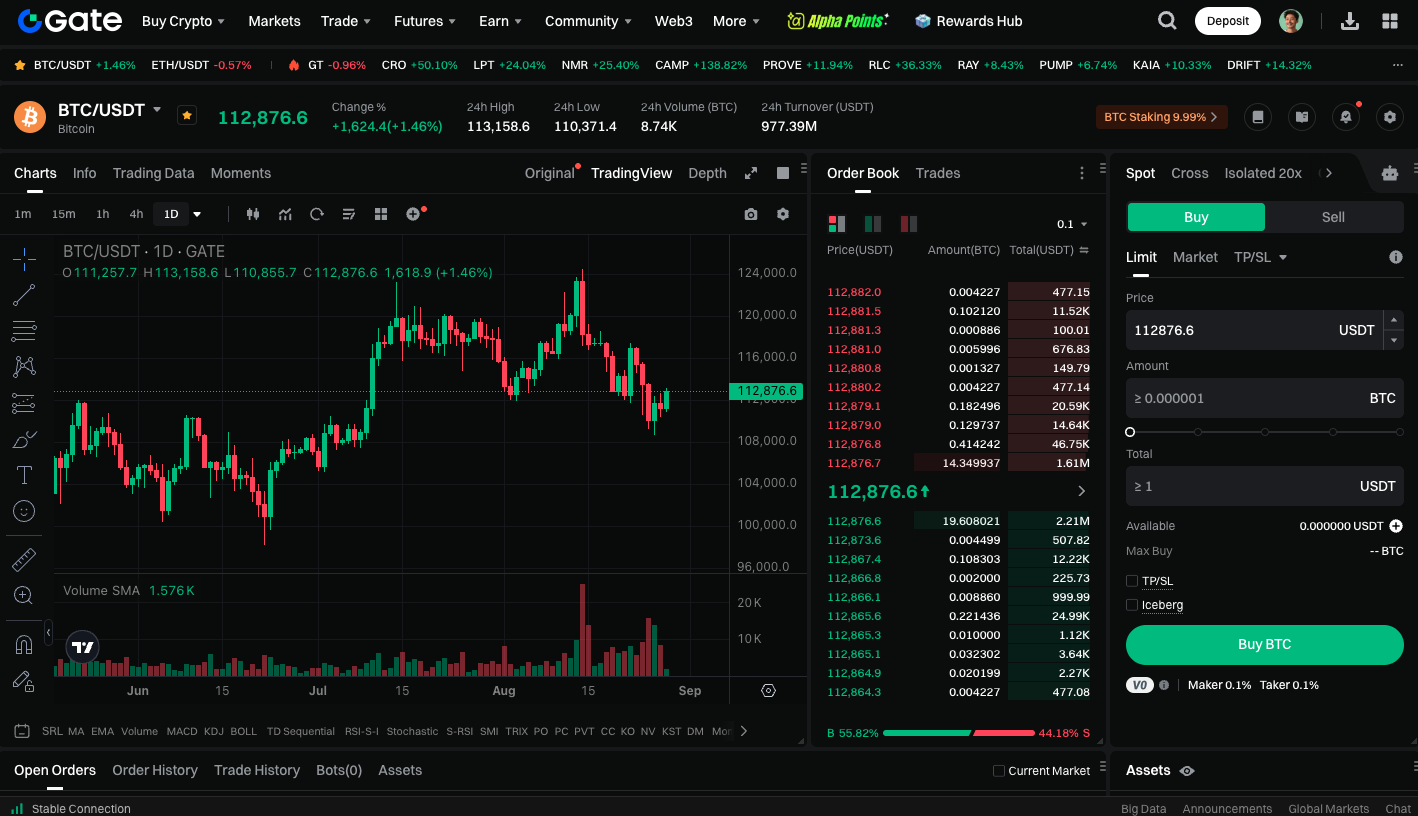

Lors du récent mouvement correctif, Bitcoin a brièvement reculé aux alentours de 108 600 dollars avant de remonter vers 112 000 dollars, soit une reprise modérée d’environ 3,8 % depuis son point bas. À ce stade, le BTC évolue dans une tendance baissière à court terme. Les acheteurs particuliers anticipent un rebond vers la fourchette des 117 000 à 118 000 dollars. Toutefois, la pression persistante des ventes institutionnelles complique la réalisation de cet objectif à court terme.

Facteurs de risque majeurs pour le BTC

Le marché a absorbé d’importants volumes d’achats dans la zone des 111 000 à 110 000 dollars, tandis qu’une nouvelle zone de forte liquidité se forme aux alentours de 104 000 dollars. Si la cadence des ventes continue de ralentir, Bitcoin pourrait tester le seuil psychologique des 120 000 dollars. En revanche, si la pression vendeuse s’intensifie, le risque d’un repli vers 105 000 dollars reste élevé.

Démarrez dès maintenant l’échange de BTC au comptant : https://www.gate.com/trade/BTC_USDT

Informations essentielles à l’attention des investisseurs

À court terme, la trajectoire du cours du BTC continuera de dépendre des variations du Delta cumulatif du volume (CVD). Si la pression vendeuse exercée par les grands capitaux ralentit et converge avec l’optimisme des investisseurs particuliers, de nouveaux niveaux de soutien pourraient se dessiner. Si la divergence persiste, le marché risque de s’installer dans une phase de consolidation prolongée.

Articles Connexes

Pi Network (PI) au taux de change du franc CFA d'Afrique de l'Ouest (XOF) : Valeur actuelle et guide de conversion

Comment vendre la pièce PI : Guide du débutant

Valeur de Pi Crypto : Lancement sur Mainnet le 20 février 2025 & Prédictions de prix futures

Qu'est-ce que FAFO : jeton MEME dérivé de la plateforme sociale de Trump

Est-ce que XRP est un bon investissement? Un guide complet sur son potentiel