OmarCrypto

لا يوجد محتوى حتى الآن

OmarCrypto

✍️ اللي يتابع بوعي… يفهم التحوّل $BTC

المتابع الشاطر المثابر

اللي تابع تغريداتي السابقة أول بأول

شاف الشارت بعينه، ويعرف التالي:

🔹 كان البيتكوين في المنطقة الأولى

دعم 85K – مقاومة 90K

🔹 ومع الأيام الأخيرة تحولنا إلى منطقة جديدة:

دعم 90K – مقاومة 95K

السوق ما يعطي إشارات فجأة, التحوّل يحصل تدريجيًا…

المتابع الشاطر المثابر

اللي تابع تغريداتي السابقة أول بأول

شاف الشارت بعينه، ويعرف التالي:

🔹 كان البيتكوين في المنطقة الأولى

دعم 85K – مقاومة 90K

🔹 ومع الأيام الأخيرة تحولنا إلى منطقة جديدة:

دعم 90K – مقاومة 95K

السوق ما يعطي إشارات فجأة, التحوّل يحصل تدريجيًا…

BTC-3.33%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

📉 افتتاح سلبي بعد الإجازة

بعد إجازة من 16 إلى 20 هالشهر

افتتحت البورصات الأمريكية على Gap هابط.

السبب؟

مهاترات ترامب خلال اليومين الماضية

وتأثيرها المباشر على ثقة الاقتصاد الأمريكي والأوروبي.

السوق لا يحب الضجيج السياسي…

ويترجمها دائمًا على أسواق البورصة.

بعد إجازة من 16 إلى 20 هالشهر

افتتحت البورصات الأمريكية على Gap هابط.

السبب؟

مهاترات ترامب خلال اليومين الماضية

وتأثيرها المباشر على ثقة الاقتصاد الأمريكي والأوروبي.

السوق لا يحب الضجيج السياسي…

ويترجمها دائمًا على أسواق البورصة.

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

💰 المال العقاري يدخل البتكوين 🔥

شركة Cardone Capital

تعلن تخصيص حوالي 10 مليون دولار في #Bitcoin

حسب تصريح CEO Grant Cardone

حتى رأس المال المحافظ بدأ يتعامل مع البتكوين كأصل استراتيجي, مو مضاربة… تموضع.

شركة Cardone Capital

تعلن تخصيص حوالي 10 مليون دولار في #Bitcoin

حسب تصريح CEO Grant Cardone

حتى رأس المال المحافظ بدأ يتعامل مع البتكوين كأصل استراتيجي, مو مضاربة… تموضع.

BTC-3.33%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

💰 صندوق Vanguard Group

أحد أضخم مديري الأصول عالميًا (أكثر من 12 تريليون دولار)

دخل شراء لأول مرة على سهم $MSTR

🔹 شراء 1.23 مليون سهم

🔹 بقيمة 202.5 مليون دولار

هذا مو مضارب تويتر ولا FOMO

هذا تموضع مؤسسي محسوب

واللي يفهم الإشارة يلحق بدري 😉

أحد أضخم مديري الأصول عالميًا (أكثر من 12 تريليون دولار)

دخل شراء لأول مرة على سهم $MSTR

🔹 شراء 1.23 مليون سهم

🔹 بقيمة 202.5 مليون دولار

هذا مو مضارب تويتر ولا FOMO

هذا تموضع مؤسسي محسوب

واللي يفهم الإشارة يلحق بدري 😉

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

🚨 سجل عائد السندات الحكومية اليابانية لأجل 40 عامًا مستوى قياسي جديد يوم الثلاثاء، في ظل موجة بيع واسعة لسندات الحكومة.

✅ مع تصاعد مخاوف المستثمرين من أن يؤدي مقترح خفض ضريبة المبيعات على الغذاء إلى تفاقم الوضع المالي للدولة.

🚨 ارتفع عائد سندات 10 سنوات بأكثر من 10 نقاط أساس إلى 2.38% وهو أعلى مستوى منذ عام 1999.

