Previsão de preço do BNT em 2025: análise das tendências do mercado e dos fatores potenciais de crescimento para o Bancor Network Token

Introdução: Posição de mercado do BNT e valor de investimento

O Bancor (BNT), como sistema pioneiro de provisão de liquidez para tokens de baixa capitalização, evoluiu consideravelmente desde sua fundação em 2017. Em 2025, sua capitalização de mercado chegou a US$ 71.857.754, com cerca de 112.260.201 tokens em circulação e cotação próxima de US$ 0,6401. Este ativo, apelidado de "Pioneiro dos Protocolos de Liquidez", ocupa papel essencial no universo das finanças descentralizadas (DeFi) e na atividade de formador de mercado automatizado.

O artigo apresenta uma análise detalhada das tendências de preço do Bancor entre 2025 e 2030, incluindo padrões históricos, oferta e demanda, evolução do ecossistema e fatores macroeconômicos, para entregar projeções profissionais de preços e estratégias de investimento eficazes aos investidores.

I. Histórico do preço do BNT e situação atual do mercado

Evolução histórica do preço do BNT

- 2017: Lançamento do BNT por US$ 3,8575, início da jornada do Bancor

- 2018: Máxima histórica de US$ 10,72 em 9 de janeiro, durante o mercado altista de cripto

- 2020: Mínima histórica de US$ 0,120935 em 13 de março, diante do crash global do mercado

Situação atual do mercado do BNT

Em 28 de setembro de 2025, o BNT negocia a US$ 0,6401, com capitalização de mercado de US$ 71.857.754. O volume negociado em 24 horas é de US$ 14.163,99, sinalizando atividade moderada. O BNT teve queda de 0,85% nas últimas 24 horas, mas alta de 1,2% na última hora. O token passou por grande volatilidade: queda de 9,42% na semana e 15,19% nos últimos 30 dias. Por outro lado, acumulou 17,66% de valorização no último ano. O preço atual representa uma queda de 94,03% em relação à máxima histórica e alta de 429,29% ante a mínima, evidenciando potencial de crescimento e volatilidade futura.

Clique para acessar o preço de mercado atual do BNT aqui

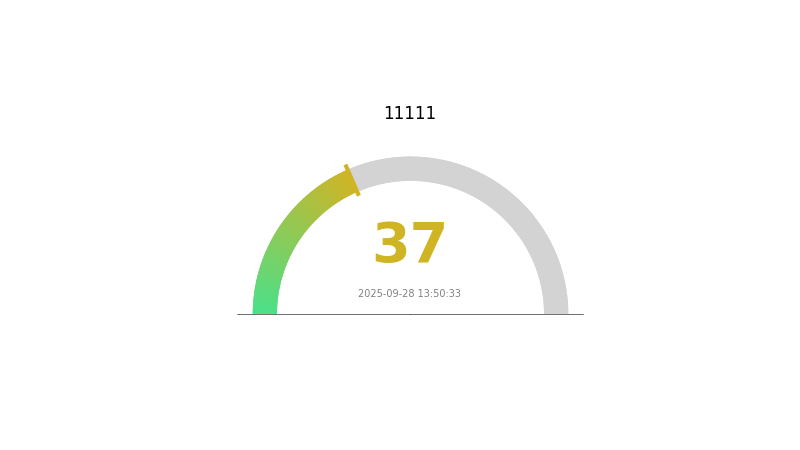

Indicador de sentimento do mercado BNT

28/09/2025 Índice de Medo e Ganância: 37 (Medo)

Clique para ver o Índice de Medo e Ganância atual

O mercado cripto sinaliza cautela, com Índice de Medo e Ganância em 37 (medo). Esse cenário indica aumento do conservadorismo entre investidores, seja por incertezas ou oscilações recentes. Diante disso, alguns traders podem enxergar oportunidades estratégicas de compra, enquanto outros preferem cautela. Ficar sempre informado e basear decisões em análise é fundamental nesse contexto.

