BTC Gains Over 11% in Two Weeks, LAUNCHCOIN Soars Over 5,500%|Gate Research

Overview

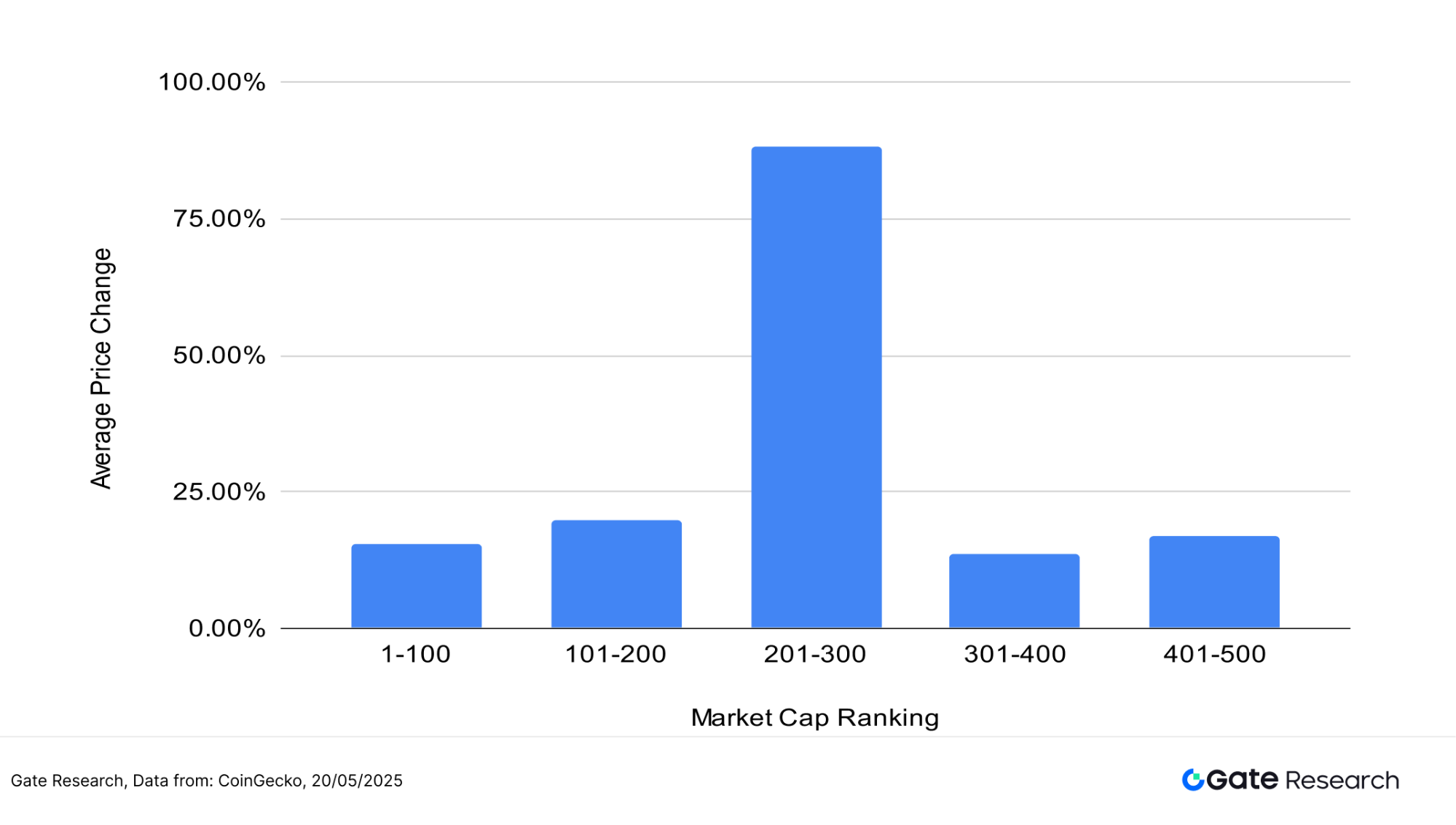

Gate Research has analyzed and summarized the market trends and notable airdrop opportunities during the period from May 5 to May 19, 2025. The crypto market experienced a significant rebound, with total market capitalization rising over 14% and Bitcoin reaching a high of 106,518 USDT, up more than 11%. Among the top 500 tokens by market cap, the average gain was 30%, with tokens ranked 201–300 performing the best, averaging over 88% in returns. LAUNCHCOIN, MOODENG, and KTA recorded impressive gains of over 5,500%, 578%, and 524% respectively, reflecting concentrated capital inflows into high-profile, narrative-driven tokens and a notable recovery in market sentiment.