🚨 ارتفع عائد سندات 20 عامًا بنحو 22 نقطة أساس إلى 3.47%.

✅ مع تصاعد مخاوف المستثمرين من أن يؤدي مقترح خفض ضريبة المبيعات على الغذاء إلى تفاقم الوضع المالي للدولة.

🚨 ارتفع عائد سندات 10 سنوات بأكثر من 10 نقاط أساس إلى 2.38% وهو أعلى مستوى منذ عام 1999.

🚨 ارتفع عائد سندات 20 عامًا بنحو 22 نقطة أساس إلى 3.47%.

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

🚨 بورصة نيويورك (NYSE) تدخل عالم البلوكتشين

الـ NYSE تطوّر منصة تداول قائمة على البلوكتشين تتيح:

▪️ تداول الأسهم وETF المرمزة 24/7

▪️ تسوية فورية بدون انتظار

▪️ تمويل عبر العملات المستقرة

📌 وول ستريت لا تحارب الكريبتو…

ويبقى المشروع رهناً بالموافقة التنظيمية SEC قبل إطلاقه.

الـ NYSE تطوّر منصة تداول قائمة على البلوكتشين تتيح:

▪️ تداول الأسهم وETF المرمزة 24/7

▪️ تسوية فورية بدون انتظار

▪️ تمويل عبر العملات المستقرة

📌 وول ستريت لا تحارب الكريبتو…

ويبقى المشروع رهناً بالموافقة التنظيمية SEC قبل إطلاقه.

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أي شخص ما يفهم التحليل الفني

يشوف هبوط أمس واليوم كارثة.

الكارثة الحقيقية؟

إنه ما يملك شارت يشرح له ليش صار الهبوط.

التحليل الفني فهم، وعي، ومرونة.

الشجاعة والفلسفة مكانها المجالس.

الفلوس مو رقم على الشاشة…

ثروة إما تكبر أو تصغر حسب قراراتك.

يشوف هبوط أمس واليوم كارثة.

الكارثة الحقيقية؟

إنه ما يملك شارت يشرح له ليش صار الهبوط.

التحليل الفني فهم، وعي، ومرونة.

الشجاعة والفلسفة مكانها المجالس.

الفلوس مو رقم على الشاشة…

ثروة إما تكبر أو تصغر حسب قراراتك.