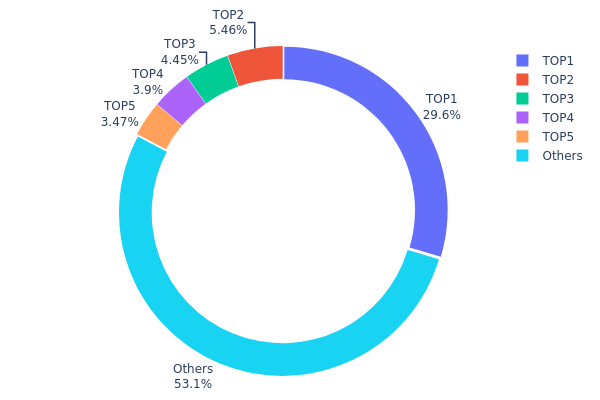

Distribuição das posições de BNT

A distribuição dos endereços detentores de BNT revela alta concentração: o maior endereço possui 29,61% da oferta, e os cinco maiores concentram 46,88% dos tokens. Essa estrutura levanta preocupações quanto à manipulação de mercado e riscos de centralização.

Movimentações dos maiores endereços podem aumentar volatilidade, além de influenciar governança e preço. Por outro lado, 53,12% dos tokens estão em demais endereços, sinalizando alguma dispersão.

Esse padrão sugere que, apesar da descentralização parcial do BNT, há poder concentrado em poucos players, exigindo atenção dos investidores e partes interessadas quanto à estabilidade e dinâmica de mercado no longo prazo.

Clique para consultar a distribuição atual de detentores do BNT

| Top | Endereço | Quantidade detida | Percentual |

|---|---|---|---|

| 1 | 0x6497...2bc373 | 33.249,70K | 29,61% |

| 2 | 0xe331...9d45cb | 6.126,10K | 5,45% |

| 3 | 0xf977...41acec | 5.000,00K | 4,45% |

| 4 | 0x02f6...ec1430 | 4.380,42K | 3,90% |

| 5 | 0xf727...b587a7 | 3.900,02K | 3,47% |

| - | Demais endereços | 59.604,89K | 53,12% |

II. Principais fatores que influenciam o preço futuro do BNT

Mecanismo de oferta

- Mineração de liquidez e emissão protocolar: O aumento da oferta de BNT ocorre principalmente pela mineração de liquidez e pela emissão protocolar, ampliando a oferta total.

- Impacto atual: A liquidez ilimitada eleva o volume no protocolo, resultando em expansão da oferta total de BNT.

Desenvolvimento técnico e fortalecimento do ecossistema

- Modelo econômico flexível do BNT: O modelo flexível do BNT é considerado viável na versão v2.1.

- Aplicações no ecossistema: Como AMM DEX pioneiro, o Bancor segue evoluindo ecossistema e soluções.

III. Projeção de preço do BNT para 2025-2030

Perspectiva para 2025

- Previsão conservadora: US$ 0,55 - US$ 0,60

- Previsão neutra: US$ 0,60 - US$ 0,65

- Previsão otimista: US$ 0,65 - US$ 0,68 (dependendo de condições favoráveis)

Perspectiva para 2027-2028

- Expectativa de mercado: Possível fase de crescimento e adoção crescente

- Projeção de preço:

- 2027: US$ 0,44 - US$ 0,82

- 2028: US$ 0,68 - US$ 0,89

- Catalisadores: Avanços tecnológicos, uso ampliado da rede e recuperação do mercado

Projeção de longo prazo para 2030

- Cenário base: US$ 0,75 - US$ 0,95 (crescimento estável)

- Cenário otimista: US$ 0,95 - US$ 1,10 (adoção acelerada e mercado favorável)

- Cenário transformador: US$ 1,10 - US$ 1,21 (inovações disruptivas e adoção massiva)

- 31/12/2030: BNT US$ 1,21 (pico potencial em cenário altamente favorável)

| Ano | Máxima prevista | Média prevista | Mínima prevista | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,67893 | 0,6405 | 0,55083 | 0 |

| 2026 | 0,84444 | 0,65972 | 0,4618 | 3 |

| 2027 | 0,81976 | 0,75208 | 0,4362 | 17 |

| 2028 | 0,88809 | 0,78592 | 0,67589 | 22 |

| 2029 | 0,89559 | 0,837 | 0,62775 | 30 |

| 2030 | 1,21282 | 0,8663 | 0,4678 | 35 |

IV. Estratégias profissionais de investimento e gestão de riscos para BNT

Metodologia de investimento em BNT

(1) Estratégia de longo prazo

- Perfil recomendado: Investidor de valor para longo prazo

- Sugestões de operação:

- Acumular BNT em correções de mercado

- Definir objetivos de preço e realizar rebalanceamento periódico

- Armazenar BNT em carteiras não custodiais seguras

(2) Estratégia de negociação ativa

- Ferramentas de análise técnica:

- Médias móveis: Identificação de tendência

- RSI: Monitoramento de sobrecompra/sobrevenda

- Pontos importantes nas operações de swing trade:

- Identificar suportes e resistências

- Utilizar ordens de stop-loss para controle de risco

Estrutura de gestão de riscos para BNT

(1) Princípios de alocação de ativos

- Conservador: 1-3%

- Agressivo: 5-10%

- Profissional: 10-15%

(2) Soluções de proteção de risco

- Diversificação: Distribuição dos investimentos entre criptomoedas

- Ordens de stop-loss: Venda automática para limitar perdas

(3) Soluções para armazenamento seguro

- Carteira hot indicada: carteira Gate Web3

- Armazenamento frio: carteiras de hardware para grandes valores

- Segurança: Ativar autenticação de dois fatores e usar senhas robustas

V. Riscos e desafios potenciais do BNT

Riscos de mercado do BNT

- Volatilidade: Altos níveis no mercado cripto

- Liquidez: Baixo volume pode gerar slippage

- Concorrência: Outros protocolos DeFi ameaçam a participação de mercado do BNT

Riscos regulatórios do BNT

- Incerteza regulatória: Mudanças podem afetar o funcionamento do BNT

- Custos com compliance: Adaptação regulatória pode elevar despesas

- Restrições internacionais: Regulamentos distintos podem limitar adoção

Riscos técnicos do BNT

- Vulnerabilidades em smart contracts: Possibilidade de falhas e ataques

- Escalabilidade: Congestionamentos podem afetar transações e taxas

- Falhas de oráculos: Preço errado pode comprometer o ecossistema

VI. Conclusão e recomendações práticas

Avaliação do valor de investimento do BNT

O BNT representa exposição relevante ao universo DeFi, graças ao seu modelo inovador de liquidez. O ativo tem potencial de valorização a longo prazo, mas volatilidade e riscos regulatórios devem ser ponderados.

Recomendações de investimento para BNT

✅ Iniciantes: Comece com quantias reduzidas e priorize formação ✅ Experientes: Avalie o BNT como componente de portfólio DeFi diversificado ✅ Institucionais: Realize análise de risco detalhada e controle rigoroso

Modalidades de negociação com BNT

- Negociação à vista: Operar BNT na Gate.com

- Participação em staking: Prover liquidez no protocolo Bancor

- Integração DeFi: Utilizar BNT em aplicações de cultivo de rendimento

Investimentos em criptomoedas apresentam riscos elevados. Este artigo não configura recomendação de investimento. Decida com cautela, respeitando sua tolerância ao risco e buscando orientação profissional. Nunca invista mais do que pode perder.

Perguntas Frequentes

Qual o futuro do BNT?

O BNT tende a crescer no longo prazo e pode atingir US$ 1,42 até 2030, conforme análise de tendências de mercado favoráveis para o Bancor Network Token.

Qual a projeção de preço para o BNB em 2030?

O BNB pode chegar a US$ 1.224,43 em 2030, considerando estimativa de variação de 5% nos preços conforme tendências do mercado atual.

Qual a previsão de preço do XRP em 2025?

Especialistas apontam que o XRP pode alcançar o máximo de US$ 2,76 até setembro de 2025 e mínima de US$ 2,72.

Qual a previsão para o Bio Protocol coin em 2030?

Pelas tendências atuais, o Bio Protocol coin pode atingir cerca de US$ 1,77 até 2030.

Compartilhar

Conteúdo