Amid the market rebound, several promising projects have launched airdrop campaigns, including Kadena (a high-performance Layer 1), Camp Network (a decentralized creator platform), Avalon (a Web3 open-world game), and Coinshift (a multi-chain treasury management platform). This report provides a brief introduction to these projects and how to participate, helping users capture airdrop opportunities and identify strategic positions during the market rebound.

Crypto Market Overview

According to CoinGecko data, from May 5 to May 19, the cryptocurrency market experienced a significant rebound. BTC rose from approximately 95,600 USDT to a peak of 106,518 USDT, gaining over 11%, while the total crypto market capitalization increased by more than 14%. BTC hit its weekly low at 00:00 on May 6 (UTC+8) and reached its high on May 19, indicating accelerated capital inflows and gradually recovering market confidence. [1]

The rebound over the past two weeks was driven by multiple favorable factors. First, easing U.S. employment and inflation data strengthened expectations of a Federal Reserve rate cut later this year. At the same time, a de-escalation in U.S.-China trade tensions reduced concerns over further tariff hikes, jointly boosting risk asset performance. Second, Bitcoin spot ETFs continued to see net inflows, especially BlackRock’s IBIT, reflecting renewed institutional interest. [2] On the Ethereum side, growing anticipation for the Pectra upgrade and a more favorable regulatory outlook have turned market sentiment increasingly bullish. [3]

1. Overview of Price Performance

This section presents grouped statistics of the top 500 tokens by market capitalization, analyzing the average price change across different market cap segments from May 5 to May 19.

The overall average gain was 30.78%. Among all segments, tokens ranked 201–300 in market cap showed the strongest performance, with an average increase of 88.03%, significantly outperforming other groups and highlighting increased capital inflows into mid and small-cap assets. Tokens ranked 101–200 and 401–500 also performed steadily, with average gains of 19.78% and 16.82%, respectively. In contrast, the 301–400 segment underperformed, averaging only a 13.69% increase.

Overall, despite some divergence in mid and small-cap performance, the rally extended across all market cap tiers, indicating a broad recovery in market sentiment and a wider return of capital to the crypto market.

Note: Market cap data is based on CoinGecko. The top 500 tokens were grouped by every 100 ranks (e.g., 1–100, 101–200, etc.). For each group, we calculated the average percentage change in price from May 5 to May 19, 2025. The overall average (30.78%) represents the unweighted mean of individual token returns within the top 500.

Figure 1: The average gain across the top 500 tokens was 30.78%, with tokens ranked 201–300 showing the highest performance at an average of 88.03%.

Top Gainers and Losers

Over the past two weeks, the crypto market experienced a notable rebound, driving strong rallies among many small-cap tokens. LAUNCHCOIN led the gains with a staggering 5,572.35% increase far outpacing other projects—reflecting intense speculative interest. LAUNCHCOIN is the native token of Believe.app, a platform that allows users to instantly mint new tokens via posts on X, sparking a wave of social token creation on Solana. MOODENG (+578.56%) and KTA (+524.25%) followed closely, each gaining more than fivefold, highlighting the market’s appetite for highly volatile assets. Other narrative-driven or concept-themed tokens such as ETHFI, NEIRO, and GOAT also posted strong performances, each surging over 100% for the week.

On the downside, losses were mainly concentrated among older projects or assets lacking market momentum. LAYER saw the largest drop at -69.04%, followed by PUNDIX (-28.87%), VENOM (-23.21%), and CONSCIOUS (-22.32%), reflecting ongoing liquidity pressure on lower-profile tokens during the capital rotation phase. Notably, many of the underperforming tokens focus on areas such as off-chain oracles, communication infrastructure, or transaction layers—suggesting that infrastructure projects struggled to attract capital in this sentiment-driven rebound.

In contrast, Meme and AI-themed tokens saw significantly stronger inflows due to their high social visibility and narrative strength, outperforming infrastructure assets and highlighting the market’s current preference for speculative, story-driven plays. Overall, while market sentiment continues to recover and capital flows return, investor attention remains heavily concentrated on tokens with strong narratives, social momentum, or newly emerging themes, whereas infrastructure-oriented assets without clear narratives are seeing more conservative positioning.