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

فيه عملة جديدة

حطيتها في المفضلة الشهر الماضي على أساس أشتريها

اليوم أنتبهت لها ولقيتها اسبوعين صاعدة +75% 😪

أحيانًا الواحد مع الضيق الوقت يضيع فرص ما تتكرر

خاصة وأننا في إتجاه هابط من سنتينّ

اذا صححت ممكن ارجع اشتريها

وممكن أشوف غيرها

السوق فرص

حطيتها في المفضلة الشهر الماضي على أساس أشتريها

اليوم أنتبهت لها ولقيتها اسبوعين صاعدة +75% 😪

أحيانًا الواحد مع الضيق الوقت يضيع فرص ما تتكرر

خاصة وأننا في إتجاه هابط من سنتينّ

اذا صححت ممكن ارجع اشتريها

وممكن أشوف غيرها

السوق فرص

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

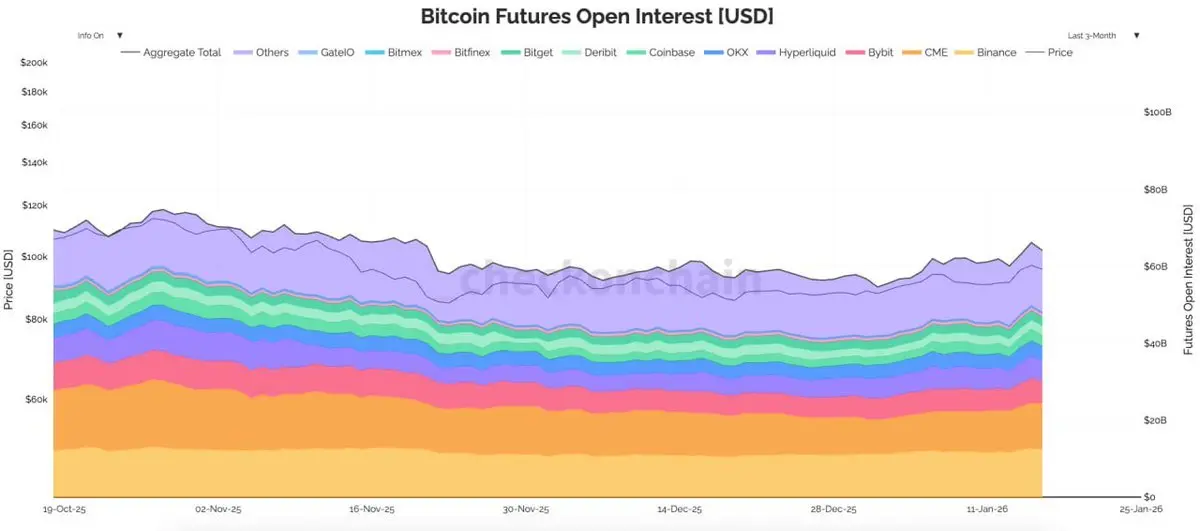

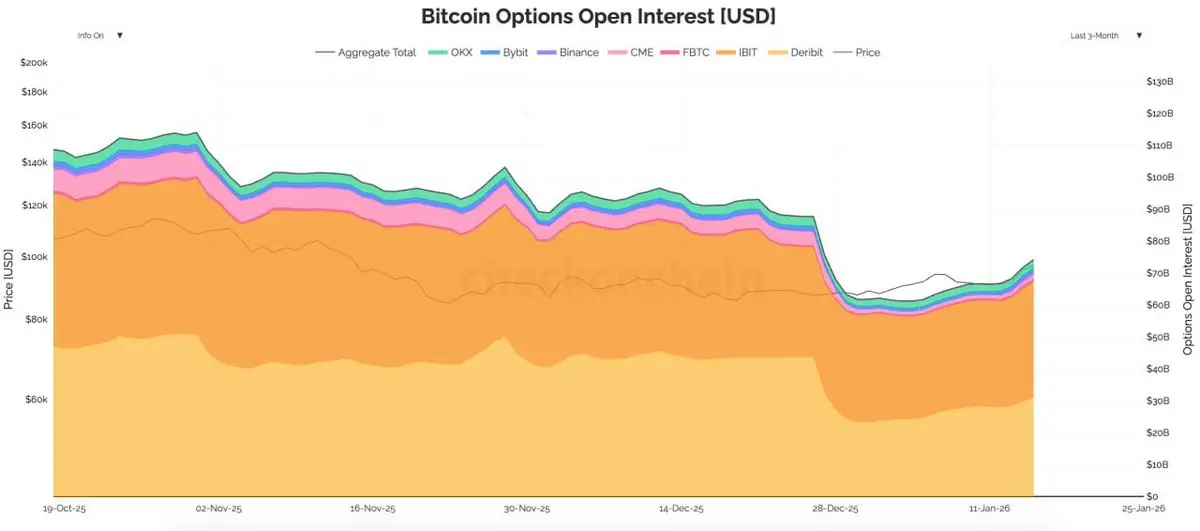

📊 تحول جديد في سوق البتكوين #Bitcoin

لأول مرة عقود الخيارات 74.1B$ تتفوق على الفيوتشر 65.2B$.

هذا مو حماس مضاربين…

هذا إدارة مخاطر مؤسسية وتحضير لمرحلة قادمة والله أعلم.

اللي يفهم السوق يشتغل بهدوء "اللهم أحفظنا من العين"…

واللي متأخر لسه يدور قاع وهمي.

لأول مرة عقود الخيارات 74.1B$ تتفوق على الفيوتشر 65.2B$.

هذا مو حماس مضاربين…

هذا إدارة مخاطر مؤسسية وتحضير لمرحلة قادمة والله أعلم.

