انتبه جيدًا لهذا الأمر.

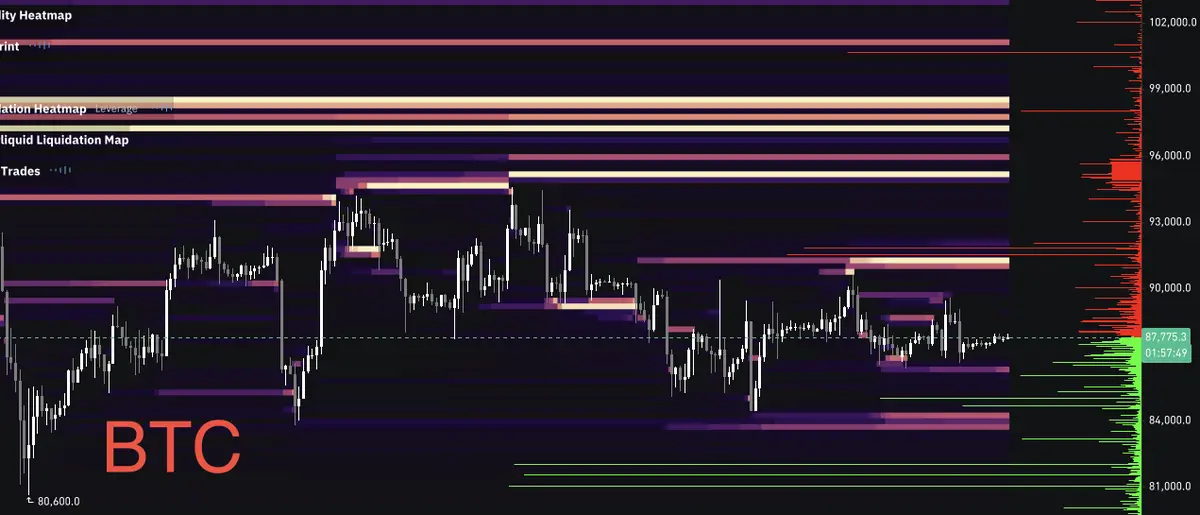

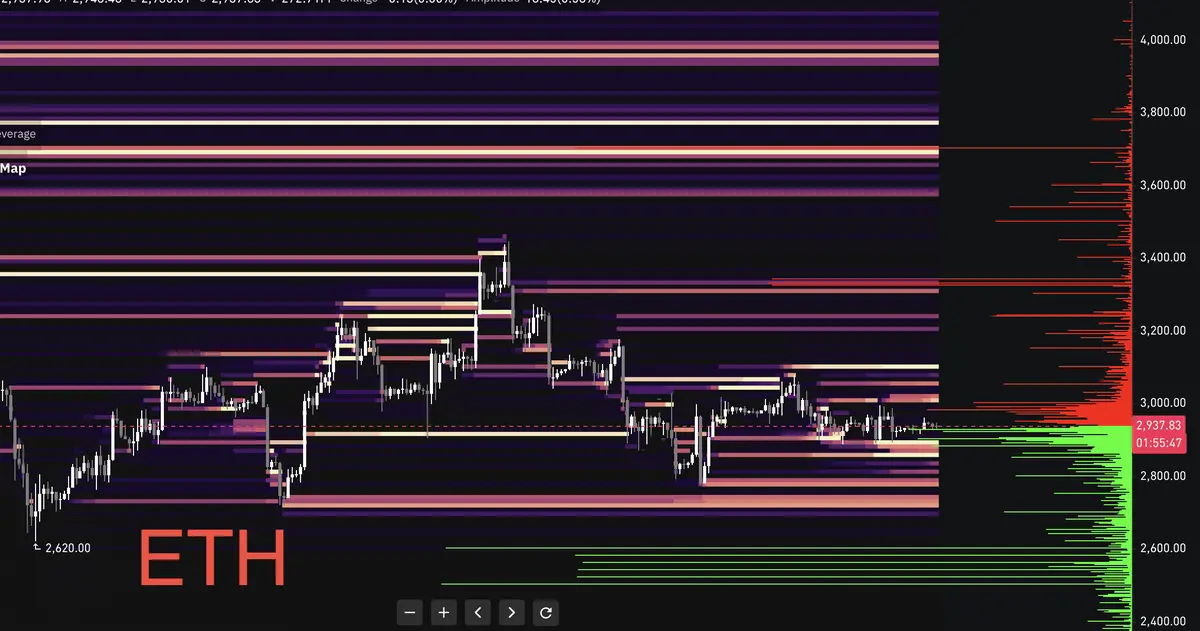

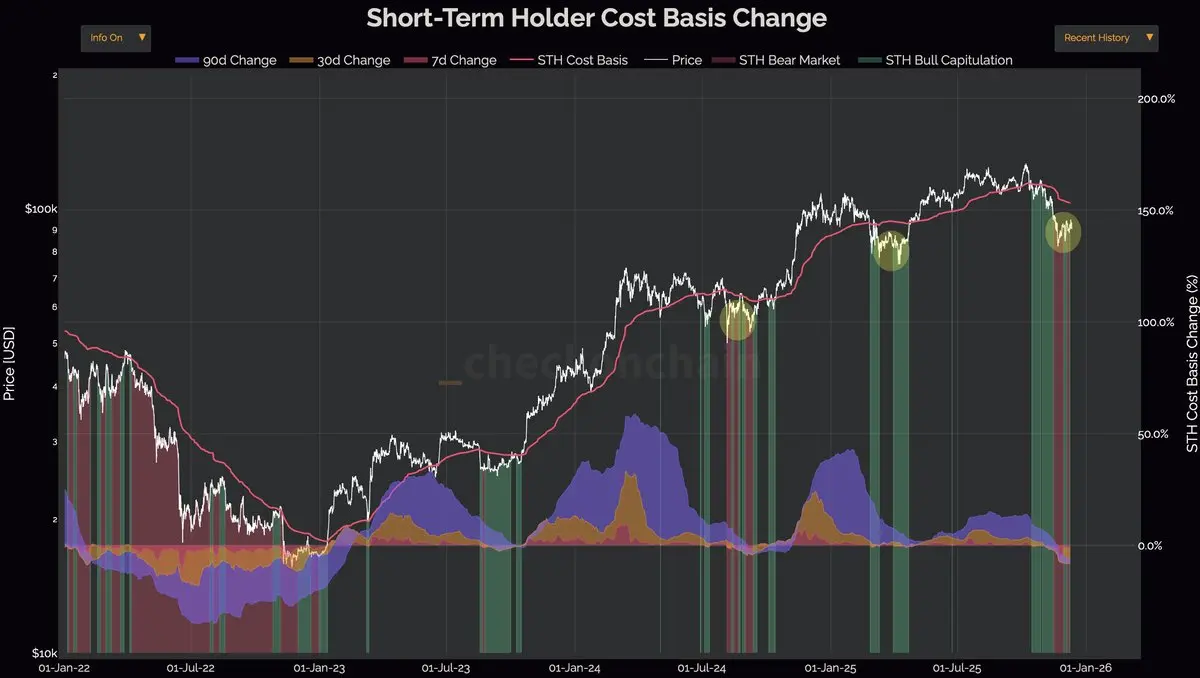

تُظهر معدلات التمويل أن هناك الكثير من الأشخاص الذين لديهم مراكز طويلة.

قد يؤدي ذلك إلى عملية تصفية أخيرة قبل بدء الحركة الصاعدة الحقيقية.

شاهد النسخة الأصليةتُظهر معدلات التمويل أن هناك الكثير من الأشخاص الذين لديهم مراكز طويلة.

قد يؤدي ذلك إلى عملية تصفية أخيرة قبل بدء الحركة الصاعدة الحقيقية.