Figure 2: LAUNCHCOIN, the native token of Believe.app, was the top performer, soaring over 5,000%.

Relationship Between Market Cap Ranking and Price Performance

To further analyze the relationship between token market cap and price performance during this period, we plotted a scatter chart of the top 500 cryptocurrencies by market capitalization. The X-axis represents market cap ranking (with smaller numbers indicating higher market cap), and the Y-axis shows the percentage change in price from May 5 to May 19. A symmetrical log scale (symlog) is used on the Y-axis to better visualize both gains and losses. Each point represents a single token—green indicates a price increase, red indicates a decline.

Overall, most tokens posted positive returns, with gains concentrated in the 10% to 80% range, indicating a broad-based market rebound. Some tokens saw outsized gains—particularly small- to mid-cap projects like LAUNCHCOIN (+5,572%), MOODENG, and KTA—which stood out at the top of the chart, reflecting strong speculative inflows.

On the other hand, top losers such as LAYER, PUNDIX, and VENOM—despite belonging to different market cap tiers—largely focus on infrastructure areas like modular blockchain architecture, crypto payments, and enterprise-grade services. These projects lacked short-term narrative appeal or strong community momentum, suggesting that infrastructure-related tokens continue to be overlooked in a sentiment-driven market.

In contrast, tokens in the mid-cap range (ranked roughly 100–300) showed more active and widespread gains, suggesting capital was more broadly distributed and favored assets with social traction or strong narratives.

In summary, this rally was not primarily led by large-cap assets, but rather driven by narrative strength, topic-based speculation, and community engagement—resulting in a structurally split market where large-cap tokens remained stable while mid and small-cap tokens outperformed.

Figure 3: Most tokens recorded positive returns, with gains largely concentrated between 10% and 80%.

Top 100 Market Cap Leaders

In this market rebound, the top 100 cryptocurrencies by market capitalization demonstrated overall resilience, with most assets posting positive returns and several projects showing notable gains—becoming focal points for capital inflows. To more accurately reflect the performance of mainstream tokens, stablecoins and LSDs (liquid staking derivatives) have been excluded from the following analysis.

Leading gainers included WIF (+85.84%), PEPE (+64.07%), ETH (+37.72%), DOGE (+36.00%), and ENA (+33.60%), highlighting that Meme coins and major Layer 1 assets remain popular targets for capital allocation. WIF and PEPE surged on the back of social media momentum and high-volume trading, while ETH’s price recovery reflected improved fundamentals tied to ETF expectations and the upcoming Pectra upgrade.

On the downside, despite the overall market uptrend, a few top 100 tokens recorded minor losses. These included LEO (-3.96%), FLR (-3.65%), S (-2.24%), XDC (-0.68%), and APT (-0.19%). Although these tokens did not participate in the rally, their limited downside suggests capital has not fully exited and that they retain certain defensive characteristics.

Overall, Meme coins, Layer 1s, and narrative-driven assets responded most strongly in this rebound, emerging as top-performing sectors and signaling a clear uptick in market risk appetite. Meanwhile, fundamentally strong tokens showed relative price stability, shaping a market structure characterized by “leaders staying strong, and selecting weaker assets catching up.”

Figure 4: The top gainers among the top 100 tokens were mostly concentrated on Meme coins and major Layer 1 assets, indicating where capital was most heavily allocated during this rally.

2. Volume Surge Analysis

Alpha Insight: Trading Volume Growth

Building on the analysis of token price performance, this section examines changes in trading volume during the current market rebound. Using pre-rally volume levels as a baseline, we calculated the volume increase multiple for each token up to May 19 to assess shifts in market attention and trading activity.

The most significant spike in trading volume was observed in ZKJ, the native token of Polyhedra Network, with a staggering 179.77x increase indicating exceptionally high market participation. LAUNCHCOIN, the native token of Believe.app, followed with a 104.58x increase, mirroring its explosive price surge. CFG (+23.58x), MOODENG (+18.98x), and DEGEN (+9.60x) also recorded notable volume growth, all of which are small- to mid-cap tokens with strong recent social momentum.

Overall, while a sharp rise in trading volume does not necessarily lead to immediate price increases, it is often a precursor to capital inflows and can reflect rising market attention. Investors can monitor volume spikes, such as when the current volume exceeds the recent multi-day average by more than 2x and evaluate price movements in parallel to identify potential trend initiations. Volume anomalies are especially telling for small-cap tokens, where even modest increases can trigger outsized price reactions, making volume a valuable signal for short-term speculative trading.