اللي يفهم السوق يشتغل بهدوء "اللهم أحفظنا من العين"…

واللي متأخر لسه يدور قاع وهمي.

BTC-3.33%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

✍️ التداول فرص واستمرارية أم صعود إنتقائي $DUSK

اذا انت تنتظر صعود كبير جدا مستمر 👇

💢فاصحاب الإتجاه الهابط دخلوا متابعيهم All in قبل اشهر على اساس بداية البول رن وبعدين خرجوهم على خسارة كبيرة جدا.💢

وأنفسهم اصحاب الإتجاه الهابط علقوا متابعيهم من مارس 2024 لما كانوا يتحدثون عن بول رن لأنهم دخلوا متأخرين 🕐

لا تفكر صاحب الإتجاه الهابط راح يحقق أحلامك 50x لما يصعد السوق

اذا اعطاك +50% راح يقلك: ربحت او ما ربحت ؟ تزعل !! بلوك.

لذلك أنصحك اعتمد على نفسك وتابع أكثر من محلل فني محترف ثم قرر بناءً على الشارت

عشان بكره لا تصيح مثلما صاحوا اصحاب التصريف.

التداول فرص فأغتنمها.

اذا انت تنتظر صعود كبير جدا مستمر 👇

💢فاصحاب الإتجاه الهابط دخلوا متابعيهم All in قبل اشهر على اساس بداية البول رن وبعدين خرجوهم على خسارة كبيرة جدا.💢

وأنفسهم اصحاب الإتجاه الهابط علقوا متابعيهم من مارس 2024 لما كانوا يتحدثون عن بول رن لأنهم دخلوا متأخرين 🕐

لا تفكر صاحب الإتجاه الهابط راح يحقق أحلامك 50x لما يصعد السوق

اذا اعطاك +50% راح يقلك: ربحت او ما ربحت ؟ تزعل !! بلوك.

لذلك أنصحك اعتمد على نفسك وتابع أكثر من محلل فني محترف ثم قرر بناءً على الشارت

عشان بكره لا تصيح مثلما صاحوا اصحاب التصريف.

التداول فرص فأغتنمها.

DUSK-6.97%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

راح انشغل هاليومين بترتيب الفرص والإستفادة من الصعود 🚀

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

اللي طلع من السوق على خسارة في الفوري SPOT

ويفكر أنه ذكي راح يعوض خسارته في الرافعة FUTURE

معليش يا صاحبي

الفيوتشر أصعب من السبوت وتحتاج رياضيات 🧮

صحيح يعطيك شورت ولونق ولكن لو أنت فاشل في السبوت كيف تبغى تنجح في الفيوتشر, ممكن يحرق فلوسك بالكامل

تربح أسبوع ينحرق في يوم بغلطة

ويفكر أنه ذكي راح يعوض خسارته في الرافعة FUTURE

معليش يا صاحبي

الفيوتشر أصعب من السبوت وتحتاج رياضيات 🧮

صحيح يعطيك شورت ولونق ولكن لو أنت فاشل في السبوت كيف تبغى تنجح في الفيوتشر, ممكن يحرق فلوسك بالكامل

تربح أسبوع ينحرق في يوم بغلطة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

سوق الكريبتو مقسم على ثلاثة حاليًا 👇

💸 مجموعة مرنة تحقق أرباح بتداول الفرص.

🚑 مجموعة متورطة في عملة تم التصريف عليهم.

🙇♂️ مجموعة تنتظر قيعان حتى Order book ما وصلها في اكتوبر.

💸 مجموعة مرنة تحقق أرباح بتداول الفرص.

🚑 مجموعة متورطة في عملة تم التصريف عليهم.

🙇♂️ مجموعة تنتظر قيعان حتى Order book ما وصلها في اكتوبر.