Figure 5: ZKJ recorded the largest volume increase at 179.77x, indicating exceptionally high market engagement.

Alpha Insight: Volume-Price Relationship Analysis

To further examine the relationship between trading volume and price movement, we plotted a scatter chart comparing the volume increase multiple and the percentage price change for each token. The X-axis represents the two-week volume increase relative to a baseline period, while the Y-axis shows the corresponding price change during the same period. A symmetrical log scale (symlog) is used to clearly display extreme variations.

From the chart, tokens in the upper right quadrant such as LAUNCHCOIN, MOODENG, KTA, and NEIRO exhibit a classic “volume-driven breakout” pattern. LAUNCHCOIN, in particular, surged over 5,000% with a matching spike in volume, fueled by the popularity of the social token minting platform Believe.app, making it a core focus of the Meme narrative in this rally. MOODENG and KTA also experienced rapid inflows and sharp price increases, driven by narrative catalysts and community hype. These tokens tend to share clear thematic value and strong expectations for liquidity, making them attractive to short-term capital and illustrating how theme-driven momentum continues to play a key role in driving price gains during market recovery phases.

In contrast, ZKJ recorded the highest volume increase across the market (+179.77x), but its price fell slightly by around 3%, showing a classic case of “high volume without price follow-through.” ZKJ is the native token of Polyhedra Network, which focuses on zero-knowledge proof (ZKP) infrastructure. On May 9, it launched a staking feature on BNB Chain, offering a four-week bonus reward program that likely triggered the surge in trading activity. However, as the staking-related news had already been priced in to some extent and failed to attract sustained buying after launch, the price remained flat or slightly declined indicating that while attention was high, follow through momentum was lacking.

In summary, while volume surges do not always translate into price increases, the chart shows that most top-performing tokens were accompanied by significant volume growth. This reinforces that volume remains a critical indicator for gauging short-term momentum and market attention. Structurally, the trend reflects a split where theme-driven tokens led strongly, while some others showed stagnation despite heightened trading activity.

Figure 6: Tokens like LAUNCHCOIN, MOODENG, and KTA appear in the upper right quadrant, displaying typical “volume-driven breakout” characteristics.

Airdrop Highlights

This section outlines the most notable airdrop opportunities from May 5 to May 19, 2025. The featured projects not only show strong potential for future token distributions but are also backed by reputable venture capital firms. Several Web3 projects—including Kadena (a high-performance Layer 1), Camp Network (a decentralized platform for on-chain creators), Avalon (a Web3 AAA open-world game), and Coinshift (a multi-chain treasury management platform)—have launched or confirmed airdrop campaigns during this period, offering users diverse opportunities to participate and earn rewards.

This report provides an overview of these high-potential projects, their airdrop initiatives, and how to get involved helping users stay up to date with the latest airdrop opportunities and strategically position themselves for potential gains in the evolving crypto landscape.

Airdrop

Kadena

Kadena is a high-performance Layer 1 blockchain platform that adopts a unique multi-chain parallel architecture known as Chainweb, which increases network scalability by allowing multiple blocks to be mined simultaneously. The platform uses a Proof-of-Work (PoW) consensus mechanism to ensure security and features its own smart contract language, Pact, which offers low fees, high throughput, and enterprise level usability, making it suitable for applications in finance, supply chains, and more.[5]

Currently, Kadena has launched an airdrop campaign on Galxe, with a total reward pool of 100,000 KDA tokens. KDA is the native token of the Kadena blockchain and is used for transaction fees, miner incentives, and smart contract deployment. Users can qualify for rewards by completing specific tasks.

How to participate:

- Visit Kadena’s task page on the Galxe platform and connect wallet or social account.

- Complete X-related social media tasks to earn 60 points.

- Complete Telegram and Discord social tasks to earn 50 points.

Camp Network

Camp Network is a decentralized social protocol designed for creators, aiming to provide Web3 users with permissionless tools for content creation, distribution, and monetization. The platform allows creators to publish on-chain content, build communities, issue membership NFTs, and share revenue through built-in incentive mechanisms—enhancing both user participation and economic alignment. Camp’s mission is to break away from the centralized control of Web2 content platforms and give creators full ownership of their content and community assets.[6]

Camp Network is currently running an incentivized testnet, where participants can earn points by completing tasks. These points may be redeemable for project tokens in the future.