- أعجبني

- 2

- 1

- إعادة النشر

- مشاركة

Baset68 :

:

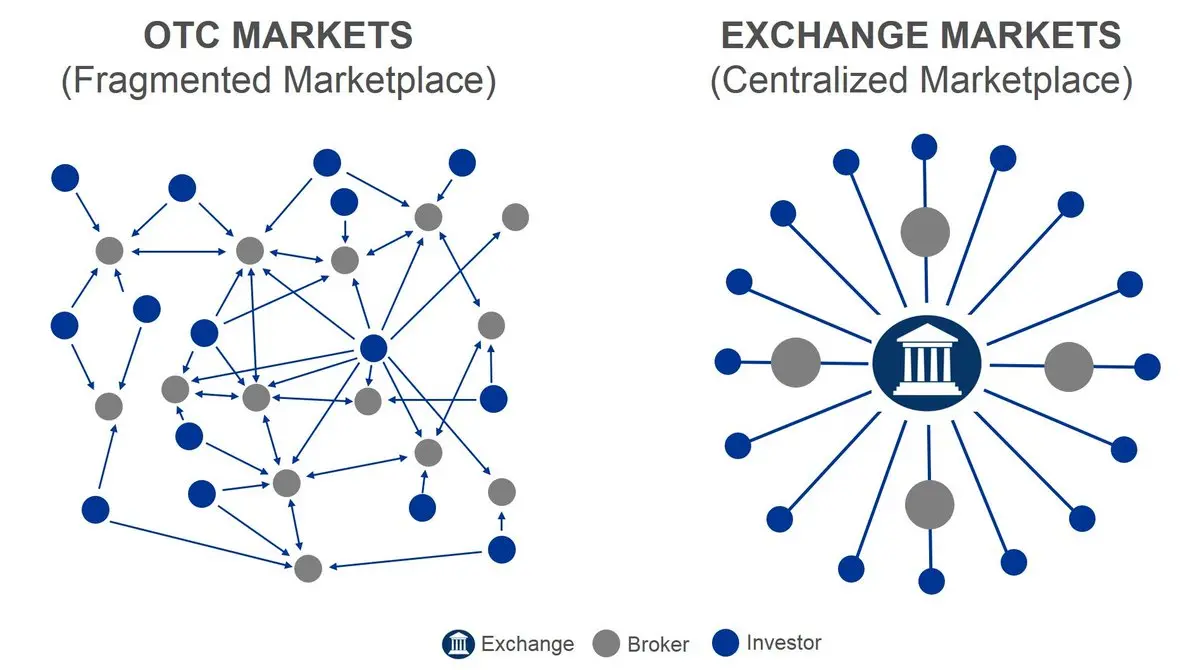

السوق الصاعد في أوجه 🐂أي شراء مؤسسي أو صناديق ETFs للبتكوين والعملات يتم عبر OTC

ليش OTC؟

✔️ بدون Pump مفاجئ

✔️ بدون ما يكشف نية الشراء

النتيجة؟

السعر يتحرك بعد ما يخلص التجميع… مو وقت التنفيذ.

اللي يراقب on-chain بس…

غالباً يشوف الحركة بعد ما خلص الشغل.

ليش OTC؟

✔️ بدون Pump مفاجئ

✔️ بدون ما يكشف نية الشراء

النتيجة؟

السعر يتحرك بعد ما يخلص التجميع… مو وقت التنفيذ.

اللي يراقب on-chain بس…

غالباً يشوف الحركة بعد ما خلص الشغل.

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

❌ أنا ما أشتري قاع

✅ أنا أشتري فرصة على التحليل الفني

✅ أنا أشتري فرصة على التحليل الفني

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- 1

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

المواضيع الرائجة

عرض المزيد8.82K درجة الشعبية

37.09K درجة الشعبية

50.02K درجة الشعبية

12.89K درجة الشعبية

9.05K درجة الشعبية

Gate Fun الساخن

عرض المزيد- القيمة السوقية:$3.39Kعدد الحائزين:00.00%

- القيمة السوقية:$0.1عدد الحائزين:10.00%

- القيمة السوقية:$3.39Kعدد الحائزين:10.00%

- القيمة السوقية:$3.39Kعدد الحائزين:10.00%

- القيمة السوقية:$3.38Kعدد الحائزين:10.00%

تثبيت