How to participate:

- Visit Camp Network’s page on Clusters, choose a username, join the community, and connect wallet.

- Access the Camp Network testnet, connect wallet, and complete tasks to earn points.

Avalon

Avalon is a Web3 MMORPG developed by Avalon Corp, aiming to build a virtual universe focused on immersive gameplay, with true asset ownership and cross-chain interoperability enabled by blockchain technology. The project emphasizes the “magic of gaming” over financial speculation and aspires to create a creator-driven ecosystem through the integration of powerful game engines and decentralized infrastructure.[7]

Avalon is currently in its testing phase. Players can earn points by completing social tasks and connecting their wallets, which may later be tied to token airdrops.

How to participate:

- Visit the Avalon quest page, register an account, and log in.

- Complete social tasks and connect your wallet to earn points.

Coinshift

Coinshift is a multi-chain treasury management platform tailored for DAOs and Web3 organizations, supporting networks like Ethereum, Arbitrum, and Base. The platform integrates multisig wallets, portfolio tracking, batch payments, real-time payroll streaming (via Superfluid), and cross-chain financial reporting—enabling teams to manage on-chain funds efficiently and securely. Coinshift has also introduced csUSDL, a yield-bearing stablecoin that allocates idle treasury funds to DeFi protocols and real-world assets (RWA) for stable returns. The platform currently serves over 300 organizations and manages more than $1 billion in assets.[8]

Coinshift is running a task campaign on its official platform, allowing users to earn points through social and daily tasks. These may lead to future reward distributions.

How to participate:

- Visit Coinshift’s official campaign page and connect wallet or social account.

- Complete daily and social tasks to earn points.

Reminder

Airdrop plans and participation methods are subject to change at any time. Therefore, it is recommended that users follow the official channels of the above projects for the latest updates. Additionally, users should exercise caution, be aware of the risks, and conduct thorough research before participating. Gate does not guarantee the distribution of subsequent airdrop rewards.

Conclusion

Reviewing the period from May 5 to May 19, the crypto market experienced a broad-based rebound driven by favorable macro conditions and improving liquidity. Major assets like BTC and ETH continued to climb, reflecting a notable recovery in risk appetite. The top 500 tokens by market cap recorded an average gain of over 30%, with mid and small-cap assets performing especially well. Projects such as LAUNCHCOIN, MOODENG, and KTA with strong narratives and concentrated capital inflows led the rally and emerged as key highlights of this cycle. Volume data also indicates that capital is actively flowing into tokens supported by compelling narratives and strong community engagement. However, some tokens like ZKJ, despite significant volume growth, failed to see price appreciation due to fading momentum or already-priced-in expectations demonstrating a “high volume, no follow-through” pattern.

Overall, while the market has not fully exited the consolidation phase, capital allocation trends are becoming clearer: on one hand, investors are focusing on fundamental improvements in blue-chip assets, and on the other, they are aggressively rotating into narrative-driven, high-beta small caps. This has resulted in a structural pattern defined by “thematic rotations supported by mainstream stability.” As long as capital inflows continue and policy expectations remain steady, the market is likely to maintain a moderately bullish tone.

On the airdrop side, projects tracked in this report such as Kadena, Camp Network, Avalon, and Coinshift demonstrated diversity in type, clear participation pathways, and active community involvement. These projects have well-defined technical visions and ecosystem use cases, and are backed by reputable institutions, giving them strong long-term growth potential. Most are currently in testnet or early-stage community phases, offering users the chance to earn points through low-barrier tasks and qualify for future token drops. Actively participating in such projects not only increases the likelihood of receiving native token rewards, but also allows users to better understand project mechanics and build early positions in promising assets.

Reference:

- CoinGecko, https://www.coingecko.com/

- Sosovalue, https://sosovalue.com/assets/etf/us-btc-spot

- X, https://x.com/ethereum/status/1920419477889388697

- X, https://x.com/PolyhedraZK/status/1920063169810374848

- X, https://x.com/kadena_io/status/1922313391365829098

- X, https://x.com/campnetworkxyz/status/1923432776205750700

- X, https://x.com/AVALON/status/1900639791441428501

- X, https://x.com/0xCoinshift/status/1919805774802649135

Gate Reasearch is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, trending insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024